Smart and Revolut have been leaders within the fintech cross-border transactions house, disrupting conventional banking methods. With Revolut’s IPO probably coming in 2025, it’s attention-grabbing to match each firms to find out whether or not Smart is positioned to problem Revolut’s dominance or if the 2 serve totally different functions for traders.

Key Highlights

Smart trades at a fraction of Revolut’s non-public valuation.

Smart Nearing All-Time Highs, however nonetheless not costly.

Banks are positioning within the battle to come back: Smart offers.

Seeing Revolut All over the place

Throughout a latest journey to Spain, I couldn’t escape Revolut’s adverts. Aggressive advertising and marketing and IPO rumors received me considering: How will a publicly traded Revolut have an effect on Smart? Whereas each are fintech firms, and disruptors to conventional banking, their methods and enterprise fashions differ considerably.

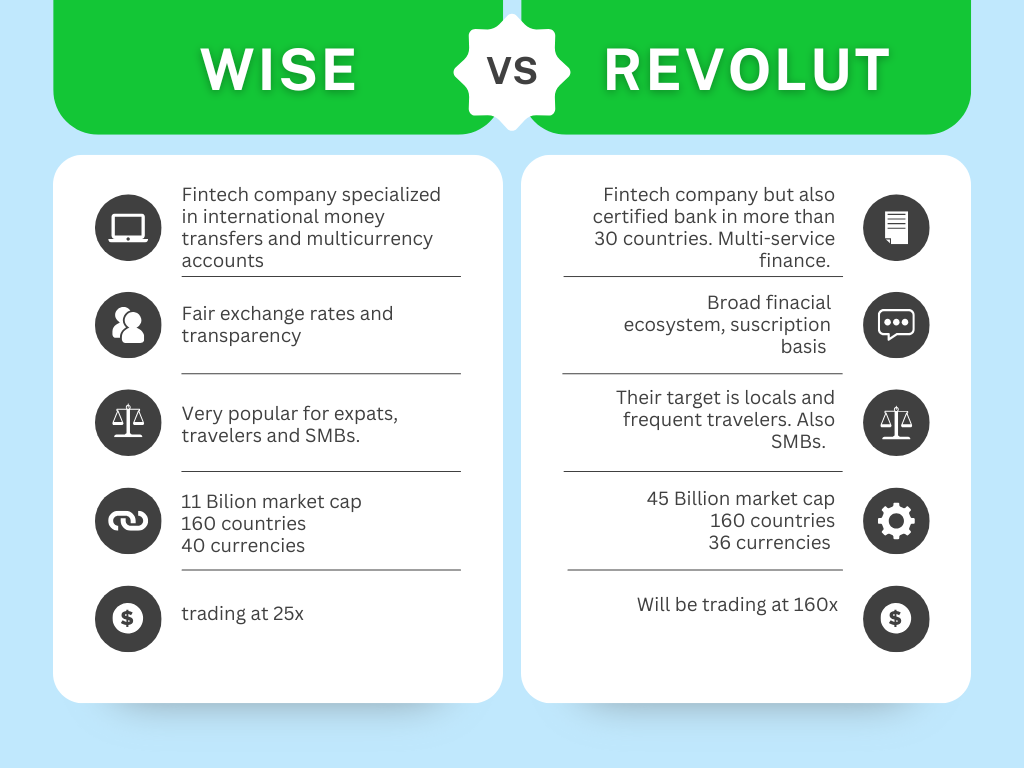

Smart’s mission is evident: low-cost, clear, and environment friendly cross-border transfers. Revolut, then again, goals to turn out to be a world monetary super-app, providing all the pieces from banking to crypto. Given these distinct objectives, ought to traders actually be evaluating the 2?

Revolut’s IPO particulars are nonetheless scarce, however a secondary share sale occurred in August 2024, factors towards a $45 billion valuation. That’s an enormous valuation, particularly for an organization that, whereas rising quick, hasn’t persistently been worthwhile. In the meantime, Smart is buying and selling at 25x P/E with regular profitability and a powerful return on capital. Let’s take a more in-depth have a look at their enterprise fashions.

