[ad_1]

Key Takeaways:

Initia reserves 5% of its 1B INIT provide for an airdrop to early supporters.The 2 largest allocations—every 25%—go towards staking and group rewards.Tokens for the workforce and buyers are topic to a 4-year vesting schedule, together with a 1-year lock-up.

Initia Launches Mainnet with 1 Billion INIT Provide and Group-First Airdrop

Initia has formally launched its mainnet — a serious step towards constructing a modular, interconnected multichain future. To mark the event, the workforce has launched the long-awaited INIT airdrop. A complete of 5% of the 1 billion token provide—50 million INIT—can be distributed to early supporters, testers, and the broader group.

Eligible customers can declare their allotted tokens by means of Might 24, 2025, by visiting and interacting with Initia’s official airdrop portal. The distribution excludes workforce and inside contributors, reinforcing Initia’s community-first strategy.

Strategic Token Allocation Goals to Steadiness Incentives and Safety

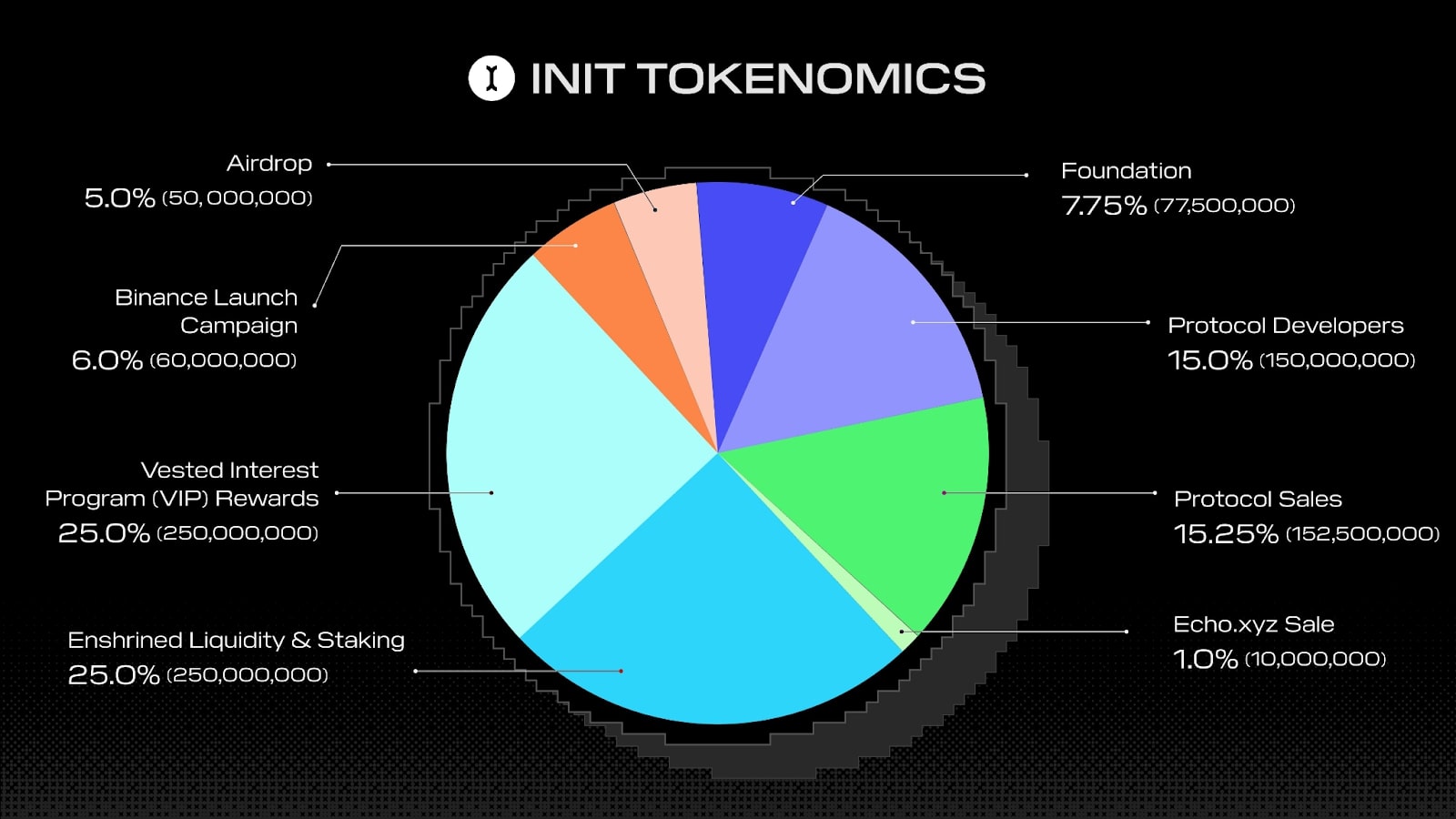

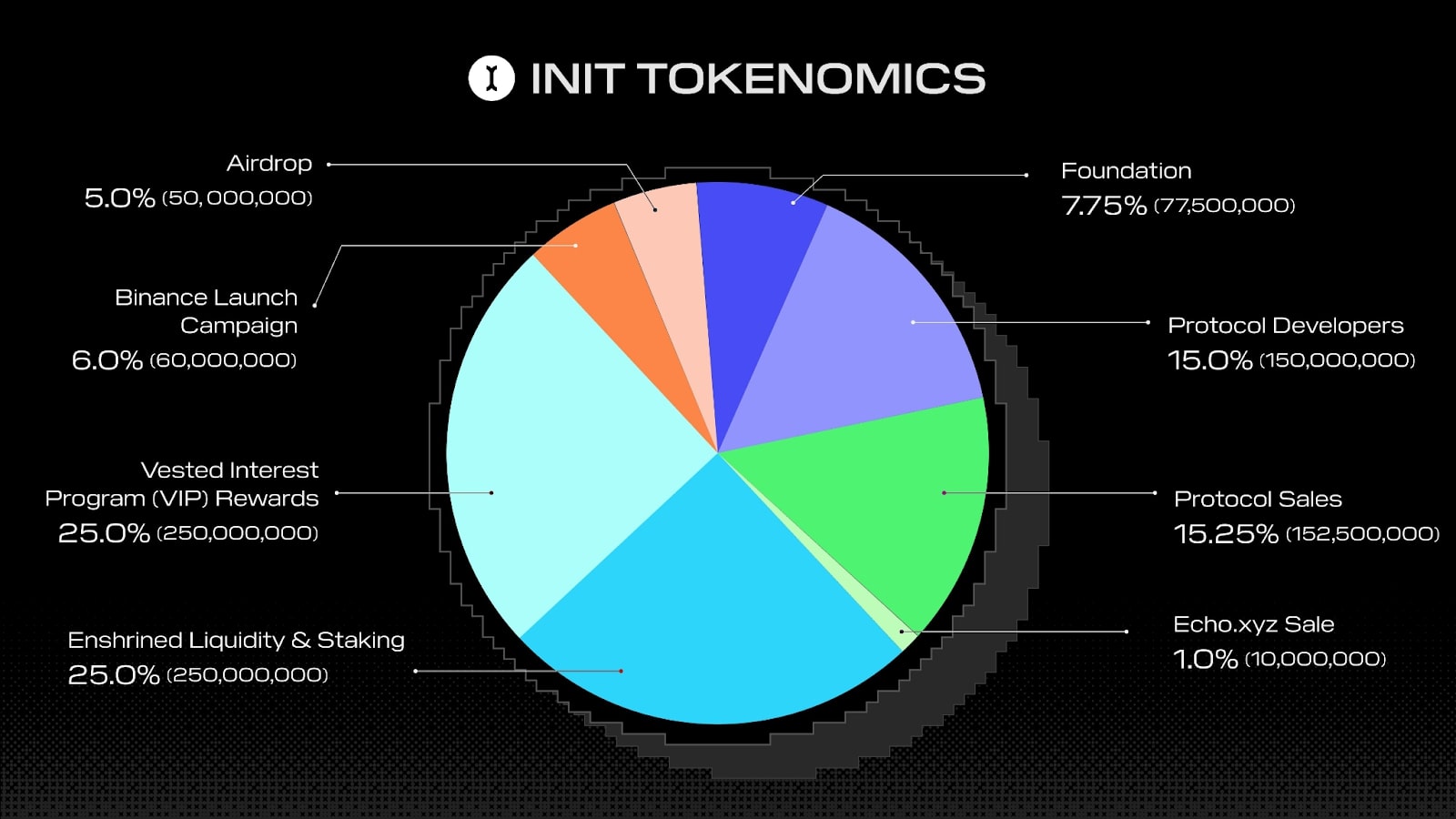

Initia’s tokenomics replicate a nuanced technique, mixing consumer incentives with long-term sustainability and protocol safety. Right here’s how the 1 billion INIT tokens are allotted:

