Tokenization—the illustration of real-world property (RWAs) as digital tokens on a blockchain—is “the following era for markets,” in accordance to Larry Fink, CEO of BlackRock. In actual fact, 97% of asset managers agree that tokenization will revolutionize asset administration, with the Boston Consulting Group forecasting the market dimension for tokenization to achieve $16 trillion by 2030.

Nonetheless, realizing tokenization at scale presents challenges, notably due to the multi-chain panorama, the place patrons, sellers, asset issuers, and different market individuals are fragmented throughout quite a few private and non-private blockchains, every tailor-made to particular geographies, companies, or use circumstances. So not solely should tokenized property be transferable cross-chain, however the information required to facilitate transactions of tokenized property comparable to internet asset worth (NAV), proof reserves, pricing info, id information, and extra have to be persistently out there onchain.

We at Chainlink Labs imagine that the present approaches to tokenization fall brief as a result of they solely give attention to the “asset receipt” being onchain however not different key information associated to the property. Bringing the 2 collectively onchain is the important thing to unlocking strong and compliant secondary markets for tokenized property. This requires a unified golden document for every tokenized asset—a single information container that gives the asset’s possession and key information, all of which is well verifiable, pretty accessible, and capable of be programmed upon by all individuals.

The next submit explores how Chainlink uniquely allows a unified golden document in asset tokenization, serving to unlock deeper liquidity, extra environment friendly workflows, and smarter, extra programmable monetary devices and companies. To study extra concerning the tokenized asset megatrend, try our trade report: The Definitive Information to Tokenized Property.

