[ad_1]

Cause to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by business specialists and meticulously reviewed

The very best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Este artículo también está disponible en español.

Ethereum has skilled a much-needed surge above the $2,000 stage, a key psychological and technical mark that bulls have struggled to reclaim since March 10. This breakout sparked optimism out there, however the momentum was short-lived, as ETH rapidly pulled again beneath the extent and was unable to verify a strong maintain. Analysts broadly agree {that a} robust and sustained transfer above $2,000 is vital for Ethereum to provoke a broader restoration rally.

Associated Studying

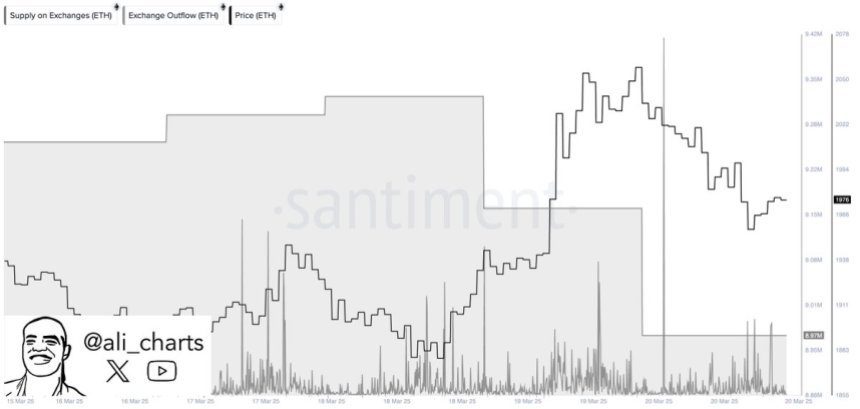

Regardless of the hesitation at resistance, on-chain information exhibits indicators of rising investor confidence. In response to Santiment, traders have withdrawn over 360,000 ETH from centralized exchanges within the final 48 hours. This shift is usually interpreted as a bullish sign, suggesting that giant holders are transferring their property to personal wallets, presumably in anticipation of upper costs.

In the meantime, the broader macroeconomic panorama continues to use strain. Commerce struggle tensions and unpredictable coverage selections from the U.S. authorities have weighed closely on each crypto and conventional markets, intensifying volatility and investor uncertainty. Nonetheless, Ethereum’s newest change outflows trace at a possible pattern shift — one that would favor accumulation and set the stage for the following main transfer, offered bulls can reclaim and maintain above the $2K threshold.

Ethereum Faces Crucial Check Amid Trade Outflows

Ethereum has misplaced over 57% of its worth since mid-December, falling from a excessive of round $4,100 to current lows close to $1,750. This sharp correction has created a difficult setting for bulls, who’ve repeatedly did not reclaim and maintain greater worth ranges.

Now, the $2,000 mark stands as a psychological and technical battlefield. If Ethereum can firmly set up help above this stage, it may present the muse for a restoration rally. Nonetheless, a failure to take action would seemingly end in additional draw back and reinforce the bearish pattern.

Associated Studying

The present market panorama struggles with uncertainty. On one facet, continued macroeconomic headwinds—rising commerce tensions, inflation considerations, and coverage shifts from the U.S. authorities—have weakened investor confidence and pushed volatility throughout danger property. Then again, there are indicators of potential restoration and accumulation.

High crypto analyst Ali Martinez shared information from Santiment, revealing that traders have withdrawn over 360,000 ETH from centralized exchanges up to now 48 hours. Traditionally, large-scale withdrawals are thought-about a bullish sign, as they recommend traders are transferring property into chilly storage for long-term holding slightly than making ready to promote.

This transfer may point out rising confidence amongst massive holders and sign the early levels of a brand new accumulation part—offered Ethereum can maintain above $2,000.

Value Holds Regular Under $2,000

Ethereum is at present buying and selling at $1,960 after briefly trying to reclaim the $2,000 mark in yesterday’s session. The psychological and technical resistance at $2,000 stays an important barrier that bulls should overcome to shift market momentum of their favor. Regardless of a small bounce from current lows, Ethereum has struggled to achieve traction amid persistent market uncertainty.

Bulls must push ETH above $2,000 and reclaim greater ranges akin to $2,150 and $2,300 to verify the start of a restoration part. A sustained transfer above these ranges wouldn’t solely sign a possible pattern reversal however may additionally appeal to sidelined traders again into the market. Till that occurs, Ethereum stays weak to continued draw back strain.

Associated Studying

If bulls fail to interrupt above the $2,000 resistance within the coming periods, Ethereum may lose help at present ranges and revisit decrease demand zones round $1,850 and even $1,750. With the broader crypto market nonetheless beneath the affect of macroeconomic volatility and weak sentiment, the approaching days are prone to be pivotal for ETH’s short-term course. A decisive transfer both above or beneath this key vary will seemingly set the tone for the following main worth motion.

Featured picture from Dall-E, chart from TradingView

[ad_2]

Source link