[ad_1]

Motive to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by business consultants and meticulously reviewed

The best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Este artículo también está disponible en español.

Regardless of the latest crypto crash that despatched most digital property tumbling, Ethereum (ETH), Solana (SOL) and Cardano (ADA) have managed to carry their floor. In line with newest studies, these three cryptocurrencies at the moment are main the charts as probably the most trending cash available in the market after the crash.

Associated Studying

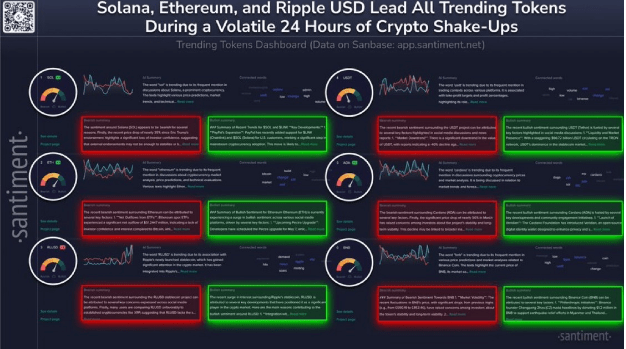

Santiment Unveils High Trending Cryptos

The crypto market took a big hit after fears of new tariffs carried out by United States President Donald Trump rattled traders and despatched digital property plunging throughout the board. Nevertheless, whereas US inventory markets closed, indicators of restoration started to emerge throughout particular cryptocurrencies, with Ethereum, Solana, and Cardano main the post-crash chatter.

In line with an X (previously Twitter) publish by Santiment, a market intelligence platform, Solana is now again within the headlines as market analysts carefully watch its worth motion following its crash.

The favored meme coin is seeing an elevated stage of speculative predictions, market traits, and technical chart breakdowns. In consequence, SOL is recapturing the eye of retail and institutional traders. There’s additionally been notable exercise inside the Solana community as anticipation for a worth rebound or breakout retains spreading.

Ethereum can also be trending within the crypto market, not only for its extended worth hunch and response to the crypto crash, however its ongoing transition to Ethereum 2.0 — a key improve targeted on scalability and vitality effectivity.

Santiment notes that analysts are highlighting Ethereum’s community efficiency in the course of the market stress, showcasing a rise in discussions concerning the cryptocurrency’s market evaluation. There have additionally been elevated worth predictions, technical evaluations, and talks concerning the cryptocurrency’s scalability and adoption.

Similar to Solana and Ethereum, Cardano is seeing renewed consideration as merchants assess the cryptocurrency’s place within the broader market. There was an inflow of mentions surrounding Cardano’s market traits, with customers speculating on its future worth motion and potential investments. Forecasts for the ADA worth additionally vary extensively, with social media buzz and speculative posts fueling the cryptocurrency’s presence on trending charts.

Whereas not as extensively mentioned as ETH, SOL, and ADA, Binance Coin (BNB) has additionally been displaying up in technical forecasts. Santiment reveals that analysts are monitoring BNB’s buying and selling ranges and potential worth actions, making it a focus for traders and merchants.

Associated Studying

Stablecoins Be a part of Record Of Trending Belongings

Along with the altcoins above, Santiment has disclosed that stablecoins have additionally joined the checklist of high trending property. Whereas Ethereum, Solana, and Cardano skilled main declines after the crypto crash, stablecoins, as their names suggest, remained secure towards the greenback.

Ripple’s newly launched stablecoin RLUSD is trending resulting from its affiliation with the crypto funds firm, which gained vital consideration following the completion of its authorized battle with the US Securities and Change Fee. The stablecoin has been built-in into Ripple’s fee system, enhancing cross-border transactions and attracting institutional curiosity.

There has additionally been a big enhance in adoption and buying and selling quantity, with crypto trade Kraken reporting an 87% surge within the latter and a $10 billion progress within the former.

Featured picture from Gemini Imagen, chart from TradingView

[ad_2]

Source link