[ad_1]

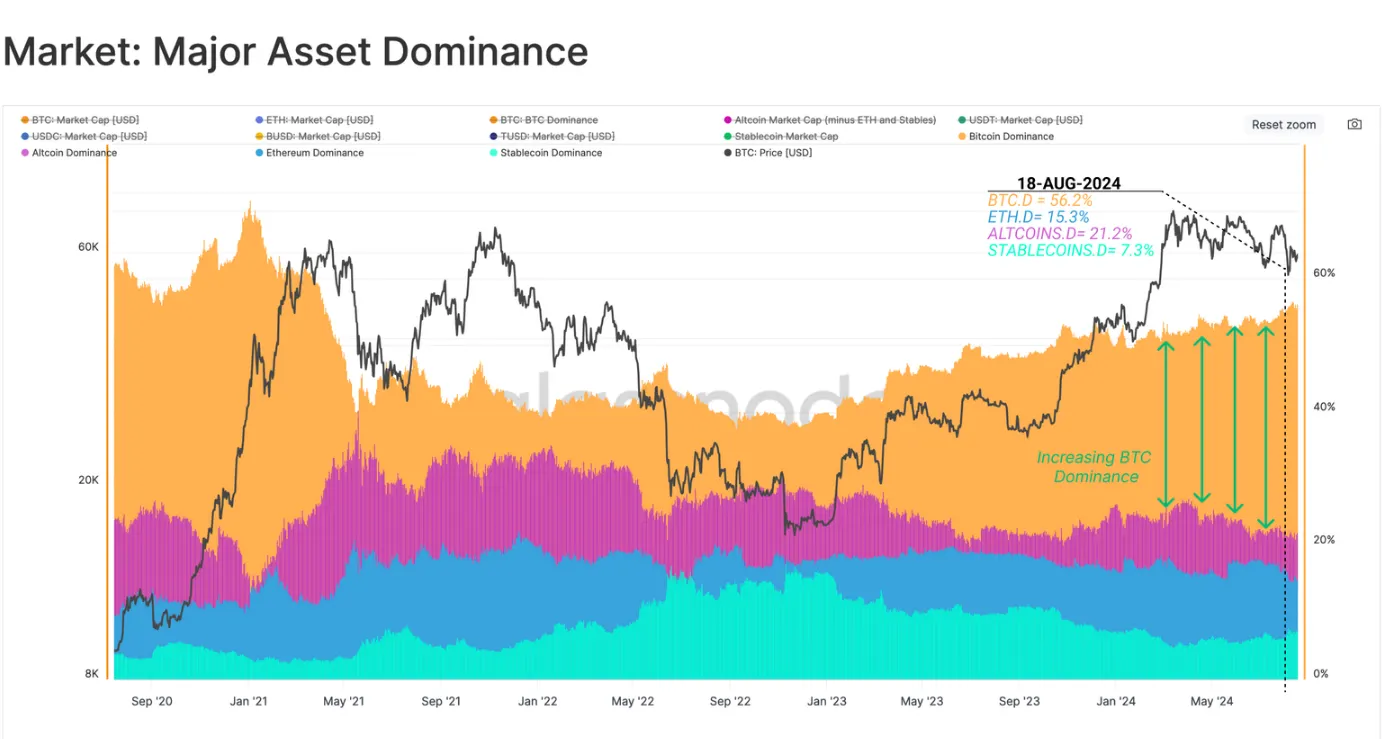

Bitcoin‘s market dominance has surged to a commanding 56% of the overall cryptocurrency market capitalization, marking a shift in investor sentiment and probably reshaping the digital asset panorama.

The rise in Bitcoin’s market dominance from 38.7% in November 2022 comes amid a fancy backdrop of market volatility, macroeconomic elements, and evolving institutional curiosity.

A brand new Glassnode report reveals that regardless of latest turbulent worth motion, long-term holders of Bitcoin stay unwavering of their conviction.

These steadfast buyers proceed to build up and maintain onto their cash, with information displaying that “HODLing conduct is considerably outpacing spending conduct.”

This pattern is especially evident within the fast improve of long-term holder provide, particularly from cash acquired throughout the March 2024 all-time excessive.

Talking with Decrypt, Ben El-Baz, Managing Director of HashKey International, attributed this surge to heightened mainstream investor confidence as Bitcoin’s market dominance approaches “historic highs.”

“Within the present market setting, buyers are extra inclined to decide on Bitcoin as a steady funding, fairly than altcoins together with Ethereum, that are extra risky however provide probably larger returns,” El-Baz stated.

The report additionally highlights an attention-grabbing dynamic between realized and unrealized losses amongst short-term holders. The STH-MVRV Ratio, a metric measuring unrealized monetary stress for latest patrons, has dipped beneath the equilibrium worth of 1.0, indicating that the typical new investor now holds an unrealized loss.

Nonetheless, the magnitude of each unrealized and realized losses stays comparatively small in comparison with earlier main bottom-forming occasions, suggesting a potential overreaction to latest market actions.

“Broader implications” for the crypto ecosystem

This shift in the direction of Bitcoin dominance will not be occurring in isolation, with Jonathan Hargreaves, International Head of Enterprise Growth & ESG at Elastos, seeing “broader implications” for the complete cryptocurrency ecosystem.

The present Bitcoin dominance “can stimulate the general development of the cryptocurrency market, increasing the complete ecosystem fairly than merely reallocating extra worth to BTC,” Hargreaves defined.

He emphasised the significance of Layer 2 options and interoperability between Bitcoin and Ethereum networks in fostering development throughout the sector.

The macroeconomic setting can also be enjoying a task in Bitcoin’s ascendancy, with El-Baz pointing to “the potential for rate of interest cuts by the Federal Reserve and a extra favorable political local weather,” as elements.

This sentiment is echoed within the Glassnode information, which reveals a constructive web capital influx for Bitcoin, Ethereum, and stablecoins, with solely 34% of buying and selling days seeing a bigger 30-day USD influx, even because the market has usually contracted because the March ATH.

Nonetheless, the rising tide of Bitcoin’s dominance might not carry all boats equally.

Roy Hui, Co-Founder amd CEO of LightLink, noticed that regardless of the growing dominance of Bitcoin, there hasn’t been a major shift from BTC to ETH and different altcoins.

Hui advocated for a strategic method to make sure sustained development and broader market integration, suggesting partnerships with Web2 firms as a key technique.

El-Baz cautioned that altcoins together with Ethereum might face “even better challenges” by 2024 and 2025. This sentiment is mirrored within the Glassnode information, which reveals a decline in Ethereum dominance from 16.8% to fifteen.2%, and a extra pronounced drop within the wider Altcoin sector from 27.2% to 21.3%.

Trying forward, upcoming political occasions together with the U.S. election are including one other layer of complexity to Bitcoin’s rising dominance and its implications for the broader crypto market, stated Vijay Pravin Maharajan, CEO and Founding father of bitsCrunch, who highlighted “rumblings and hypothesis across the potential for Bitcoin to turn into a US reserve asset.”

Day by day Debrief E-newsletter

Begin every single day with the highest information tales proper now, plus authentic options, a podcast, movies and extra.

[ad_2]

Source link