[ad_1]

Este artículo también está disponible en español.

Bitcoin (BTC) seems to be bouncing off its summer season slumber, say analysts who consider the asset may rebound within the coming months. Current technical indications and charts counsel that BTC may very well be on the cusp of a major worth transfer. The cryptocurrency is geared for a bounce that might take the asset far past $92,000, regardless of current losses.

Associated Studying

Brief-Time period Projection

Bitcoin’s quick technical projection factors to a presumably optimistic pattern. Proper now, Bitcoin is promoting 39.27% under its projected worth for subsequent month, based on CoinCheckup. Nonetheless, a rise is seen within the coming week; short-term indicators counsel a attainable comeback.

With forecasts of a 70.68% acquire, this momentum may open the trail for vital worth rise over the following three months. These short-term indicators may level to a shopping for alternative earlier than an even bigger rise begins.

Previous Efficiency And Forecasts

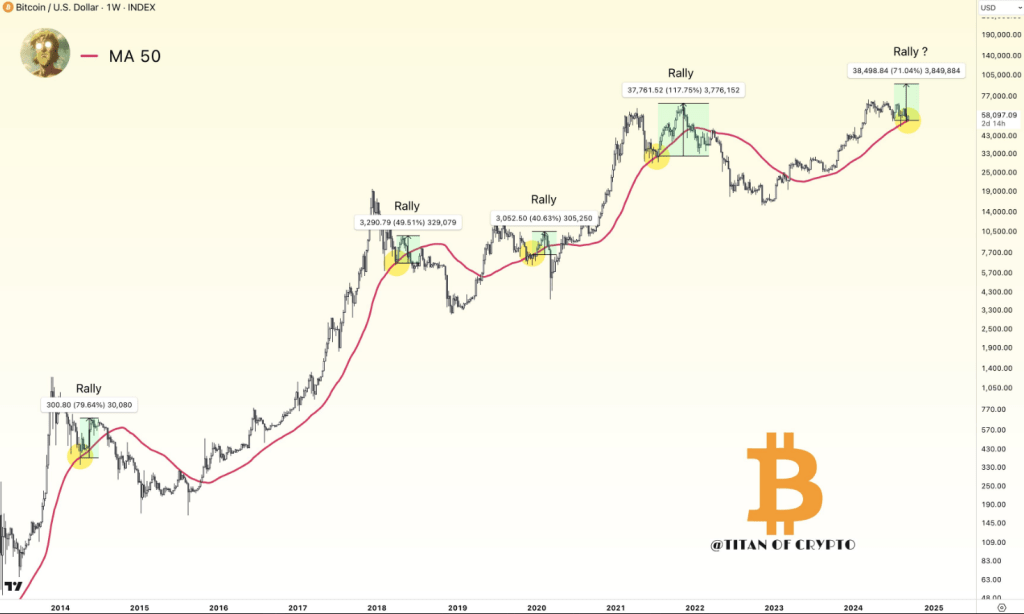

This worth motion of Bitcoin coincides with traits which were exhibited throughout previous halving occasions. In accordance with common analyst Titan of Crypto, the present pattern goes consistent with most the earlier traits, particularly the post-halving durations which were the supply of varied vital actions.

#Bitcoin Rally Imminent? 🚀

In earlier cycles, when the value retested the 50-week easy shifting common 🔴, it bounced no less than 40%.

On common, the bounce was 71%. If #BTC rallies 71% from right here, it may attain $92,000. pic.twitter.com/e3ghGxn3NS

— Titan of Crypto (@Washigorira) September 13, 2024

Titan underlined on the weekly chart a major assist degree retest on September thirteenth, which traditionally has resulted in common worth positive aspects of 71%. In accordance with his evaluation based mostly on historic knowledge, Bitcoin may quickly surpass the $92,000 mark, subsequently attaining a brand new file for the foreign money.

For Bitcoin, it’s all the time been a difficult month as a result of common returns are available at round -4.69%. However historical past would inform a unique story when the next months, particularly October and November, go on to mirror appreciable will increase.

In October, Bitcoin has usually delivered common positive aspects of twenty-two.9%; in November, 46.8%.This pattern helps the current projection of a attainable comeback, subsequently strengthening the assumption that Bitcoin may bounce again slightly powerfully within the subsequent months.

Bitcoin Lengthy-Time period Outlook

Within the long-run, the prospect of Bitcoin stays very promising. It is going to virtually definitely rise upward with an estimation of 102% for the following six months and an opportunity to rise throughout the 12 months by 166%. This might present intense market confidence in the way forward for the digital foreign money and may even let Bitcoin proceed outperforming at its present low.

Associated Studying

The power of the cryptocurrency to get better the $60,000 degree these days reveals a superb change in market angle, which prepares the bottom for the attainable worth positive aspects.

All issues thought-about, historic patterns and current technical indications of Bitcoin level to a vibrant future. Though present losses and short-term difficulties create hazards, typically the sample reveals a giant comeback and attainable worth surge.

Bitcoin is an efficient asset for each current and future advantages since buyers who negotiate the short-term volatility may very well be well-positioned to revenue from the anticipated long-term improvement. The probabilities for a robust comeback for Bitcoin appear extra possible because the market steadies and momentum gathers.

Featured picture from Pexels, chart from TradingView

[ad_2]

Source link