Present Challenges With Tokenization

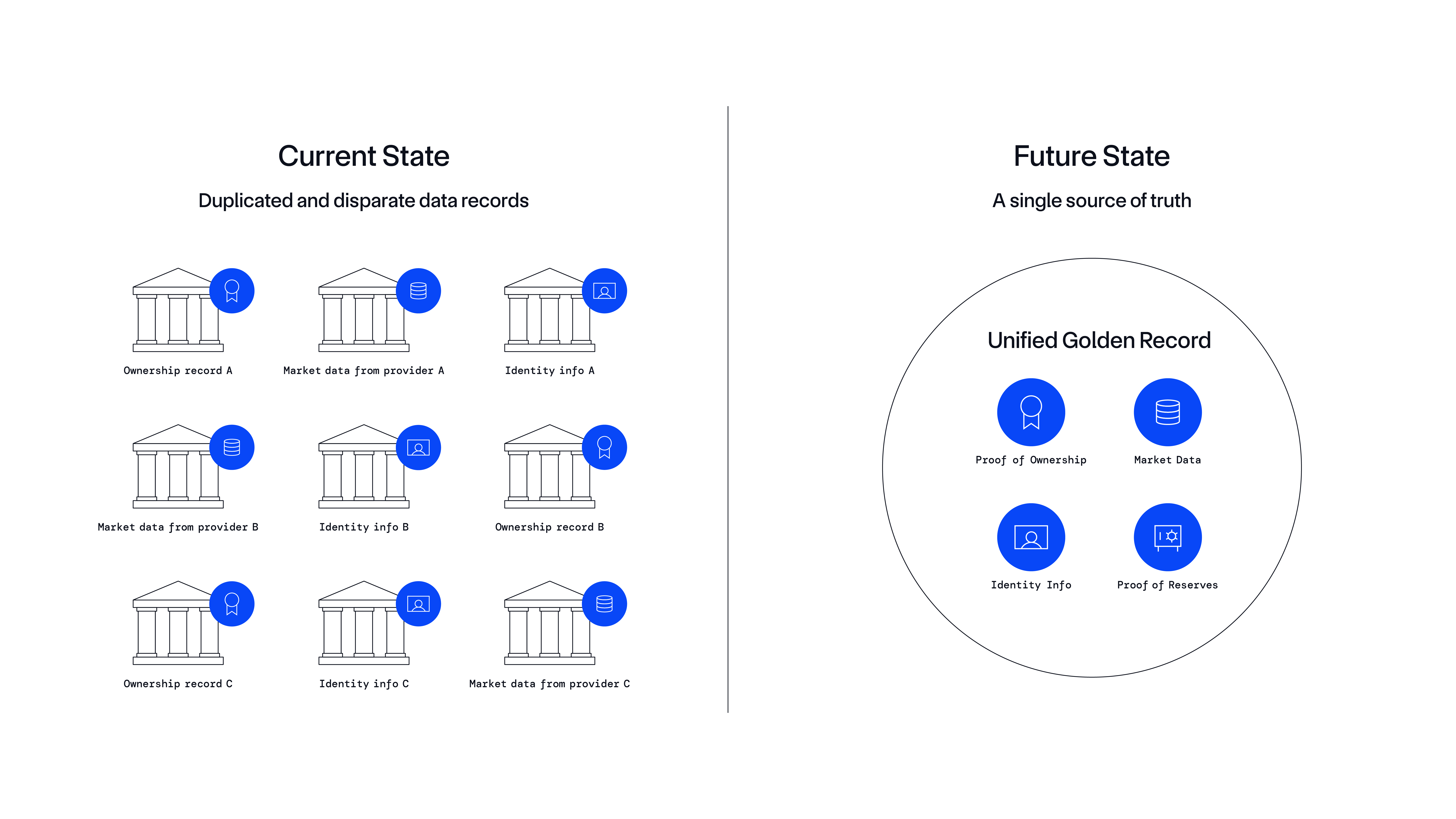

Within the conventional monetary system, asset information—comparable to reference information, pricing info, possession historical past, id checks, auditor attestations, and so forth—resides in quite a few disparate backend methods throughout totally different market individuals, together with banks, asset managers, and monetary market infrastructures. Throughout monetary transactions, asset information have to be gathered and oftentimes duplicated between counterparties for all individuals to get a standard view of market actions.

Sadly, some key information could exist outdoors of a counterparty’s purview, making performing full due diligence difficult and even inconceivable in some cases. Moreover, discrepancies and data asymmetries inevitably emerge through the synchronization course of as a result of mismatched or lacking information, leading to failed trades, reconciliation issues, and different errors that drive up prices and settlement occasions.

“Between 2020 and 2022, the method failed a whole bunch of occasions at funds with $342 billion in property … In the course of the first 10 months of 2022, the evaluation discovered that these liable for putting NAVs severely bungled the method virtually 130 occasions, an 18% improve from the identical interval in 2021. The variety of fund outlets reporting such errors elevated much more, by over 29%.”— Calculating NAV Is Onerous, Ignites Evaluation

Blockchains launched a shared distributed ledger for verifying and storing asset possession and transaction information, serving as a single supply of fact amongst all market individuals. Nonetheless, blockchains solely observe possession of property issued on their very own networks. Moreover, the existence of a whole bunch and ultimately 1000’s of various blockchains implies that tokenized property, liquidity, and information about such property will originate and transfer throughout totally different blockchains. Knowledge about tokenized property may even reside and be dynamically up to date inside a wide range of offchain databases and methods, all of which want to stay in sync with onchain networks.

Thus, for a extremely dependable, single supply of fact a few tokenized asset—a unified golden document—to exist and enhance upon the identical synchronization issues presently present in conventional finance, it have to be out there on any blockchain, stay credibly impartial to forestall info asymmetries, and synchronize in real-time with current offchain infrastructure and information sources.

With no unified golden document, asset tokenization will principally be restricted to customers holding possession receipts for comparatively opaque property, slightly than being bearer devices totally enriched with all the knowledge wanted to entry their worth and danger profile. Liquid and environment friendly secondary markets are unlikely to kind round tokenized receipts as a result of market individuals must coordinate with a wide range of companies and methods to acquire all the knowledge and approvals wanted to make knowledgeable choices and execute transactions.

For instance, potential purchasers could have to coordinate with a number of counterparties to verify the NAV of a tokenized cash market fund, verify if a tokenized carbon credit score is legitimate or redeemable, or confirm if there may be an excellent debt on a bit of actual property. This simplified mannequin of tokenization is harking back to the info synchronization downside that led to the 2008 Monetary Disaster, the place traders didn’t have all of the underlying information concerning the property they have been holding, creating vital info asymmetry and systemic danger.

