[ad_1]

On-chain knowledge reveals the Bitcoin Market Worth to Realized Worth (MVRV) Ratio of the short-term holders is at present making a retest that might show vital for BTC’s value.

Bitcoin STH MVRV Ratio Is Retesting Its 155-Day MA Proper Now

As defined by on-chain analyst Checkmate in a brand new put up on X, the short-term holder MVRV Ratio breaking above its 155-day transferring common (MA) may result in bullish motion for Bitcoin.

The MVRV Ratio is a well-liked indicator that, briefly, retains monitor of how the worth held by the BTC traders as a complete (that’s, the market cap) compares towards the worth that they initially put in (the realized cap). When the worth of this metric is bigger than 1, it means the common handle on the community could be assumed to be holding a internet revenue proper now. However, it being beneath the edge suggests the dominance of loss available in the market.

Within the context of the present matter, the MVRV Ratio of solely a selected section of the sector is of curiosity: the short-term holders (STHs). The STHs embrace the traders who purchased their cash throughout the previous 155 days. Thus, the MVRV Ratio for this cohort tells us in regards to the revenue/loss standing of the patrons from the final 5 months.

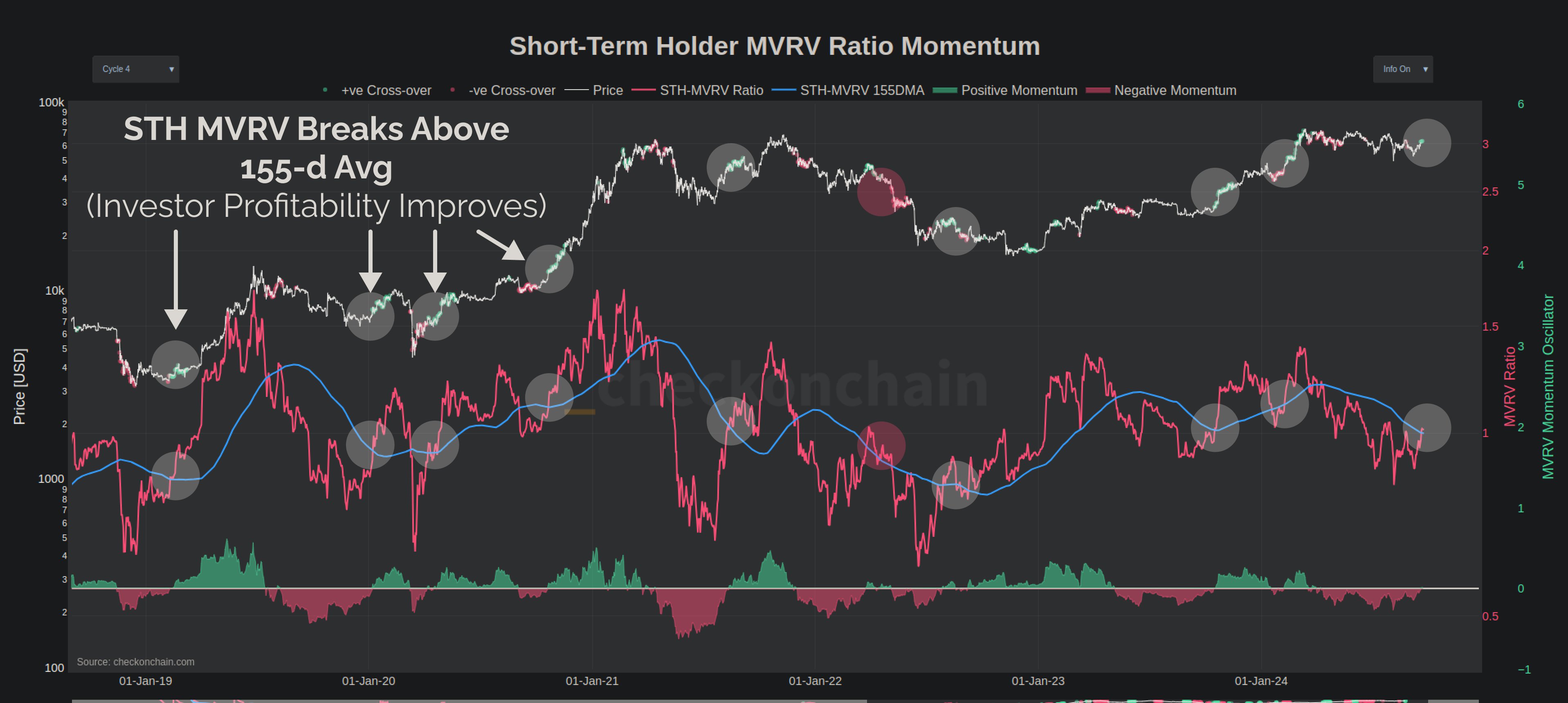

Now, here’s a chart that reveals the development within the Bitcoin STH MVRV Ratio over the previous few years:

As displayed within the above graph, the Bitcoin STH MVRV Ratio has surged not too long ago as the most recent restoration rally within the cryptocurrency’s value has taken place. With this enhance, the indicator has edged simply above the 1 mark, implying profitability has returned for the cohort. Extra importantly, although, the metric is now looking for a break above its 155-day MA. As Checkmate has highlighted within the chart, BTC has usually tended to take pleasure in some bullish momentum at any time when the STH MVRV Ratio has crossed above this line.

