[ad_1]

Bitcoin has been steadily pushing up over the previous few days, fueled by optimistic sentiment following the U.S. Federal Reserve’s optimistic outlook on financial development. Buyers are displaying renewed confidence as BTC holds above the $104K mark, consolidating slightly below its all-time excessive (ATH) and setting the stage for a possible breakout.

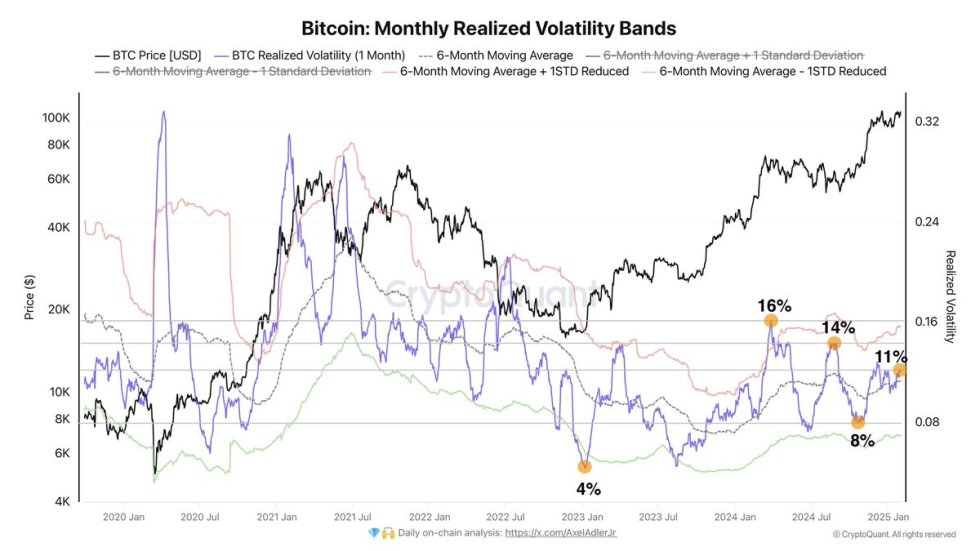

Regardless of latest volatility, CryptoQuant knowledge shared by Axel Adler highlights an fascinating development in Bitcoin’s value conduct. BTC’s month-to-month realized volatility at present stands at 11%, considerably decrease than earlier cycle peaks of 16% and 14%. Traditionally, volatility has tended to say no earlier than main value actions, suggesting that Bitcoin could possibly be gearing up for its subsequent massive transfer.

As Bitcoin hovers slightly below ATH, market contributors are intently watching key ranges to find out whether or not BTC will break into value discovery or enter a short-term consolidation section. With sturdy fundamentals and bullish momentum, analysts consider Bitcoin’s subsequent transfer might outline the market’s trajectory for the approaching months. The query now’s: will BTC lastly push above ATH, or will it take one other breather earlier than the following leg up?

Bitcoin Enters Essential Part, Poised for Main Features

Bitcoin is now at a crucial juncture, with many analysts predicting huge returns this yr as BTC prepares to enter uncharted territory as soon as once more. Whereas some argue that Bitcoin is close to a cycle prime, others consider the actual rally is simply starting, with new all-time highs (ATH) and better value targets on the horizon.

Supporting the bullish case, CryptoQuant knowledge shared by Axel Adler reveals that BTC’s month-to-month realized volatility at present sits at 11%, decrease than earlier cycle peaks of 16% and 14%. Traditionally, volatility tends to say no earlier than main breakouts, making this metric a key indicator of an impending explosive transfer. In previous cycles, volatility dropped to eight% earlier than a reasonable rally and even additional to 4% forward of main surges, suggesting that BTC is setting the stage for one more leg increased.

The approaching weeks might be pivotal, as bull markets sometimes speed up aggressively within the last yr of the halving cycle. Buyers are eyeing the $110K mark, which many see as a psychological degree that might set off FOMO-driven shopping for if damaged. In the meantime, long-term holders stay assured, with on-chain knowledge displaying BTC continues to move out of exchanges, lowering obtainable provide.

If historical past repeats itself, BTC could possibly be on the point of a parabolic rally, driving the crypto market into new all-time highs and solidifying its position because the best-performing asset of this cycle. Buyers are actually intently watching key resistance ranges, ready for Bitcoin to substantiate its subsequent transfer. Whether or not BTC consolidates additional or explodes previous ATH, one factor is definite: volatility is returning, and Bitcoin’s greatest strikes are nonetheless forward.

Bitcoin Value Holds Sturdy as Market Awaits Breakout

Bitcoin (BTC) is buying and selling at $104,700 after days of volatility and uncertainty, because the market fluctuates between bullish value motion and bearish sentiment. Regardless of BTC’s resilience above key demand ranges, market sentiment turned cautious in latest days. Nevertheless, on Wednesday, Bitcoin reignited optimism, suggesting that bulls are getting ready for the following leg increased.

For BTC to substantiate a robust uptrend, the worth should shut above the $106K mark within the coming days. Breaking this degree would sign renewed bullish momentum and will set off an explosive rally towards $110K and past. Analysts consider that when BTC surpasses ATH and enters value discovery, momentum-driven shopping for might push the worth considerably increased.

Nevertheless, failure to clear $106K might end in continued consolidation or perhaps a retracement to retest assist ranges. Buyers are intently watching whether or not BTC can maintain present ranges and break via resistance to substantiate the following section of the bull cycle.

With institutional demand rising and key on-chain metrics favoring long-term energy, BTC seems well-positioned for a possible breakout. The approaching days might be essential, as Bitcoin teeters on the sting of one other main value surge.

Featured picture from Dall-E, chart from TradingView

[ad_2]

Source link