[ad_1]

Este artículo también está disponible en español.

On-chain knowledge exhibits that Bitcoin miners have been promoting for round a yr now. Right here’s how a lot they’ve offered to this point.

Bitcoin Miners Have Shed Over 4% Of Their Holdings In Previous Yr

As identified by CryptoQuant group analyst Maartunn in a brand new put up on X, the BTC miners have been in web promoting mode for a major time period. The on-chain metric of relevance right here is the “miner reserve,” which retains observe of the overall quantity of cash that the miners as an entire are carrying of their wallets proper now.

Associated Studying

When the worth of this indicator rises, it means the chain validators are including a web variety of tokens to their mixed holdings. Such a pattern generally is a signal that this cohort is accumulating, which might naturally be bullish for the asset’s worth.

Then again, the metric observing a decline suggests the miners are withdrawing cash from their addresses. The primary motive why this group makes such transactions is for selling-related functions, so this sort of pattern can have a bearish impression on BTC.

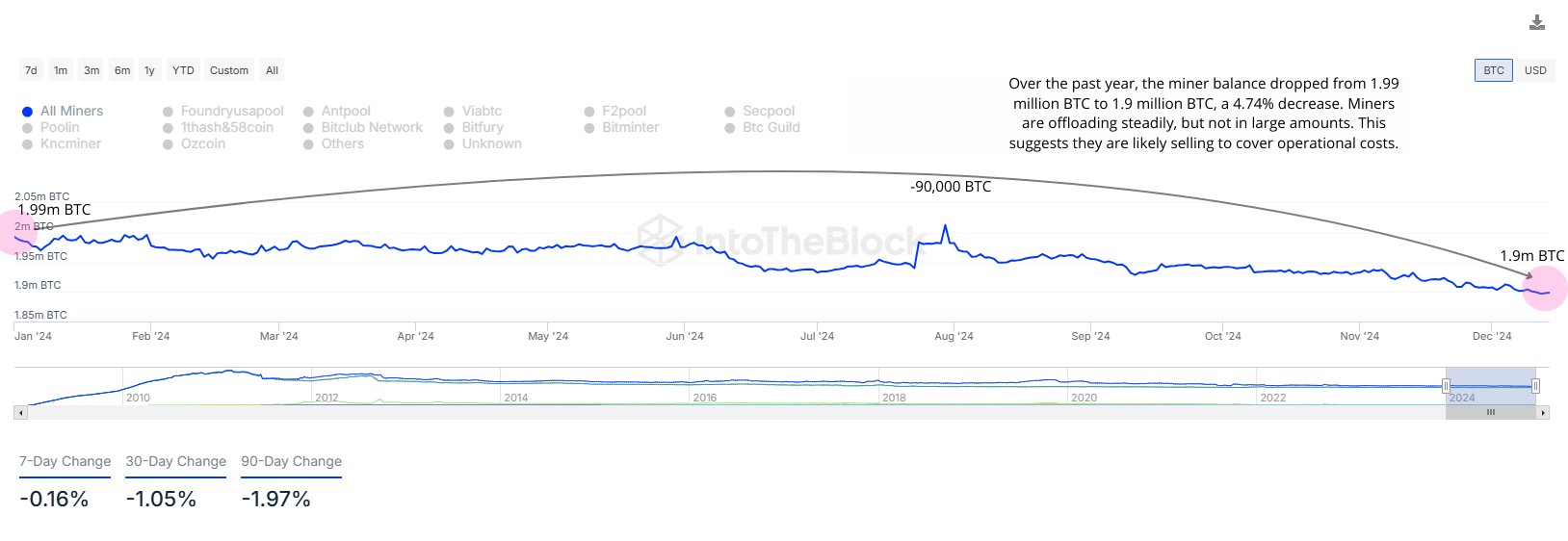

Now, here’s a chart that exhibits the pattern within the Bitcoin miner reserve over the previous yr:

As displayed within the above graph, the Bitcoin miner reserve has gone by a gentle downtrend throughout this window. There have been some temporary intervals of deviation, however the general trajectory has remained towards the draw back.

Traditionally, the miners have had a presence as constant sellers on the community. The rationale behind that is the truth that these chain validators have fixed operating prices within the type of electrical energy payments, which they repay by promoting their BTC rewards for fiat.

Typically, although, regardless of being common sellers, miners don’t pose an excessive amount of of a risk to the value, as their promoting tends to be of a scale that may readily be absorbed by the market. That mentioned, the instances that they do take part in a serious selloff may be to be careful for.

Through the begin of this yr, the Bitcoin miners held a complete of 1.99 million BTC of their reserve. As we speak, the identical metric stands at 1.90 million BTC, implying the miners have offered 90,000 BTC (about $9.3 billion on the present trade price) or 4.74% of their holdings.

Associated Studying

It is a notable quantity by itself, however when contemplating the context that this promoting has come over some size of time somewhat than inside a slender window, the selloff stops being too attention-grabbing.

“Miners are offloading steadily, however not in giant quantities,” notes the analyst. “This means they’re doubtless promoting to cowl operational prices.” As such, it’s potential that Bitcoin wouldn’t really feel any main bearish results from this miner selloff.

The miner reserve might nonetheless be to regulate within the close to future, nonetheless, as any sharp modifications within the metric might doubtlessly spell a brand new final result for Bitcoin.

BTC Value

Bitcoin set a brand new all-time excessive past the $106,000 mark earlier within the day, however the coin seems to have seen a pullback since then because it’s now buying and selling round $104,000.

Featured picture from Dall-E, IntoTheBlock.com, chart from TradingView.com

[ad_2]

Source link