Companies Mannequin Breakdown: Smart vs. Revolut

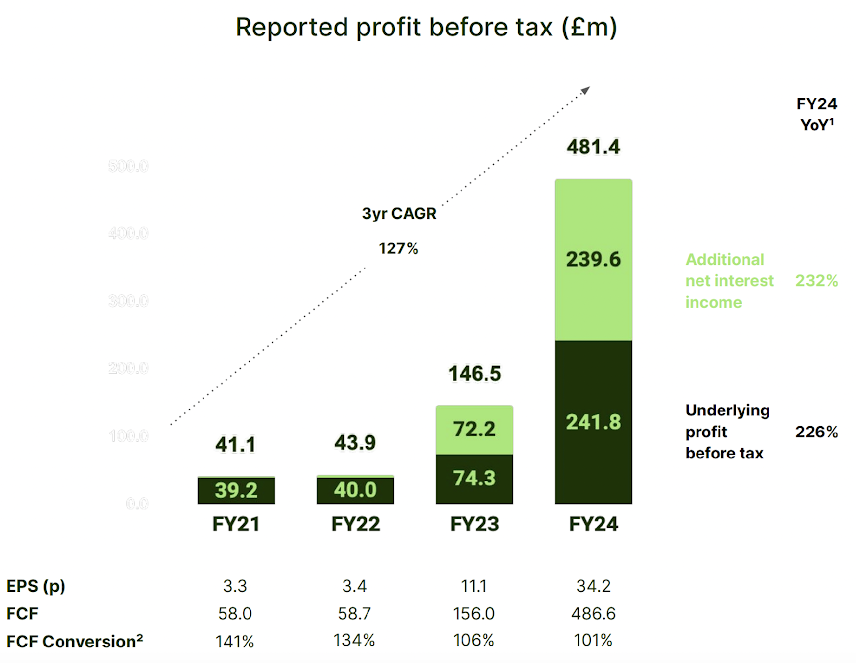

Smart is likely one of the world’s quickest rising fintech, whereas being very worthwhile. Launched in 2011, the enterprise is listed on the London Inventory Change beneath the ticker, WISE. In fiscal 12 months 2024, Smart supported round 12.8 million folks and companies, processing roughly £118.5 billion in cross-border transactions, and saving prospects over £1.8 billion, in keeping with the data supplied by the corporate.

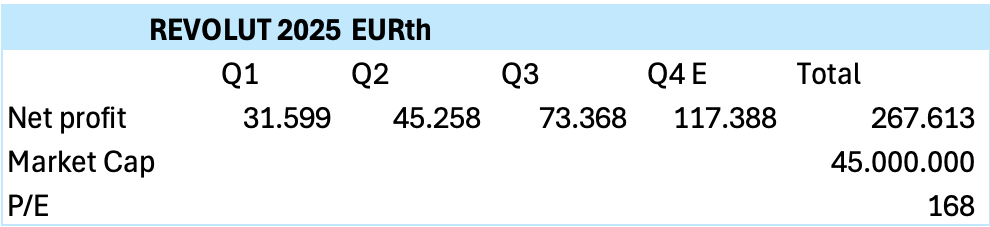

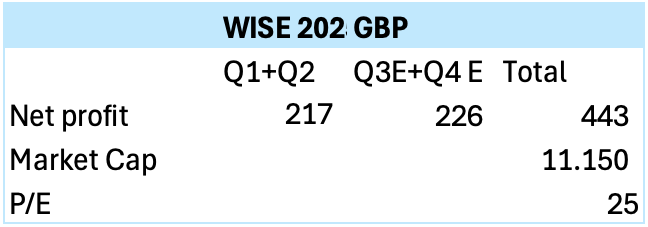

The true valuation of Revolut’s IPO continues to be unsure, though the obtainable info factors to a $45Bn worth, given latest transactions. Because the final annual assertion obtainable for Revolut on their web site is dated for 2023 and the newest monetary report was with date 30 of September 2024, I needed to make some common predictions to match each firms:

1 GBP in hundreds of thousands

2 EUR, in hundreds

As a reference, Revolut’s valuation could be nearly 7 instances Smart’s present valuation. This implies two issues, probably: Smart is undervalued and Revolut is overvalued. In my view, each are right, and I wouldn’t put money into Revolut given the newest identified valuation.

