[ad_1]

In search of the simplest strategy to monitor pockets revenue and loss (PnL)? You’ve come to the appropriate place! On this information, we’ll introduce Moralis’ crypto PnL characteristic, offering complete insights into pockets and token profitability. With this characteristic, you may seamlessly get the general profitability of a given tackle, acquire perception into the PnL standing of particular person tokens, and fetch the highest worthwhile wallets for a given ERC-20 token!

Are you desperate to dive into the code? Right here’s our Pockets PnL Abstract endpoint in motion:

import fetch from ‘node-fetch’;

const choices = {

technique: ‘GET’,

headers: {

settle for: ‘utility/json’,

‘X-API-Key’: ‘YOUR_API_KEY’

},

};

fetch(‘https://deep-index.moralis.io/api/v2.2/wallets/0xd8da6bf26964af9d7eed9e03e53415d37aa96045/profitability/abstract?chain=eth’, choices)

.then(response => response.json())

.then(response => console.log(response))

.catch(err => console.error(err));

Calling this endpoint returns the desired pockets’s whole buying and selling quantity, whole PnL, PnL share, and different key metrics. Right here’s an instance of what it appears like:

{

total_count_of_trades: 12,

total_trade_volume: ‘3793782.5812942344’,

total_realized_profit_usd: ‘-20653.121064896484’,

total_realized_profit_percentage: -1.350177388165031,

total_buys: 8,

total_sells: 20,

total_sold_volume_usd: ‘1509006.703335308’,

total_bought_volume_usd: ‘2284775.8779589264’

}

That’s it; monitoring pockets revenue and loss doesn’t must be more difficult than this when utilizing Moralis. For a extra in-depth tutorial on how this works and additional info on our different endpoints, be a part of us on this article or try the Pockets API documentation web page!

Prepared to make use of our crypto PnL characteristic? Join free with Moralis and acquire quick entry to our industry-leading improvement instruments!

Overview

Crypto PnL is an important monetary metric used to find out a portfolio’s internet revenue or loss. Merchants, buyers, and analysts depend on this metric to evaluate asset efficiency over particular durations. As such, it’s elementary for creating instruments resembling cryptocurrency wallets and buying and selling platforms because it offers customers with a transparent overview of their portfolios’ efficiency.

Historically, acquiring this info requires in depth guide information aggregation, together with monitoring trades and cryptocurrency costs. Nonetheless, this course of can now be streamlined utilizing a Web3 information supplier like Moralis.

With Moralis’ crypto PnL characteristic, you may simply decide the general profitability of a given tackle, analyze the PnL standing of ERC-20s, and determine the highest worthwhile wallets for particular tokens. To study extra about how this characteristic works and the way it can profit you, observe our complete information. Let’s dive in!

What’s PnL in Crypto?

Crypto PnL, quick for “revenue and loss,” refers back to the monetary final result of your buying and selling actions. It’s calculated based mostly on the distinction between the shopping for and promoting costs of your cryptocurrency tokens. As such, crypto PnL offers an outline of how your property are performing over a given interval.

Crypto PnL is an important metric for merchants and analysts alike, providing a complete overview of portfolio efficiency. Merchants depend on it to evaluate the effectiveness of their methods, whereas analysts use it for varied functions, together with tax reporting.

In case you’re constructing decentralized finance (DeFi) platforms, cryptocurrency wallets, decentralized exchanges (DEXs), portfolio trackers, or different Web3 platforms, incorporating crypto PnL is essential. This characteristic will give your customers a transparent indication of how their property are performing instantly inside your platform, boosting each engagement and retention.

Nonetheless, calculating crypto PnL from scratch may be advanced and time-consuming. It requires monitoring all trades a consumer makes and monitoring costs at particular occasions, a course of that may be tedious if achieved manually.

Thankfully, a Web3 information supplier like Moralis can streamline this course of. It eliminates the effort of guide calculations, permitting you to deal with enhancing your platform’s options and consumer expertise!

