We’re excited to launch the Chainlink Digital Belongings Sandbox (DAS), designed by Chainlink Labs and powered by the Cross-Chain Interoperability Protocol (CCIP), to speed up digital asset innovation inside monetary establishments.

The Chainlink DAS is the best resolution for monetary establishments that wish to rapidly innovate and expertise the potential of producing new income alternatives, growing efficiencies, bettering time-to-market, and extra. With the DAS alongside knowledgeable assist and consultancy providers offered by Chainlink Labs, monetary establishments can now go from the beginning of their digital asset journey to having accomplished a profitable PoC in days, not months, saving them not solely time and assets but additionally realizing enterprise affect a lot quicker.

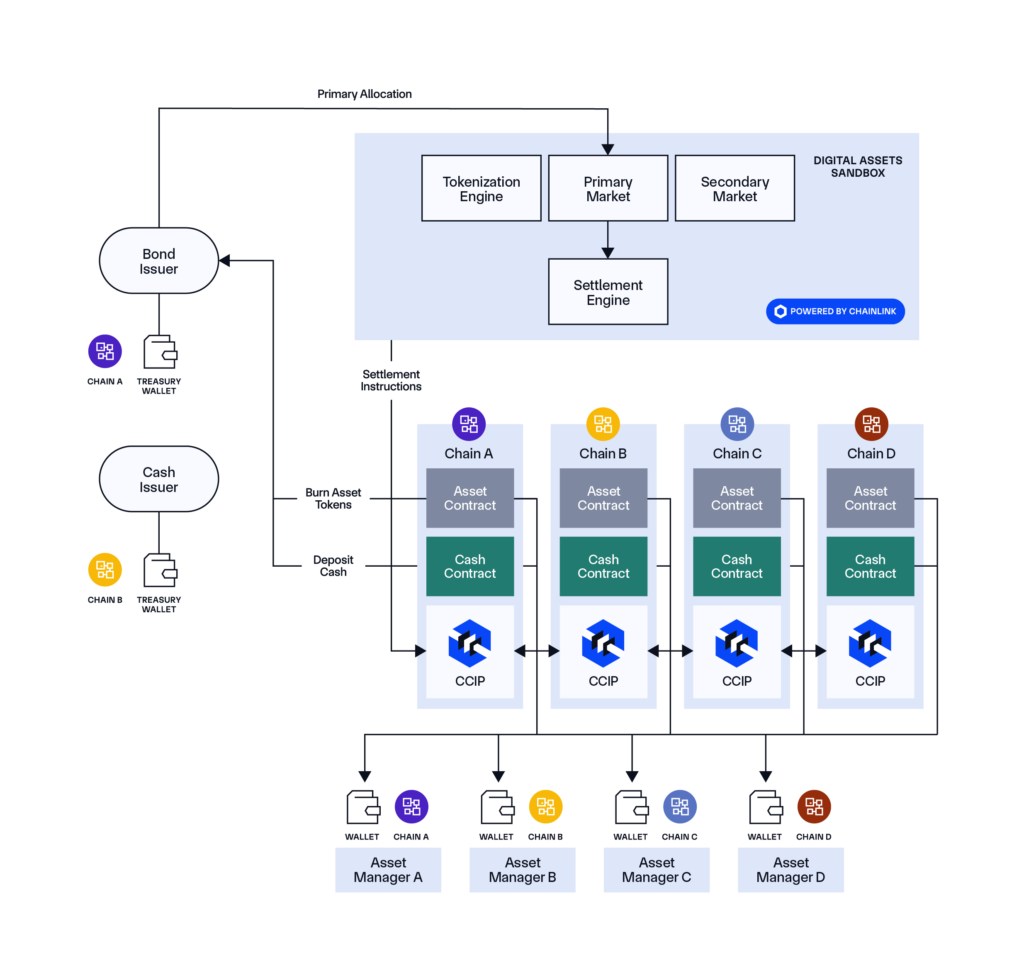

The Chainlink DAS allows establishments to entry ready-to-use enterprise workflows for digital property. For instance, establishments can use the Chainlink DAS throughout a number of blockchain testnets to digitize a conventional bond by changing it into digital tokens and enabling these tokens to be traded and settled on a Supply versus Cost (DvP) foundation, together with many different real-world examples involving a wide range of monetary devices throughout their complete life cycles.

The Tokenized Asset Alternative Is Measured in Trillions

Asset tokenization is a transformative alternative for capital market individuals, together with buyers, issuers, intermediaries, and infrastructures. By 2030, Northern Belief and HSBC estimate that 5-10% of all property might be digital and a joint examine from BCG and ADDX tasks the tokenized asset market to succeed in $16 trillion or 10% of the worldwide GDP. To be taught extra concerning the tokenized asset megatrend, try our {industry} report: The Definitive Information to Tokenized Belongings.

At the moment, for monetary establishments coping with the complicated, fragmented, and ever-evolving panorama of blockchain applied sciences, conducting even a fundamental proof of idea (PoC) will be technically difficult and costly. PoCs contain intensive integration work and complicated processes, typically stretching over intervals of a number of months or longer. In a world the place hundreds of private and non-private blockchains exist alongside a wide range of totally different asset lessons, connecting blockchain transactions to present legacy programs and enabling cross-chain synchronization shouldn’t be a simple course of—it requires specialised information and substantial technical effort.

For instance, a 2023 examine on distributed ledger expertise (DLT) from the Worldwide Securities Providers Affiliation (ISSA) discovered that 28% of economic establishments report challenges with inner prioritization of assets, whereas 33% wrestle with integrating DLT into legacy IT programs and throughout a number of blockchain networks. Moreover, Deloitte stories that the technical expertise hole is a serious hurdle, with corporations struggling to search out the required expertise to develop and implement blockchain options, which results in further constraints. All of those elements are limiting an establishment’s potential to rapidly get began to innovate, construct new PoCs, and benefit from the big alternative tokenization presents.

