[ad_1]

Cash is a vital requirement for functioning of the society via monetary transactions. It is usually one of many collectively acknowledged shops of worth everywhere in the world. Some societies used livestock as cash after which steadily developed to cowrie shells, adopted by the introduction of steel cash. The descriptions of cash at this time would typically seek advice from fiat foreign money, which is any government-backed authorized tender.

Why do you want the fiat foreign money vs cryptocurrency debate when you might have trusted types of cash like bodily money and cash? Apparently, the evolution of cash has paved the trail for introduction of cryptocurrencies as a serious power of change within the broadly accepted types of cash and worth. The fiat foreign money and cryptocurrency variations may play an important function in defining the longer term course of economic developments. Allow us to be taught extra concerning the variations between fiat foreign money and cryptocurrencies.

Construct your identification as a licensed blockchain knowledgeable with 101 Blockchains’ Blockchain Certifications designed to supply enhanced profession prospects.

What are Fiat Currencies and How Do They Work?

The easiest way to start a cryptocurrency vs fiat foreign money comparability includes studying about their definitions. Fiat foreign money or fiat cash refers to a particular kind of foreign money issued by a rustic’s authorities or central financial institution. You will need to be aware that fiat currencies should not supported by bodily commodities like gold. Quite the opposite, the worth of fiat foreign money depends upon the belief of individuals within the authorities issuing the foreign money. A few of the frequent examples of fiat foreign money embody the US greenback and the Euro.

Essentially the most notable side within the definition of fiat currencies factors in the direction of their centralized nature. It comes beneath the management of a government, comparable to central banks or the federal government. Centralization is among the key components within the comparability of fiat foreign money and cryptocurrency because it defines the extent of management customers have over their property. The centralized authority controlling the fiat foreign money can specify rates of interest, set up new financial insurance policies, and management the availability of fiat foreign money.

Fiat currencies have been serving because the spine of many economies for hundreds of years. Governments difficulty and management the availability of fiat currencies with the target of sustaining stability of their economies. Alternatively, central banks are accountable for administration of fiat currencies via adjustment of cash provide by printing extra fiat foreign money or withdrawing them from circulation.

Excited to be taught the fundamentals of cryptocurrency and the methods by which blockchain know-how empowers cryptocurrencies, Enroll now within the Cryptocurrency Fundamentals Course

What are Cryptocurrencies and How Do They Work?

Cryptocurrencies are a digital foreign money that leverages cryptography and blockchain know-how to supply decentralization and higher safety. Questions like “Is cryptocurrency higher than fiat foreign money?” come up from the truth that cryptocurrencies use blockchain know-how. Blockchain serves as a distributed ledger for recording all cryptocurrency transactions, alongside making certain immutability, transparency, and safety of transactions. Essentially the most outstanding trait of cryptocurrencies is decentralization, which means that central authorities don’t difficulty or management them.

Cryptocurrencies are created via minting or mining, based on the design of the cryptocurrency. For instance, Bitcoin makes use of crypto mining for creation of latest cryptocurrencies. Alternatively, Ethereum and different altcoins use the Proof of Stake know-how as an alternative of mining. Cryptocurrencies have the benefit in crypto vs fiat foreign money debate as they emphasize privateness and safety. Whereas the transaction particulars on a public blockchain are seen to everybody, customers’ private data stays nameless. On high of that, in addition they supply flexibility when designing decentralized monetary programs.

The distinctive traits of cryptocurrencies additionally invite consideration to the restricted provide. Whereas fiat currencies will be printed by central banks when the necessity arises, many of the cryptocurrencies have a predetermined restrict on their most provide. For instance, the utmost provide of Bitcoin is 21 million BTC. The fiat foreign money and cryptocurrency distinction additionally factors out the transparency of cryptocurrencies. Blockchain know-how information all transactions on public ledgers, thereby making certain transparency alongside accountability of all customers throughout the community.

The working mechanism of cryptocurrencies allows customers to hold out quicker transactions than conventional strategies, comparable to bank card funds and wire transfers. Most significantly, cryptocurrency house owners don’t should depend on banks or different monetary intermediaries to carry and handle their cash. Customers can retailer crypto property of their wallets with full management over what to do with the property. Nevertheless, cryptocurrencies additionally current some limitations owing to regulatory uncertainty and the volatility related to them.