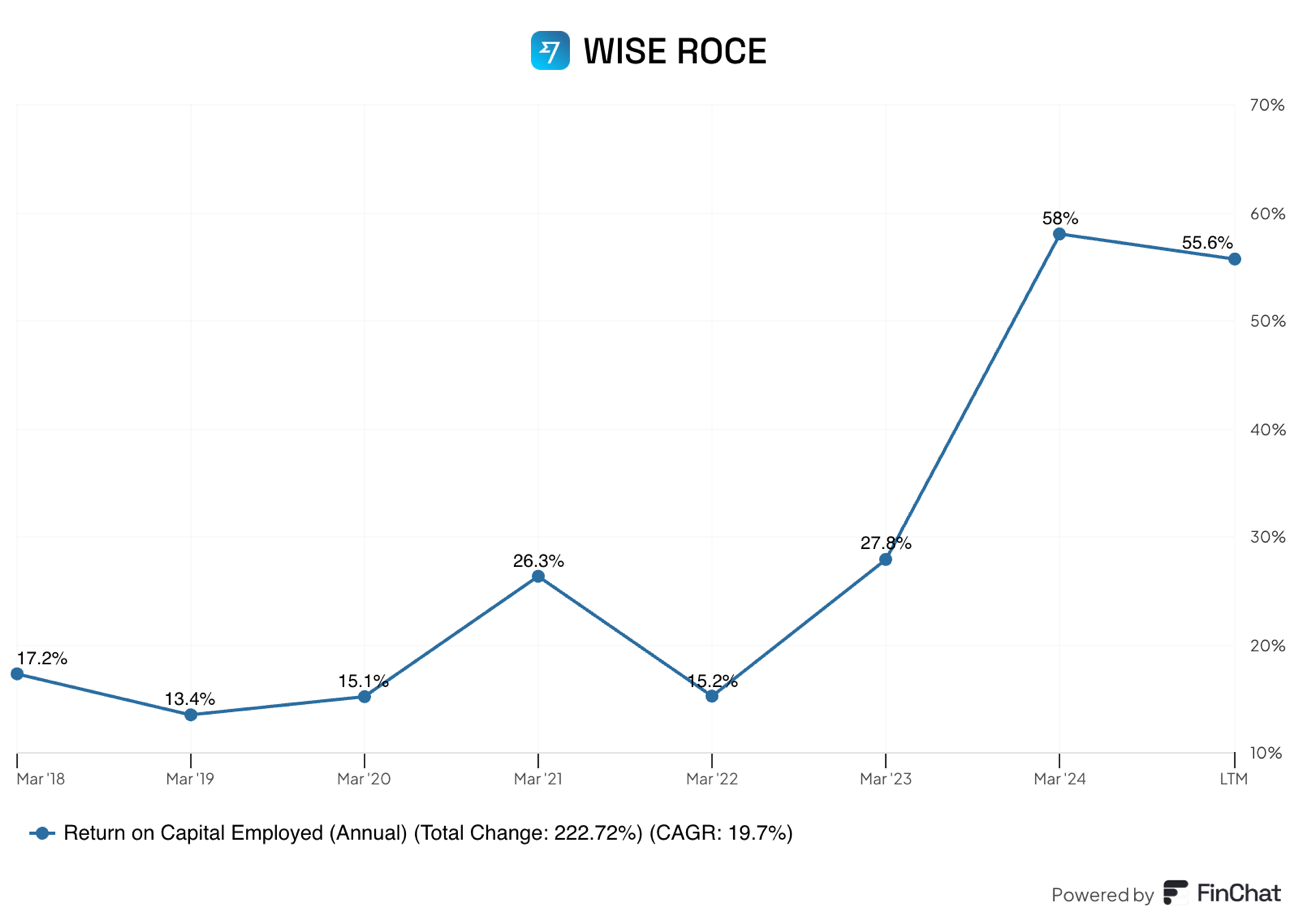

Smart, buying and selling at 25x P/E, is an attention-grabbing alternative, rising 15-20% yearly. With strong returns on capital employed since 2018, proving the administration dedication in value discount and improve the shareholder’s revenue.

Smart is a Fintech (used to explain new know-how that seeks to enhance and automate the supply and use of economic providers). Utilizing Smart’s platform, prospects can transfer their cash overseas to 40 totally different currencies in just one account. The corporate primarily generates income from cash transfers, conversion providers and debit card providers. Smart additionally generates income from its multi-currency funding function. This function permits prospects to buy items in funding funds, supplied by fund managers, utilizing their Smart account steadiness.

The client progress charge has been of 29% in 2024 in contrast with 2023, even thought, they needed to pause clever enterprise new accounts as a result of they’re rising too quick for his or her capability! This 12 months they’re targeted on put money into infrastructure to get the flexibility to provide the large present demand.

