[ad_1]

Lately, the controversy surrounding Bitcoin’s (BTC) potential market share relative to gold has garnered vital consideration, as lately authorised Bitcoin Alternate-Traded Funds (ETFs) can deliver Bitcoin considerably nearer to gold in key metrics.

Jurrien Timmer, Director of International Macro at Constancy Investments, has put ahead an evaluation that sheds mild on this topic. By analyzing the worth of “financial gold” and Bitcoin’s market capitalization, in addition to contemplating the impression of halvings on Bitcoin’s provide, Timmer presents insights into the long run dynamics of those two property.

Gold Vs Bitcoin

Timmer’s evaluation begins by estimating the share of gold held by central banks and personal buyers for financial functions, excluding jewellery and industrial utilization. Whereas this estimation just isn’t actual, primarily based on information from the World Gold Council, Timmer means that financial gold accounts for about 40% of the full above-ground gold.

Drawing upon his earlier calculations, Timmer posits that Bitcoin has the potential to seize round 1 / 4 of the financial gold market, with financial gold valued at round $6 trillion and Bitcoin’s market capitalization at $1 trillion.

Timmer additional delves into the impression of Bitcoin halvings on its value. Traditionally, halvings have had a considerable impact on Bitcoin’s worth. Nonetheless, Timmer raises the speculation that diminishing returns could happen sooner or later because the incremental provide of recent Bitcoin decreases.

By evaluating the excellent provide and incremental provide of Bitcoin with these of gold, Timmer demonstrates that the diminishing impression of the halvings is prone to be extra pronounced sooner or later.

Because the variety of cash accessible for mining dwindles, the affect of every subsequent halving occasion on Bitcoin’s value could diminish. This perception prompts Timmer to discover alternative routes to venture Bitcoin’s value trajectory.

BTC’s Value Projections

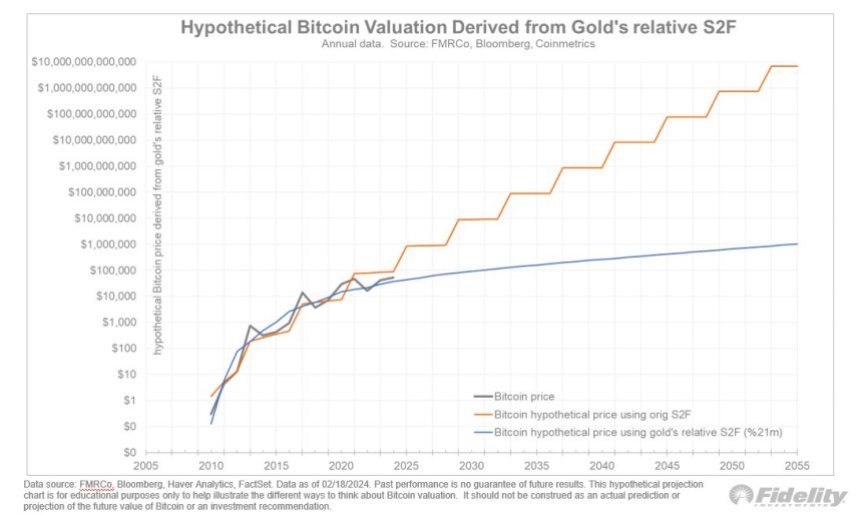

To account for the diminishing impression of halvings, Timmer introduces the idea of a modified Inventory To Movement (S2F) curve. This curve is derived by overlaying an asymptotic provide curve, representing the share of cash mined relative to the ultimate provide cap, onto the unique S2F curve.

Timmer proposes utilizing a regression formulation incorporating PlanB’s unique S2F curve and the asymptotic provide curve as unbiased variables. This modified S2F curve aligns extra intently with the availability dynamics of gold, reflecting a state of affairs through which Bitcoin’s shortage benefit continues, however its impression on value progressively diminishes over time.

Utilizing the modified S2F mannequin and contemplating the availability traits of gold, Timmer generates hypothetical value projections for Bitcoin that place the cryptocurrency at roughly $100,000 by the top of 2024.

In response to Timmer, if Bitcoin had been to seize 1 / 4 of the financial gold market, it might signify a outstanding shift within the international distribution of wealth, which might progressively drive up the cryptocurrency’s value over the approaching years.

Featured picture from Shutterstock, chart from TradingView.com

Disclaimer: The article is offered for instructional functions solely. It doesn’t signify the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You’re suggested to conduct your individual analysis earlier than making any funding choices. Use data offered on this web site completely at your individual danger.

[ad_2]

Source link