[ad_1]

Because the market rebound slows, Bitcoin SV captured some momentum and gaining some floor in opposition to the bears right this moment, August 8. The coin has been up extra than 10% since final month, an enormous benefit out there’s hostile setting.

Associated Studying

Bitcoin SV is a tough fork of Bitcoin Money which can be a fork of Bitcoin itself. BSV, nevertheless, has traits distinctive to itself, not like its shut cousins that make it extra enticing to companies.

Fixing Actual World Issues With On-Chain Options

President of the Blockchain Affiliation Uganda Reginald Tumusiime mentioned his group’s challenge, the KitePesa, a stablecoin backed by the Ugandan shilling. In response to him, a lot of the international locations in Subsaharan Africa have been exploring central financial institution digital forex (CBDC) initiatives as a type of forex. This institutional curiosity in blockchain tech and stablecoins are the elements that KitePesa will leverage for additional improvement.

The challenge has its deserves. The Ugandan individuals have been switching to digital banking which affords the identical options as conventional banks however with comfort as cellphones develop into an increasing number of prevalent. In 2023, clients of cellular cash suppliers reached 42.9 million with the determine anticipated to rise within the coming many years.

KitePesa will leverage institutional curiosity to construct a dependable blockchain infrastructure that operates and features a lot better than conventional cellular cash networks. With Uganda’s sturdy regulatory framework concerning funds and the applied sciences concerned, KitePesa has regulatory backing to function in a authorized setting.

The challenge might be launched on the BSV Blockchain, integrating the considerably native challenge into the worldwide market which can make investments as they see potential in KitePesa.

Continuation Rally Would possibly Occur At These Ranges

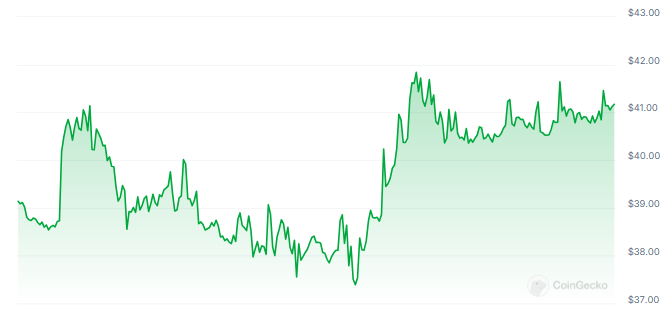

BSV could possibly be confronted with a breakthrough and is making an attempt to settle between $40.29 and $45.30. If the bulls are profitable in taking this place, we’d see additional upward motion within the coming days or perhaps weeks.

Nonetheless, the market nonetheless has its doubts with the full market cap of the crypto market seeing a measly 0.2% acquire prior to now 24 hours as Bitcoin and Ethereum recuperate at a snail’s tempo. In non-public fairness, indices, futures, and commodities are experiencing hiccups because the market expects extra volatility forward and after the discharge of a number of macro indicators.

Associated Studying

This may hamper BSV’s brief time period to long-term acquire because the coin strikes with the broader market. The present motion is a part of the outlying group of cryptocurrencies that outpaced the entire crypto market.

If BSV can stabilize on the $40.29-$45.30 worth vary, we’d see a continuation rally in the long run. However this transfer continues to be extremely depending on the broader market’s motion that’s at present grinding to a halt.

Buyers and merchants ought to nonetheless deal with BSV with warning as it may be prone to any market swing each upward and downward.

Featured picture from Pexels, chart from TradingView

[ad_2]

Source link