Introducing Moralis – The Trade’s Main Crypto PnL API for Monitoring Pockets Revenue & Loss

With Moralis’ realized crypto PnL characteristic, you may seamlessly question the revenue and loss standing of any pockets. As such, this characteristic presents complete insights into pockets and token profitability, making it simpler to trace and analyze income/losses throughout tokens and determine probably the most worthwhile wallets for any ERC-20 token!

The realized crypto PnL characteristic consists of three endpoints:

Pockets PnL SummaryFetch the general profitability of a given tackle over a particular time interval, together with whole buying and selling quantity, whole revenue/loss, and different key metrics:

import fetch from ‘node-fetch’;

const choices = {

technique: ‘GET’,

headers: {

settle for: ‘utility/json’,

‘X-API-Key’: ‘YOUR_API_KEY’

},

};

fetch(‘https://deep-index.moralis.io/api/v2.2/wallets/0xd8da6bf26964af9d7eed9e03e53415d37aa96045/profitability/abstract?chain=eth’, choices)

.then(response => response.json())

.then(response => console.log(response))

.catch(err => console.error(err));

Instance Response:

{

total_count_of_trades: 12,

total_trade_volume: ‘3793782.5812942344’,

total_realized_profit_usd: ‘-20653.121064896484’,

total_realized_profit_percentage: -1.350177388165031,

total_buys: 8,

total_sells: 20,

total_sold_volume_usd: ‘1509006.703335308’,

total_bought_volume_usd: ‘2284775.8779589264’

}

Pockets PnL BreakdownGet an in depth breakdown of buys, sells, and revenue/loss for every ERC-20 token traded by a pockets. This endpoint helps you perceive the efficiency of particular person tokens in a portfolio:

import fetch from ‘node-fetch’;

const choices = {

technique: ‘GET’,

headers: {

settle for: ‘utility/json’,

‘X-API-Key’: ‘YOUR_API_KEY’

},

};

fetch(‘https://deep-index.moralis.io/api/v2.2/wallets/0xd8da6bf26964af9d7eed9e03e53415d37aa96045/profitability?chain=eth’, choices)

.then(response => response.json())

.then(response => console.log(response))

.catch(err => console.error(err));

Instance Response:

{

consequence: [

{

token_address: ‘0xc02aaa39b223fe8d0a0e5c4f27ead9083c756cc2’,

avg_buy_price_usd: ‘1250.89117636677242138858’,

avg_sell_price_usd: ‘1217.57108487456170834445’,

total_usd_invested: ‘765334.18465647742708110434311858’,

total_tokens_bought: ‘611.831148157427433472’,

total_tokens_sold: ‘611.831148157427433472’,

total_sold_usd: ‘744947.914822087616974748507047918740485538176519383’,

avg_cost_of_quantity_sold: ‘1250.89117636677242138858’,

count_of_trades: 5,

realized_profit_usd: ‘-20386.26983438981010635958779520045817511936’,

realized_profit_percentage: -2.663708252302914,

total_buys: 3,

total_sells: 18,

name: ‘Wrapped Ether’,

symbol: ‘WETH’,

decimals: ‘WETH’,

logo: ‘https://logo.moralis.io/0x1_0xc02aaa39b223fe8d0a0e5c4f27ead9083c756cc2_018112a9229b4bf1bf0d042beb7c2c55’,

logo_hash: ‘0a7fc292596820fe066ce8ce3fd6e2ad9d479c2993f905e410ef74f2062a83ec’,

thumbnail: ‘https://logo.moralis.io/0x1_0xc02aaa39b223fe8d0a0e5c4f27ead9083c756cc2_018112a9229b4bf1bf0d042beb7c2c55’,

possible_spam: false

},

//…

]

}

High Worthwhile Wallets by TokenFetch the highest worthwhile wallets which have traded a sure token, offering insights into probably the most profitable merchants for that asset:

import fetch from ‘node-fetch’;

const choices = {

technique: ‘GET’,

headers: {

settle for: ‘utility/json’,

‘X-API-Key’: ‘YOUR_API_KEY’

