[ad_1]

Key Takeaways:

Technique acquires 13,390 BTC for $1.34B, pushing common purchase value near $100K.BTC yield hits 15.5% YTD, prompting Technique to boost its 2025 goal to 25%.Critics warn of potential draw back dangers amid hovering leverage and record-high entry factors.

Michael Saylor’s Technique continues its aggressive Bitcoin accumulation with a $1.34 billion buy final week, coinciding with BTC briefly topping $100,000. This strategic purchase introduced the agency’s complete holdings to an eye-popping 568,840 BTC. Whereas the transfer indicators confidence in long-term worth, market critics are sounding alarms in regards to the dangers of such concentrated publicity.

Learn Extra: Technique Plans $21 Billion Bitcoin Purchase with New Inventory Provide

Technique Makes Landmark Buy as BTC Crosses $100K

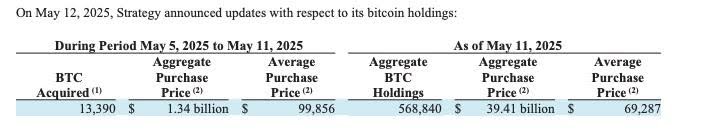

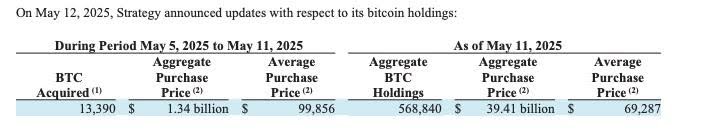

Between Might 5 and Might 11, Technique acquired 13,390 BTC at a mean value of $99,856 per coin, as disclosed in a current SEC submitting. This newest acquisition marks one of many firm’s most costly BTC entries up to now and raises its cumulative Bitcoin holdings to 568,840 BTC—valued at roughly $39.41 billion, with a mean value foundation of $69,287.

The acquisition occurred as Bitcoin reclaimed and quickly held the $100,000 stage for the primary time in historical past on Might 8, pushed by a mixture of institutional demand, provide constraints, and growing curiosity from sovereign wealth funds.

The announcement got here immediately from Michael Saylor, Technique’s co-founder and Government Chairman, who posted the information on X (previously Twitter), sparking widespread dialogue within the crypto neighborhood and conventional finance sectors alike.

Technique has acquired 13,390 BTC for ~$1.34 billion at ~$99,856 per bitcoin and has achieved BTC Yield of 15.5% YTD 2025. As of 5/11/2025, we hodl 568,840 $BTC acquired for ~$39.41 billion at ~$69,287 per bitcoin. $MSTR $STRK $STRF https://t.co/oSXRMwiTkU

— Michael Saylor (@saylor) Might 12, 2025

Learn extra: Michael Saylor Calls on U.S. Authorities to Buy 25% of BTC Provide

Yield Surpasses 15.5%, 2025 Goal Raised to 25%

Following the $1.34B acquisition, Technique achieved a 15.5% Bitcoin yield YTD for 2025—a efficiency metric that displays the ratio of BTC holdings to diluted shares and capital enter. The agency had initially set a 15% yield goal for the complete yr however has now raised its ambition to 25%.

This sharp upward revision suggests continued bullish sentiment inside the corporate, even at elevated market costs. Final yr, Technique posted a staggering 74% BTC yield, and it appears decided to take care of excessive efficiency in 2025, regardless of elevated volatility.

What Is BTC Yield and Why Does It Matter?

The time period “BTC yield” as utilized by Technique is a proprietary metric reflecting the rise in Bitcoin holdings relative to complete fairness or share dilution. Whereas not a traditional monetary metric, it’s grow to be a key inner benchmark for Technique’s aggressive Bitcoin technique. Reaching 15.5% YTD implies that their acquisition tempo and BTC efficiency have outpaced shareholder dilution, sustaining worth per share.

Critics Elevate Purple Flags Over Value and Leverage

Not everyone seems to be applauding the technique. Peter Schiff, a long-time gold advocate and outstanding Bitcoin critic, responded to Saylor’s announcement with a stark warning. Posting on X, Schiff stated:

“Your subsequent purchase will doubtless push your common value above $70,000. The following leg down in Bitcoin will doubtless push the market value beneath your common value. Not good contemplating how a lot you borrowed to purchase the Bitcoin.”

His criticism targets Technique’s in depth use of debt and fairness to fund Bitcoin acquisitions. Based on filings earlier this month, the agency doubled its deliberate capital increase to $84 billion—cut up between fairness and fixed-income choices—to take care of its BTC-buying technique. That stage of leverage, Schiff argues, may result in important realized losses if the market turns south.

Market Outlook: A Balancing Act Between Confidence and Danger

The crypto neighborhood stays divided. Whereas Bitcoin’s rally above $100,000 has fueled renewed pleasure and institutional FOMO, analysts warn that rising common entry costs for mega-holders like Technique introduce higher draw back threat. If Bitcoin retreats to earlier assist ranges within the $80,000–$90,000 vary, it may check the profitability of current high-level buys.

Nonetheless, Technique’s unwavering accumulation technique sends a robust sign to the market: they’re betting on Bitcoin not simply as a retailer of worth however as a core company treasury asset for the lengthy haul.

Some analysts, together with Galaxy Digital and Bernstein, view the transfer as in line with broader institutional traits. They spotlight that ETF inflows stay regular and miner promoting has slowed post-halving, additional tightening provide within the quick time period.

Technique vs. The Subject: A Rising Divide

Whereas Technique continues to guide the cost, different crypto-native corporations seem much less wanting to comply with go well with. A Bloomberg report earlier this yr revealed that Coinbase, regardless of exploring the same Bitcoin accumulation technique, finally determined towards it, citing operational dangers and steadiness sheet volatility.

As BTC costs soar, company methods are diverging. Some corporations favor diversified treasury allocations or tokenized real-world belongings, whereas Technique doubles down on Bitcoin alone.

Closing Ideas

The most recent $1.34 billion BTC buy cements Technique’s place as the most important company Bitcoin holder by far. However the true query is whether or not this daring, debt-fueled accumulation mannequin can face up to the following correction. With a mean acquisition value nearing $70K and leverage climbing, the stakes have by no means been larger—for Technique, and for the broader market that follows its lead.

[ad_2]

Source link