As soon as an emblem of luxurious skincare, Estée Lauder ($EL) is now dealing with challenges, with a lower in gross sales largely due to its Asia gross sales efficiency, with rising competitors from newer manufacturers that resonate extra with youthful shoppers, and in addition new Korean advertising laws. On Tuesday, February 4th they introduced quarterly outcomes, and now the corporate is buying and selling at its lowest valuation in 5 years, let’s analyze their newest numbers.

Key Highlights

Buying and selling at 5 yr low, is it a cut price, or a price entice?

Assessing Estée Lauder’s model and pricing energy in a extremely aggressive skincare market.

Firing 7000 folks: the corporate’s restoration plan.

Enterprise Mannequin Overview

Estée Lauder is a steward of luxurious status manufacturers, from skincare to haircare, fragrances, and make-up, with a variety of goal prospects, and with presence in additional than 150 international locations. Based in 1946 by Esther Lauder, with only a choice of lotions and perfumes, it’s immediately an organization with greater than 20 manufacturers which have traditionally maintained robust model and pricing energy.

Their shoppers have been loyal for years, significantly amongst older shoppers. Within the present world, youthful generations are uncovered to skincare from an early age, usually preferring cheaper merchandise. Regardless that The Extraordinary, certainly one of their manufacturers, affords higher offers, luxurious manufacturers like Estee Lauder, LaMer, Clinique, and MAC are the true money generator with over 1B in gross sales every.

One notable shift is that 9 Estée Lauder manufacturers have a presence in Amazon US immediately when beforehand they didn’t promote on Amazon in any respect. A few of the manufacturers are below the “Premium magnificence” class, signalling a strategic transfer to adapt to digital shopper behaviour. One other instance is that they now have a presence in TikTok store UK. Regardless of this, the corporate faces mounting pressures from rivals that dominate on-line gross sales and influencer partnerships, and with the brand new development on Korean Magnificence, Dr.Jart+ one of many Korean magnificence manufacturers of Estee Lauder, now has extra competitors than ever as a result of the US market is the most important shopper in skincare worldwide. If shopper preferences change in the direction of Korean magnificence manufacturers, all the opposite manufacturers of the corporate should adapt quite shortly.

Funding Thesis

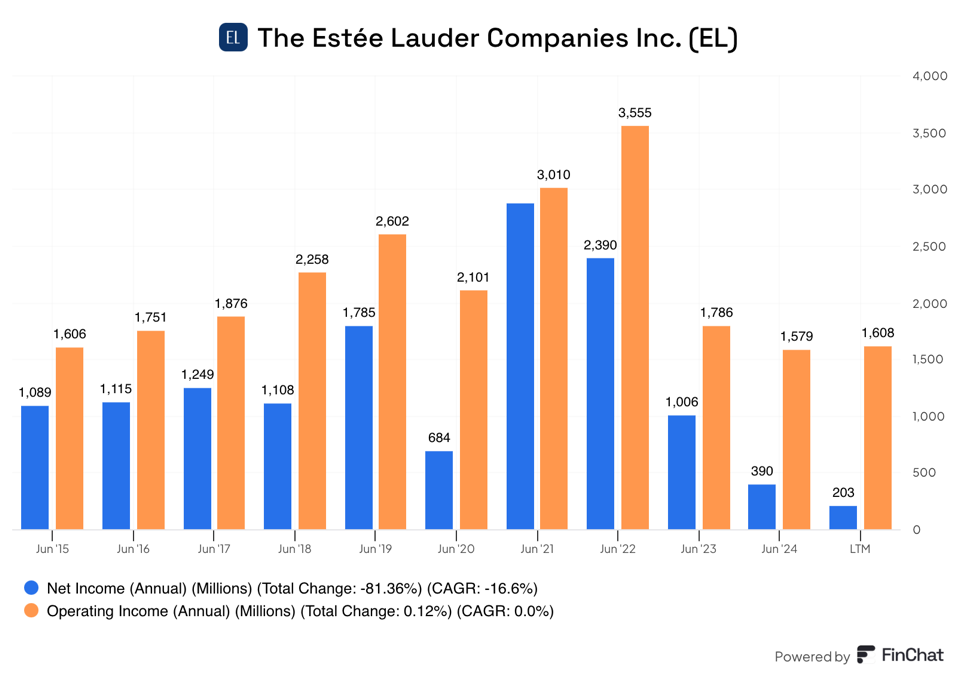

Whereas Estée Lauder has lengthy been a robust participant within the luxurious magnificence trade, current monetary struggles increase issues. The corporate’s newest annual report, and the current second quarterly outcomes, point out a difficult retail surroundings, with declining gross sales in key markets. For instance, Asia with a -11% in gross sales through the earlier six months. Additionally, web gross sales decreased in complete -6% newest quarter to $4 billion. And the steering for the third quarter will not be optimistic in any respect. This has damage the working margin, which is now the bottom of the last decade.