},

};

fetch(‘https://deep-index.moralis.io/api/v2.2/erc20/0x7c9f4c87d911613fe9ca58b579f737911aad2d43/top-gainers?chain=eth’, choices)

.then(response => response.json())

.then(response => console.log(response))

.catch(err => console.error(err));

Instance Response:

{

title: ‘Wrapped Matic’,

image: ‘WMATIC’,

decimals: ’18’,

emblem: ‘https://emblem.moralis.io/0x1_0x7c9f4c87d911613fe9ca58b579f737911aad2d43_128bc82fe3d945e59c5e67b540eb7ab5’,

possible_spam: false,

consequence: [

{

address: ‘0x202bb2fab1e35d940fde99b214ba49dafbcef62a’,

avg_buy_price_usd: ‘0.9183155718922578201779330700749389942841’,

avg_sell_price_usd: ‘1.59952463158282389246’,

total_tokens_bought: ‘50.425564410689794636’,

total_usd_invested: ‘46.30658101979248190652763127006057463808’,

total_tokens_sold: ‘50.423563438810080581’,

total_sold_usd: ‘80.6537317325558427356221252383435353256’,

avg_cost_of_quantity_sold: ‘0.91831557189225782928’,

count_of_trades: 2,

realized_profit_usd: ‘34.34898823639942076774324344951973710758’,

realized_profit_percentage: 74.18027969262069

},

//…

]

}

This overview covers our crypto PnL characteristic. Subsequent, we’ll stroll you thru a tutorial on methods to use these endpoints to trace pockets revenue and loss!

3-Step Tutorial: Tips on how to Monitor Pockets Revenue & Loss

We’ll now present you methods to monitor the revenue and loss standing of any pockets. And due to the accessibility of our premier API, you will get the info you want in three easy steps:

Get a Moralis API Key

Write a Script Calling the Pockets PnL Abstract Endpoint

Run the Code

Nonetheless, earlier than we get going, you’ll have to care for a few conditions!

Stipulations

Earlier than shifting on, be sure to have the next put in and arrange:

Step 1: Get a Moralis API Key

Click on the “Begin for Free” button on the high proper to enroll in an account with Moralis:

