[ad_1]

Introduction

The primary half of the 12 months noticed elevated indicators that monetary establishments are exploring the blockchain ecosystem by way of initiatives like cryptocurrency ETFs and asset tokenization. Whereas most of the people is changing into extra acquainted with the broad advantages of blockchain, how establishments will combine with the blockchain ecosystem shouldn’t be essentially as clear. Some key essential components for such integration embrace transparency into asset valuation, cross-chain interoperability, custody, settlement, safety, and extra. On this quarterly replace, we talk about the advantages of tokenization and the way Chainlink Proof of Reserve (PoR), Chainlink’s Each day Reference Worth, and different Chainlink providers can improve the tokenization economic system.

The Advantages of Asset Tokenization

Asset tokenization includes making a digital illustration (i.e., a token) of an asset, the place the token represents possession of the underlying asset and might be utilized and traded on a blockchain. Nearly any asset, whether or not bodily or monetary, might be tokenized, providing a variety of potential advantages, together with:

Elevated entry for market individuals: Asset tokenization presents digital tokens that may be simply purchased, offered, and traded on blockchains. This course of also can allow fractional possession, which permits individuals to buy smaller, extra inexpensive parts of high-value property that might in any other case be unavailable to some customers. Thus, tokenization helps democratize markets by offering entry to a broader vary of individuals.

24/7 buying and selling of property: Tokenization allows 24/7 asset buying and selling by leveraging blockchains, which function constantly with out the constraints of conventional market hours. This accessibility permits traders to commerce tokenized property at any time, offering higher flexibility and responsiveness to market modifications. As such, this elevated availability enhances liquidity and market effectivity, as transactions are now not confined to the working hours of conventional exchanges, permitting for a extra dynamic and world buying and selling setting.

Elevated transparency of markets: Tokenization will increase market transparency by recording all transactions on an immutable blockchain ledger. This transparency permits individuals to trace the historical past and possession of tokenized property, serving to to make sure the integrity of the market. Enhanced transparency fosters belief amongst individuals as they’ll independently confirm info and make extra knowledgeable choices.

How Chainlink Proof of Reserve Enhances Asset Tokenization

Tokenization successfully bridges the hole between conventional investments and digital property. The growth of blockchain into the realm of real-world property (RWAs) by way of tokenization is a pure evolution that unlocks a mess of alternatives. As property turn out to be tokenized, the Chainlink platform stories and updates the mandatory efficiency knowledge onchain to allow the utilization of tokenized property and help a thriving onchain finance ecosystem round them, simply as Chainlink did with crypto-native property in DeFi. By verifying the standing of offchain property and relaying that info onchain, PoR together with Chainlink Cross-Chain Interoperability Protocol (“CCIP”) might help create a unified golden report that enhances the utility and transparency of tokenized RWAs.

By representing property digitally on a blockchain community, asset managers can profit from a standardized, environment friendly, and clear ecosystem that may not solely streamline operations and scale back administrative burdens considerably but additionally improve income era by way of elevated liquidity. Tokenizing funds simplifies and automates the fund administration course of for asset managers and traders alike, giving rise to a normal platform for order processing, possession monitoring, and knowledge administration, which might in the end stimulate liquidity and provide a extra scalable strategy to make various investments extra globally accessible.

Chainlink has already confirmed itself as important blockchain infrastructure by connecting sensible contracts with safe, dependable, and correct offchain knowledge. By offering key market knowledge onchain, Chainlink enabled the expansion of DeFi right into a multi-hundred-billion greenback business and unlocked core onchain primitives and superior use circumstances. Now, Chainlink is enabling the subsequent section of onchain markets by offering the foundational infrastructure required to make tokenized property composable and programmable throughout each conventional methods and public/personal blockchains. This contains Chainlink enriching tokenized property with essential real-world knowledge, enabling interoperability throughout blockchains and conventional methods, and guaranteeing dynamic synchronization so tokenized property keep up-to-date with key knowledge as they transfer throughout chains. The result’s unlocking highly effective functions that, in comparison with conventional finance, function enhanced liquidity, utility, programmability, and new distribution channels that may function globally 24/7/365.