Get acquainted with the phrases associated to cryptocurrency with Cryptocurrency Flashcards.

What are the Variations between Fiat Foreign money and Cryptocurrencies?

The fiat foreign money vs cryptocurrency debate has been rising as a outstanding spotlight in conditions the place the crypto market continues shifting in the direction of a bullish run. It makes everybody assume that cryptocurrencies may lastly take over fiat foreign money as a generally accepted retailer of worth. Nevertheless, the decline of crypto costs brings again the stability in comparisons between fiat and cryptocurrency. Right here is an outline of a few of the notable components that differentiate fiat currencies from cryptocurrencies.

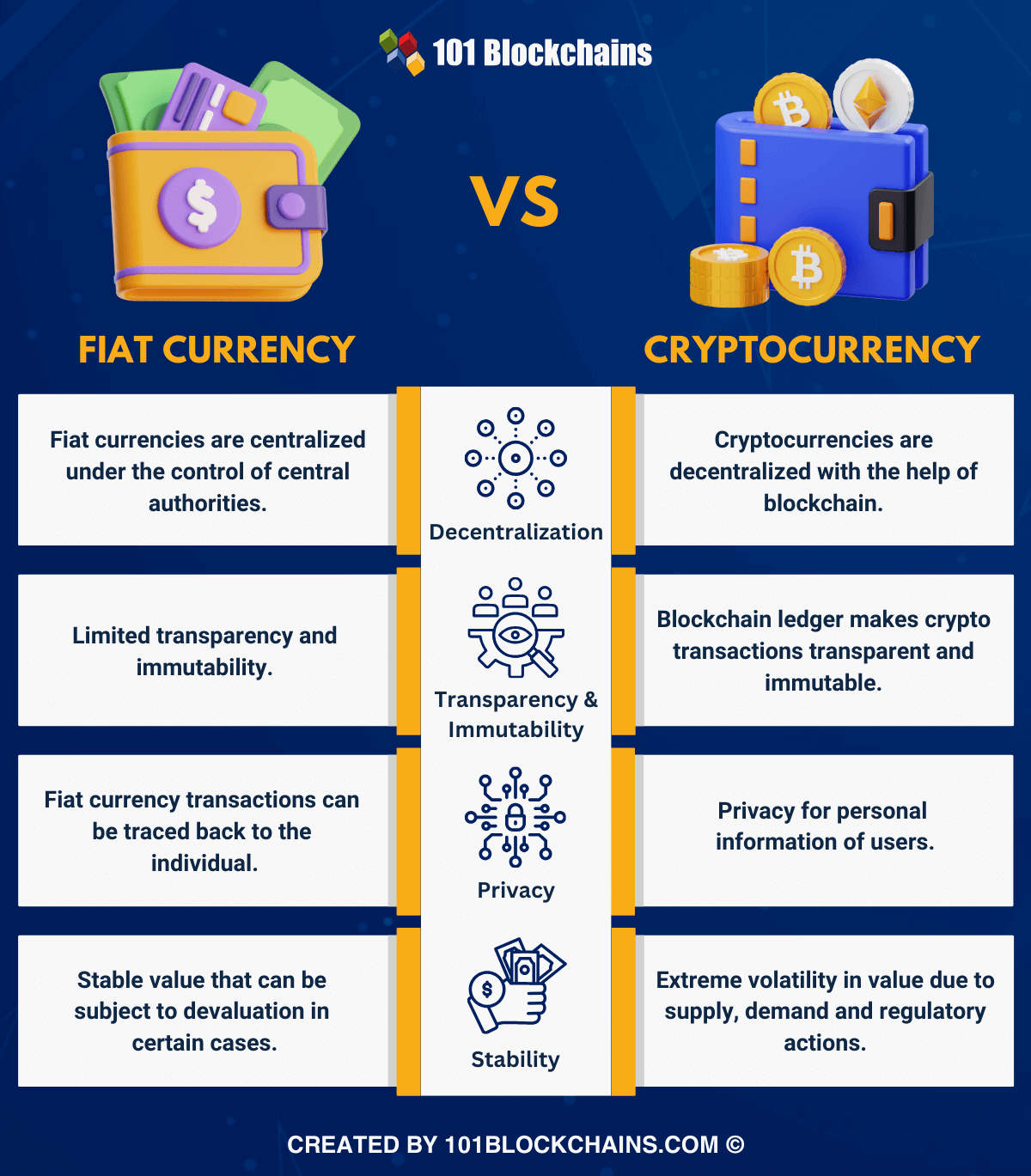

The foremost consider variations between cryptocurrencies and fiat foreign money is decentralization. Fiat currencies are issued and controlled by central authorities comparable to governments of central banks, thereby making them centralized. Such variations between fiat foreign money and cryptocurrency are seen in the truth that the central authorities have full management over the availability of cash and rates of interest. On high of it, the central authorities may decide the financial insurance policies.

