[ad_1]

Este artículo también está disponible en español.

Bitcoin’s short-term worth path stays unsure because the market struggles to verify its subsequent transfer. Analysts and traders are divided, with some calling for a breakout into new all-time highs whereas others anticipate renewed promoting strain into decrease costs. The value has been consolidating in a slender vary for the previous twelve days, holding above the $94,000 demand degree and going through resistance under the $100,000 mark.

Associated Studying

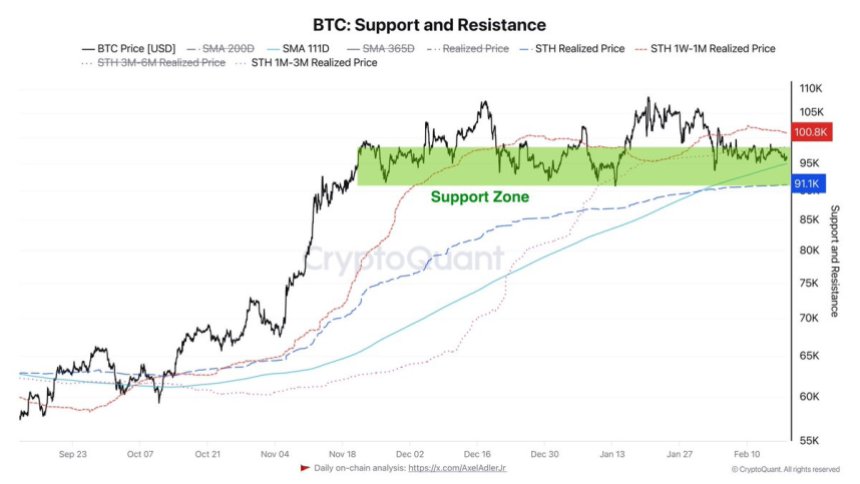

Key knowledge from CryptoQuant reveals that the closest assist zone for BTC is forming between $91,000 and $95,000. This vary is bolstered by two vital technical indicators: the 111-day easy shifting common (SMA 111D), at present at $95,000, and the Quick-Time period Holder (STH) Realized Value, which sits at $91,000. These ranges counsel that BTC is buying and selling above traditionally important assist areas, the place short-term holders have realized their income or losses.

Whereas the long-term construction stays bullish, traders are rising impatient as BTC fails to reclaim key resistance ranges. If Bitcoin can push above $100K within the coming days, analysts count on a rally into worth discovery. Nevertheless, dropping assist round $94K–$95K may set off elevated promoting strain and a deeper correction into decrease demand zones.

Bitcoin Prepares For A Decisive Transfer

Bitcoin’s current consolidation part has fueled hypothesis a few potential breakout, with many analysts suggesting that the market is witnessing the calm earlier than the storm. Whereas short-term path stays unsure, the long-term bullish construction stays intact, and lots of count on BTC to make a robust transfer towards new all-time highs quickly.

Crypto analyst Axel Adler shared key CryptoQuant knowledge on X, highlighting that Bitcoin’s nearest assist zone is forming round $91,000–$95,000. This vary is important as a result of it aligns with the 111-day easy shifting common (SMA 111D) at $95,000 and the Quick-Time period Holder (STH) Realized Value at $91,000. These ranges characterize areas the place short-term holders have traditionally realized income or losses, making them essential for sustaining bullish momentum.

On the resistance aspect, Adler notes that Bitcoin faces a key provide zone between $98,000 and $101,000. This space is outlined by the mixture exit costs of holders with a holding interval of 1 week to 1 month at $100,800 and people with a one- to three-month holding interval at $98,200.

Associated Studying

As BTC continues to commerce inside this slender vary, traders are carefully watching these ranges for a decisive breakout. A push above $101K may set off a rally into worth discovery. Whereas dropping assist at $91K may result in additional draw back.

BTC Bulls Face A Large Check

Bitcoin is buying and selling at $95,600 after practically two weeks of sideways motion inside a slender vary, fluctuating lower than 4% in both path. This prolonged interval of consolidation has left merchants on edge, as they await a decisive transfer in both path.

For BTC to keep up its bullish construction, the $95,000 degree should maintain. This worth level aligns with technical assist, and a break under it may sign sturdy promoting strain. Bulls face a vital check at this stage, as they have to defend this assist and provoke a push above key resistance ranges.

To substantiate a breakout, Bitcoin must reclaim the $98,000 mark and, finally, the psychologically important $100,000 degree. A profitable transfer above these ranges would supply the momentum wanted to problem all-time highs and re-enter worth discovery. Nevertheless, failure to carry $95K may set off a draw back transfer, with BTC doubtlessly testing assist zones nearer to $91K.

Associated Studying

As Bitcoin consolidates, merchants stay cautious, waiting for quantity spikes and elevated shopping for strain to verify the following worth motion. The approaching days can be essential in figuring out whether or not BTC resumes its uptrend or faces additional correction.

Featured picture from Dall-E, chart from TradingView

[ad_2]

Source link