[ad_1]

Hedera (HBAR) has surged by 13.7% previously 24 hours and a notable 31.5% during the last week. This uptick is a part of a broader “altcoin season,” the place choose altcoins are experiencing vital good points. Scott Melker, a distinguished determine within the crypto evaluation area, at this time shared his insights into the altcoin market and particularly on HBAR’s potential for progress.

Altcoin Market Overview

Melker, also called the “Wolf of all Streets,” has highlighted the importance of the Complete 3 market cap, which excludes Bitcoin (BTC) and Ethereum (ETH), to gauge the well being of the altcoin market. In keeping with Melker, Complete 3 reaching a brand new cycle excessive of roughly $550 billion on a weekly shut is a transparent indicator of a sturdy altcoin market poised for additional growth.

He acknowledged, “ it usually offers us a clearer image of what’s occurring with altcoins. […] With that in thoughts, you will need to word that TOTAL 3 simply made a brand new cycle excessive on the weekly shut, round $550B. This means that the altcoin market stays wholesome and prone to proceed to develop.”

Technical Evaluation Of Hedera (HBAR)

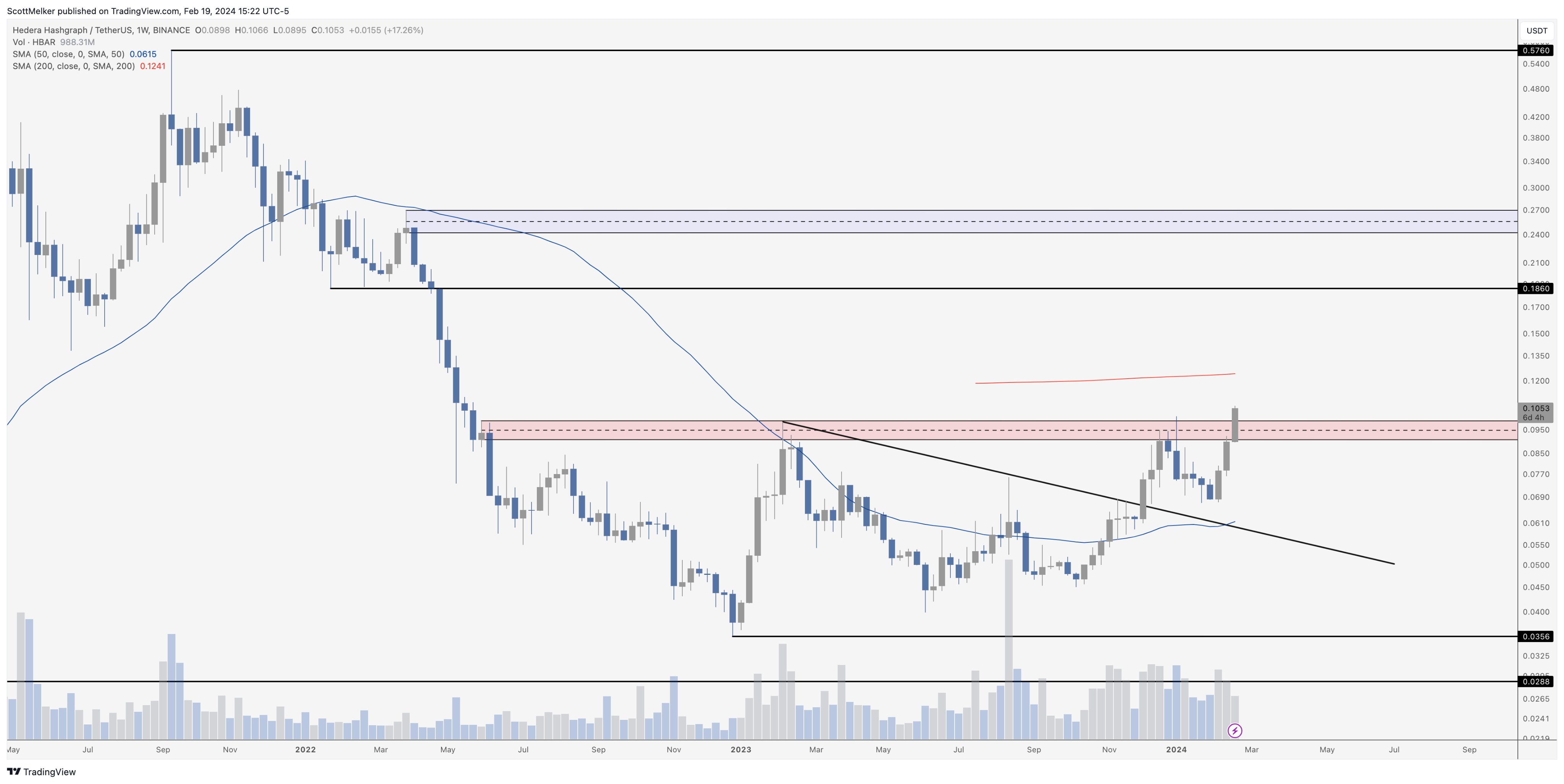

This dynamic is the premise for HBAR (1-week chart, HBAR/USDT), for which Melker’s evaluation exhibits a really optimistic situation. Presently, the Hedera worth is difficult a big resistance zone. Melker has recognized the $0.10 stage as pivotal for HBAR’s potential uptrend.

This resistance zone, highlighted by Melker in purple, is essential as a result of a constant shut above this stage on the each day and weekly charts would sign a shift in momentum favoring the bulls. At press time, HBAR was buying and selling simply above this key resistance zone, with yesterday’s each day candle closing above $0.10 for the primary time since Might 2022. The worth closed at roughly $0.1117. Melker states:

HBAR is pushing onerous into the important thing resistance zone that I mentioned many months in the past. To maintain it extra easy, a push above 10 cents ought to do the trick. Bulls need to see each day and weekly closes above the purple zone. A retest of that zone as help could be a perfect entry.

Two Easy Shifting Averages (SMAs) are plotted on the chart: the 50-day SMA at round $0.0615, which HBAR is at present nicely above, and the 200-day SMA at roughly $0.1241, which is barely above the present worth motion. The worth positioning between the 2 SMAs will be interpreted as a consolidation zone the place the value wants to ascertain a agency course.

Melker factors out that previous the $0.10 resistance zone, there seems to be minimal historic resistance till practically a 2x enhance across the $0.186 stage. This lack of resistance means that if HBAR can keep its place above the purple zone, there may be potential for a comparatively unobstructed upward trajectory.

“As you’ll be able to see on the left of the charts, there may be nearly NO RESISTANCE till practically 2x, round .186. This coin dropped onerous, leaving a vacuum. It ought to do nicely if it could actually push via right here,” Melker remarks.

Nonetheless, if HBAR manages to interrupt via the $0.186 resistance zone, Melker’s last goal is the blue zone round $0.25. This is able to web traders greater than a 2x on their funding.

At press time, HBAR traded at $0.10647.

Featured picture from Disruption Banking, chart from TradingView.com

Disclaimer: The article is offered for instructional functions solely. It doesn’t characterize the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You might be suggested to conduct your personal analysis earlier than making any funding choices. Use data offered on this web site fully at your personal threat.

[ad_2]

Source link