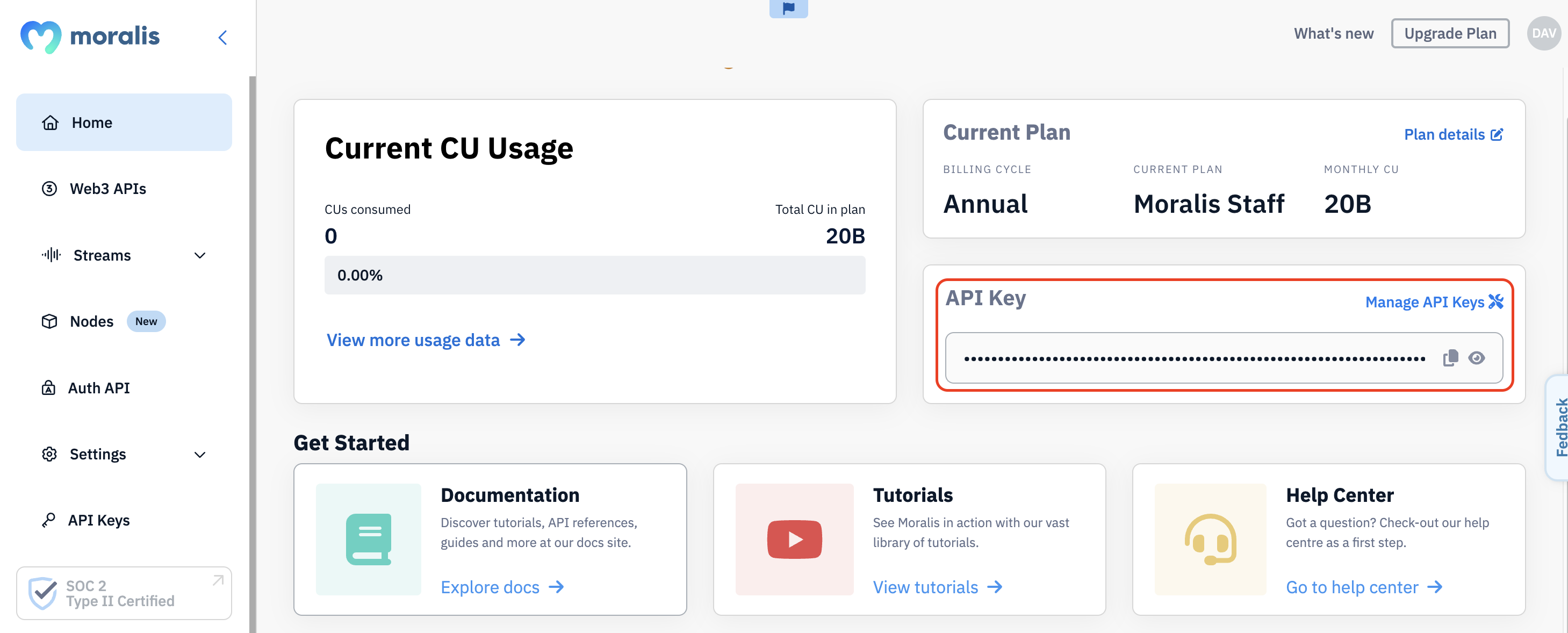

From there, you’ll discover your API key instantly beneath the “House” tab:

Copy and maintain the important thing for the second, as you’ll want it through the subsequent step!

Step 2: Write a Script Calling the Pockets PnL Abstract Endpoint

Open your most well-liked IDE, arrange a folder, launch a terminal, and initialize a undertaking with this command:

npm init

Set up the wanted dependencies with this terminal command:

