[ad_1]

Some see the insurance coverage business as lagging in new know-how adoption. However a latest research by Coleman Parkes of 236 insurance coverage business determination makers reveals that this generalization isn’t essentially true.

Insurers across the globe are, in truth, racing towards generative AI (GenAI) adoption – with 9 in 10 planning to take a position over the subsequent 12 months.

As consultants in analyzing dangers based mostly on huge volumes of delicate private knowledge, insurance coverage corporations are poised to achieve tremendously from GenAI capabilities. However solely those that pursue the chance with eyes broad open to each advantages and dangers will succeed.

Insurers want to handle GenAI governance, privateness, ethics and fraud

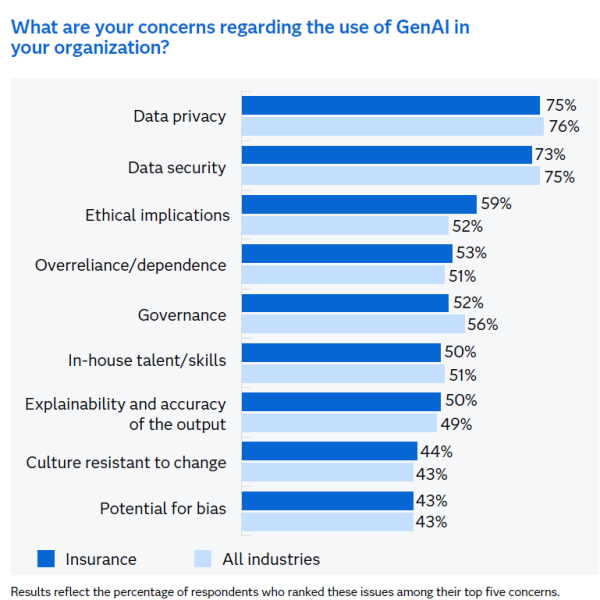

Just like different industries surveyed, insurers cite knowledge privateness and safety as two of their greatest considerations about GenAI. This can be a crucial matter, particularly since inadequate safety of enterprise belongings or prospects’ private knowledge may open the door to a large number of fraud and cybersecurity dangers.

But simply 6% of insurers who’re contemplating using giant language fashions (LLMs) have privateness danger measures in place. Many (43%) plan to develop their in-house capabilities for privateness danger detection, whereas 38% are inclined to purchase a third-party answer.

GenAI coaching begs for consideration

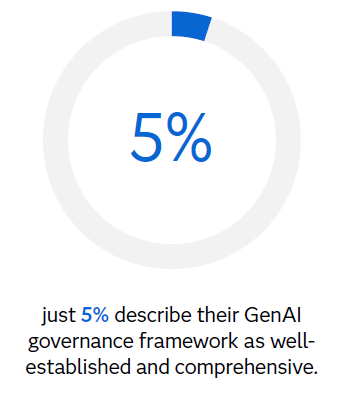

Many insurance coverage companies lack ample coaching on GenAI governance and monitoring, with most saying their coaching has been “minimal.” Additional, governance expenditures are 10% (or much less) of complete spend – and governance frameworks are being developed as they go.

Insurers ought to take into account whether or not this degree of governance coaching – and budgeting for GenAI governance frameworks – is ample for the dangers concerned.

Governance know-how, transparency and accountability

Relating to GenAI governance, many insurers (37%) say know-how limitations are a difficulty for his or her agency. Nearly 1 / 4 (24%) cite an absence of transparency and accountability as the most important blockers to efficient governance and monitoring. Complicating issues, all insurance coverage corporations should handle non-negotiable AI laws. However these are evolving and range tremendously throughout areas.

Insurers can use GenAI to realize enterprise targets – if implementation retains up

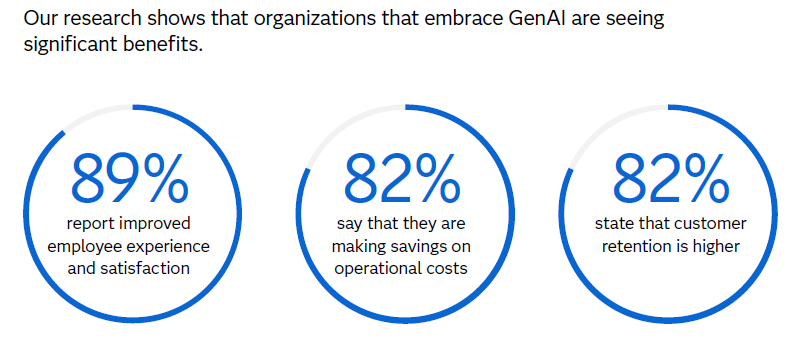

The Coleman Parkes survey uncovered three prime methods organizations are utilizing GenAI to enhance their enterprise. The analysis reveals that organizations embracing GenAI (throughout all sectors) are seeing large advantages via:

Better buyer retention.

Improved worker expertise and satisfaction.

Diminished operational prices.

At problem: Most insurers look like working towards GenAI compliance on the similar time they’re implementing the know-how. All of the whereas, AI laws are being applied in main insurance coverage markets globally. To maintain up, insurers want to handle statutes round algorithmic bias, AI accountability, and extra.

Coordinated efforts to watch GenAI are wanted, too. This entails frequently evaluating whether or not the know-how’s outcomes are efficient and environment friendly at assembly enterprise wants.

Innovating with artificial knowledge technology will carry insurers into the longer term

Artificial knowledge technology is a sort of generative AI approach utilizing algorithms to generate knowledge that mimics real-world knowledge. Artificial knowledge is efficacious throughout industries, particularly people who routinely have to safeguard giant quantities of protected, delicate private knowledge. By utilizing artificial knowledge, organizations can handle considerations round privateness and equity whereas avoiding the time, price and complexity of amassing and managing real-world knowledge.

One promising space for insurers entails utilizing artificial knowledge to battle bias. In the same vein, synthetically generated knowledge might help insurers deal with danger administration and compliance necessities.

Nonetheless unsure concerning the worth of artificial knowledge for insurance coverage? Contemplate this assertion cited by Property Casualty 360: “By 2027, as many as 40% of the AI algorithms utilized by insurers will combine artificial knowledge to be able to guarantee equity inside their processes and adjust to laws” (a prediction by IDC FutureScape).

The place insurers have to focus

As with all companies, insurers should work exhausting to keep up a stellar repute whereas utilizing know-how ethically to handle enterprise calls for. On the similar time, they have to be ready to juggle multifaceted buyer, regulatory and stakeholder considerations.

The Coleman Parkes research highlights many alternative elements of GenAI the place insurers have to focus. For instance, insurers could be smart to guage:

What they’re spending on GenAI governance and monitoring – to allow them to decide if the finances must be elevated.

Whether or not their degree of workers coaching is ample for the dangers concerned, and whether or not coaching is consistent with regulatory necessities.

Get the complete GenAI for insurance coverage report back to be taught extra and see the way you stack as much as your friends

[ad_2]

Source link