[ad_1]

Este artículo también está disponible en español.

Ripple Labs is approaching a pivotal turning level with a possible preliminary public providing (IPO), a improvement that has been speculated about for a while. An IPO could possibly be a transformative second harking back to Amazon.com Inc.’s preliminary public providing (IPO) in 1997. Jake Claver, a Certified Household Workplace Skilled (QFOP), articulates this attitude in a thread on X, suggesting that Ripple’s strategic maneuvers might mirror the trajectory that propelled Amazon into a world tech behemoth.

In keeping with Claver, the corporate has cemented its place throughout the blockchain ecosystem by way of its sturdy cross-border fee options, at the moment supporting over 300 monetary establishments worldwide. The corporate’s utilization of XRP, allows transactions which might be markedly sooner and cheaper in comparison with these processed by way of the Society for Worldwide Interbank Monetary Telecommunication (SWIFT) community. Claver emphasizes, “This positions Ripple as a sooner, extra clear SWIFT 2.0.”

Regardless of these accomplishments, Ripple has navigated substantial challenges, most notably its authorized battle with the US Securities and Alternate Fee (SEC). Nonetheless, current courtroom rulings have favored Ripple, doubtlessly clearing the trail for bigger alternatives, together with a public providing. Claver notes, “The current courtroom rulings in Ripple’s favor might open doorways to larger alternatives, like going public.”

Why Ripple Is Like Amazon In 1997

Drawing a parallel to Amazon’s evolution, Claver noticed, “Simply as Amazon was often known as a web-based bookstore earlier than its IPO, Ripple is acknowledged for its blockchain options. However there’s potential for far more.” He additional elaborated, “When Amazon went public, it raised $54 million, enabling growth into new markets.” Ripple additionally stands to unlock doubtlessly huge progress alternatives by way of a public itemizing.

Associated Studying

Ripple’s strategic acquisitions, together with that of Metaco—now rebranded as Ripple Custody—show its intent to broaden its market presence. Claver remarks, “With acquisitions like Metaco, now Ripple Custody, they’re already exhibiting an curiosity in increasing their attain. This could possibly be just the start.”

The potential implications of Ripple choosing an Preliminary Public Providing (IPO) or a direct itemizing are multifaceted. Claver outlines that an IPO would offer Ripple with recent capital, enabling speedy scaling and entry into new markets similar to tokenized securities, real-world belongings (RWAs), and decentralized finance (DeFi). He states, “An IPO would offer Ripple with recent capital, enabling them to scale shortly and enter new markets like tokenized securities, RWAs, or DeFi.”

Furthermore, the inflow of capital from an IPO might facilitate additional acquisitions, permitting the corporate to develop its choices and strengthen its portfolio. Claver attracts a direct comparability to Amazon’s acquisitions, noting, “Ripple might use IPO funds to accumulate different corporations and develop its choices. Just like Amazon’s acquisitions of Complete Meals and Twitch, Ripple might break into new markets and strengthen its portfolio.”

Enhanced monetary sources would additionally empower Ripple to speed up its analysis and improvement efforts. Claver explains, “Extra sources would permit Ripple to speed up R&D, enhance the XRP Ledger, and discover new functions like sensible contracts, tokenized real-world belongings, and central financial institution digital currencies (CBDCs).”

Associated Studying

Claver differentiates between the 2 main routes to going public: an IPO and a direct itemizing. He elaborated, “An IPO entails issuing new shares to boost capital, sometimes underwritten by funding banks, however comes with prices like underwriting charges and regulatory necessities. In distinction, a direct itemizing doesn’t contain issuing new shares; as a substitute, current shareholders promote their shares available on the market. This methodology is mostly more cost effective and faster than an IPO.”

Given Ripple’s sturdy monetary standing, with over $1.3 billion in money reserves, Claver suggests {that a} direct itemizing may be a viable choice. “Ripple might go for a direct itemizing as a result of it already has a powerful steadiness sheet,” he states. “A direct itemizing gives transparency and avoids lockup durations that limit insider gross sales in a standard IPO.”

Past the monetary mechanics, Claver underscores that going public serves as a legitimizing drive for Ripple. He attracts a parallel to Amazon’s IPO, stating, “Amazon’s IPO legitimized e-commerce. For Ripple, a public itemizing would legitimize its position in international finance, signaling to banks and regulators that it’s right here to remain.”

