[ad_1]

Yesterday, August 5, LINK, the native forex of Chainlink, a decentralized Oracle supplier, plunged to a six-month low. Altering palms at round $8, LINK fell by 64% from March highs, breaking out from a bull flag, signaling weak spot. The correction was throughout the board, and main altcoins like Solana and Cardano additionally posted sharp losses.

LINK Holders Accumulating, Outflows From Exchanges Spike

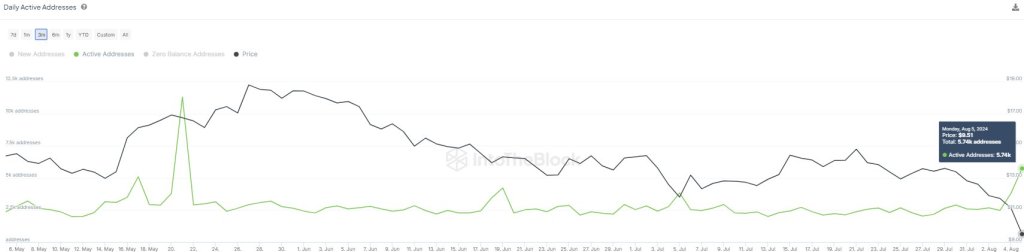

Nonetheless, because the markets bled, breaking under key assist ranges, sensible buyers noticed this as a chance to build up. In response to IntoTheBlock knowledge on August 6, yesterday, there was a marked enhance within the variety of lively LINK addresses, rising to ranges not seen in roughly three months.

Associated Studying

The uptick in lively addresses coincided with a spike in outflows from exchanges. This growth means that customers had been extra eager to build up LINK, not promote, regardless of falling asset costs.

Outflows from centralized exchanges like Binance and Coinbase are often thought of internet constructive. With customers controlling cash through their non-custodial wallets, they’ll’t readily promote for different liquid cash or stablecoins.

Over time, costs are likely to recuperate steadily afterward every time there may be excessive worry, particularly amongst LINK holders. Just like the occasions of March 2020, when crypto costs flash crashed as a consequence of a COVID-19-led collapse, aggressive buyers can contemplate such drops a chance to purchase.

In March 2020, LINK fell by a whopping 70%. Nonetheless, months later, as the cash printers had been powered on, crypto costs rose, lifting LINK by practically 35X at its 2021 peak.

Just like what occurred then, the drop in costs coupled with outflows from exchanges and accumulation amongst entities makes it possible that LINK will bounce again strongly.

Most Holders Are In Purple, However Companions Are In Chainlink Options

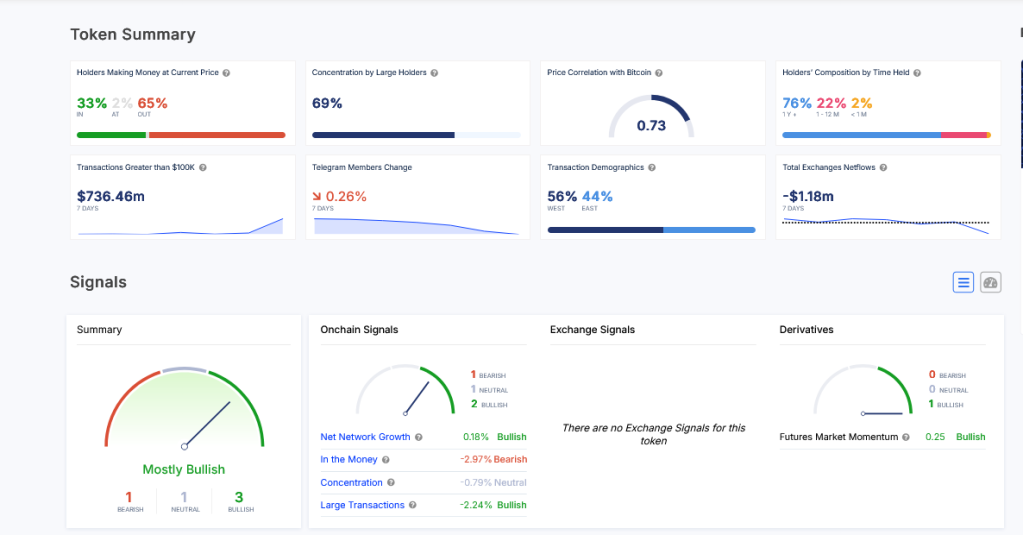

Up to now, IntoTheBlock knowledge reveals that 65% of LINK holders are in losses, and solely 32% are in inexperienced. Encouragingly, although, most LINK holders are “diamond palms” and have been holding their stash for over a yr.

The extra long-term holders or addresses holding the coin or token for over 155 days, the extra resilient costs are within the wave of liquidation.

In addition to worth motion, optimism is excessive amongst LINK holders. Chainlink is a number one decentralized oracle supplier providing providers to DeFi and NFT protocols.

Associated Studying

On the similar time, Chainlink Labs, the middleware developer, continues to strike high quality partnerships. Not too long ago, 21Shares built-in Chainlink’s Proof-of-Reserve on Ethereum to boost transparency.

Function picture from DALLE, chart from TradingView

[ad_2]

Source link