Este artículo también está disponible en español.

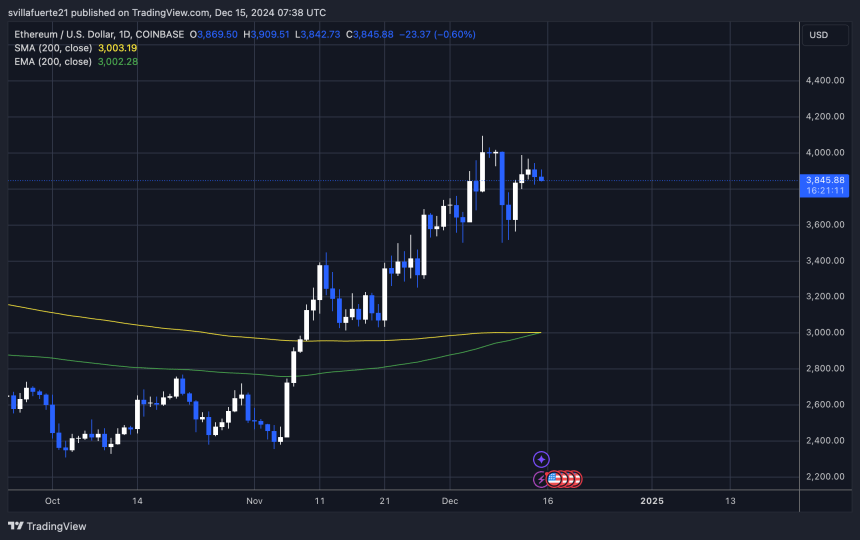

Ethereum is making one other try to interrupt above the $4,000 degree because it edges nearer to its all-time highs. Regardless of its robust fundamentals, doubts linger available in the market relating to Ethereum’s efficiency this cycle, with some anticipating it to underperform amid stiff competitors from different blockchain ecosystems. Nonetheless, Ethereum’s latest value motion means that it’s constructing momentum, maintaining traders on edge for a possible breakout.

Associated Studying

High analyst Carl Runefelt just lately shared a technical evaluation, noting that Ethereum has encountered robust resistance close to the $4,000 mark and is now consolidating inside a symmetrical triangle on the hourly chart. This sample usually precedes a decisive transfer, leaving merchants speculating whether or not ETH will escape to new highs or face a brief pullback.

Ethereum’s efficiency at this key degree will possible form market sentiment within the coming weeks. A breakout above $4,000 may pave the best way for a rally towards its all-time excessive, reigniting investor confidence. However, failure to clear this resistance may validate bearish considerations and result in a retrace. As ETH stays at a vital juncture, all eyes are on its potential to navigate this pivotal zone and ship the following main transfer.

Ethereum Getting ready To Transfer

Ethereum has been grappling with vital resistance above the $4,100 degree, leaving the market in suspense as merchants anticipate its subsequent transfer. With the worth consolidating and displaying indicators of stress, Ethereum seems able to make a decisive transfer within the coming days. The vital query stays: will it break increased, or is a pullback imminent?

Runefelt shared his insights on X, mentioning that Ethereum is at present buying and selling inside a symmetrical triangle on the hourly chart—a sample recognized for signaling potential breakouts or breakdowns. Based on Runefelt, Ethereum’s instant future hinges on two key ranges.

A breakout above $4,100 would affirm a bullish trajectory, possible propelling ETH towards new highs. Conversely, a breakdown beneath $3,675 would sign bearish sentiment, opening the door for a deeper correction.

Associated Studying

Runefelt emphasizes the significance of those ranges, noting that the symmetrical triangle suggests mounting strain that would quickly result in vital volatility. As Ethereum holds its place close to vital resistance, the following few days are shaping as much as be pivotal for figuring out its market route.

Technical Ranges To Watch

Ethereum (ETH) is at present buying and selling at $3,840 after failing to interrupt above the vital $4,000 resistance degree. Whereas the worth stays robust and inside vary of this key degree, it must clear $4,000 to verify the continuation of its uptrend. With no decisive breakout, ETH dangers shedding momentum, leaving merchants and traders cautious in regards to the subsequent transfer.

The $4,000 degree has confirmed to be a big psychological and technical barrier for Ethereum, with a number of makes an attempt to interrupt it being met with promoting strain. A profitable breach of this resistance would possible pave the best way for ETH to focus on increased ranges, probably pushing towards the yearly excessive of $4,100 and past.

Associated Studying

Nonetheless, if Ethereum fails to beat this hurdle, the market may see a retrace to decrease demand zones. The $3,500 space is rising as a vital assist degree that merchants are intently monitoring. A dip to this degree may present a powerful basis for a bounce, however shedding this assist may sign a shift towards bearish sentiment.

Featured picture from Dall-E, chart from TradingView