Supply: Finchat.io

To face this problem, Estée Lauder has launched the Revenue Restoration and Development Plan (PRGP), referred to as “Magnificence Reimagined” which goals to enhance value efficiencies and drive sustainable development with an estimated reaching date for 2027.

Due to this turnaround try, the corporate expects one other income discount within the subsequent quarter. As a part of this PRGP, they anticipate to spend between 1.2 billion and 1.6 billion earlier than taxes on employee-related prices (between 5.800 and seven.000 job cuts from 62.000 workers).

The massive query right here is, can $EL keep the earlier working margin whereas sustaining or rising revenues, or are they a part of the previous now?

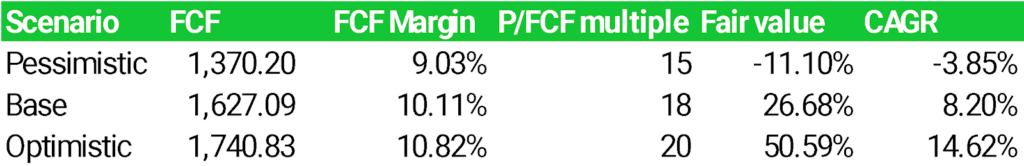

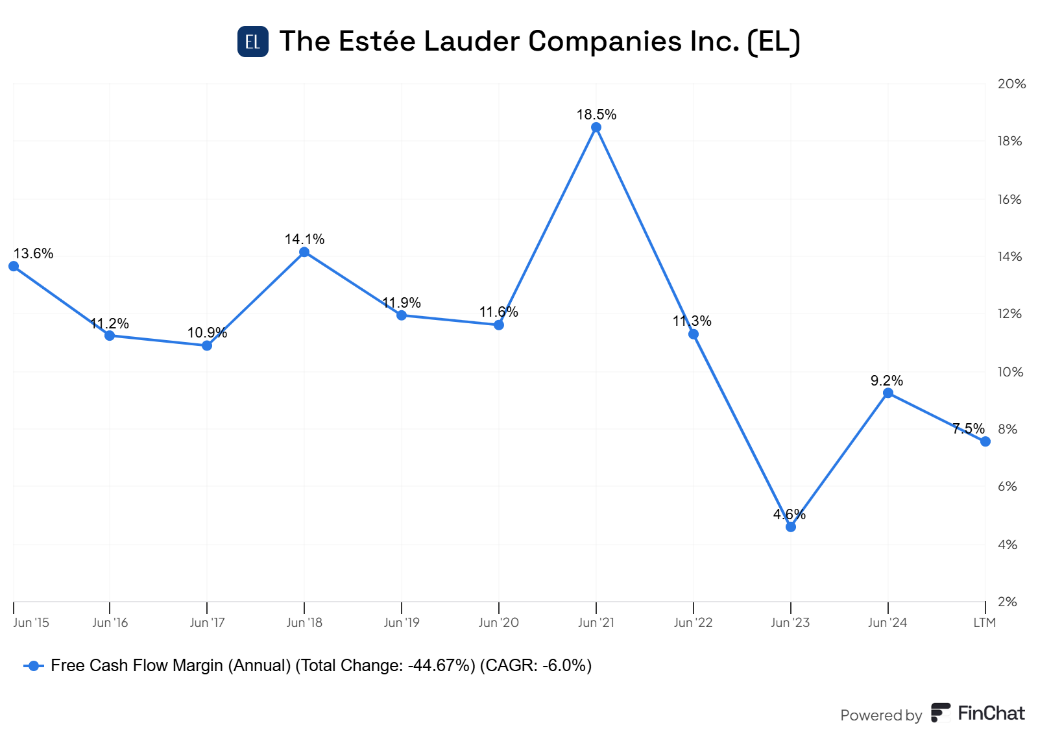

Though we all know that subsequent yr goes to be difficult by way of margins and income, we purpose to calculate the corporate’s sustainable free money movement. For that motive, we construct three totally different situations. Base, pessimistic, and optimistic.

