[ad_1]

Institutional funding in Bitcoin ETFs is pushed by a startling 27% rise in adoption that happens inside the second quarter of 2024. That improve displays a rising confidence of institutional gamers within the digital forex market.

Knowledge supplied by K33 Analysis confirmed that over 260 new corporations joined the US spot Bitcoin ETF house, skyrocketing the entire variety of skilled corporations holding these ETFs to 1,199 as of the tip of June.

Retail Vs. Institutional Traders

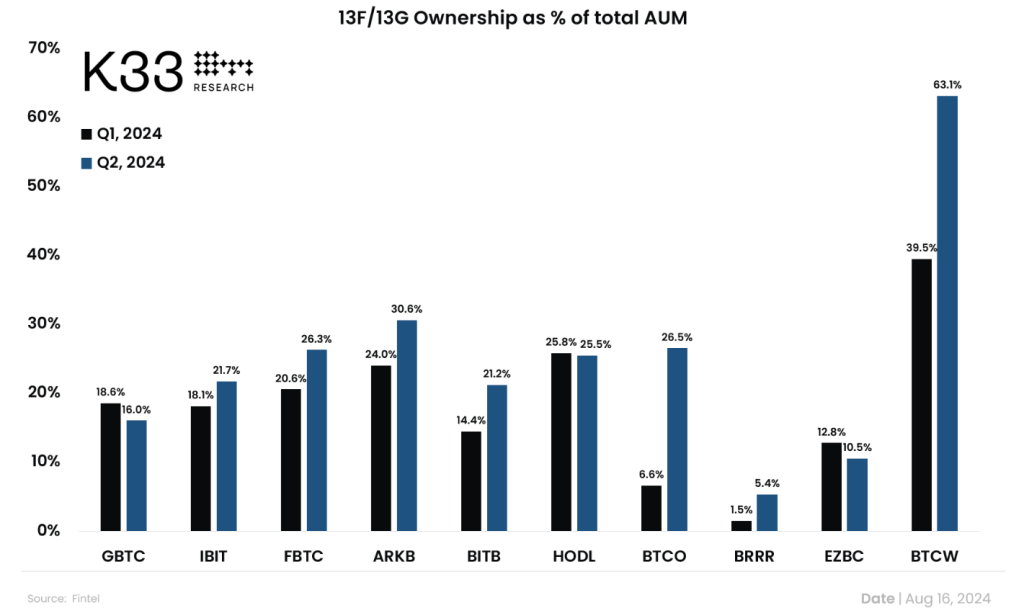

Though institutional curiosity is excessive, retail traders personal most Bitcoin ETFs. Institutional traders elevated to 21% of whole AUM in June from 18% in Q1. This improvement exhibits that atypical traders management the market at the same time as establishments acquire floor.

Institutional possession of BTC ETFs grew solidly in Q2!

In accordance with 13F filings, 1,199 skilled corporations held investments in U.S. spot ETFs as of June 30, marking a rise of 262 corporations over the quarter.

Whereas retail traders nonetheless maintain nearly all of the float,… pic.twitter.com/YanrZpfcCG

— Vetle Lunde (@VetleLunde) August 16, 2024

This pattern is highlighted by the presence of well-known corporations, corresponding to Goldman Sachs and Morgan Stanley, which have large investments in Bitcoin ETFs. For example, Goldman Sachs holds round 7 million shares value almost $418 million, whereas Morgan Stanley has acquired 5.5 million shares valued at $190 million.

Slumping Bitcoin Value Towards Hovering Adoption

Regardless of growing institutional acceptance, Bitcoin’s worth has lagged. Bitcoin was buying and selling at $59,190 as of August 17, battling to interrupt $60,000.

Analysts say one of many causes for this worth stagnation might be because of ETF inflows, that are operating decrease than common. August fifteenth ETF inflows got here in at simply $11 million, a meager restoration from an $81 million outflow the day prior. Lengthy-term holders begin to accumulate as soon as once more and create worth issues that alter the dynamics of the market.

BTC worth down within the final week. Supply: Coingecko

BTC worth down within the final week. Supply: Coingecko

The Street Forward

Trying forward, the key to a contemporary path ahead for Bitcoin and the entire cryptocurrency sector might be this rising institutional acceptance. The truth that a mixed $4.7 billion entered spot Bitcoin ETFs in Q2 may counsel that huge monetary corporations are ultimately beginning to see Bitcoin as an autonomous asset class as an alternative of solely a automobile for hypothesis.

Nevertheless, the true driver would be the momentum of Bitcoin above the $60,000 stage. The analysts additionally watched the resistance carefully with substantial hurdles close to $61,700 and $59,000. If the value breaks above these two hurdles, it will set off a wave of brief liquidations which may drive costs greater.

Value Standing

Bitcoin ETFs have been considerably unstable even whereas their institutional acceptance is gathering steam. The way forward for Bitcoin hinges lastly on this delicate equilibrium between institutional and atypical traders. That scene may change drastically and set the trail for wider acceptance and inclusion of cryptocurrencies into funding portfolios as typical finance approaches digital belongings.

Featured picture from Pexels, chart from TradingView

[ad_2]

Source link