Chainlink PoR allows custodian and auditor attestations by creating an onchain supply of fact for correct and clear asset collateralization. By enabling onchain verification by way of a community of certified custodians and prime auditors, Chainlink PoR offers:

Safe and high-quality reserve knowledge sources that present a clear and real-time evaluation mechanism for verifying the collateralization of digital property.

Automated onchain verification, which might be deployed for automated onchain audits that give customers a superior assure of an asset’s underlying collateralization.

Enhanced transparency by way of open onchain monitoring by anybody in close to real-time, permitting traders to confirm asset collateralization independently and generate the next diploma of transparency for the crypto ecosystem round asset collateralization.

One instance of this use case is the gold-backed token PAXG, the place Chainlink PoR helps make sure the token is absolutely backed by offchain gold reserves. For extra safety and transparency into the stablecoin’s minting course of, PAXG has additionally built-in PoR’s Safe Mint function to assist stop the minting of tokens with out ample backing, defending the stablecoin in opposition to infinite mint assaults.

One other instance of this use case, which we mentioned in our final quarterly evaluation, is Bitcoin ETF issuers using Chainlink PoR to supply transparency into their property, serving to to allow the onboarding of extra establishments into the ETF ecosystem. The ARKB ETF (issued by 21Shares and ARK Funding Administration) makes use of Chainlink Proof of Reserve, which pulls reserve knowledge immediately from ARKB’s custodian (Coinbase Prime) and stories the info onchain (Ethereum mainnet) through Chainlink decentralized oracle networks.

A further potential use case for Chainlink PoR is onchain credit score scores, which mirror danger analytics companies’ views on an organization’s creditworthiness with respect to, for instance, a bond issued by that firm. Credit score scores usually are not solely descriptive; they’ll even have a direct impression on firms if their scores are downgraded (by, for instance, rising borrowing prices or triggering a debt covenant). As such, credit score scores are helpful for market individuals who want to value property and handle portfolio allocation and danger. Presently, there is no such thing as a strong credit standing framework for onchain property, which limits institutional confidence in investing in these property and hampers their capacity to construct programmatic logic into allocation and danger administration choices. Reporting scores onchain (i.e. AAA or AA scores for specific tokenized property) will assist allow programmatic danger administration and capital allocation. For instance, if the credit standing of a collateral backing of an asset is downgraded, programmatic logic can routinely rebalance a portfolio to make the most of much less of that asset. A future state of a totally strong and world onchain monetary ecosystem relies upon a trusted and accessible asset credit standing framework.