The Want for a Unified Golden File

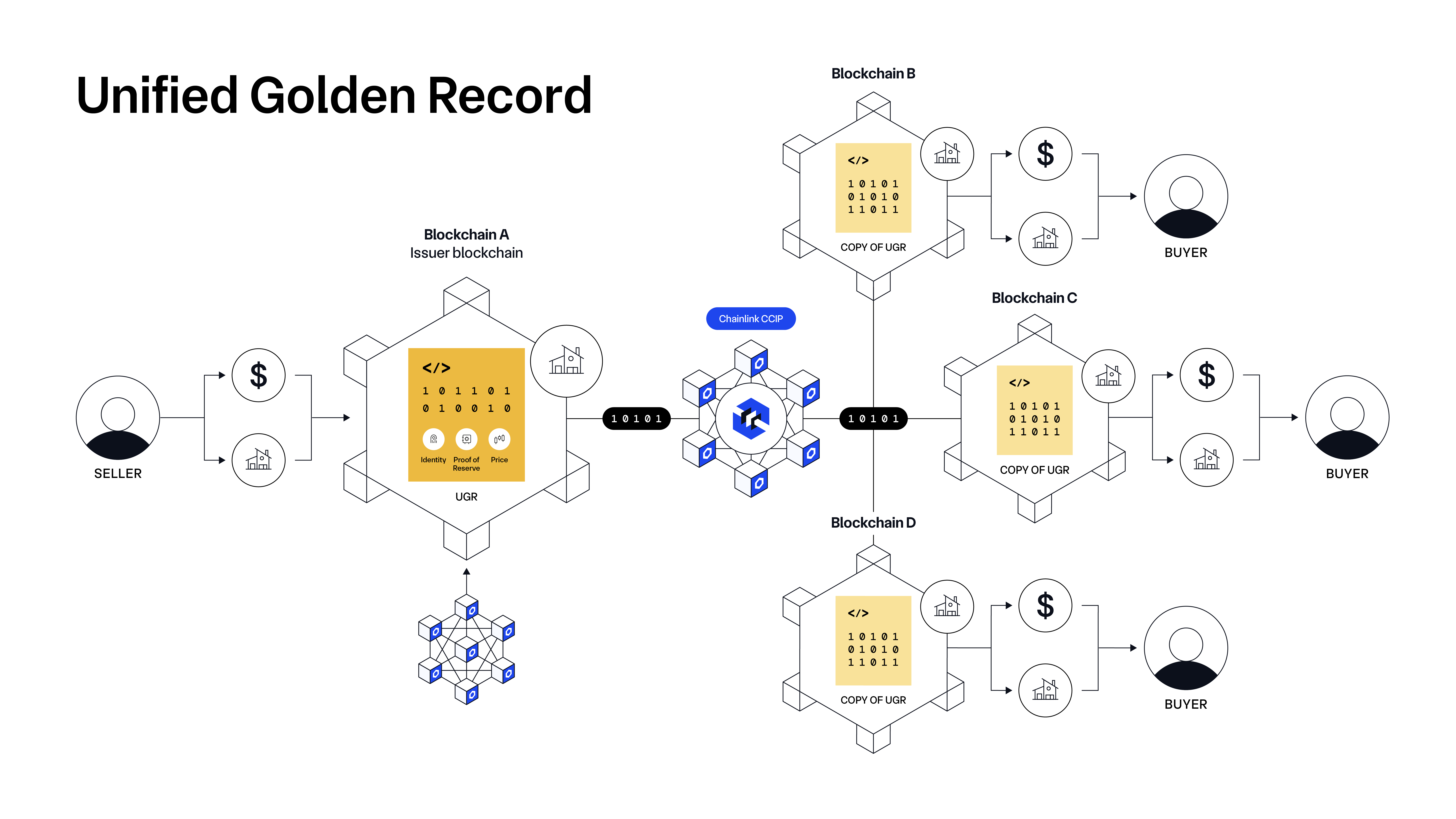

A unified golden document is a verifiable, persistent, updateable, and interoperable information container that lives on a blockchain and is embedded inside a tokenized asset’s sensible contract. It serves as a single supply of fact for the asset, which could be referenced by all market individuals, together with traders, banks, asset issuers, asset managers, and FMIs.

A unified golden document for a tokenized asset supplies all market individuals with a shared supply of fact that features asset possession and supplementary info. Realizing unified golden information requires three key capabilities:

Knowledge Enrichment—To make sure that tokenized property are trusted and accessible throughout numerous jurisdictions and organizations, a unified golden document should embody key offchain information comparable to market pricing, reference information, compliance checks, id verifications, possession information, auditor attestations, and proof of reserves. This information is foundational to issuing property and facilitating transactions in capital markets.

