On-chain knowledge exhibits 16,000 BTC, which have been dormant for 5-7 years, have lastly proven some motion on the Bitcoin blockchain.

5-7 Years Outdated Bitcoin Age Band Has Made A Massive Transfer

As identified by an analyst in a publish on X, a big stack of dormant cash has moved throughout the community at present. The related on-chain indicator right here is the “Spent Output Age Bands” (SOAB), which retains observe of the actions of the varied Age Bands on the blockchain.

“Age Bands” right here consult with teams of cash divided based mostly on their complete holding time. For instance, the 1-month to 3-month Age Band would come with all cash which were dormant (that’s, staying inside the identical tackle) since between one and three months in the past.

If numerous cash belonging to this holding time vary would switch on the blockchain, then the SOAB for this explicit Age Band would register a spike. Within the context of the present dialogue, the 5-7 years Age Band is of curiosity.

The chart under exhibits the latest SOAB knowledge for this Age Band particularly:

Appears to be like like the worth of the metric has simply registered a big spike | Supply: @binhdangg1 on X

As displayed within the above graph, a considerable amount of cash aged between 5-7years outdated seem to have simply been moved on the community because the corresponding Age Band has registered a spike.

This Age Band is a phase of the broader and “long-term holder” (LTH) group, which incorporates traders who’ve been holding onto their cash since a minimum of 155 days in the past.

Statistically, the longer a holder retains their cash dormant, the much less probably they grow to be to promote at any level. As such, the LTHs are typically thought-about to be extra resolute than the remainder of the market (the “short-term holders“).

For the reason that 5-7 years Age Band would come with cash which can be outdated even in LTH phrases, their house owners must be diamond fingers amongst diamond fingers. As a consequence of this cause, it may be one thing notable when such historical entities lastly determine to interrupt their silence.

Associated Studying: Cardano (ADA) To Break $8 In Bull Run: Analyst Predicts Timeline

Through the newest SOAB spike, these traders have moved an enormous stack of 16,000 BTC (round $837.8 million on the present trade price). Now, what implications this transfer could have in the marketplace is determined by what these traders intend to attain with it.

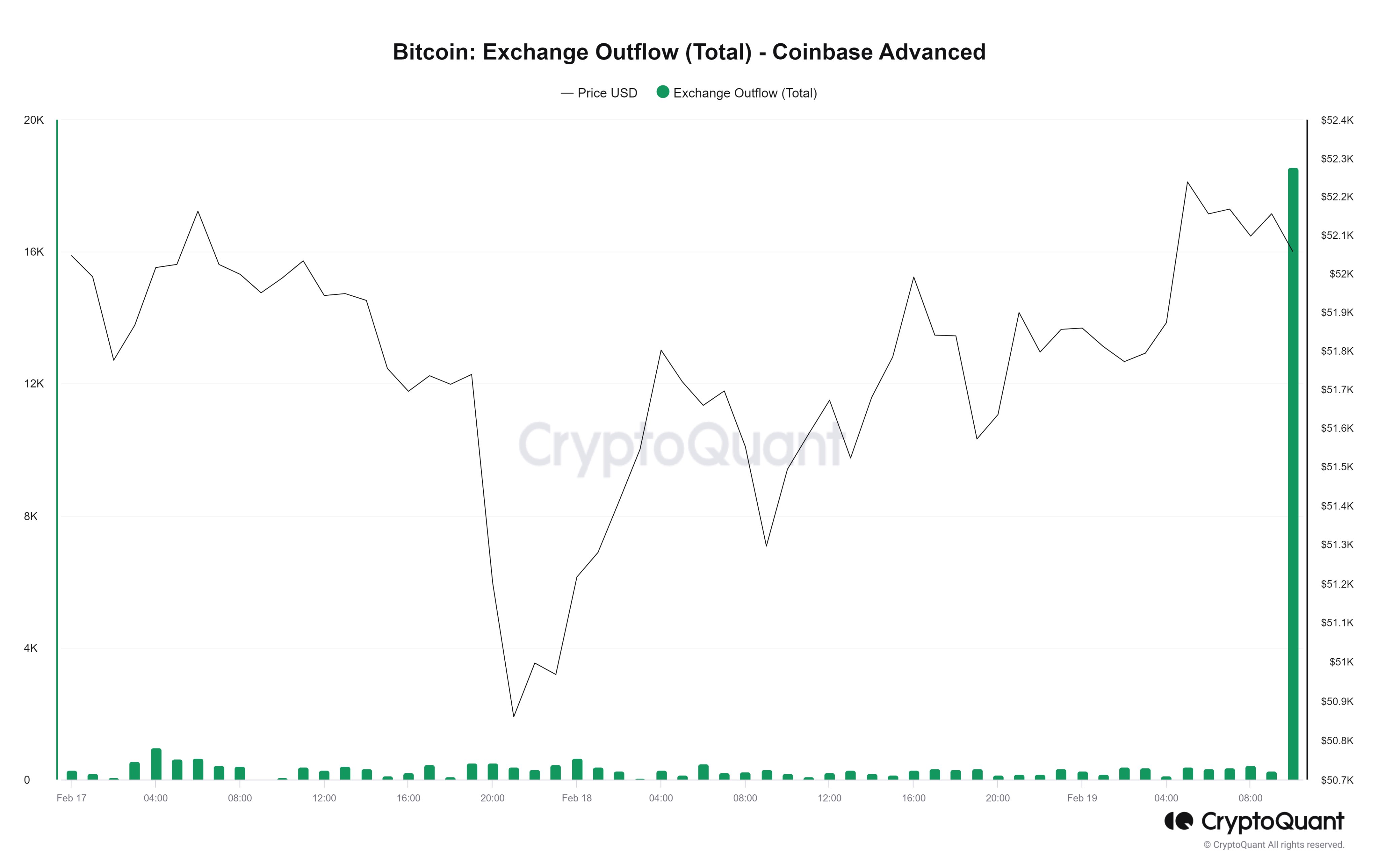

A dive deeper into on-chain knowledge suggests the transfer was an outflow from the cryptocurrency trade Coinbase, because the chart under exhibits:

The worth of the metric seems to have been fairly excessive up to now day | Supply: @binhdangg1 on X

The truth that it’s an outflow could also be a constructive signal for Bitcoin, because it signifies that promoting could not have been the purpose right here. Fairly, the transfer implies the whale entity behind it might be transferring in direction of self-custody to HODL additional, or a big purchaser like an ETF is gobbling this BTC up.

BTC Value

Bitcoin had made a go to right down to $50,600 in the course of the weekend, however the cryptocurrency already seems to have bounced again as its worth is now floating across the $52,400 stage.

The value of the coin seems to have total moved sideways over the previous couple of days | Supply: BTCUSD on TradingView

Featured picture from Erling Løken Andersen on Unsplash.com, CryptoQuant.com, chart from TradingView.com

Disclaimer: The article is offered for academic functions solely. It doesn’t characterize the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You’re suggested to conduct your individual analysis earlier than making any funding choices. Use data offered on this web site solely at your individual threat.