The final time that such a crossover had occurred within the indicator was again within the first quarter of this yr and what had adopted it was the coin’s rally to a brand new all-time excessive (ATH).

Given the priority, it’s doable that BTC might as soon as once more see a bullish wave, ought to the STH MVRV Ratio handle to interrupt past its 155-day MA. “If the bulls get their approach, and we set a weekly larger excessive ~$65.3k, I’d fairly count on an try and the ATH,” notes the analyst.

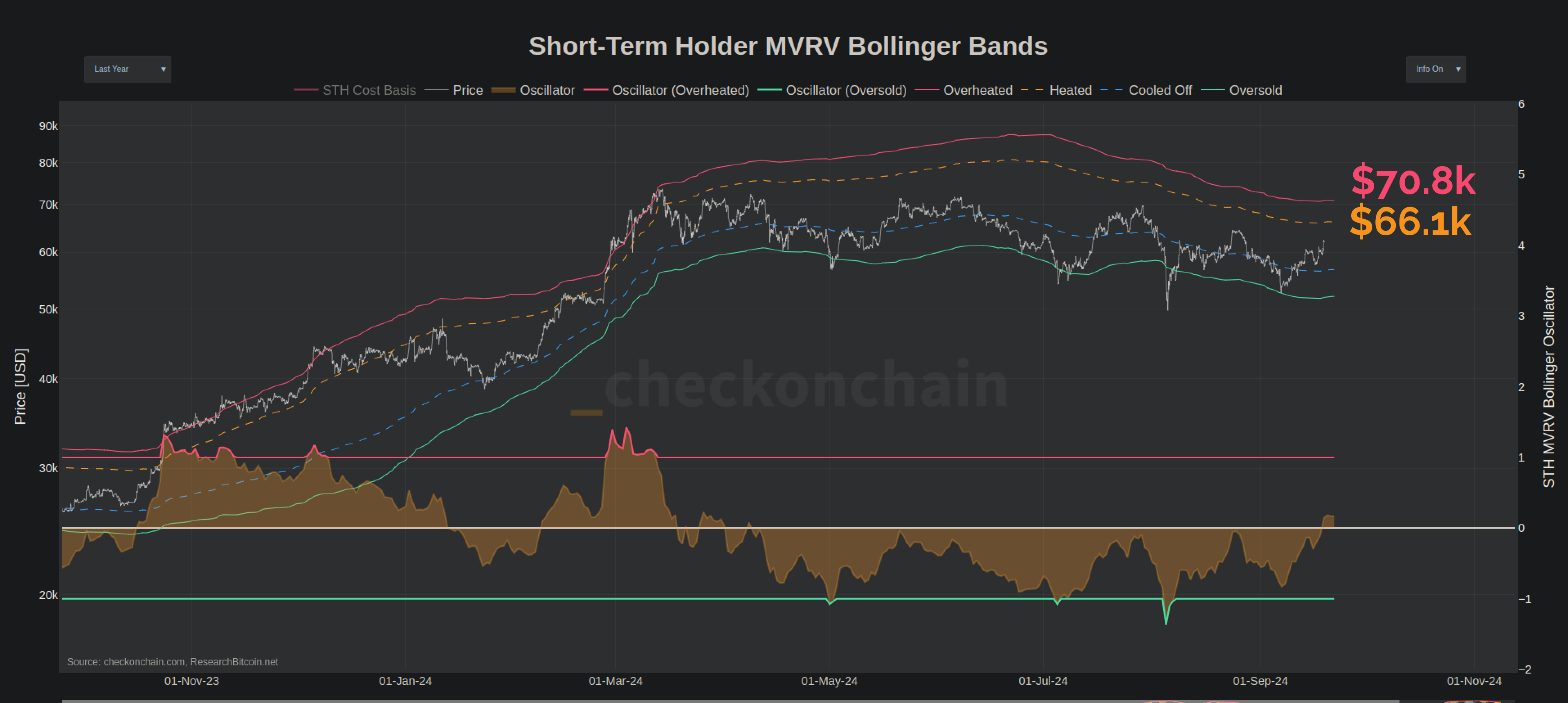

Checkmate additionally warns, nonetheless, that profit-taking from these traders may very well be to be careful for as soon as the worth reaches the $66,100 to $70,800 vary. It is because, these traders, who don’t are inclined to have a powerful resolve, would get into notable income at these ranges.

BTC Value

Bitcoin has seen a bounce of round 8% over the previous week, which has taken its value to the $63,700 degree.

[ad_2]

Source link