This can be a firm with a strong background and has luxurious manufacturers with pricing energy. Within the pessimistic state of affairs, in case the corporate doesn’t obtain an enchancment in its web margins, the corporate remains to be overvalued. Nevertheless, if they will handle to get again to their regular margins, which they’re attempting to realize by means of their PRGP program, the corporate may ship an annual return of over 14% through the coming three years.

Supply: Finchat.io

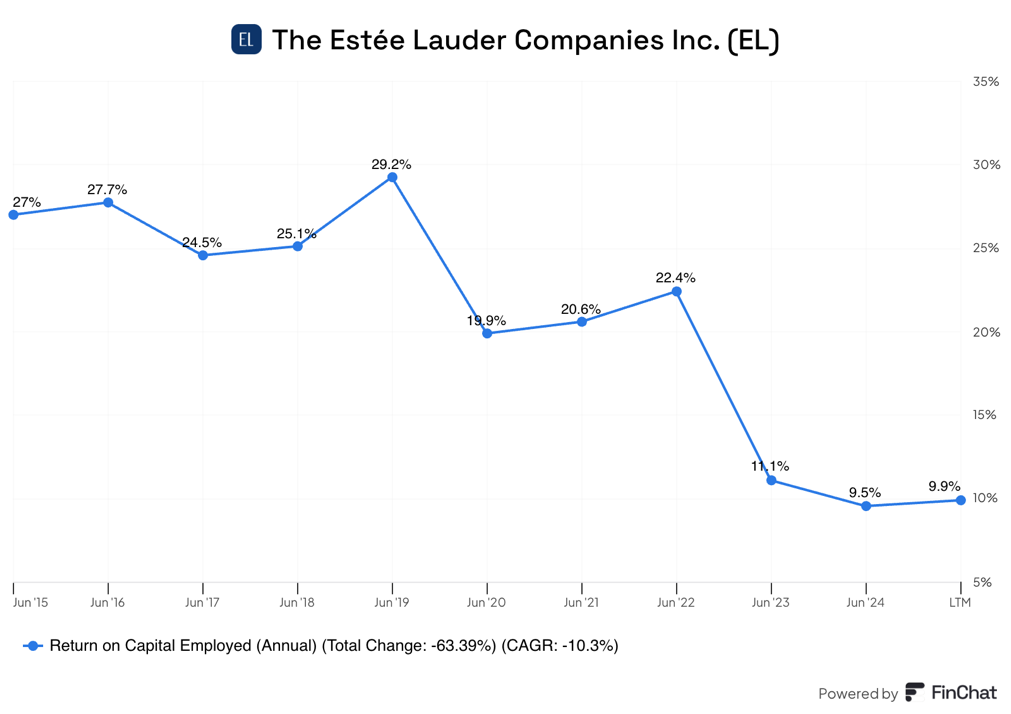

As we will discover within the graphic under, the returns on capital employed have been secure since 2015, with a median of 24,55% in eight years. This made the corporate commerce a P/E valuation inside the 30x- 40x vary. So, if the corporate improves its margins, it will enhance its present ROIC as properly, and it may result in a greater margin than our optimistic valuation.

Supply: Finchat.io

Dangers

Declining model energy: Regardless of their lengthy trajectory within the sector, new know-how and discoveries in skincare and new globalized skincare tendencies, shifts in Korean magnificence, and influencers-led manufacturers are a real concern for the model.

New leaders: Stéphane de la Faverie, took place in January 2025 and he has a monitor report of being basic supervisor for some corporations within the magnificence sector. Nevertheless, that is his first time being a CEO, and he’s in a very unhealthy place to begin studying. Different members of the workforce, just like the CFO are retiring, which could possibly be additionally a possibility for brand spanking new and extra up to date concepts to the brand new technology’s wants.

Execution of their PRGP: Turnarounds have confirmed to be tough to implement, and as buyers now we have to firmly imagine within the administration functionality to implement well timed measures to vary the trail of the corporate.

Macroeconomic danger: we noticed within the pandemic interval of 2020, a big discount of their gross sales, and this can be a show that $EL can be affected by the financial surroundings.

Solvency danger: If the corporate can’t get well its margins, and revenues preserve deteriorating, the debt that the corporate holds can develop into a significant downside. With 6 billion in web debt, they’ve the danger of being unable to pay their obligations.

Regulatory challenges: They acknowledge one of many main impacts on the gross sales was the Korean guideline for e-commerce, being Korea roughly 10% of their gross sales. It’s identified that advertising methods play with the urgency and requirements of the buyer. Listed here are a number of the new tips:

The way in which that they promote their costs and product measurement.

Restrictions within the subscription program.