With the launch of DAS, Chainlink is fixing these key issues by bettering the velocity, decreasing the fee, and reducing the complexity of bringing new digital asset use circumstances to market.

The Chainlink Digital Belongings Sandbox

The preliminary model of the Chainlink DAS is concentrated on tokenized bond workflows. Chainlink DAS allows monetary establishments to simply conduct onchain trials round end-to-end tokenized asset workflows by offering a preconfigured, customizable, cross-chain, and safe enterprise surroundings—that includes pre-built use circumstances, pattern utility workflows, and consumer interfaces. Customers can launch and consider PoCs individually or along with different establishments in a collaborative digital asset surroundings, and leverage consultancy providers from the Chainlink Labs staff to outline a digital asset adoption roadmap primarily based on confirmed, scalable, and future-proof blockchain applied sciences.

As a part of the Chainlink DAS establishments can entry:

A preconfigured surroundings, to be built-in with main personal and public blockchains with safe interoperability between chains powered by CCIP.

Pre-built workflows and use circumstances, with tokenized bonds because the preliminary supported asset, and the workflows that cowl its full life cycle, from issuance to asset servicing and company actions. Upcoming releases are anticipated to assist extra monetary devices and workflows, like fund tokenization and distribution, and cross-border funds.

A number of deployment fashions, starting from a personal, devoted surroundings for a single establishment to a shared surroundings alongside quite a few different individuals.

Professional assist and consultancy providers, offered by the Chainlink Labs staff, which has the deep {industry} experience and expertise wanted to help each enterprise and technical organizations.

Customization, throughout chains and workflows to adapt them to customers’ particular enterprise wants.

With this easy-to-use turnkey resolution, monetary establishments can now take a look at and validate enterprise use circumstances inside days, fairly than months. Powered by CCIP, monetary establishments can switch knowledge and property throughout any public or personal blockchain in a single atomic transaction, in addition to transact throughout the multichain ecosystem from their present infrastructure via a single level of integration. In consequence, establishments can expertise the complete potential of cross-chain digital property to raised perceive and display the potential of digital property throughout PoCs, collaborative trials, and repair suppliers.

Finish-To-Finish Tokenized Bond Workflow Examples

Out of the field the Chainlink DAS contains tokenized bonds workflows throughout your complete asset lifecycle, beginning with the issuance, on-line public sale and first market allocation on an atomic DvP foundation, secondary markets with central restrict order books (CLOB), OTC buying and selling, safe settlement, and custody and asset servicing with each coupon and maturity funds. Future variations are anticipated to characteristic further modules, increasing assist for varied monetary devices and use circumstances, together with fund tokenization and cross-border funds.

Let’s check out an instance workflow for tokenized bonds:

On-line Public sale and Major Market Allocation for Tokenized Bonds With Atomic DvP Settlement

The method begins with two choices: importing an allocation file or launching an public sale. Within the first choice, the workflow begins with the add of the allocation file offered by the book-runner or issuer, which then triggers the distribution and settlement course of. Within the second choice, the workflow begins with organising the public sale particulars, together with begin and finish dates/instances, supply measurement, minimal and most costs, and many others., adopted by launching the public sale and monitoring bids obtained. After analyzing quantity and imbalance at every value and reviewing the main points of every particular person bid, the ultimate value is determined and the public sale is executed. In each eventualities, the method culminates in atomic DvP settlement transactions powered by CCIP. Bond tokens are delivered to the non-custodial wallets of asset managers on their respective networks, whereas the issuer receives funds of their non-custodial pockets on their chosen community.

This workflow allows customers to completely leverage the utility of tokenized property powered by CCIP, remodeling property from single-chain to any-chain property. By enabling atomic DvP settlement, Chainlink DAS and CCIP allow seamless motion and execution of directions throughout blockchain boundaries, enhancing the effectivity and safety of transactions, and eradicating counterparty threat.

Powered by Chainlink’s Enterprise-Grade Platform

The enterprise-grade sandbox is underpinned by Chainlink’s industry-standard platform, which is the one platform able to addressing the knowledge, liquidity, and synchronization challenges for capital markets. Chainlink has enabled over $12 trillion in onchain transaction worth and is pioneering the way forward for international markets onchain by way of collaborations with Swift, ANZ Financial institution, Sygnum and Constancy Worldwide, and extra. Sandbox customers can even obtain the assist and consultancy providers of Chainlink Labs, the group behind many cutting-edge improvements which have facilitated the expansion of the onchain economic system.

Simplifying this course of and decreasing growth time from months or a number of quarters to days is simply step one. Chainlink Labs, the first contributing developer of Chainlink, might help evolve the following levels of product roadmaps, and expertly information establishments throughout all phases of the adoption course of, together with exploration, testing, growth, and manufacturing.

If you wish to discover how your digital property technique can profit from Chainlink’s industry-standard platform and the brand new Digital Belongings Sandbox, attain out to one in every of our specialists.

Disclaimer: This publish is for informational functions solely and accommodates statements concerning the future, together with anticipated product options, growth, and timelines for the rollout of those options. These statements are solely predictions and mirror present beliefs and expectations with respect to future occasions; they’re primarily based on assumptions and are topic to threat, uncertainties, and adjustments at any time. There will be no assurance that precise outcomes won’t differ materially from these expressed in these statements, though we imagine them to be primarily based on affordable assumptions. All statements are legitimate solely as of the date first posted. These statements could not mirror future developments because of consumer suggestions or later occasions, and we could not replace this publish in response.