The Rising Adoption of Chainlink Proof of Reserve

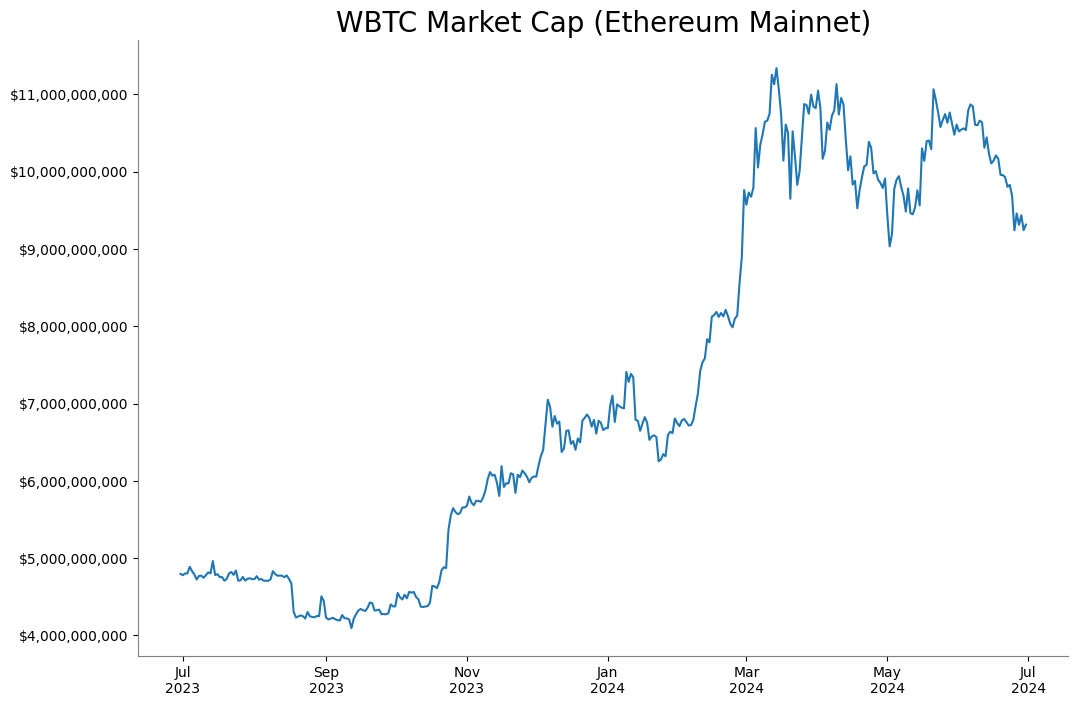

Tokenization’s advantages for asset issuers typically rely on the ensuing token being actively traded and utilized, which requires consumer belief. Since tokenized property and bridged property are related in that they’re representations of an underlying asset, it’s pure to reveal how Chainlink PoR might help facilitate tokenization by way of its confirmed success in offering enhanced transparency into bridged property (each conventional and digital native). One of the crucial distinguished examples of Chainlink PoR’s worth proposition is wrapped Bitcoin (WBTC) on Ethereum mainnet, with a market cap north of $9 billion as of Q2 2024. BitGo—the issuer of WBTC—built-in Chainlink Proof of Reserve to show the collateralization of WBTC onchain to each DeFi protocols and customers.

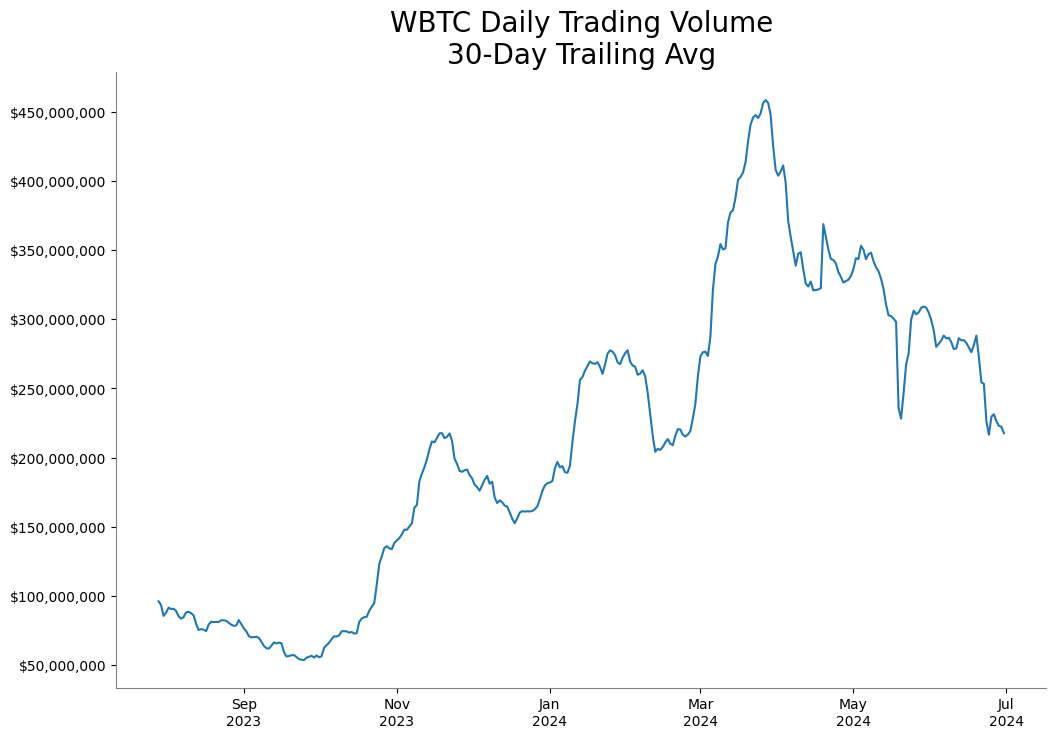

We are able to additionally see the day by day buying and selling volumes for WBTC have doubled in the identical interval:

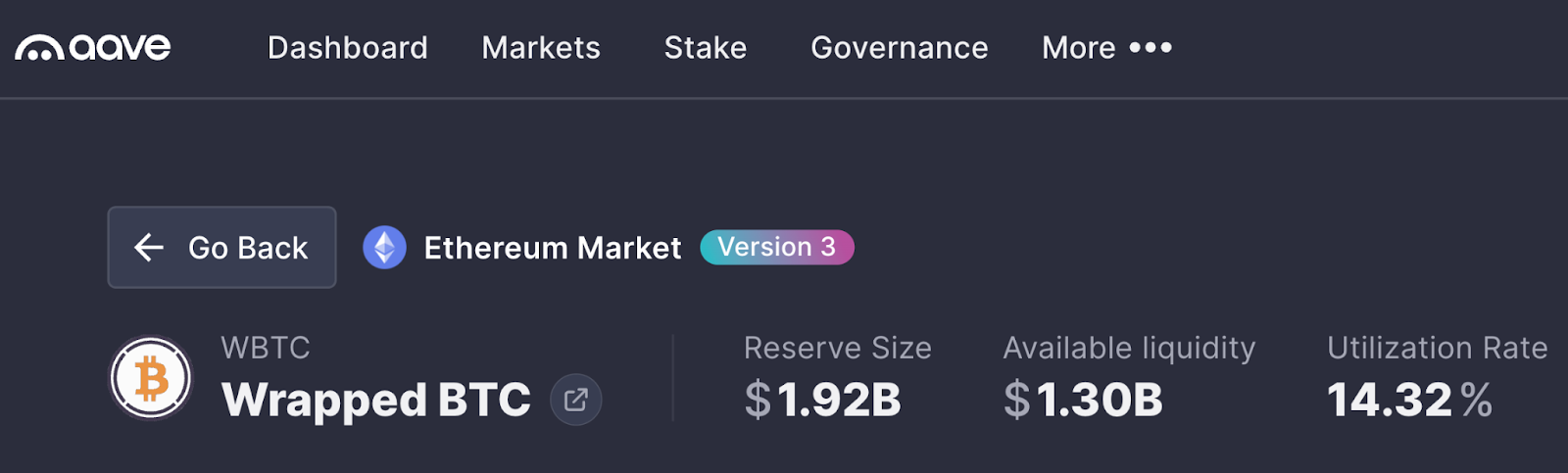

WBTC can be listed as collateral on the most important lending platforms on Ethereum mainnet, together with on Aave v3 (with $1.92 billion deposited):