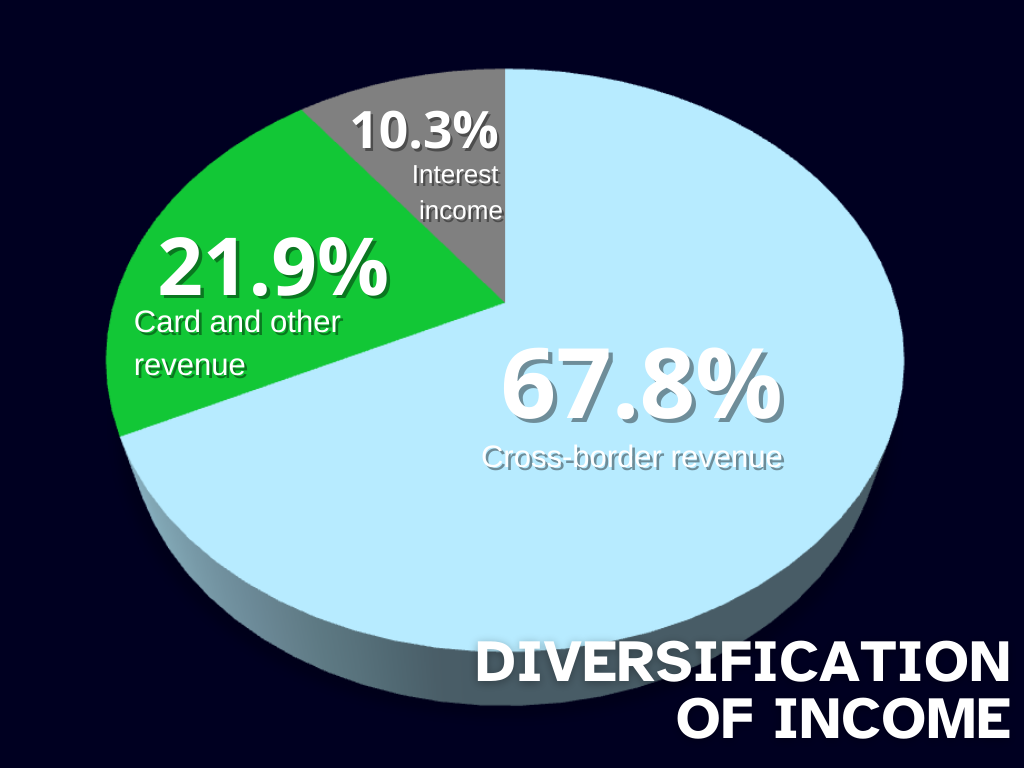

The final a part of the income that’s essential to focus on is the curiosity revenue with a ten.3% of the income with a worth of 120.7m (this income solely considers the curiosity revenue of the primary 1% yield. If we think about all of the curiosity revenue, beneath and over 1%, it might be 485m). That is produced from investments in cash market funds, listed bonds, and curiosity from money at banks.

To create a clear and reasonable option to transfer your cash overseas, they think about the mid-market change charges which is the value the banks are keen to pay for purchasing or promoting the currencies, and the mid-point between each is the mid-market change charge (the truthful charge as effectively). That is thought of the “actual” conversion charge, and that’s the primary distinction with banks, they don’t often share the true conversion charge with you, as a result of they put the margin on high of the true charge.

