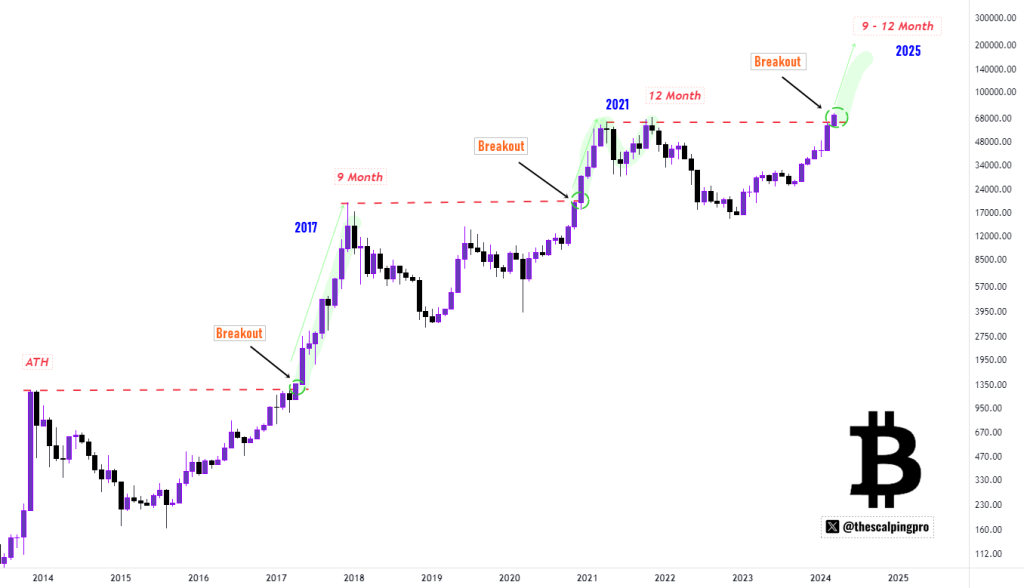

In line with one crypto analyst on X, Bitcoin has been on a tear up to now few months and can possible peak at across the $150,000 to $150,000 zone within the subsequent 9 to 12 months.

The bullish preview hinges on Bitcoin’s historic efficiency after breaking all-time highs (ATHs), particularly within the final years, together with 2017 and 2022. Since October 2023, the coin has been trending increased, rising from beneath $25,000 to surging above the $40,000 degree.

Within the first two weeks of March, the coin broke above $70,000 to register contemporary all-time highs of round $72,800. Nonetheless, bulls usually are not slowing down. latest worth motion, Bitcoin broke above $73,000 on March 12 earlier than these positive factors have been prolonged on March 13.

Bitcoin To Peak By December At Over $200,000?

Following the latest upswing on March 12, the technical analyst says Bitcoin is making ready for a robust leg up because it enters uncharted territory and worth discovery. Whereas costs have been oscillating, transferring in tight ranges after tearing increased within the Asian and European classes, the uptrend stays, and bulls have an opportunity.

To cement this bullish outlook, the analyst factors to historic cycles, particularly 2017 and 2021. In each cases, Bitcoin posted sharp positive factors after breaking above all-time highs. Nonetheless, even with this breakout, the rally peaked after 9 to 12 months.

The analyst notes that in 2017, Bitcoin soared 1,300% earlier than peaking after 9 months as soon as after recording all-time highs at round $20,000. Equally, in 2021, Bitcoin climbed 250% earlier than peaking 12 months after breaking above 2017-2018 highs of $20,000. By November 2021, the coin had rallied to $70,000.

By evaluating the present cycle to previous ones, the analyst suggests a possible peak throughout the subsequent 9 to 12 months after costs floated above $70,000 in early March 2024.

Notably, the analyst thinks BTC will broaden by 120% to $150,000 even with a conservative method, disregarding bullish sentiment. In the meantime, assuming consumers are buoyant and establishments don’t decelerate on their present buy, the coin would possibly add a minimum of 200% from $70,000, putting it at over $200,000.

Establishments Driving BTC Demand, Affect Of Halving

Nonetheless, solely time will inform the place Bitcoin will rally to within the subsequent few months. For now, the broader crypto group expects the coin to soar within the coming days, pumped by institutional demand.

Furthermore, there may be extra confidence within the upcoming halving occasion. The community will slash rewards by half. Analysts anticipate this to create a shortage disaster that may help costs.

Function picture from Canva, chart from TradingView