[ad_1]

Purpose to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by business specialists and meticulously reviewed

The best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Este artículo también está disponible en español.

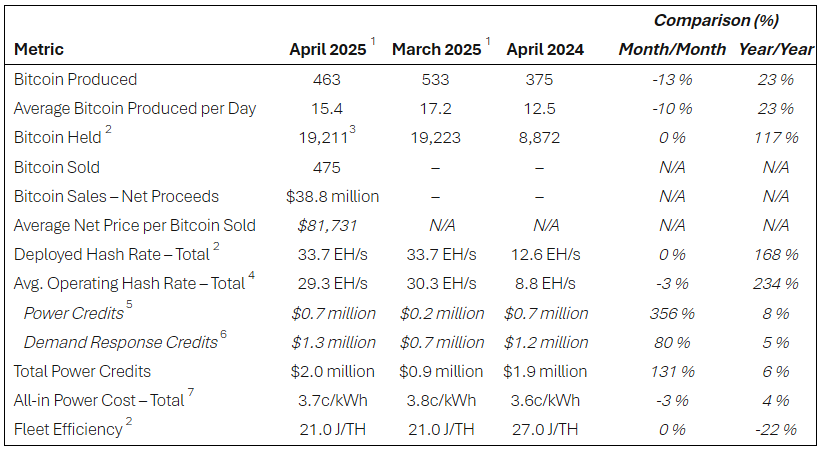

Riot Platforms offered 475 Bitcoin price $38.8 million in December as revenue margins slender all through the mining sector. The Colorado agency, the second-largest publicly traded Bitcoin miner by market capitalization, offered the cryptocurrency at a median value of $81,731 per coin, Monday’s operations replace disclosed.

Associated Studying

Mining Income Slim Following Bitcoin Halving Occasion

The sell-off follows a 12 months since Bitcoin’s fourth halving occasion, the place mining rewards have been halved. Miners now get 3.125 Bitcoin per block, down from 6.25, in a pre-programmed lower that occurs each 4 years or so. The self-adjusting lower has tightened margins for mining operations that rely on a steady stream of recent tokens to pay for rising bills.

Riot Platforms mined 463 Bitcoin final April, lowering by 13% from the prior month although it sustained the identical stage of computing energy. The agency tapped the remaining 12 Bitcoin from reserves for ending the sale.

Supply: Riot Platforms

CEO Defends Technique As ‘Decreasing’ Shareholder Dilution

All through April, Riot stated it made the strategic option to promote its month-to-month manufacturing of bitcoin to finance continued progress and operations, Riot CEO Jason Les acknowledged within the replace. Les stated promoting Bitcoin lessens the corporate’s want to boost cash by issuing new shares, which might dilute present shareholders’ possession stakes.

Riot Publicizes April 2025 Manufacturing and Operations Updates.

“Riot mined 463 bitcoin in April because the community skilled two successive problem changes throughout the month,” stated @JasonLes_, CEO of Riot. “April was a major month for Riot as we closed on the acquisition… pic.twitter.com/0cSznh5fBM

— Riot Platforms, Inc. (@RiotPlatforms) Could 5, 2025

Even with the sell-off, Riot retains 19,211 Bitcoin on its steadiness sheet. That stash is valued at about $1.8 billion at present costs, demonstrating the corporate has substantial cryptocurrency holdings even because it sells some to money out.

Mining Issue Will increase As Competitors Heats Up

The issues that Riot is experiencing are reflective of wider developments in Bitcoin mining. The problem stage of the community, a measure of how tough it’s to mine new Bitcoin, was almost a whopping 120 trillion hashes as of Could 4. That’s a 35% enhance from final 12 months, based on CoinWarz knowledge.

As extra miners vie for a similar diminished payouts, every operation should enhance electrical energy and gear bills in an effort to obtain Bitcoin. This competitors has constricted margins all through the business, compelling companies to reassess their money administration practices.

Supply: Statista

Associated Studying

Whereas Bitcoin has gained 45% in worth over the previous 12 months and most not too long ago traded over $95,000, it stays beneath its January peak of $109,000. This value retreat has additional pressured mining corporations already coping with larger prices and decrease manufacturing.

Riot’s transfer underscores the tightrope Bitcoin miners stroll: they should steadiness short-term money necessities with hypothesis on the longer term price ticket of the most well-liked cryptocurrency. In the meanwhile, a minimum of one massive participant is choosing money upfront over future potential.

Featured picture from Riot Platforms, chart from TradingView

[ad_2]

Source link