[ad_1]

Este artículo también está disponible en español.

The founder and CEO of the on-chain analytics agency CryptoQuant has defined the place the height Bitcoin market cap lies primarily based on the present hashrate.

Bitcoin Ceiling May Lie At This Stage Based mostly On Community Hashrate

In a brand new submit on X, CryptoQuant founder and CEO Ki Younger Ju mentioned a BTC pricing mannequin that places higher and decrease bounds on the cryptocurrency’s worth utilizing the development within the mining hashrate.

The mining hashrate right here refers to a metric that retains observe of the entire computing energy the miners have at present related to the Bitcoin blockchain.

Miners use their computing energy to compete towards one another to develop into the primary to resolve sure mathematical puzzles and obtain the block reward as compensation.

Associated Studying

On condition that BTC can’t exist with out the miners or, at the very least, not be as safe and not using a decentralized community, some imagine the intrinsic worth of the cryptocurrency could be measured utilizing the hashrate.

In spite of everything, the Bitcoin miners must pay fixed electrical energy payments to host the hashrate, and they might solely be prepared to run as many farms as could be value it.

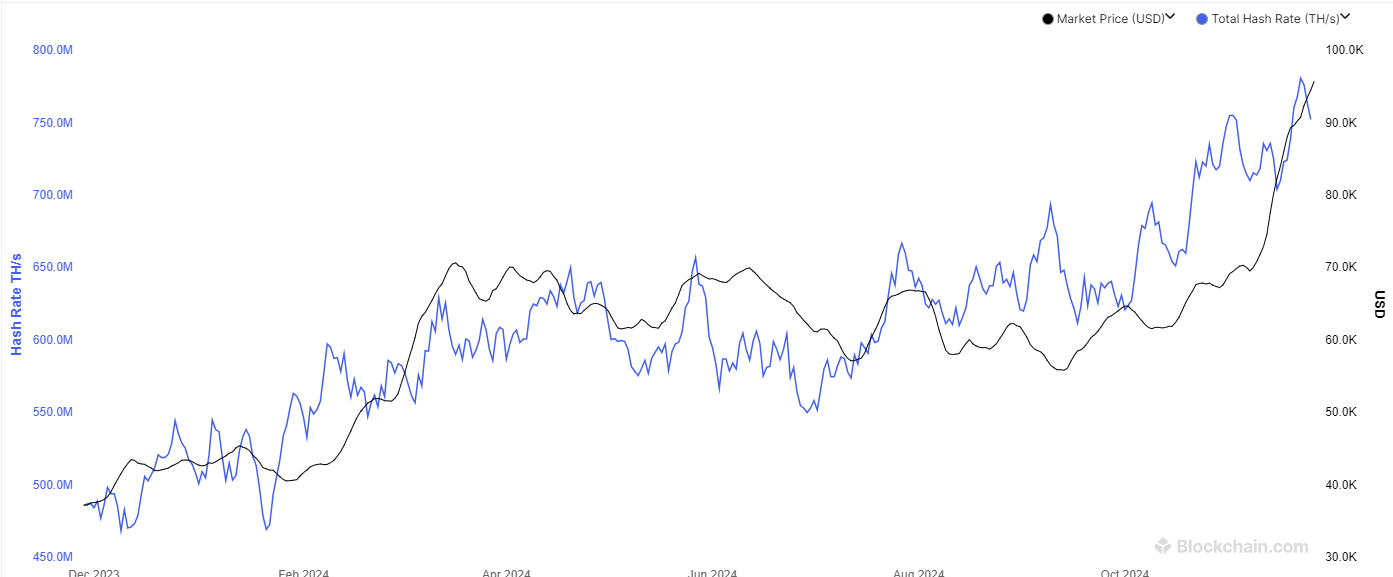

The chart under exhibits that the BTC mining hashrate has been rising not too long ago and setting new all-time highs (ATHs).

The explanation behind this uptrend is the rally that the asset has been observing; worth is the principle variable for the income of those chain validators, because the block subsidy they obtain in BTC naturally fluctuates with it.

Talking of the block subsidy, a characteristic of the BTC community is that its worth is completely slashed in half about each 4 years in an occasion referred to as the Halving. A consequence of the Halving is that miner income in BTC is continually heading down.

The pricing mannequin shared by Younger Ju considers this reality by adjusting the mining hashrate. This indicator then takes the market cap’s ratio with this adjusted hashrate and determines the best and lowest values for this ratio within the asset’s historical past.

Right here is the chart for the mannequin that exhibits what values the asset’s market cap would want to achieve for the ratio to develop into equal to both of those extremes:

As displayed within the above graph, the utmost potential Bitcoin market cap primarily based on the present worth of the community’s hashrate is nearly $5 trillion. The asset’s market cap is just a little below $1.9 trillion, which implies it’s simply 38% of this higher restrict.

One thing to notice, although, is that the 2021 bull run prime occurred below the highest line of the mannequin. So, it’s potential that the highest for the present cycle could not contact the road, both. That stated, the market cap did come nearer to the height ratio again then than it has up to now on this cycle, which may at the very least counsel there may be room left for BTC within the rally.

Associated Studying

A peculiar characteristic within the chart’s strains is that they’ve some abrupt drawdowns in 2016, 2020, and 2024. These naturally correspond to the Halving occasions that occurred in these years and mirror their financial impact on Bitcoin mining.

BTC Value

On the time of writing, Bitcoin is buying and selling at round $94,400, up greater than 2% during the last seven days.

Featured picture from Dall-E, CryptoQuant.com, Blockchain.com chart from TradingView.com

[ad_2]

Source link