[ad_1]

Franklin Templeton, a monetary juggernaut overseeing a formidable $1.5 trillion, has not too long ago introduced its strategic entry into the extremely aggressive area of spot Ethereum Trade-Traded Funds (ETFs) inside the US. This strategic transfer comes scorching on the heels of their profitable initiation into the Bitcoin ETF enviornment, indicating a rising confidence within the expansive and dynamic digital asset panorama.

Ethereum Staking Technique: Franklin’s Progressive Method

Whereas following the footsteps of its rivals in mirroring the construction of their Bitcoin ETF, Franklin Templeton provides a novel twist to its proposed “Franklin Ethereum ETF.” The corporate plans to stake a portion of its Ethereum holdings, doubtlessly permitting buyers to earn supplementary earnings by the community’s distinctive validation mechanism. This modern method echoes methods employed by trade gamers corresponding to ARK 21Shares, including an extra layer of sophistication to the already fiercely aggressive race.

We’re enthusiastic about ETH and its ecosystem. Regardless of the midlife disaster it’s not too long ago skilled, we see a vibrant future with many sturdy tailwinds to push the Ethereum ecosystem forward-EIP 4844-Alt DA-Neighborhood Revitalization-Restaking

— Franklin Templeton (@FTI_US) January 17, 2024

Though Franklin Templeton enters the Ethereum ETF race barely later than some counterparts, the corporate has a confirmed observe file of embracing innovation. Current expressions of admiration for the basics of Ethereum and different blockchains trace at broader ambitions past Bitcoin. This strategic pivot aligns seamlessly with CEO Jenny Johnson’s imaginative and prescient of embracing rising applied sciences, exemplified by the corporate’s playful adoption of the “laser eyes” meme on social media.

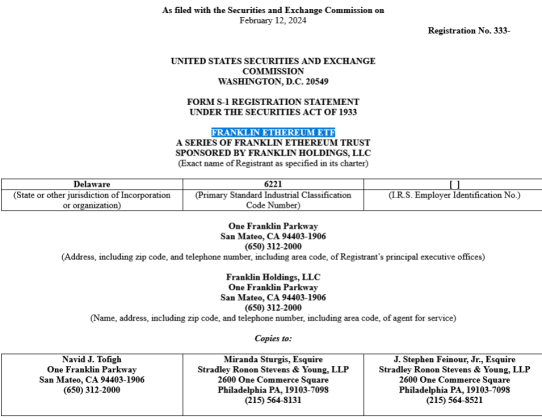

Franklin Templeton’s S-1 software for a spot Ether ETF. Supply: SEC

The Ethereum ETF Panorama: A Crowded Area with Regulatory Hurdles

Within the pursuit of approval from the Securities and Trade Fee (SEC), Franklin Templeton finds itself amidst a crowded discipline, with heavyweight rivals like BlackRock, VanEck, and Constancy already within the race. The SEC has set deadlines starting from Might to August for choices on these purposes, implying that Franklin might must train persistence on this regulatory course of.

Right here’s the newest desk of different filers that I’ve pic.twitter.com/xCRRMwK76r

— James Seyffart (@JSeyff) February 12, 2024

The Path Forward: Potential Advantages And Regulatory Uncertainties

If the Franklin Ethereum ETF secures approval, it may provide buyers a regulated and handy channel to realize publicity to Ethereum, doubtlessly attracting new individuals to the ever-evolving crypto panorama. The elevated institutional adoption might play a job in legitimizing the trade and boosting Ethereum’s value. Nonetheless, buyers should tread cautiously, given the regulatory hurdles and the inherent volatility related to the cryptocurrency market.

ETHUSD buying and selling at $2,667 on the each day chart: TradingView.com

Analyst Insights: Divided Opinions on Ethereum ETF Approvals

Analysts’ views on the chance of Ether ETF approvals in 2024 stay divided. Bloomberg’s Eric Balchunas not too long ago adjusted his odds from 70% to 60%, underscoring the uncertainty surrounding the SEC’s stance on these monetary merchandise.

Franklin Templeton’s entry into the Ethereum ETF race provides a layer of complexity to an already intense competitors. Whereas potential advantages are attractive, buyers should stay aware that ETF approval will not be assured, and a complete understanding of the market is essential earlier than making funding choices on this quickly evolving panorama.

Featured picture from Pexels, chart from TradingView

[ad_2]

Source link