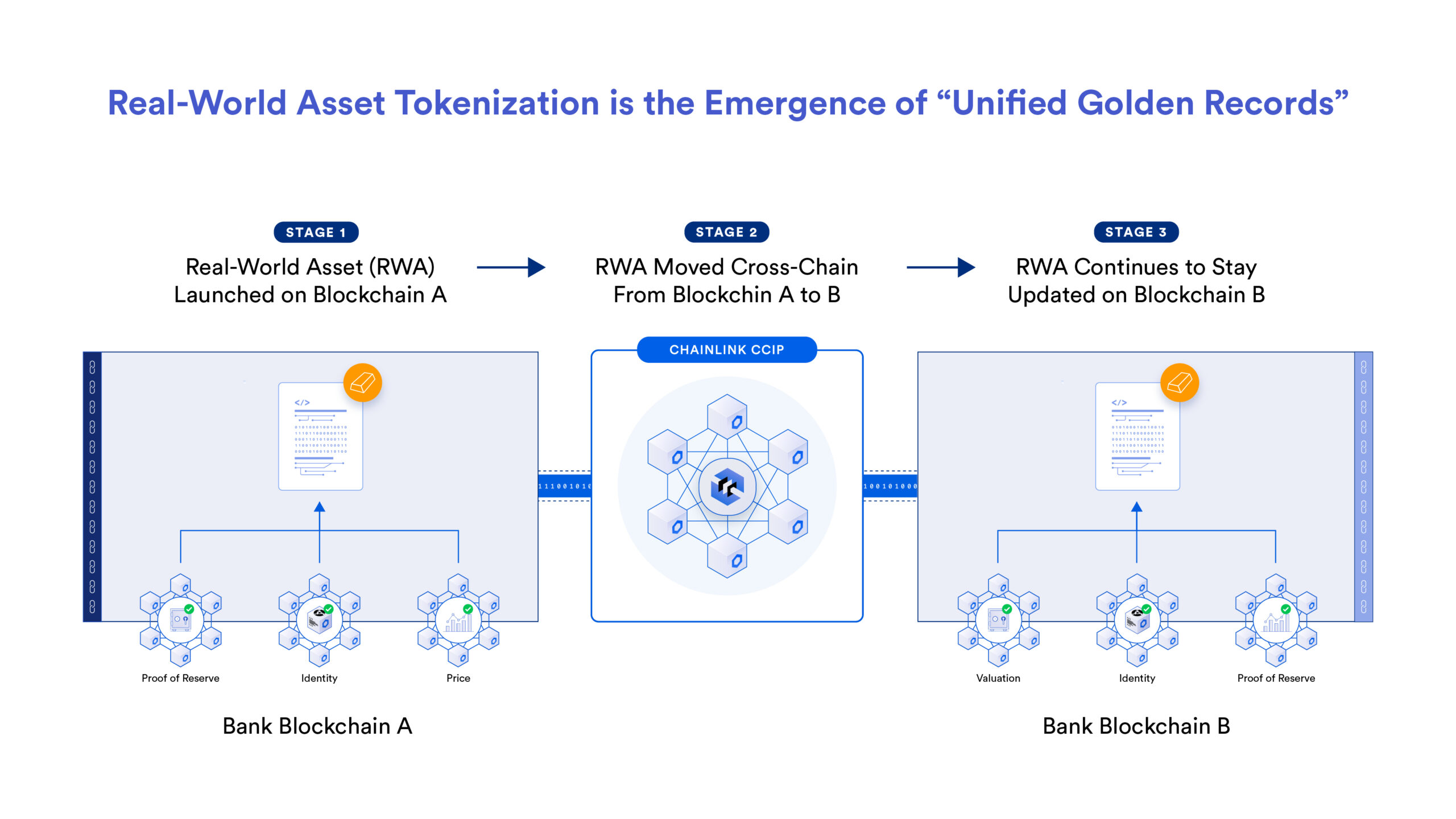

Cross-chain Interoperability—Making certain that tokenized property are composable throughout disparate blockchains and could be transferred wherever market demand exists is crucial for realizing enhanced liquidity inside onchain finance. As such, a unified golden document should stay hooked up/embedded throughout the tokenized property because it strikes throughout totally different onchain environments, together with each public blockchains and personal DLT networks.

Continuous Synchronization—Because the asset and its information transfer throughout numerous chains, it should proceed to be up to date with offchain information. That is crucial to sustaining the unified golden document amongst an more and more advanced internet of private and non-private blockchain networks. It’s additionally a prerequisite to programming automated actions and companies based mostly on a unified golden document, as outdated info can result in pricey errors and time delays.

Market individuals can pull publicly out there information that’s embedded within the unified golden document into their current backend methods at any time or use that information to set off extra advanced and automatic onchain actions, comparable to verifying the collateralization of a tokenized asset used to safe an onchain mortgage.

Introducing Unified Golden Information Powered by Chainlink

As extra property get tokenized, the necessity for an correct, decentralized, and tamper-proof unified golden document will increase, notably if monetary establishments are to understand the total automation, transparency, and programmability advantages that derive from distributed ledgers and tokenized property.

Let’s have a look at how Chainlink is the one platform that uniquely helps every unified golden document functionality.

Excessive-High quality Knowledge to Enrich a Unified Golden File

The “rubbish in, rubbish out” principle refers back to the idea that the standard of an output from a system is set by the standard of its inputs. If flawed, inaccurate, or poor-quality information enters a system, the ensuing output may even be flawed, inaccurate, or of poor high quality.

Blockchain know-how stands out for its capability to create a unified understanding or single supply of fact amongst totally different events. As soon as info is verified and recorded onchain, it turns into a verifiably trusted reference enter for everybody concerned. This consensus is important in driving coordination efforts the place a collective settlement is required for the system to perform successfully.

Chainlink performs an important position in making certain that offchain information about tokenized property introduced onto a blockchain and used as inputs in tokenized asset transactions are safe, correct, and credibly impartial for all individuals. Chainlink helps preserve information accuracy by having a decentralized community {of professional} service suppliers (i.e., node operators) gather and mixture information from throughout a number of unbiased sources to supply aggregated onchain updates to the unified golden document in real-time. The mix of a number of layers of decentralization and strong cryptoeconomic incentives ensures a excessive stage of tamper resistance and accountability.