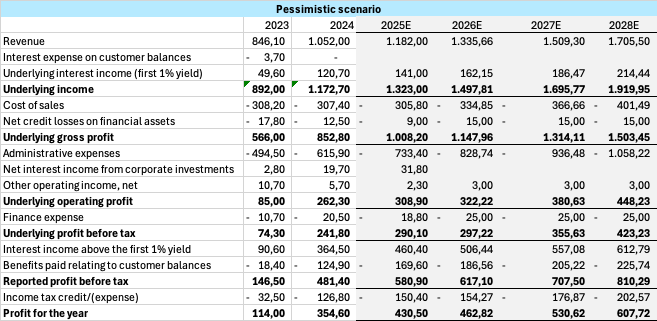

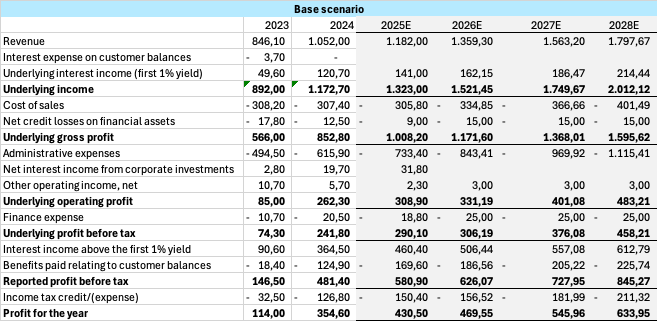

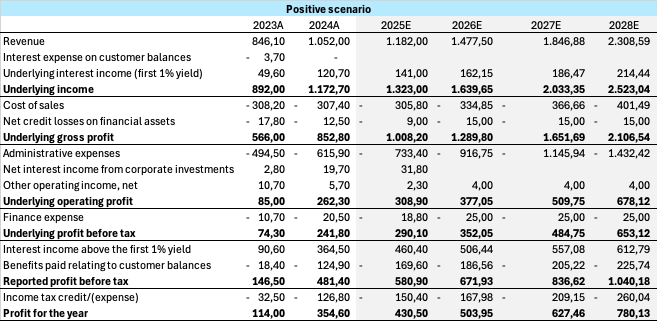

Funding thesis

As we’re near the top of their finish of economic 12 months, anticipated in March 2025, I made some estimations of what might be the way forward for the income of the corporate, (once I first purchased a Smart share, my estimations, even the constructive one had been so low in contrast with at the moment outcomes) I needed to renew my eventualities up to now, making new estimations for the interval (2025-2028) for the pessimistic situation I estimated a progress of 13% yearly, which is decrease than their very own expectations of a 15-20% progress CAGR. For the bottom situation I thought of 15% progress of income, excellent within the low vary of their expectations , and for the constructive situation a really optimistic progress of 25%.

Utilizing the mid-point progress estimate of the corporate (15%), and being conservative on the curiosity revenue that Smart can have sooner or later, we might see a rise of over 44% internet revenue. Thus, utilizing the identical a number of that the corporate trades at the moment (25x) we’d have a return of over 44% in three years (As a result of the 2025 outcomes are nearly right here and are in base of the final semester outcomes).

If we think about the web money place of the corporate, which stays at 800m, (excluding the shopper’s held steadiness), the corporate trades even decrease, which might give us much more upside. Adjusting the web money place, the corporate’s PE ratio is round 24 instances earnings. We might all the time go away room for multiple-expansion, which given the corporate’s progress, return on capital employed, and profitability, is a really seemingly risk.

Nevertheless, with the inventory close to all-time highs, is it nonetheless a purchase? With buyer progress at 29% YoY and cross-border volumes up 24% to £37.8B, Smart’s fundamentals look robust, with a mean ROCE of 30% within the final 5 years, with clear aggressive benefit by way of their purple of partnerships worldwide, rising the variety of prospects +20% quarterly.

However might they hold the tempo in progress in the long run? The TAM (Complete Addressable Market) of the cross-border funds has proven an annual progress of three%, Smart’s estimation from their annual report in 2024 are that in 2027 it is going to obtain a complete quantity of £28.5 TRILLION between retail, SMBs (Small and medium enterprise), and enterprises. In 2024 the TAM just for retail was £2 trillion moved yearly. All this info means, that there’s round £28.5 trillion in alternatives for the infrastructure of clever which is presently having lower than the 1% of the market share. However this doesn’t imply that there’s no danger related to the enterprise, right here we’ll discover among the principal dangers for Smart.

WISE’s RISKS.

Nevertheless, Smart’s plan to beat this, is working along with banks worldwide, providing their prepared to attach infrastructure, and complying with each nation’s totally different rules. Being accomplice with a considerable quantity of greater than 90 firms from various sectors, together with banks, which is a crucial community to assist the bettering of decreasing SWIFT prices, and time. We additionally should think about the size of the corporate, working in over 160 international locations.

The newest information was when Morgan Stanley introduced the settlement with Smart to facilitate the overseas change worldwide capabilities for company prospects, this can be a nice milestone as a result of that is the primary funding financial institution to allow these on clever, that is the start of many different banks selecting comply with this path, as is the case with Commonplace Chartereds a financial institution in Asia, Africa and the Center East. All of those new relationships imply world presence for Smart.

