[ad_1]

Este artículo también está disponible en español.

The Bitcoin worth is nicely on its method to reaching the $100,000 worth mark, with a number of projections saying it may accomplish that by this weekend. Notably, the Bitcoin worth reached an intraday excessive of $99,486 previously 24 hours, placing it by about solely 0.5% from reaching $100,000.

As all the business continues to await the Bitcoin worth break above $100,000, crypto analyst Tony “The Bull” Severino has highlighted an fascinating outlook for what to anticipate from right here.

Bitcoin Worth Mirrors 2017 Sample

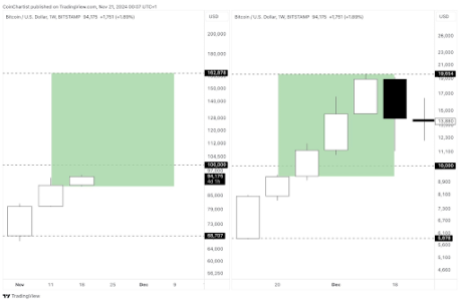

Crypto analyst Tony Severino drew parallels of Bitcoin’s current worth actions to its 2017 surge. The Bitcoin worth first broke earlier than the spherical determine mark of $10,000 within the final week of November 2017. Now seven years later, it’s exhibiting related worth actions because it seems to be to interrupt above the following spherical determine mark of $100,000.

Associated Studying

Bitcoin’s break above the $10,000 degree was a pivotal second in its worth historical past, because it marked a break above a key psychological threshold. Severino identified that after reaching this psychological milestone, the Bitcoin worth almost doubled in worth inside two weeks.

Severino used the end result of this transfer to attract parallels with the present efficiency of the Bitcoin worth. This time, nevertheless, the stakes are increased, with Bitcoin now about to interrupt above the $100,000 mark. Significantly, it is a determine that carries even better psychological significance within the outlook of the Bitcoin worth than the $10,000 mark.

Might Breaching $100,000 Trigger One other Pleasure?

Severino’s evaluation facilities round the concept breaking $100,000 may trigger one other sharp Bitcoin worth improve, very like what occurred after it crossed $10,000 in 2017. He famous that the Bitcoin worth may see features of as much as 100% from its present worth, however the tempo of the rally might occur extraordinarily quick.

Associated Studying

This speedy ascent may mark the ultimate leg of this bull run that may create a peak adopted by a big correction, very like how the 2017 bull cycle performed out. “The highest is close to,” Severino cautioned. Nevertheless, he doesn’t imagine Bitcoin’s peak is simply two weeks away; he urged it may very well be as near round two months.

It is very important notice that the Bitcoin ecosystem has modified massively because it first broke above $10,000 in 2017. At the moment, the rally was pushed largely by retail buyers and Bitcoin whales who acquired in comparatively early. The present panorama features a rising institutional curiosity in Bitcoin, particularly by way of Spot Bitcoin ETFs. This institutional curiosity has been key to the regular development of the Bitcoin worth all through this 12 months, and present market dynamics level to such continued development.

On the time of writing, Bitcoin is buying and selling at $99,032, up by 2% previously 24 hours.

Featured picture created with Dall.E, chart from Tradingview.com

[ad_2]

Source link