Collaborations with influencers, they now should disclose within the title or to start with of the advice that they’re being paid to say that.

This makes a big affect on advertising methods, which want now a totally totally different restructuring to adjust to the Korean regulation.

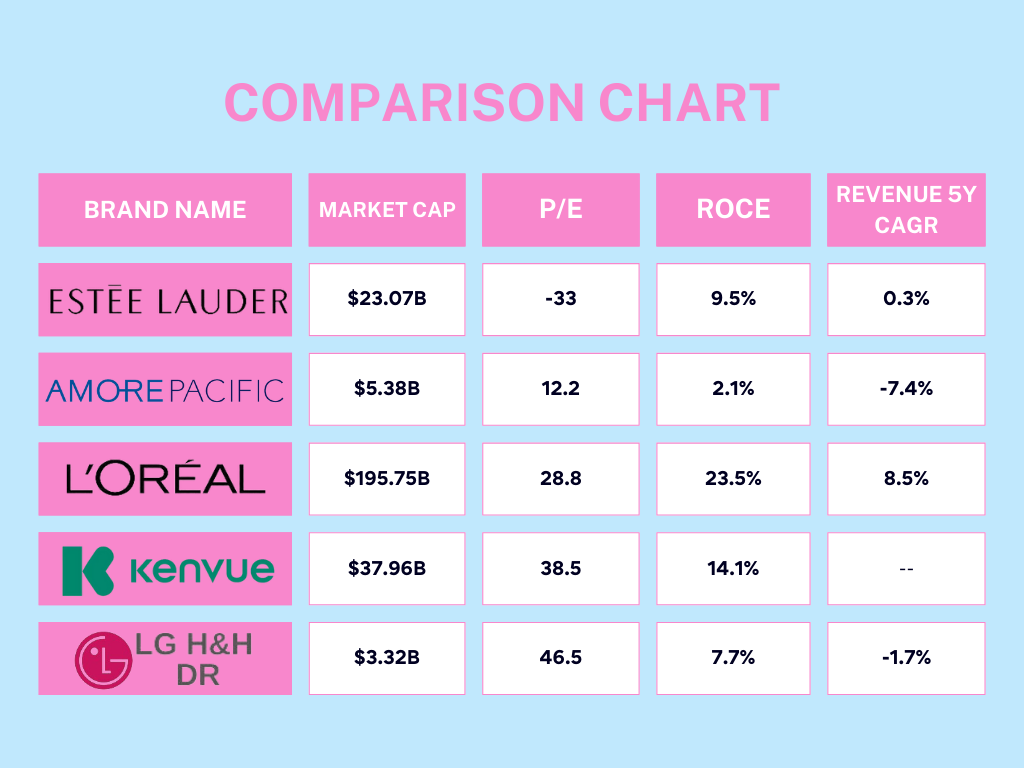

Rivals

Loreal: The most important competitor with a market cap of 192.37 Billions.

Korean magnificence manufacturers: as LG H&H, and Amorepacific corp, Goodai.

Conclusion

The Revenue Restoration and Development Plan (PRGP) is a strong technique to handle Estée Lauder’s challenges, however with a two-year timeline for execution, remains to be within the early stage of execution. My place stays cautious so, I choose to attend for the subsequent quarter’s outcomes to evaluate whether or not significant enhancements in value administration and operational effectivity are taking form. Whereas the corporate possesses robust manufacturers, administration should display a transparent dedication to driving a profitable turnaround.

One promising improvement is the combination of AI into operational processes, enhancing effectivity in stock forecasting and materials planning. Early outcomes recommend improved margins, signaling a willingness to embrace technological developments and adapt to a brand new period of shopper conduct.

Nevertheless, there’s a danger that Estée Lauder may develop into a price entice, a inventory that seems low cost however continues to say no as a result of structural weaknesses, with out a confirmed monitor report of the brand new administration this can be a chance. Whereas the corporate’s model fairness stays robust, the rise of recent rivals, shifting shopper preferences, and execution dangers in its restoration plan may restrict long-term upside.

At present ranges, I’m not investing in Estée Lauder, but when the inventory reaches a extra engaging worth that provides a prudent margin of security, it may develop into a compelling alternative. For now, my advice is to maintain $EL in your watchlist and monitor whether or not administration can execute its turnaround successfully. On this case, though the worth can doubtlessly go up, we’d have extra certainty in regards to the firm’s valuation, so the danger would diminish.

What do you suppose? Is Estée Lauder on the trail to restoration, or is it a traditional worth entice?