[ad_1]

KEY POINTS

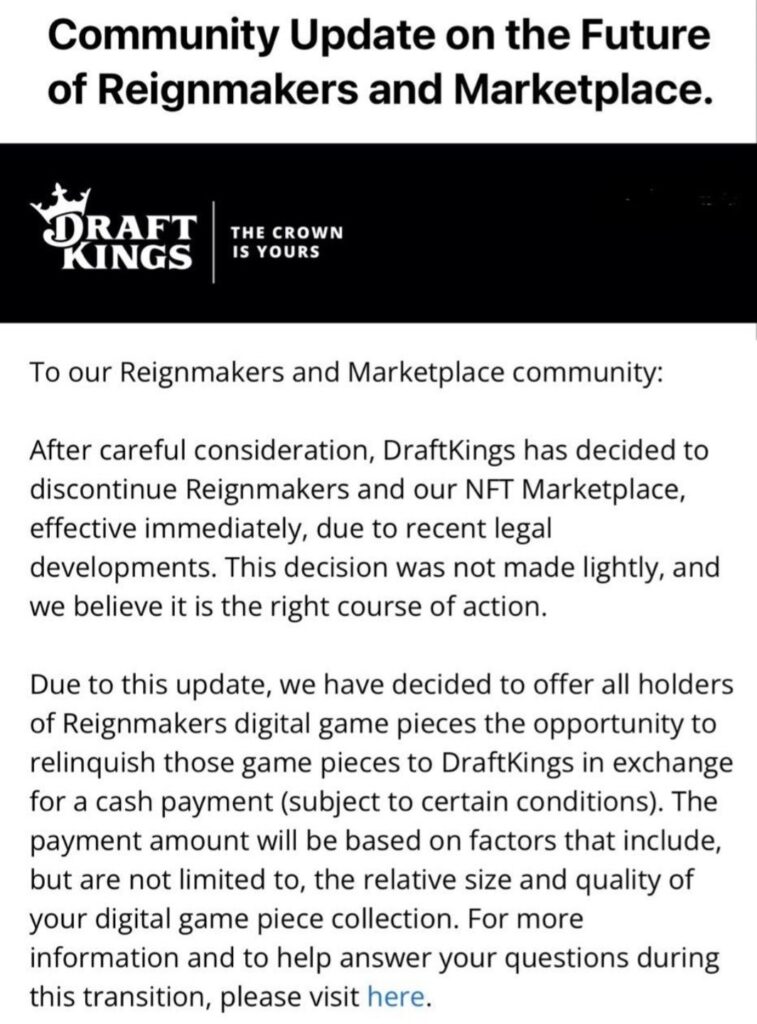

DraftKings, the American day by day fantasy sports activities and sports activities betting firm, has determined to close down its non-fungible token (NFT) sport Reignmakers and its related market.

The announcement states, “DraftKings has determined to discontinue Reignmakers and our NFT Market, efficient instantly, because of latest authorized developments.”

This determination took impact instantly, permitting holders of sport items to change their belongings for money below particular circumstances.

This transfer follows a latest authorized setback through which a U.S. decide in Massachusetts denied DraftKings’ movement to dismiss a category motion lawsuit filed by consumers of its NFTs. These consumers argue that the NFTs are unregistered securities.

DraftKings ventured into the NFT market in July 2021, after observing a surge in curiosity amongst its key prospects for digital collectibles like NBA High Shot. The corporate had even filed NFT-related trademark purposes in late 2022.

Nevertheless, ongoing authorized uncertainties have made it tough for DraftKings, in addition to different main initiatives within the business, to proceed their operations easily.

As an illustration, Starbucks ended its NFT rewards beta program, Odyssey, in March, and GameStop shut down its NFT market in January after two years of operation.

The primary subject inflicting these shutdowns is the uncertainty over whether or not NFTs needs to be thought-about securities. This uncertainty has led to a number of authorized actions and penalties in opposition to NFT initiatives.

Final August, the Securities and Alternate Fee (SEC) took its first motion in an NFT case in opposition to Impression Principle, a Los Angeles-based media firm. The corporate was fined $6.1 million for providing unregistered NFT securities often known as “Founder’s Keys,” violating securities legal guidelines.

In September, the SEC additionally focused the Stoner Cats NFT venture, leading to a $1 million penalty for promoting unregistered securities. Extra just lately, Dapper Labs settled a lawsuit over its NBA High Shot NFTs for $4 million.

In response to those regulatory pressures, two artists have filed a lawsuit in opposition to the SEC to make clear whether or not NFTs needs to be categorised as securities. The end result of this authorized problem may decide whether or not NFT creators should register their belongings and disclose potential dangers to consumers, which might considerably impression the market’s future.

[ad_2]

Source link