[ad_1]

On-chain knowledge reveals Chainlink has continued to watch damaging change netflows not too long ago, an indication that could possibly be bullish for LINK’s worth.

Chainlink Change Netflows Have Been Adverse For Nearly A Month

In a brand new submit on X, the market intelligence platform IntoTheBlock has mentioned concerning the newest pattern within the change netflow of Chainlink. The “change netflow” right here refers to an indicator that retains monitor of the web quantity of LINK coming into into or exiting out of the wallets related to centralized exchanges.

When the worth of this metric is optimistic, it means these platforms are receiving a internet variety of tokens. As one of many essential the reason why traders would ship their cash to exchanges is for selling-related functions, this sort of pattern can carry bearish implications for the asset’s worth.

Then again, the indicator being damaging suggests the holders are taking out a internet quantity of the cryptocurrency from the exchanges. Holders typically take their cash off into self-custody every time they plan to carry into the long-term, so this sort of pattern might be bullish for LINK.

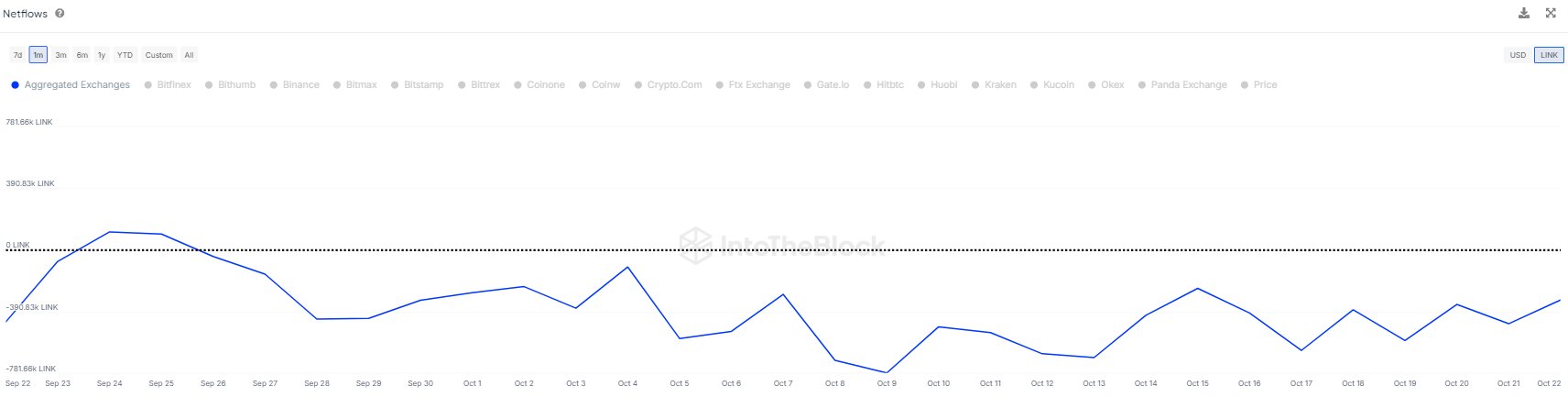

Now, here’s a chart that reveals the pattern within the Chainlink change netflow over the previous month:

The worth of the metric seems to have been damaging for some time now | Supply: IntoTheBlock on X

As is seen within the above graph, the Chainlink change netflow has been underneath zero for the previous few weeks, which means the traders have consistently been making withdrawals from these platforms.

“This pattern usually indicators accumulation, as holders transfer property to chilly storage or non-public wallets, decreasing instant promote stress,” notes IntoTheBlock. It now stays to be seen if these internet outflows would find yourself benefiting LINK or not.

The damaging change netflow isn’t the one potential bullish signal that the cryptocurrency has seen not too long ago, because the on-chain analytics agency Santiment has identified in an X submit.

The sign in query is for the Weighted Sentiment metric, which tells us concerning the sentiment associated to a given asset that’s at the moment current on the main social media platforms.

This indicator makes use of the analytics agency’s machine-learning mannequin to separate between damaging and optimistic posts, and calculate the web image. It then weighs this worth in opposition to the entire quantity of posts current on social media on that day (known as the Social Quantity).

Under is a desk that reveals the modifications on this metric on completely different timeframes for varied property within the cryptocurrency sector.

The modifications within the sentiment on social media for various property within the sector | Supply: Santiment on X

From the desk, it’s obvious that Chainlink’s newest each day change within the Weighted Sentiment has been a pointy -372% turnaround, implying that the traders are feeling FUD after the current bearish worth motion.

Traditionally, cryptocurrencies have tended to maneuver in opposition to the expectations of the group, so every time the merchants grow to be too bearish, a bullish reversal can grow to be possible. Thus, it’s potential that the most recent sharp damaging sentiment may assist the LINK worth.

LINK Value

On the time of writing, Chainlink is floating round $11.4, up 4% over the previous week.

Appears to be like like the worth of the coin has plunged over the previous couple of days | Supply: LINKUSDT on TradingView

Featured picture from Dall-E, Santiment.internet, chart from TradingView.com

[ad_2]

Source link