[ad_1]

Bitcoin remains to be due for extra sideways turbulence—and probably some extra bleeding—earlier than capturing to the sky later this month, in line with BitMEX co-founder Arthur Hayes.

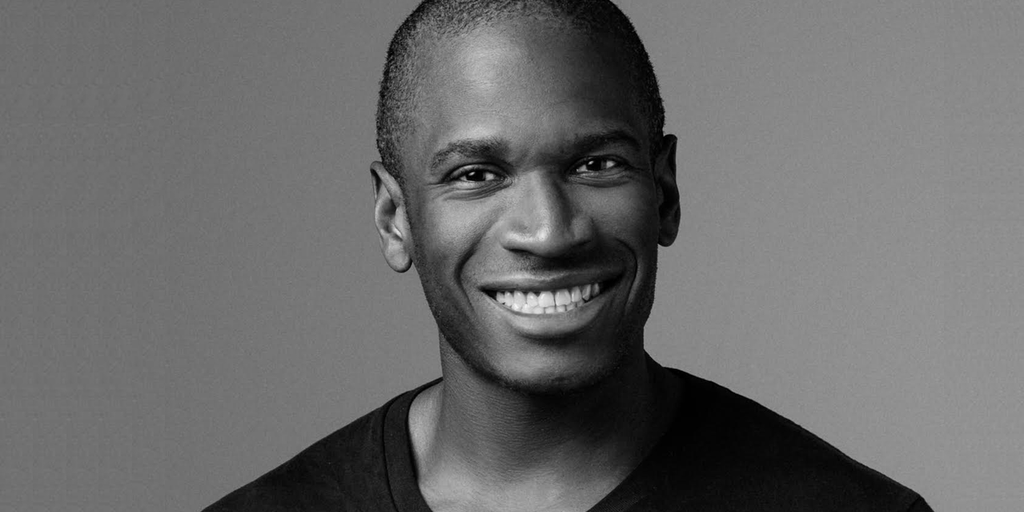

In his newest piece, the well-known crypto essayist and macro-analyst admitted that his earlier prediction that Bitcoin’s bull market would “start anew” in September was incorrect, however that his bearishness stays “non permanent.”

“I’ve modified my thoughts, however it doesn’t have an effect on my positioning in any respect. I’m nonetheless lengthy as fuck in an unlevered style,” he wrote on Tuesday.

Slightly, Hayes has merely delayed his bullish expectations by a couple of weeks as he waits on the Federal Reserve and U.S. Treasury to pump emergency liquidity into the market. This liquidity, he claims, will probably come from the Treasury Basic Account—and from a possible restart of quantitative easing meant to keep up stability within the treasuries market.

“I count on intervention to start in late September,” he added. “Between from time to time, Bitcoin, at greatest, will chop round these ranges and, at worst, slowly leak decrease in direction of $50,000.”

Bitcoin initially pumped to $64,000 following Fed chairman Jerome Powell’s promise to start decreasing rates of interest final month. Decrease rates of interest imply cheaper borrowing prices, which have largely confirmed to be bullish for scarce belongings and shares, comparable to BTC.

In an essay final week, Hayes described the pump as a “sugar excessive” that might probably die out because the Japanese yen started to see relative energy, probably killing the “yen carry commerce” that’s buoyed asset costs.

However Hayes quickly discovered there was one other issue at play. The Fed’s Reverse Repo Program (RRP) started to see extra deposits following Powell’s speech, rising due to their comparatively greater yield in comparison with US Treasury payments. In response to Hayes’s principle, a rising RRP “sterilizes” cash, unable to be re-leveraged throughout the monetary system, and due to this fact can’t increase asset costs.

“Assuming the Fed doesn’t reduce charges earlier than the September assembly, I count on T-bill yields to remain firmly beneath these of the RRP,” Hayes defined.

In the long run, Hayes expects price cuts to spice up 10-year Treasury bond yields up towards 5%. On condition that the Treasury deemed it essential to inject liquidity into the market when yields approached this degree final 12 months, Hayes expects the federal government to repeat the identical playbook, and as soon as once more increase Bitcoin.

Ought to Yellen not increase markets quick, he believes it may price Kamala Harris the election in November.

“Given these circumstances and Yellen’s dogged loyalty to the Democratic social gathering’s Manchurian candidate Kamala Harris, these pink bottoms ‘bout to stomp all around the ‘free’ market.” he stated.

Each day Debrief Publication

Begin on daily basis with the highest information tales proper now, plus unique options, a podcast, movies and extra.

[ad_2]

Source link