[ad_1]

On-chain information reveals the Bitcoin Energetic Addresses have continued to see a steep decline just lately, an indication that may very well be bearish for BTC.

Bitcoin Energetic Addresses Have Lately Seen Their Greatest Drop Since 2021

As identified by an analyst in a CryptoQuant Quicktake put up, the BTC Energetic Addresses have been seeing a decline since March of this 12 months. An deal with is alleged to be “lively” when it participates in some form of transaction exercise on the community, whether or not as a sender or receiver.

The Energetic Addresses indicator retains monitor of the distinctive whole variety of such addresses which can be making transfers on the Bitcoin blockchain every single day. The distinctive lively addresses could also be thought-about the identical because the distinctive customers visiting the community, so the metric basically tells us about BTC’s every day visitors.

Now, here’s a chart that reveals the development within the 100-day Easy Transferring Common (SMA) of the Bitcoin Energetic Addresses over the previous couple of years:

The worth of the metric seems to have been happening in latest months | Supply: CryptoQuant

As displayed within the above graph, the 100-day SMA of the Bitcoin Energetic Addresses had been rising throughout 2023 and the early elements of this 12 months, however since March, the metric has seen a pointy turnaround, with its worth now quickly happening as a substitute. The reversal occurred across the time of BTC’s new all-time excessive (ATH), so it’s seemingly that the indicator’s reducing is occurring as a result of consolidation that the coin has since been caught in.

Traders discover sharp value motion like rallies to be thrilling, whereas sideways motion to be boring, so the Energetic Addresses registering a downturn in a interval like now isn’t too odd. What could also be value noting, although, is the dimensions of the drop that the 100-day SMA of the metric has noticed. Its worth is already under the bottom level noticed within the 2022 bear market and will quickly fall under the 2021 low as effectively.

Bitcoin usually requires an lively userbase to maintain any rally going, so the indicator’s worth witnessing a collapse just lately may very well be a bearish signal. “You shouldn’t be stunned if BTC’s value begins catching up with deal with exercise development very quickly,” notes the quant.

Whereas the Energetic Addresses development has been wanting destructive, CryptoQuant CEO Ki Younger Ju has mentioned in an X put up that Bitcoin remains to be in the midst of the bull cycle.

Appears to be like like the worth of the metric has been optimistic in latest days | Supply: @ki_young_ju on X

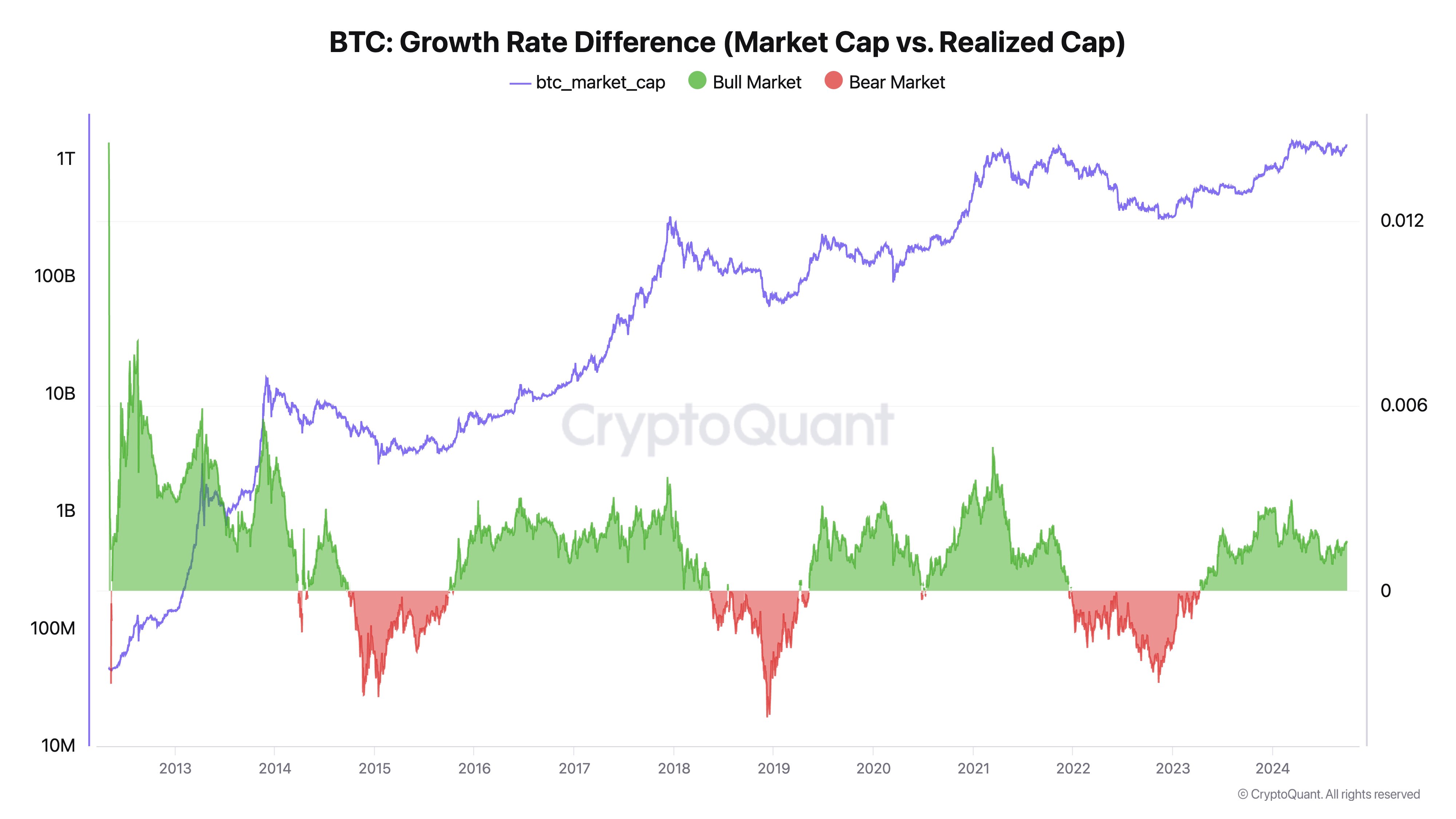

The above chart shared by Younger Ju reveals the development within the Bitcoin Development Price Distinction, which is an indicator that compares the growths of the BTC market cap and realized cap.

The latter of those, the realized cap, is an on-chain capitalization mannequin that principally tells us concerning the quantity of capital that the buyers as a complete have put into the cryptocurrency.

At current, the indicator is inexperienced, that means the market cap is rising quicker than the realized cap. “When market cap grows quicker than realized cap, it might sign a bull market; the reverse may point out a bear market,” explains the CryptoQuant CEO.

BTC Worth

Bitcoin has seen a continuation of its newest plunge throughout the previous day as its value has now slipped to the $62,700 stage.

The worth of the coin has seen a steep decline during the last couple of days | Supply: BTCUSDT on TradingView

Featured picture from Dall-E, CryptoQuant.com, chart from TradingView.com

[ad_2]

Source link