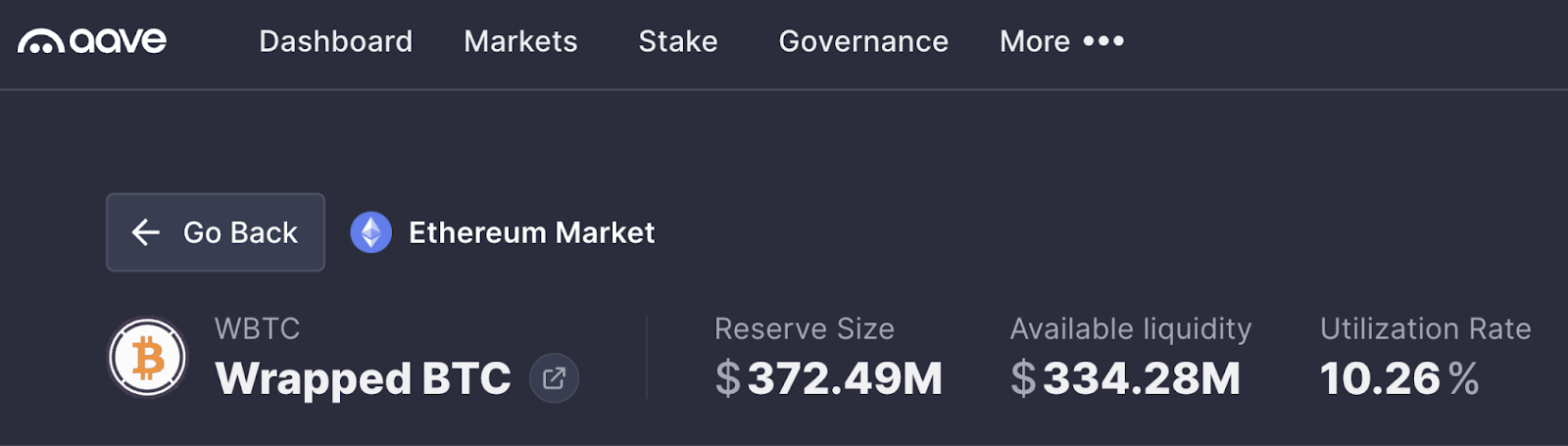

And on Aave v2 on Ethereum (with $372 million deposited):

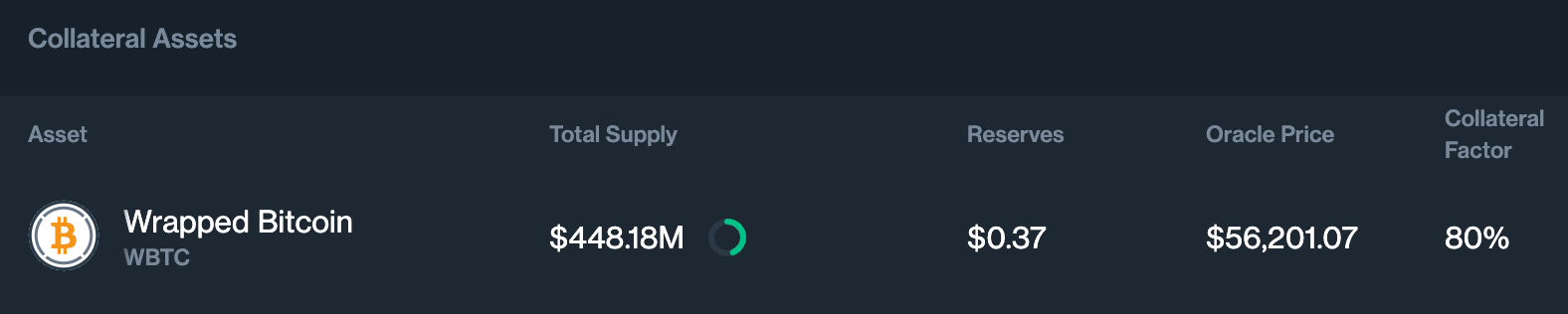

And on Compound v3 for the USDC market on Ethereum (with $448 million deposited):

