[ad_1]

Este artículo también está disponible en español.

GRASS token, one of many newest DePIN tasks, attracts important consideration from analysts and the investing public. As a Layer-2 platform on the Solana blockchain, the Grass platform permits customers to share unused web bandwidth to coach AI fashions utilizing a browser extension. With its promising know-how, it’s no shock that its token launch and airdrop final October twenty eighth was extremely anticipated.

Associated Studying

Whereas the airdrop was marred by a couple of points, together with a three-hour outage, the token’s value rally succeeded. Final October twenty ninth, the token peaked at October twenty ninth, then made a large rally from October thirty first till November 2nd, breaching the $1.50 degree.

After hitting a excessive of $1.9175 on November 2nd, it has slowed down, settled beneath the $1.75 degree, and now trades on the $1.45 degree. GRASS has rejected the $2 value, with analysts seeing a deeper pullback—so, is that this the fitting time to purchase?

A Tough Begin For GRASS

Buying and selling for GRASS began on October twenty eighth, however a couple of points delayed the token’s airdrop and launch. The crew recorded technical points, together with customers being prevented from accessing their tokens on their Phantom wallets. Additionally, the frenzy to assert the tokens was marred by the three-hour energy interruption. Moreover, some customers reported flagged transactions, and lots of had been disqualified from the airdrop.

WTF is that this @getgrass_io @grassfdn I’m utilizing it since Epoch 1 and after 10 months of utilizing, it’s saying that your pockets shouldn’t be eligible?? Actually?#grassairdrop #grassfoundation #grassSCAM pic.twitter.com/wt7BWPBI1R

— Phantom Soul (@PhantomSoulll) October 28, 2024

A complete of 1 billion GRASS tokens had been circulated, and 10% got to early supporters and contributors. It’s nonetheless too early to see the total extent of those points’ impact on GRASS, however the token began properly price-wise.

Token Tries To Breach $2

It’s difficult to make sense of GRASS’s value motion because it solely launched a couple of days in the past. Nevertheless, analysts see a bullish pattern on the chart’s decrease timeframes. The token boasts above-average quantity within the final 24 hours.

Additionally, the token’s on-balance quantity and value elevated beginning October thirtieth. Briefly, there was shopping for stress for the token, suggesting that value beneficial properties could occur quickly.

Nevertheless, GRASS rejected $2, making it the token’s short-term psychological resistance. Analysts mentioned the worth may dip to $1.75 because the RSI displays a bearish divergence.

Associated Studying

Different Analysts See A Deeper Dive For GRASS

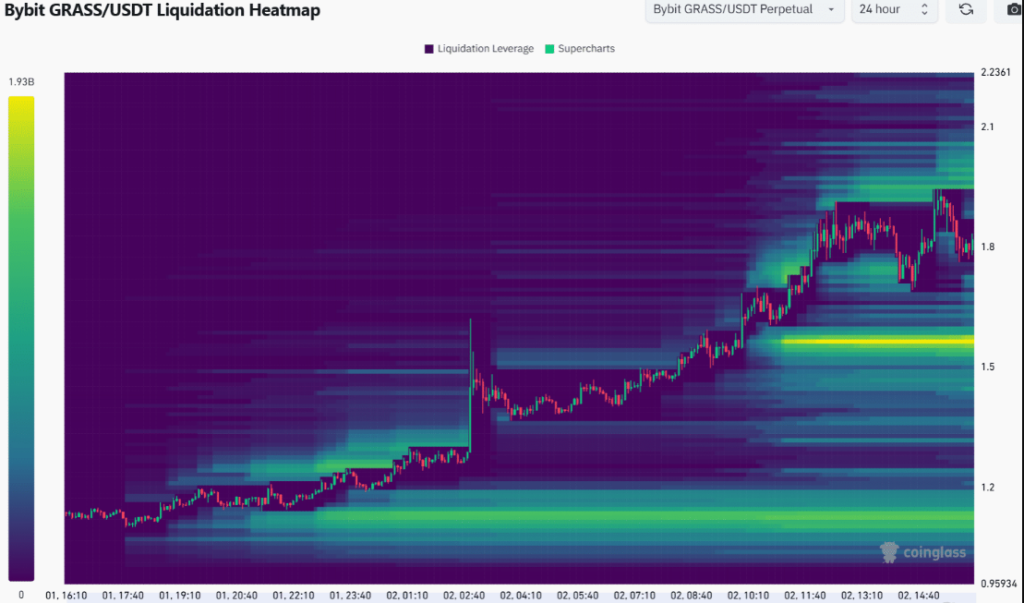

Based mostly on the technical charts, the analysts discovered two notable liquidity swimming pools at costs of $1.56 and $1.96. The present value is at present nearer to the liquidity pool at $1.56, with the token showing to reject the $1.96 degree.

Since there’s a bearish momentum and a liquidity pool at $1.56, merchants and holders can count on a value dip beneath $1,75. Swing merchants and new patrons who need to enter a place can await the token’s retesting of $1.56 and even $1.4.

Featured picture from Pexels, chart from TradingView

[ad_2]

Source link