[ad_1]

The 2 largest cryptocurrency property, Bitcoin and Ethereum are witnessing a notable shift within the habits and confidence of investor as indicated by a unfavourable development of their community exercise, resulting in sluggish performances up to now months.

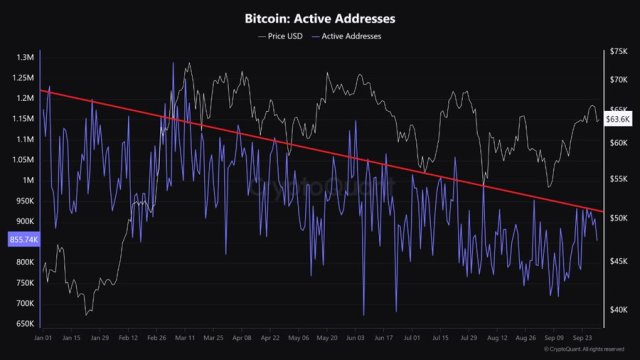

Lively Addresses In Bitcoin And Ethereum Nosedives In 2024

Recently, Bitcoin and Ethereum exercise has drastically plummeted because of a persistent drop within the variety of lively addresses on each networks. Kyle Doops, the host of the Crypto Banter present and market skilled, shared the worrying improvement on the X (previously Twitter) platform, triggering speculations about its influence on the 2 main digital property.

This pessimistic flip of occasions signifies a possible slowdown in person adoption and a wider discount in transaction quantity, reflecting that the market momentum of Bitcoin and Ethereum may be reducing. A number of components, like market uncertainty and profit-taking due to present worth swings, are thought-about to have resulted within the decline, which might trigger customers to go away the community momentarily.

The market skilled highlighted that the variety of lively addresses has been constantly reducing because the starting of this 12 months despite the final expectation of a bull market. Particularly, this suggests that fewer wallets are participating with the 2 blockchains.

Kyle Doops has underscored the necessity for persistence towards a shift to quantitative easing with a view to rekindle market pleasure because the sector awaits recent buyers as a result of liquidity is being drained by the Federal Reserve’s (Fed) tightening.

Main on-chain information and analytics agency, CryptoQuant, has additionally shed gentle on the event, noting that new buyers usually are not getting into the crypto panorama as buyers and liquidity have already entered the market in antiticipation of the Spot Bitcoin and Ethereum Alternate-Traded Funds (ETFs).

Regardless of this, CryptoQuant famous that the drop in lively addresses implies that the hype has not materialized but and there was no rally after the Fed’s first price lower, as was anticipated. This is because of the truth that the Fed is continuous quantitative tightening (QT), a technique of withdrawing liquidity from the market.

Moreover, CryptoQuant claims that in the identical interval, there have been additionally notable will increase within the M2 cash provide. Finally, the platform expects an increase in lively addresses and a return of market hype as soon as the Fed resumes quantitative easing as soon as once more, a technique of including liquidity to the market.

Destructive Value Sentiments Grows

Bitcoin and Ethereum proceed to wrestle to provoke a rally on account of the normal market turbulence, sparking considerations concerning the trajectory of the main digital property.

Presently, the value of BTC has fallen by practically 2% up to now day, buying and selling at $60,945, whereas ETH is seeing an even bigger worth decline of practically 5% in the identical time-frame, buying and selling at $2,360. Each property are at present experiencing a waning buyers’ sentiment as their buying and selling quantity is exhibiting an identical discount of over 19%.

Featured picture from Unsplash, chart from Tradingview.com

[ad_2]

Source link