US spot Bitcoin and Ethereum ETFs are seeing diverse market efficiency, signaling divergent traders’ curiosity within the prime digital belongings.

On Dec. 23, Bitcoin ETFs recorded their third straight day of outflows, totaling $226.5 million as traders adjusted their portfolios forward of the festive interval. The BTC ETFs have seen web outflows of greater than $1 billion throughout this era.

Constancy’s FBTC led the declines, shedding $146 million. Grayscale’s Bitcoin Belief adopted with $38.4 million in outflows, whereas Invesco’s BTCO noticed $25.7 million in withdrawals. Bitwise’s BITB and ARK Make investments & 21Shares’ ARKB reported mixed outflows of $39.6 million.

Nonetheless, BlackRock’s IBIT ETF stood out towards the downward development, attracting $31.6 million in inflows.

Regardless of the latest sell-offs, Bitcoin ETFs have netted $35.83 billion in inflows since their launch. The funds now maintain 5.7% of Bitcoin’s whole provide, valued at $105.08 billion, based on SoSoValue information.

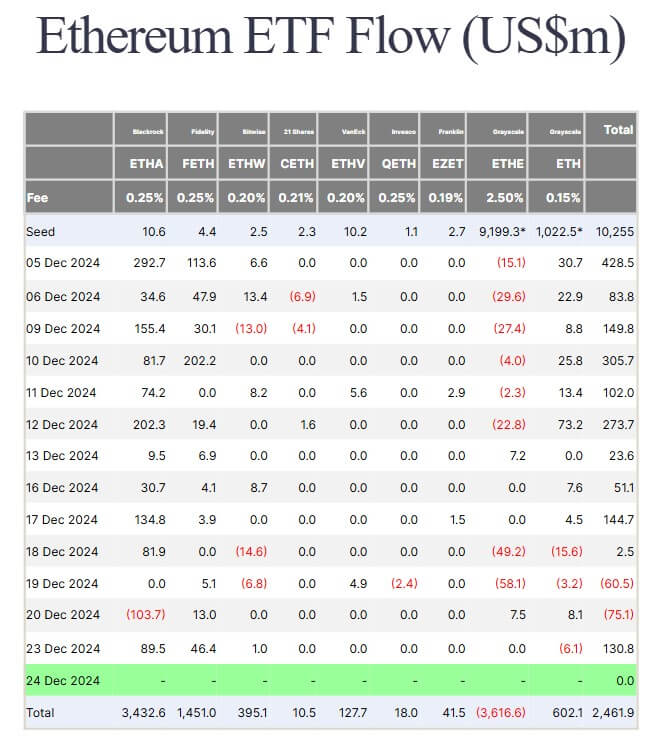

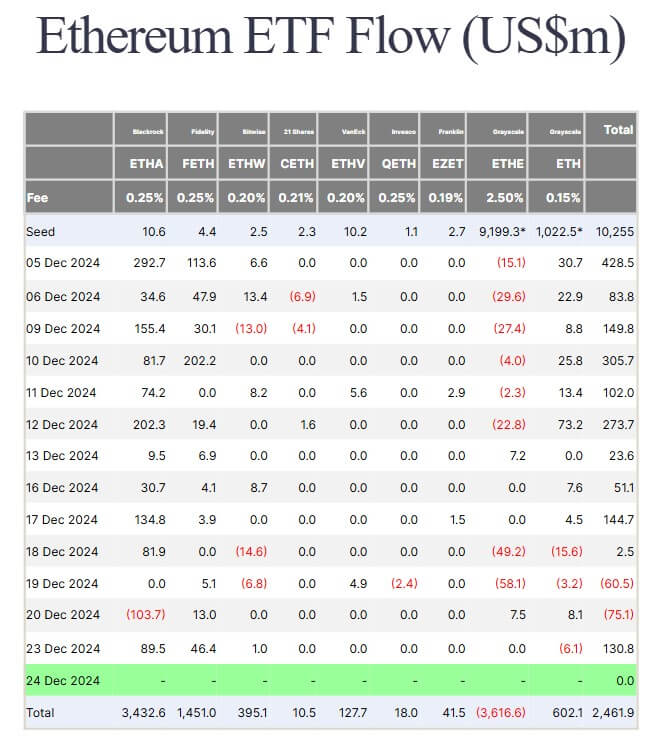

Ethereum ETFs surge

Ethereum ETFs painted a extra optimistic image, securing $130.8 million in inflows.

BlackRock’s ETHA led the best way, with inflows reaching $89.5 million. It was adopted by Constancy’s FETH fund, which added $46.4 million in inflows, whereas Bitwise’s ETHW recorded modest positive aspects of roughly $1 million.

Nonetheless, different Ethereum ETFs noticed minimal motion, apart from Grayscale’s Ethereum Mini Belief, which skilled a $6.1 million outflow.

Regardless of this, Ethereum ETFs have collectively amassed over $2.46 billion in inflows since launch.