npm set up node-fetch –save

npm set up moralis @moralisweb3/common-evm-utils

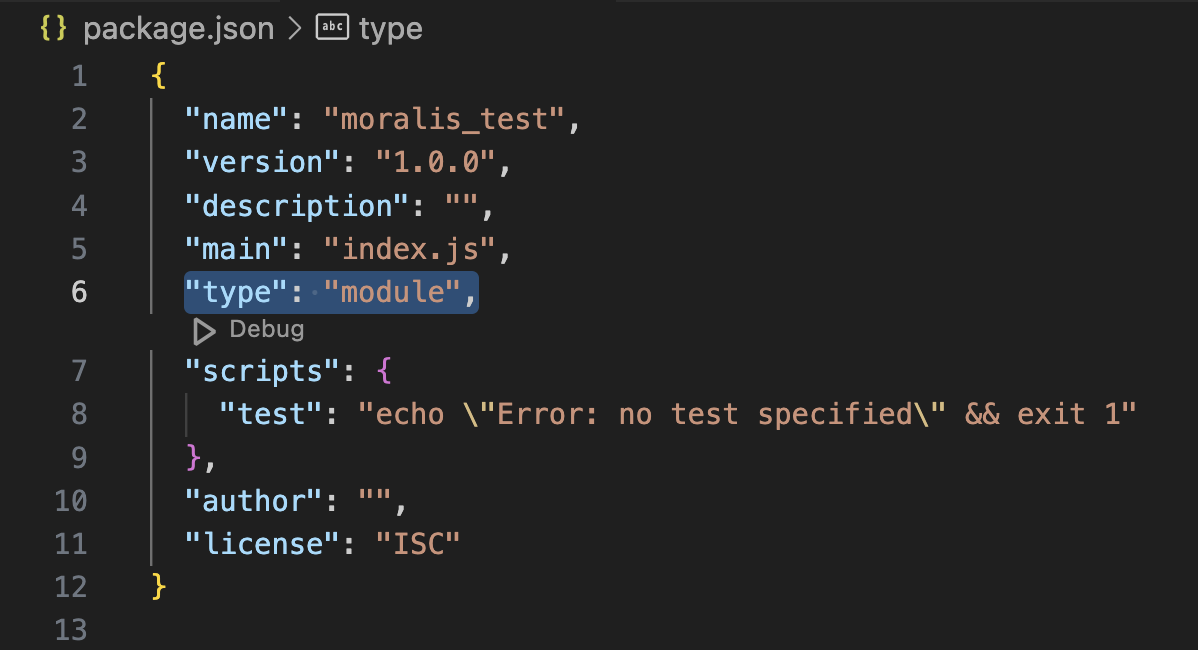

From right here, open your “package deal.json” file and add “sort”: “module” to the listing:

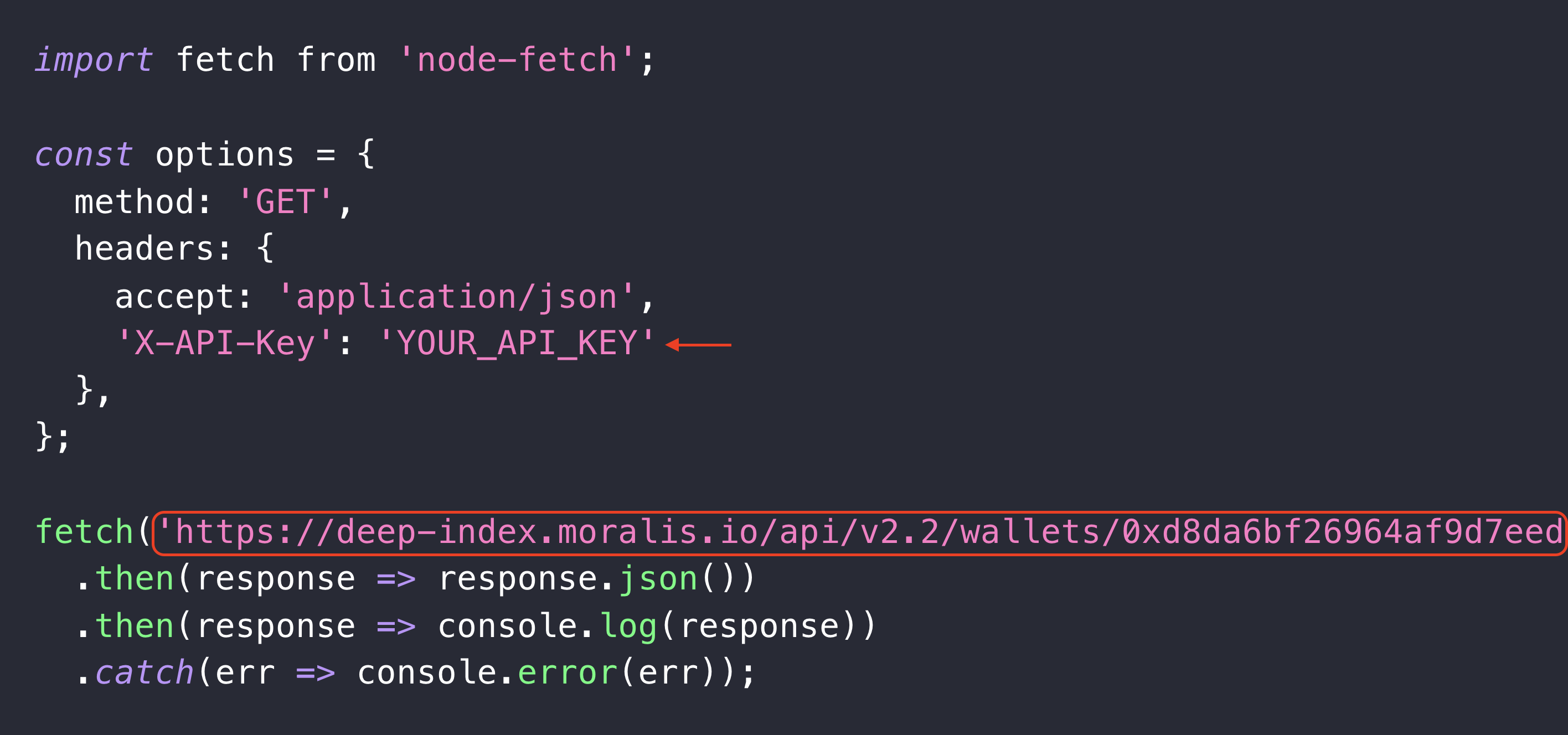

Create a brand new “index.js” file and add the next code:

