[ad_1]

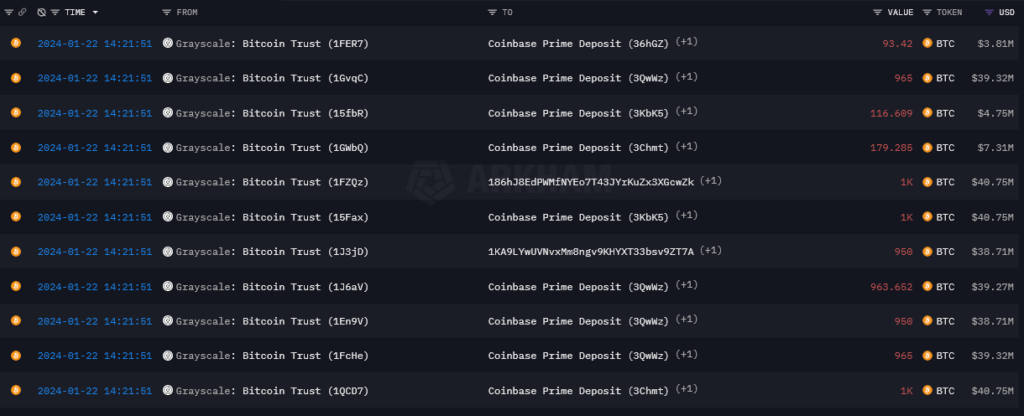

Knowledge from Arkham Intelligence reveals Grayscale has continued its each day Bitcoin outflows, which have occurred each day shortly earlier than the U.S. market opened every day since its conversion to a spot Bitcoin ETF.

With famously excessive charges, the belief continues to see buyers depart the fund searching for decrease charges or to lock in earnings. The belief traded at a 48% low cost to its underlying Bitcoin till it transformed right into a spot Bitcoin ETF. The low cost is now a mere -0.27%, that means buyers can depart the fund with an equal return to that of investing in Bitcoin, inside 37 foundation factors.

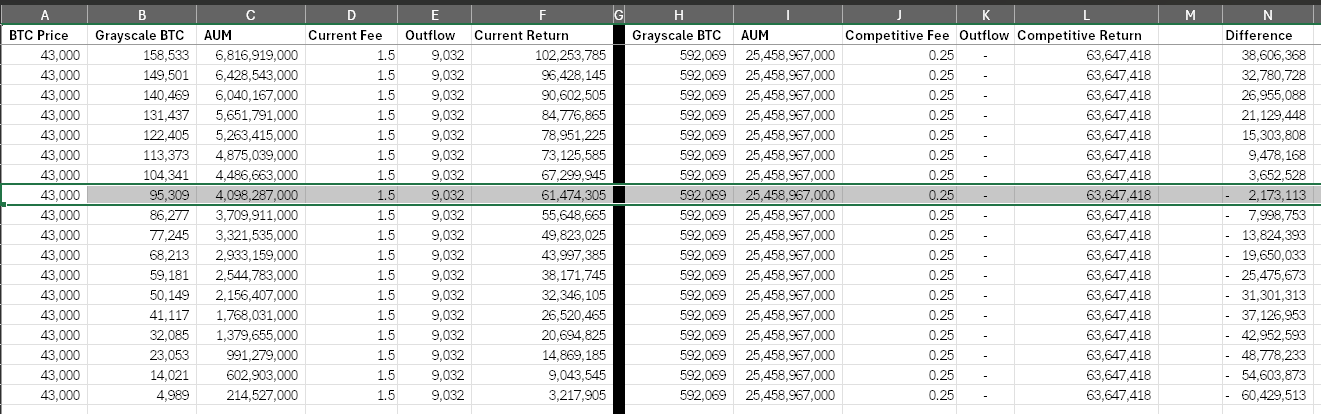

Grayscale seems to have little motivation to change its excessive charge construction as its returns will stay increased than its opponents by some margin because of the vital discrepancy. Grayscale costs 1.5%, producing round $381 million in revenues, whereas many opponents cost beneath 0.5%.

With this in thoughts, if Grayscale allowed outflows to proceed till its present ~560k BTC fell to round 95k BTC, it might nonetheless generate charges of over $60 million yearly.

That is necessary to notice as if it dropped its charges at this time and subsequently stemmed the outflows, its income would fall to $63 million, just like if it held 95k BTC at 1.5%.

BlackRock at the moment has round $1.2 billion in belongings beneath administration. At a return of 0.25%, that calculates to round $3 million in income, that means Grayscale returns virtually 400x that of BlackRock for now.

The submit Grayscale offloads additional 13k BTC as revenues nonetheless method above competitors appeared first on CryptoSlate.

[ad_2]

Source link