Cryptocurrencies leverage the ability of decentralization via blockchain know-how. The community of nodes in a blockchain contributes to verifying and validating transactions earlier than including them to the community. The most effective factor about decentralization is that it doesn’t permit any single entity to take full management of the cryptocurrency community. Most vital of all, consensus mechanisms are accountable for governance of the validation course of, thereby making certain that cryptocurrencies are immune to unauthorized manipulation and censorship.

Need to get an in-depth understanding of crypto fundamentals, buying and selling and investing methods? Enroll now within the Crypto Fundamentals, Buying and selling And Investing Course

Transparency and Immutability

The variations between fiat foreign money and cryptocurrencies additionally invite consideration to the transparency and immutability of their programs. These components are main differentiators in a cryptocurrency vs fiat foreign money debate, as blockchain supplies a clear and immutable ledger for cryptocurrency transactions. All of the transactions are documented in chronological order and can’t be modified with out consensus from community individuals.

The standard banking system doesn’t have the identical immutability and transparency. Banks and monetary service suppliers preserve information of transactions, albeit with restrictions on accessibility to the general public. On high of it, the information will be modified or manipulated by centralized authorities. The identical isn’t relevant to cryptocurrencies, as they provide higher belief and safety for transaction information.

The subsequent vital level of distinction between fiat currencies and cryptocurrencies is privateness. You possibly can consider the fiat foreign money and cryptocurrency variations when it comes to privateness because it is a vital requirement in finance. Fiat foreign money transactions can showcase a transparent path that leads again to the one who makes the transaction.

Alternatively, cryptocurrencies stand out when it comes to privateness as crypto transactions are clearly seen on the general public blockchain. Nevertheless, there’s a twist, as you may solely see the pockets addresses of senders and receivers somewhat than their private data. The emphasis on anonymity in cryptocurrency transactions ensures that it’s tough to hint the origins of transactions.

One other level of distinction between cryptocurrencies and fiat currencies is stability. Fiat currencies are typically extra secure than cryptocurrencies when it comes to worth. Nevertheless, the comparability of crypto vs fiat foreign money should additionally concentrate on the truth that fiat currencies should not utterly resistant to devaluation. For instance, the Zimbabwean greenback misplaced virtually 76% of its worth in 2022.

Cryptocurrencies have gained infamous ranges of consideration attributable to fluctuations of their worth. The costs of cryptocurrencies rise and fall in a single day and might trigger formidable losses or big earnings for customers. Nevertheless, stablecoins have been created to resolve the issues with excessive worth volatility in cryptocurrencies.

Embrace the technological leap and international adoption that awaits within the upcoming bull run of 2024-2025 with Crypto Bull Run Prepared Profession Path.

Closing Phrases

The controversy over queries like “Is cryptocurrency higher than fiat foreign money?” emerges throughout bullish cycles within the crypto market. Because the crypto market prepares for the following Bull Run, you will need to test whether or not cryptocurrencies can lastly outrun fiat currencies. Nevertheless, there is no such thing as a approach to discard fiat currencies utterly, as they function the spine of the worldwide economic system in some ways.

Quite the opposite, the advantages of cryptocurrencies are prone to appeal to extra customers. For instance, cryptocurrencies supply full management over your cash and allow you to shield your privateness. Moreover, the frequent criticism of cryptocurrencies on the premise of worth volatility additionally applies to fiat currencies in some instances. Subsequently, you will need to be taught extra concerning the variations between cryptocurrencies and fiat currencies to choose the best choice for various purposes.

*Disclaimer: The article shouldn’t be taken as, and isn’t meant to supply any funding recommendation. Claims made on this article don’t represent funding recommendation and shouldn’t be taken as such. 101 Blockchains shall not be accountable for any loss sustained by any one that depends on this text. Do your individual analysis!

[ad_2]

Source link