The current favorable authorized rulings in Ripple’s case in opposition to the SEC have considerably bolstered its place, making the prospect of a public itemizing extra possible. Claver concludes, “Ripple is at a important juncture, very similar to Amazon earlier than its 1997 IPO. If Ripple follows the same path, we might witness the rise of a brand new tech big. Whether or not by way of an IPO or direct itemizing, this transfer might unlock important progress for Ripple and the blockchain trade.”

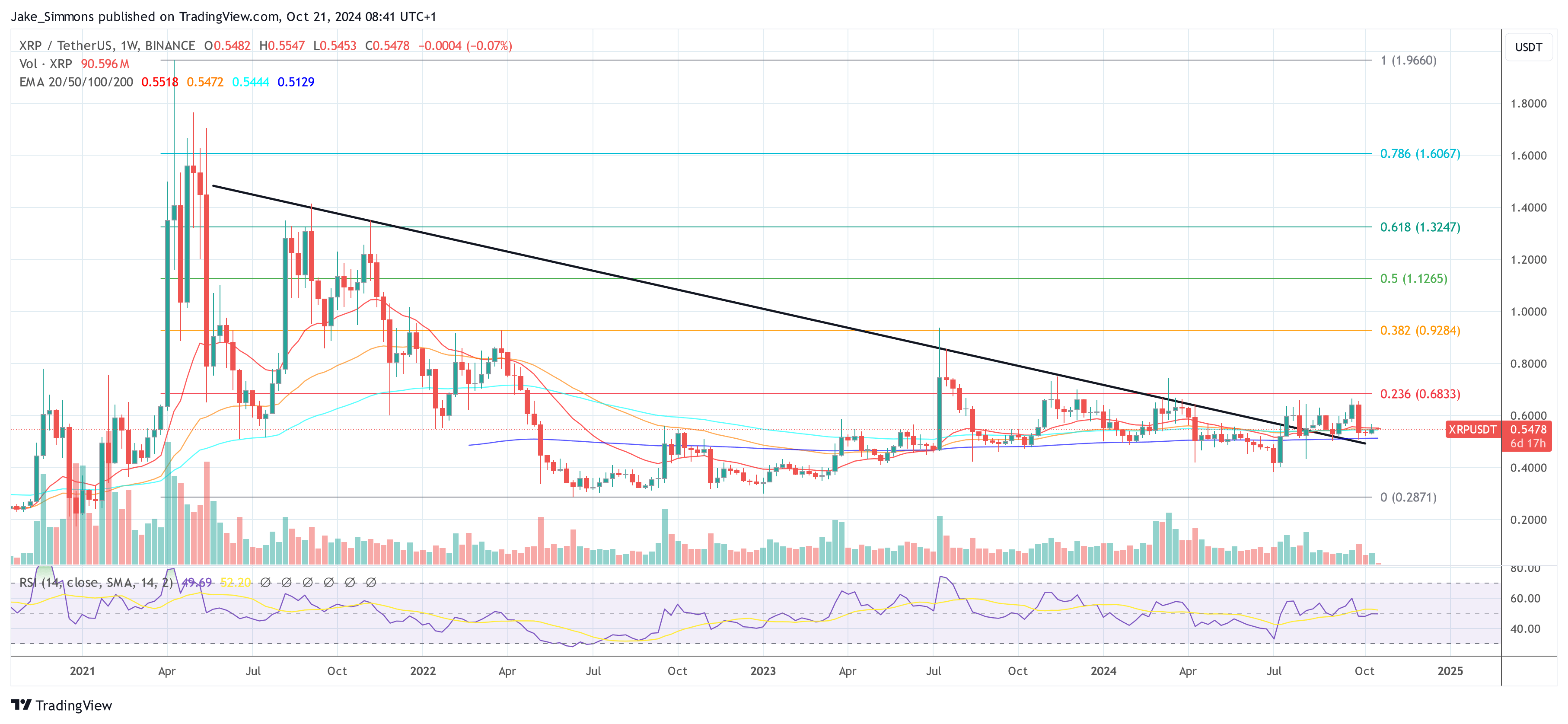

At press time, XRP traded at $0.5478.

Featured picture from Shutterstock, chart from TradingView.com

[ad_2]

Source link