This decentralized infrastructure may assist stop black swan occasions such because the latest NYSE glitch, wherein the listed value of a number of securities dropped by as much as 99.9% as a result of a failure of its centralized infrastructure. It’s additionally key to incentivizing collaboration, as no counterparty can solely personal, monetize, and handle the infrastructure used to facilitate transactions.

Seamless Knowledge and Asset Circulation Throughout Blockchain Networks

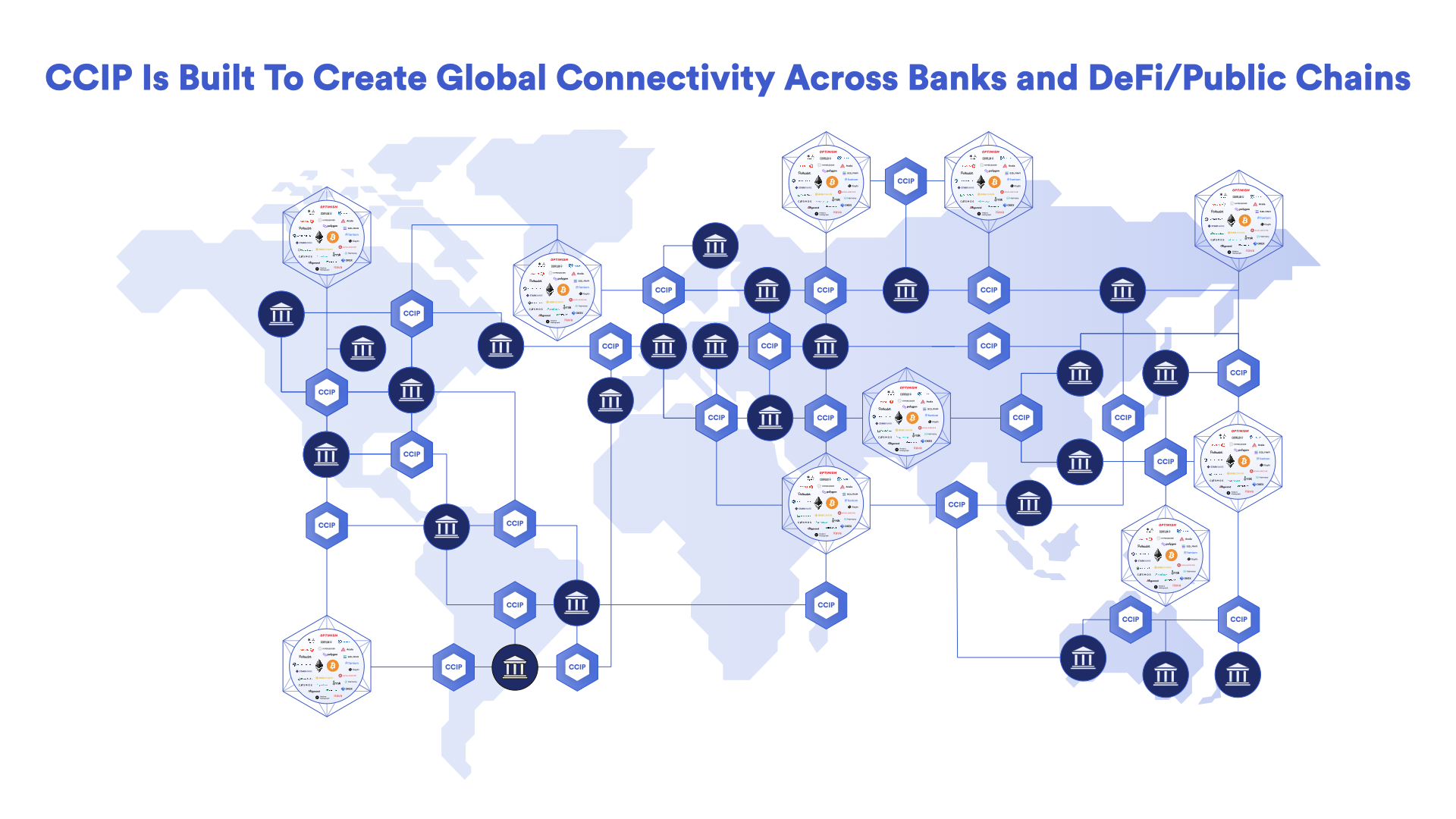

Chainlink addresses the interoperability requirement of a unified golden document by providing a platform the place unified golden information are interoperable between blockchains slightly than consolidated on a single ledger. This strategy is extra strong, future-proof, and viable for crucial information administration, as getting the complete world to agree on a single distributed ledger is very impractical, inefficient, and limits scalability. Chainlink Co-founder Sergey Nazarov additional expands on why a multi-chain strategy is the place the blockchain trade is transferring in his brief speak: How CCIP Permits an Web of Contracts.