25% – Locked Liquidity & Staking (250M INIT)

This mechanism, known as Enshrined Liquidity (EL), replaces conventional PoS staking and serves because the cornerstone of Initia’s financial safety. Liquidity suppliers assist safe the community and obtain staking rewards, buying and selling charges, and ecosystem incentives. In contrast to conventional staking programs the place tokens are merely locked, Enshrined Liquidity ties financial safety on to actual liquidity provision, making a extra capital-efficient mannequin. The 5% annual block-by-block launch charge incentivizes long-term participation underneath this design.

25% – Vested Curiosity Program (VIP) Rewards (250M INIT)

VIP rewards are designed to inspire constructive habits in any respect ranges of the Interwoven Financial system — from common finish customers to skilled dApp builders. They’re escrowed and solely made accessible upon satisfying performance-based circumstances, at an preliminary launch tempo of seven%/yr. The mechanism ensures long-term incentive alignment throughout a number of epochs.

15.25% – Protocol Gross sales (152.5M INIT)

Buyers from Initia’s three fundraising rounds obtain 15.25% of the INIT token provide. The group prioritizes low dilution and locked liquidity; that is supplemented by the truth that these tokens will accordingly have a 4-year vesting schedule (1 yr locked, 3-year linear launch). Backers of Initia embody YZi Labs, Delphi Ventures, and Hack VC, who reportedly invested over $24 million.

15% – Protocol Builders (150M INIT)

For long-term improvement, 15% of INIT is reserved for the core workforce and future contributors, which is topic to the identical vesting schedule because the buyers. Additional underpinning these info are the dedication to sustainability and accountable token distribution.

7.75% – Foundations (77.5M INIT)

The Initia Basis is accountable for ecosystem improvement and managing strategic initiatives like validator delegations and grants going ahead. The tokens devoted to the inspiration are mandatory for offering early-stage liquidity help and increasing the ecosystem’s attain.

6% – Binance Launch Marketing campaign (60M of INIT)

With a view to bootstrap liquidity of centralized exchanges, Initia has partnered with Binance to allocate 60 million tokens (6%) for launch-related campaigns, guaranteeing wholesome worth discovery and clean consumer onboarding throughout the Token Era Occasion (TGE).

5% – Group Airdrop (50M INIT)

The airdrop is cut up amongst:

90% (44.7M INIT) is allotted to early testnet members, most of whom had been non-technical customers concerned in stress-test campaigns such because the Jennie pet app.4.5% (2.25M INIT) reserved for customers of partnered protocols like LayerZero, IBC, and MilkyWay.6% (3M INIT) for the group members which can be energetic from Discord, Telegram and X (Twitter).

1% – Echo.xyz Sale (10M INIT)

These tokens are allotted to supporters from the Echo.xyz funding spherical and can vest in 4 equal tranches between 12 and 24 months after the mainnet launch.

A Modular and Owned Token Design

Initia is constructed on prime of Cosmos SDK with help for a number of VMs: EVM, MoveVM, WasmVM, making it attainable for builders to create their very own rollup: “Minitias” for something starting from DeFi protocols to completely onchain video games.

The INIT token serves as an financial driver and governance mechanism in a rollup-first world of chains the place application-specific chains natively interoperate. By giving builders each possession and liquidity, Initia solves for fragmentation — one of many three largest ache factors for appchains till now.

Extra Information: Binance Launchpool Lists Initia (INIT): Farm by Staking USDC & FDUSD

Early Momentum Sturdy as Ecosystem Expands

Already, there are greater than a dozen Layer 2s constructing on Initia’s infrastructure, and the testnet has to this point attracted greater than 190,000 wallets. As evidenced by the excessive engagement figures, Initia might emerge as a major participant within the multichain panorama, competing with the likes of Arbitrum and Optimism.

In contrast to the hype or token worth motion itself, Initia is hedging its bets on ecosystem utility, shared improvement and a highly-incentivized group to induce adoption.

Extra Information: Binance Lists Steadiness (EPT) on Alpha and Futures Forward of Token Era Occasion

[ad_2]

Source link