import fetch from ‘node-fetch’;

const choices = {

technique: ‘GET’,

headers: {

settle for: ‘utility/json’,

‘X-API-Key’: ‘YOUR_API_KEY’

},

};

fetch(‘https://deep-index.moralis.io/api/v2.2/wallets/0xd8da6bf26964af9d7eed9e03e53415d37aa96045/profitability/abstract?chain=eth’, choices)

.then(response => response.json())

.then(response => console.log(response))

.catch(err => console.error(err));

Subsequent, it’s good to configure the code barely. Firstly, add your Moralis API key by changing YOUR_API_KEY. Secondly, configure the tackle and chain parameters to suit your question:

That’s it for the code. All that is still now’s to execute the script!

Step 3: Run the Code

Open your terminal, go to the foundation folder of your undertaking, and run this command:

node index.js

In return, you’ll obtain a response showcasing the pockets’s whole buying and selling quantity, whole realized revenue/loss, realized revenue/loss share, and extra. Right here’s an instance of what it would appear like:

{

total_count_of_trades: 12,

total_trade_volume: ‘3793782.5812942344’,

total_realized_profit_usd: ‘-20653.121064896484’,

total_realized_profit_percentage: -1.350177388165031,

total_buys: 8,

total_sells: 20,

total_sold_volume_usd: ‘1509006.703335308’,

total_bought_volume_usd: ‘2284775.8779589264’

}

That’s it! Monitoring pockets revenue and loss doesn’t must be more difficult than this when utilizing Moralis!

Use Case – Construct a Crypto PnL Tracker

Now that you know the way to trace pockets revenue and loss, you may leverage this information to construct instruments like a crypto PnL tracker. A crypto PnL tracker is a platform or device that helps customers monitor their portfolio efficiency successfully!

Key options of a crypto PnL tracker embody:

Actual-Time Portfolio Monitoring: Monitor the efficiency of a portfolio in real-time, together with the revenue/loss standing for particular person ERC-20 tokens.

Historic Information Evaluation: Entry historic efficiency information to research how investments have carried out over particular durations.

Tax Calculations: Make the most of PnL information to help customers with their cryptocurrency taxes.

A crypto PnL tracker may be built-in into varied platforms, resembling portfolio trackers, cryptocurrency wallets, DEXs, and extra, to enhance the general consumer expertise of your dapps!

Past Crypto PnL & Monitoring Pockets Revenue & Loss – Diving Deeper Into Moralis

Moralis stands because the {industry}’s main Web3 information supplier, providing an intensive suite of Web3 APIs and RPC nodes past the crypto PnL characteristic. With Moralis, you may entry all crypto information in a single place, making it straightforward to develop subtle platforms like cryptocurrency wallets, portfolio trackers, and extra.

However why select Moralis’ Web3 APIs and RPC nodes?

Complete: Moralis delivers probably the most detailed API responses within the {industry}, offering extra information with fewer calls. This effectivity lets you construct dapps quicker and extra successfully.

Cross-Chain Compatibility: Moralis helps over 30 chains, together with Ethereum, Polygon, BSC, and Optimism, providing full characteristic parity throughout all networks. This implies you solely want one supplier for all of your crypto wants.

Safe: Profit from enterprise-grade information safety as Moralis is Web3’s first SOC 2 Kind 2 licensed information supplier.

To completely grasp the capabilities of Moralis, let’s delve deeper into our suite of improvement instruments, beginning with our Web3 APIs!