To resolve the blockchain interoperability downside, Chainlink launched the Cross-Chain Interoperability Protocol (CCIP)—the cross-chain interoperability customary that securely connects each main public blockchains and personal financial institution distributed ledger applied sciences (DLTs) into one Web of Contracts. Main monetary establishments and monetary market infrastructures (FMIs) are already adopting the Chainlink platform and CCIP to unlock the total potential of tokenized property, comparable to Swift, DTCC, ANZ Financial institution, and various different trade individuals.

Interoperability ensures that numerous methods can work collectively and share information with out the necessity for homogenization, which frequently results in vendor lock-in and stifles innovation. A unified golden document constructed on an interoperable basis like CCIP allows disparate methods throughout the worldwide monetary ecosystem to work together whereas making certain that information maintains its integrity and relevance no matter its level of origin or present residence and that relationships with current methods are capable of persist.

Synchronization and Composable Companies

Centralized market infrastructure requires excessive ranges of standardization to perform successfully (notably when automated), but it should even be versatile sufficient to adapt to the quickly altering wants of worldwide markets. The generalized and decentralized nature of a Chainlink-powered common golden document drives efficiencies by synchronization and composability—the power to attach current infrastructure onchain and assemble further companies on high of current ones.

By having a single, shared, trusted, truthful, and persistently up-to-date unified golden document that each one individuals have entry to and might simply connect with and program on high, monetary entities can develop and combine new functions and processes that work together seamlessly with it. This composability promotes larger operational effectivity because it negates the necessity for guide administrative approvals and redundant confirmations and reconciliations from every stakeholder—paving the way in which for a extra streamlined monetary panorama.

Some instance use circumstances the place Chainlink is already laying the muse for unified golden information embody:

Delivering NAV Knowledge Onchain

One vital information level inside a unified golden document for tokenized funds is their internet asset worth (NAV). NAV is the worth per share of the fund, which is vital from a authorized, accounting, and market perspective when conducting monetary transactions of tokenized fund shares. A collaboration between DTCC and Chainlink not too long ago explored Onchain NAV options, which could be examine within the full report: Sensible NAV Pilot Report: Bringing Trusted Knowledge to the Blockchain Ecosystem.

One other instance includes a collaboration between Chainlink, Constancy Worldwide, and Sygnum to carry NAV information onchain. This manufacturing use case for tokenized property supplies transparency and accessibility round key asset information for Sygnum’s not too long ago issued onchain illustration of Constancy Worldwide’s $6.9 billion Institutional Liquidity Fund.