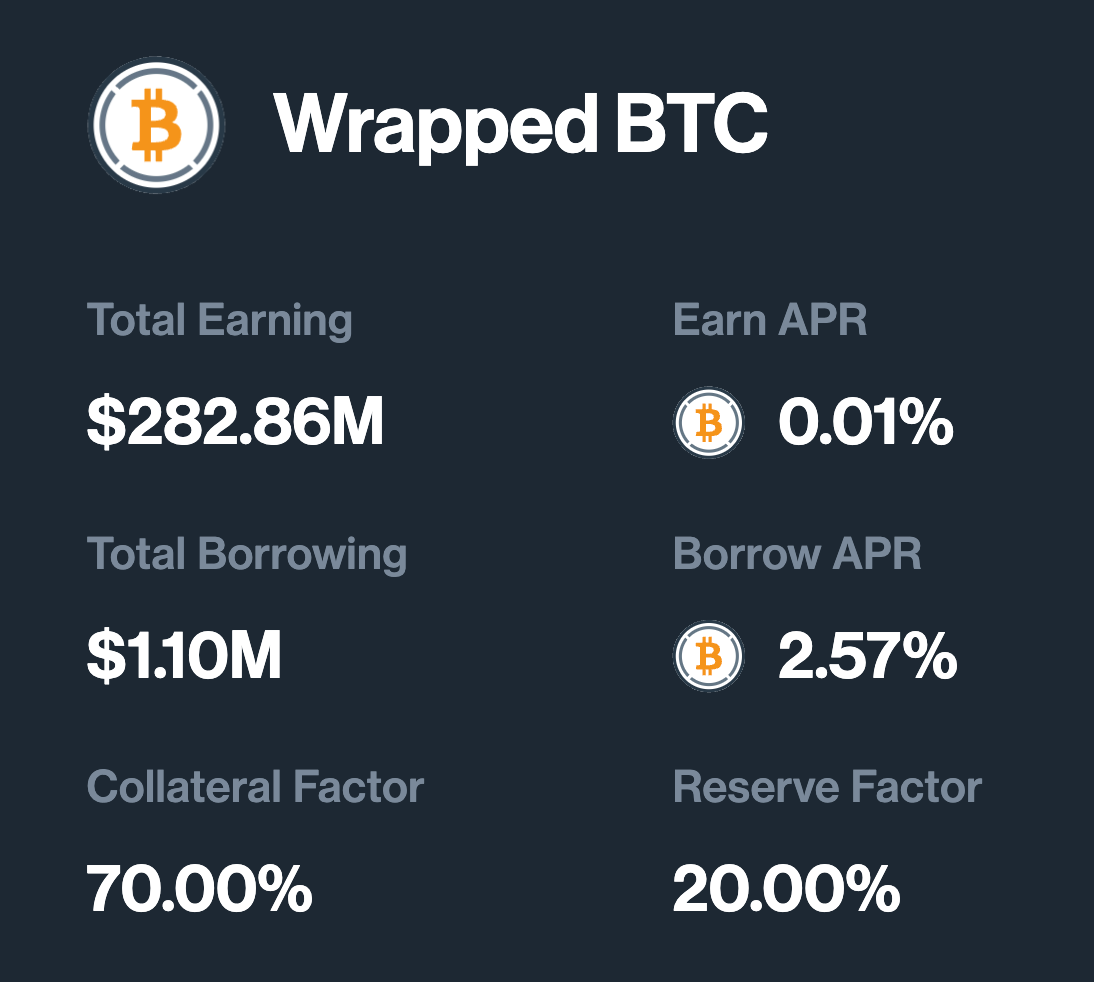

And at last on Compound v2 on Ethereum (with $283 million deposited):

Throughout these lending platforms, WBTC might be utilized as collateral with a loan-to-value ratio that ranges from 70-80%; this means the lending protocols contemplate WBTC a comparatively protected collateral asset (the utmost loan-to-values sometimes seen in DeFi are 90%+, for stablecoins).