Web3 APIs

In our suite of Web3 APIs, you’ll discover ten use-case-specific interfaces. Under, we’ll introduce three distinguished examples:

Pockets API: With the Pockets API, you may effortlessly retrieve any pockets’s crypto PnL, token balances, transaction historical past, internet value, and far more. By leveraging this device, you may seamlessly combine pockets performance into your dapps.

Token API: The Token API means that you can entry token balances, metadata, costs, and extra with only a few strains of code. This makes the Token API a superb device for dapps requiring ERC-20 information, together with DEXs, portfolio trackers, and extra.

NFT API: With the NFT API, you may effortlessly question NFT balances, metadata, costs, and extra. In case you’re trying to construct NFT marketplaces, Web3 video games, or related platforms, you should definitely try the NFT API.

Streams API: With the Streams API, you may effortlessly arrange Web3 information pipelines on the click on of some buttons to stream information instantly into your initiatives. As such, this highly effective device is right for organising real-time alerts, populating databases, or enhancing dapps with up-to-date insights on tokens, wallets, and good contracts.

Value API: The Value API permits seamless retrieval of costs for any ERC-20 token or NFT. This superior device helps batch requests, permitting you to question the costs of a number of tokens concurrently. It’s excellent for constructing DEXs, token trackers, or any platform requiring correct pricing information.

Go to our official Web3 API web page to study extra concerning the examples above and our different interfaces!

RPC Nodes

Moralis offers RPC nodes for over 30 blockchains, together with Ethereum, Polygon, BSC, and lots of others. And our user-friendly, point-and-click interface makes organising nodes a breeze!

However what units our RPC nodes aside?

Pace: Take pleasure in lightning-fast response occasions beginning at simply 70 ms, making certain you obtain the info you want at once.

Reliability: Our nodes are designed for optimum dependability, with a formidable 99.9% uptime.

Safety: Profit from top-notch information safety because the {industry}’s first SOC 2 Kind 2 licensed information supplier.

To study extra, please go to our official RPC nodes web page or try one of many following guides, the place we discover Fantom RPC nodes and Blast RPC nodes!

Abstract: Crypto PnL API – Tips on how to Monitor Pockets Revenue & Loss

Crypto PnL is a crucial monetary metric used to find out the web revenue or lack of a cryptocurrency portfolio. Merchants, analysts, and buyers depend on this metric to trace asset efficiency over particular time durations, making it important for constructing the whole lot from wallets to portfolio trackers.

Nonetheless, calculating the revenue and lack of a pockets from scratch is usually a tedious and sophisticated activity, requiring fixed monitoring of consumer transactions, token costs, and extra. Fortunately, now you can seamlessly question the crypto PnL of any portfolio with a single line of code utilizing a Web3 information supplier like Moralis.

Moralis’ crypto PnL characteristic consists of three core endpoints:

Pockets PnL Abstract: Get hold of the general profitability of a given pockets over a specified interval. This consists of whole buying and selling quantity, whole revenue/loss, revenue/loss share, and different key metrics.

Pockets PnL Breakdown: Fetch an in depth breakdown of buys, sells, and revenue/loss for every token traded by a pockets. This endpoint offers an in-depth understanding of the efficiency of particular person tokens in a portfolio.

High Worthwhile Wallets by Token: Determine the highest worthwhile wallets which have traded a particular token, providing insights into probably the most profitable merchants for that individual asset.

As such, when utilizing Moralis, you may seamlessly monitor pockets revenue and loss with out breaking a sweat!

In case you discovered this crypto PnL tutorial useful, contemplate exploring extra content material on our weblog. For instance, try our article on the DeBank API for info on our DeFi positions characteristic, or examine our Alchemy Webhooks information for extra info on streams.

Moreover, if you happen to want to monitor pockets revenue and loss your self, enroll with Moralis. You may create an account freed from cost and acquire quick entry to our suite of industry-leading instruments.

[ad_2]

Source link