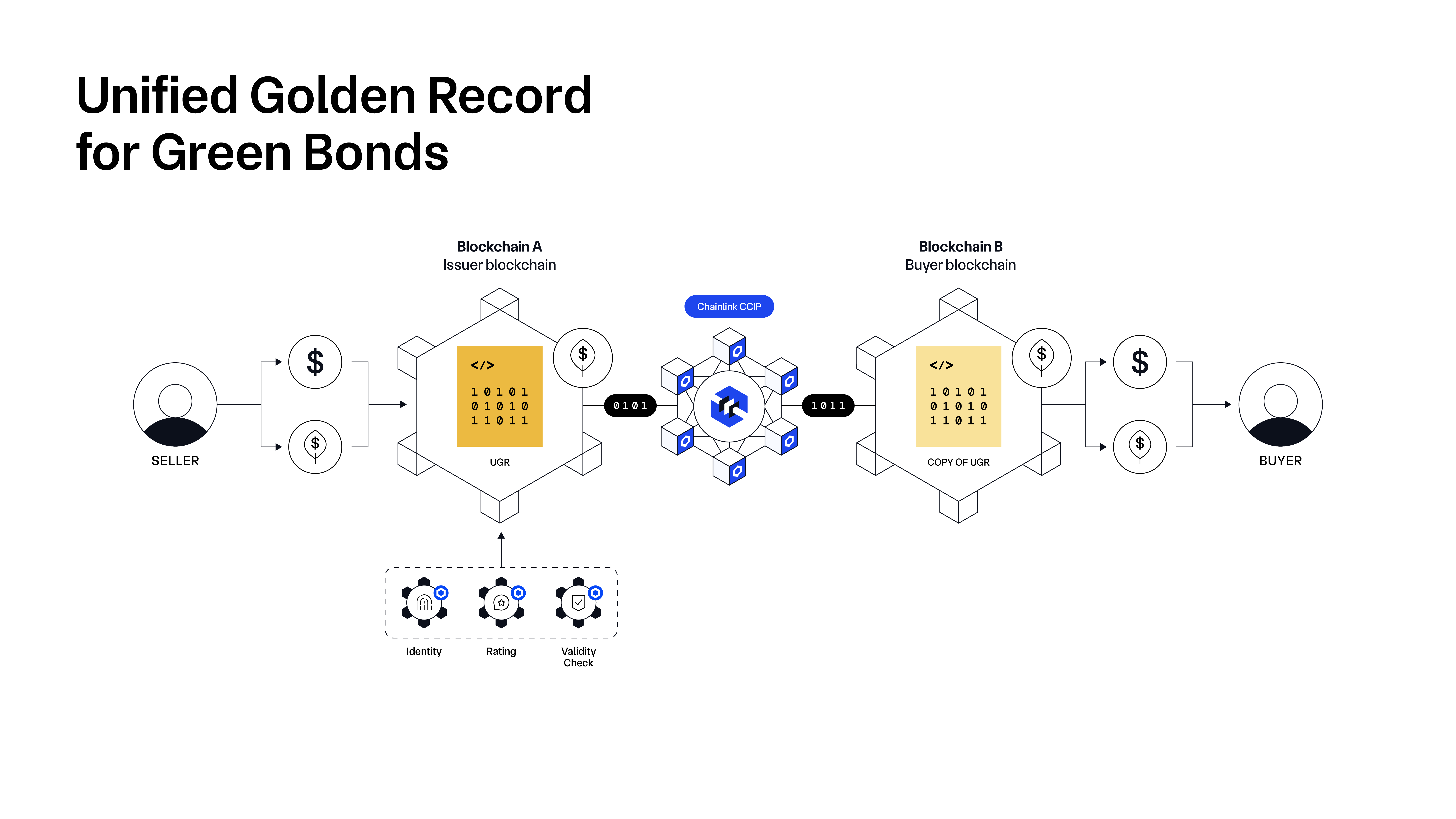

Verifying the Validity of Inexperienced Bonds

Inexperienced bonds have emerged as a technique to help particular local weather or environmental-related initiatives. Sadly, there are a number of fraudulent inexperienced bonds and double-counting practices. This additionally contains “greenwashing,” the place bonds are being offered however are not legitimate. Firms shopping for such bonds are at danger of reputational harm, monetary loss from underperforming property, authorized penalties for non-compliance, and general failure to realize real ESG aims.

Tokenization is rising as a gorgeous infrastructure to help inexperienced bonds given their historic lack of standardized infrastructure and technique of making certain validated and correct information for inexperienced financing functions. Nonetheless, for tokenized inexperienced bonds to scale, potential patrons should be capable of confirm sure details about inexperienced bonds earlier than buying them, comparable to their issuers, regulatory compliance, monetary viability, possession, and extra. A unified golden document powered by Chainlink cannot solely make all monetary and non-financial info out there onchain and verifiable by the complete monetary ecosystem, but in addition allow extra strong and environment friendly secondary markets by introducing numerous post-tokenization utilities.