Fines and compliance that compromise WISE’s mission. Final January the Shopper Monetary Safety Bureau ordered Smart to pay almost $2.5 million for a collection of unlawful actions, probably the most regarding act was the disclosure of the 6 digit conversion charge, the CFPB mentioned the rule of thumb is between 2 and 4 digit, what make us query if this “Unfair competitors” might probably have an effect on the shoppers within the US, that’s greater than three million of individuals between the 48 states, the District of Columbia, Guam, the U.S. Virgin Islands, and Puerto Rico, within the matter of their mission to make clear transactions. I haven’t discovered any communication from Smart to search out how they’re anticipating to repair this. Nevertheless a $2.5 milion isn’t a significative quantity contemplating the free money circulation of the corporate.

Foreign money Volatility. Fluctuations in change charges might have an effect on profitability, however many of the income come from charges in conversion and switch.

The stagnation of the corporate’s progress is a legitimate concern. If the expansion that we predict doesn’t materialize, the valuation and the a number of that the corporate trades at could be harmed. Nevertheless, the loyal base of consumers (“evangelical prospects” as they name them) creates an unbelievable progress in prospects, the TAM confirmed us the chances are nonetheless with house to progress, as the instance of the doorway of WISE on January to the Mexican market, and the brand new partnership with world banks, makes unlikely the stagnation within the coming three years a minimum of.

Digital currencies and cryptocurrencies, with globalization of one of these foreign money, and each time extra international locations acknowledging the makes use of of it, we might see a digital globably accepted, as is the case of the Inthanon-LionRock between Thailand and Hong kong or venture Aber between Saudi Arabia and the UAE. So ultimately you possibly can cease needing to change your cash to totally different currencies, with only one asset you possibly can pay in China, US and in Venezuela. I imagine this might be the longer term however in a perfect world. It might want an excessive amount of cooperation between nations, and that is hardly seemingly within the coming 20 years a minimum of.

Credit score danger. To evaluate this subject, the corporate has a really conservative strategy to speculate their buyer’s steadiness. As of their newest report, solely 36% of their money place is invested in market funds (3.776m out of 10.479m), whereas the remaining is in present accounts. Concerning their short-term investments, nearly 100% of the cash is invested in Aa and A devices, creating a sturdy and strong steadiness sheet for the corporate.

Conclusion

Smart was my greatest funding in 2024, however in 2025, it’s time to reassess. At 25x earnings and close to all-time highs, is it nonetheless a great deal? Initially, Revolut’s IPO appeared like another alternative, however after reviewing the restricted information obtainable, its rumored valuation might be seven instances larger than Smart’s present a number of.

For now, my focus stays on Smart, buying and selling at 25x however rising quickly in each buyer base and world enlargement. With no debt, a world infrastructure benefit, and a management staff aligned with shareholders’ pursuits (CEO and co-founder Kristo Käärmann nonetheless owns 18% of the corporate) Smart stays a compelling long-term funding.

What do you suppose? Will Revolut’s IPO be a game-changer, or is Smart nonetheless the smarter guess?

Sources

Smart annual assertion 2024

Analyst presentation 2024

Revolut annual assertion

https://clever.com/imaginary-v2/photos/2bbbb368c98fe4aa7b2aa3e133341520-FY24_Analyst_Presentation_.pdf

https://www.revolut.com/information/revolut_announces_secondary_share_sale_to_provide_employee_liquidity/

https://www.investopedia.com/softbank-backed-revolut-secures-usd45b-valuation-ahead-of-possible-ipo-8696459#:~:textual content=Revolutpercent20haspercent20securedpercent20apercent20$45,intopercent20thepercent20companypercent20inpercent202021.

https://www.theguardian.com/enterprise/article/2024/aug/16/fintech-firm-revolut-valued-employee-share-sale

https://www.statista.com/matters/11647/cross-border-payments/#topicOverview

https://www.consumerfinance.gov/about-us/newsroom/cfpb-orders-wise-to-pay-25-million-for-illegal-remittance-practices/#:~:textual content=Thepercent20CFPBpercent20ispercent20orderingpercent20Wise,saidpercent20CFPBpercent20Directorpercent20Rohitpercent20Chopra.

This communication is for info and training functions solely and shouldn’t be taken as funding recommendation, a private advice, or a proposal of, or solicitation to purchase or promote, any monetary devices. This materials has been ready with out bearing in mind any explicit recipient’s funding goals or monetary state of affairs, and has not been ready in accordance with the authorized and regulatory necessities to advertise unbiased analysis. Any references to previous or future efficiency of a monetary instrument, index or a packaged funding product are usually not, and shouldn’t be taken as, a dependable indicator of future outcomes. eToro makes no illustration and assumes no legal responsibility as to the accuracy or completeness of the content material of this publication.