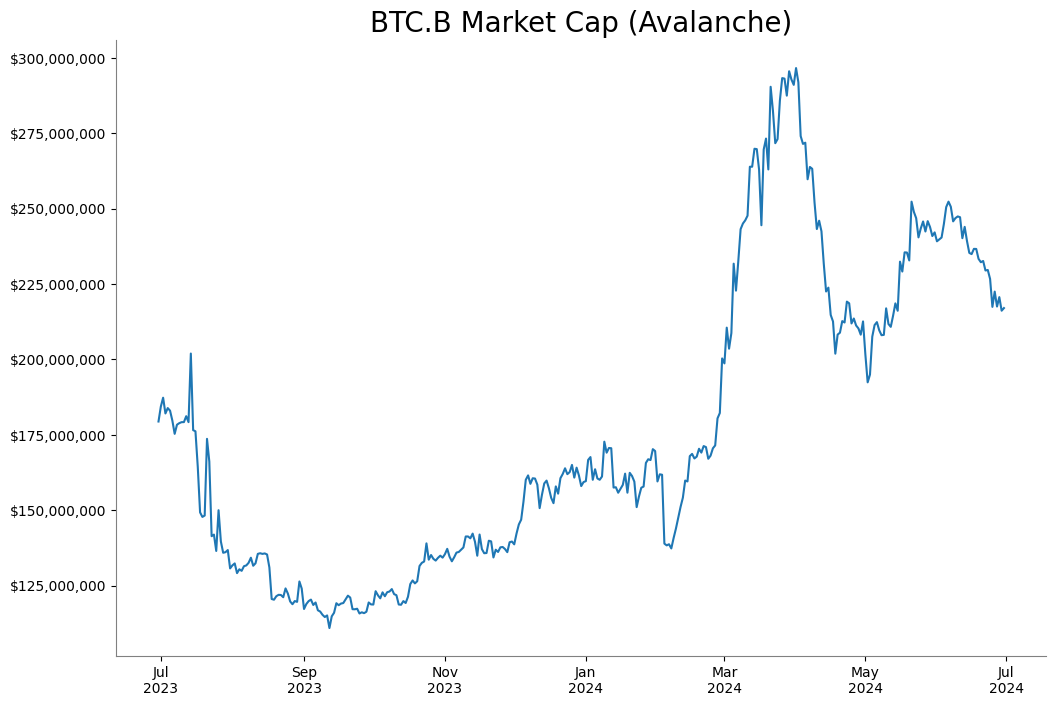

BTC.B on Avalanche additionally makes use of Chainlink PoR, and its market cap is over $200 million as of Q2 2024.

Business leaders use Chainlink Proof of Reserve for its unmatched safety, reliability, and compatibility by 1) lowering danger with automated, truth-based verification, 2) bringing enhanced transparency to customers, and three) stopping systemic failures and contagion. We imagine the transparency supplied by Chainlink Proof of Reserve will proceed to be essential as extra establishments contemplate collaborating in tokenization and cryptocurrency.

Chainlink’s Each day Reference Worth

In conventional monetary markets, a reference value is a benchmark value used as the premise for the valuation and buying and selling of economic devices. It serves as a normal for pricing property and might be derived from sources which can be typically accepted to be consultant of the market and proof against manipulation. The shortage of a reference value would have far-reaching implications, together with challenges in value discovery (the place individuals can not decide honest worth for an asset), elevated volatility, decreased liquidity, wider bid-ask spreads, and challenges in portfolio administration. Derivatives and structured merchandise would additionally face difficulties in valuation and liquidity. Public fairness markets use day by day closing value or volume-weighted common value as a reference value, whereas bond markets use yield curves or credit score spreads.

Chainlink now presents a Each day Reference Worth for its Information Feeds, which give a safe, dependable, and decentralized supply of knowledge to energy blockchain actions underpinning use circumstances like asset tokenization and different blockchain-enabled monetary devices and functions. Chainlink Information Feeds might be configured to supply generalized knowledge about any occasion, consequence, or asset sort, together with cryptocurrencies and securities. The schedule for Chainlink’s Each day Reference Costs are:

4PM SGT Singapore/Hong Kong

4PM GMT London

4PM ET New York

The Each day Reference Costs can be found to customers of Chainlink Information Feeds and Proof of Reserve for in-scope property. They are often accessed as a downloadable historic time sequence from the person feeds pages at https://knowledge.chain.hyperlink/feeds.

With Chainlink’s Each day Reference Costs, market individuals can extra simply execute the next features:

Discovery of honest and clear market values of property.

Internet asset worth calculation for funds that maintain digital property.

Order execution to optimize market impression.

Derivatives pricing.

Index development and efficiency monitoring.

Threat administration and hedging.

Attain Out to Our Staff of Consultants

To learn the way your group can profit from utilizing the Chainlink platform, attain out to our crew of consultants.

This publish is for informational functions solely and incorporates statements in regards to the future. There might be no assurance that precise outcomes won’t differ materially from these expressed in these statements, though we imagine them to be primarily based on affordable assumptions. Interactions with blockchain networks create dangers, together with dangers attributable to consumer enter errors. All statements are legitimate solely as of the date first posted. These statements might not mirror future developments resulting from consumer suggestions or later occasions and we might not replace this publish in response.

[ad_2]

Source link