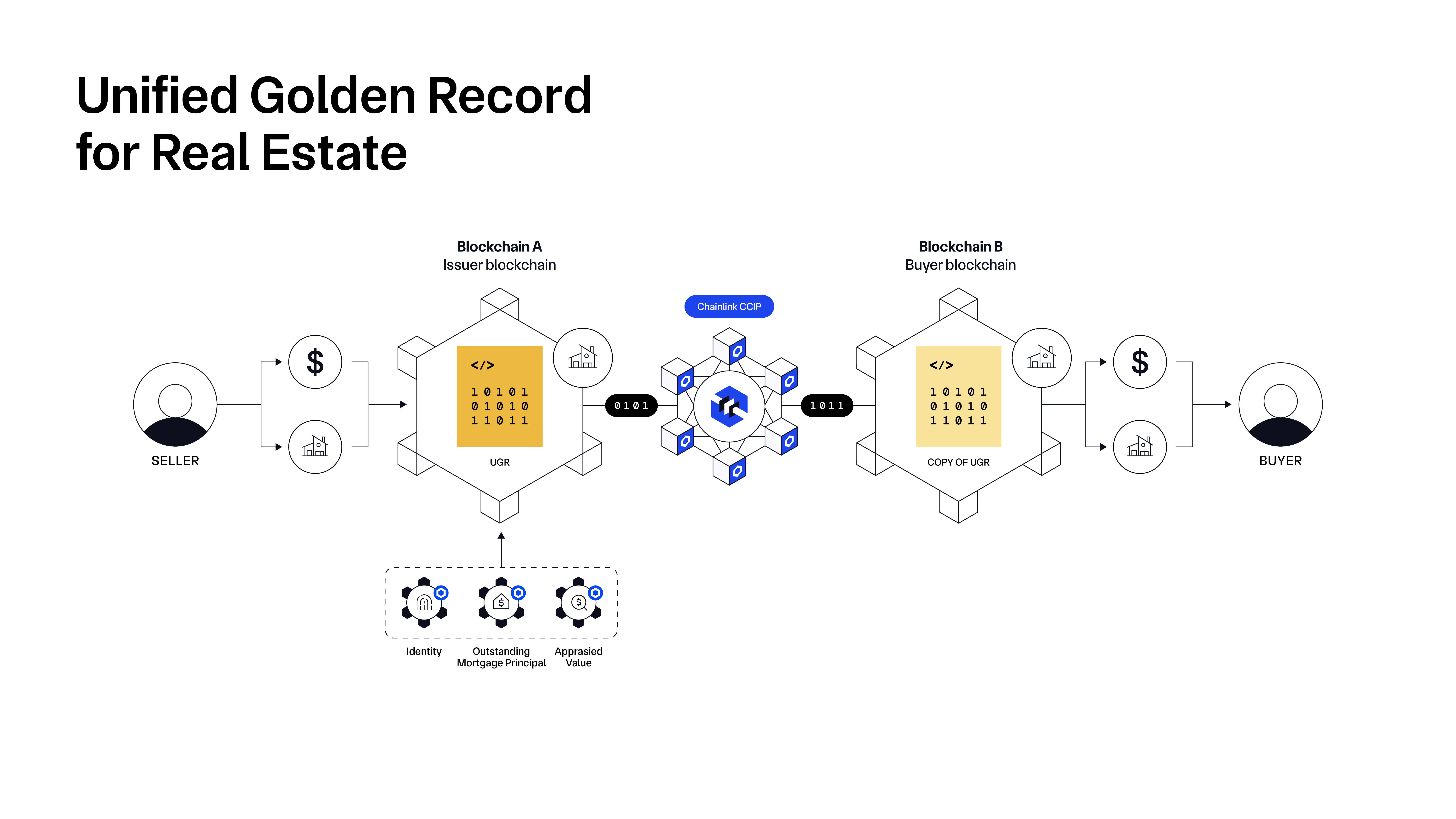

Checking the Present State of Actual Property

Tokenization is very engaging in actual property (or actual property mortgages), particularly contemplating that actual property possession could be fractionalized into any variety of tokenized shares, making it accessible to extra traders. Prior to buying tokenized actual property, patrons will wish to confirm sure details about it, comparable to who owns the deed, whether or not there may be any excellent debt, or just a dependable appraisal from a good appraiser.

Some examples of tokenized actual property property and the related information they may require embody:

Tokenized Actual Property Funding Trusts (REITs) require key information comparable to NAV, Funds from Operations (FFO), Dividend Yield, Property Kind, Geographic Location, and Occupancy Fee so traders can precisely and reliably assess the danger of the underlying collateral and make data-driven funding choices accordingly.

Tokenized Business Mortgage Backed Securities (CMBS) require key information comparable to Credit score Rankings, Unpaid Principal Balances (UPB), Yield to Maturity (YTM), Delinquency Fee, Mortgage-to-Worth Ratio (LTV), and Debt Service Protection Ratio (DSCR) for steady danger administration and risk-return evaluation.

Tokenized Particular Objective Autos (SPVs) Fairness Shares require key information comparable to property NOI, Cap Fee, Appraisal Worth, IRR, and Occupancy Fee for shareholders to make sound asset administration choices.

Chainlink can be utilized to retrieve this information from trusted off-chain sources and ship it on-chain in a safe and well timed method, creating unified golden information whereas additionally enhancing the liquidity of the tokenized property.

Think about, 24/7/365 monetary markets with superior danger administration, elevated collateralization choices, diminished info asymmetry, and enhanced programmability for automated monetary companies. Or the banking and Web3 worlds converging on a single monetary system with larger liquidity and entry worldwide. In the end, the potential real-world impression unlocked by tokenization is huge, however it may well solely be realized by the institution of unified golden information that function single sources of dependable and tamperproof fact about tokenized property, that are linked to and throughout all blockchains, synchronized with current offchain methods, and maintained in a good and decentralized method.

By leveraging Chainlink-powered unified golden information, monetary establishments throughout numerous areas can securely work together by way of an easy-to-access platform that interfaces with each new blockchain-based platforms and legacy methods. Furthermore, transparency, interoperability, and information privateness can turn out to be intrinsic traits of the monetary substrate slightly than afterthoughts. In essence, Chainlink’s interoperable platform doesn’t simply allow unified golden information; it may well advance a safer, automated, and cohesive world monetary ecosystem.

If you wish to study extra about how Chainlink can help your tokenized asset, attain out to our staff of specialists. We additionally encourage you to hearken to Chainlink Co-Founder Sergey Nazarov speak extra in depth under about how Chainlink helps capital markets’ transition onchain, comparable to by enabling unified golden information.