[ad_1]

With 37 completely different manufacturers and 4 divisions, Loreal ($OR.PA) has been on my radar since I began investing. Nevertheless it has by no means been at a reduction. Right this moment, buying and selling at 30x PE, it’s a kind of high-performing firms that not often disappoint. Is it price investing now, or ought to we look forward to a greater alternative?

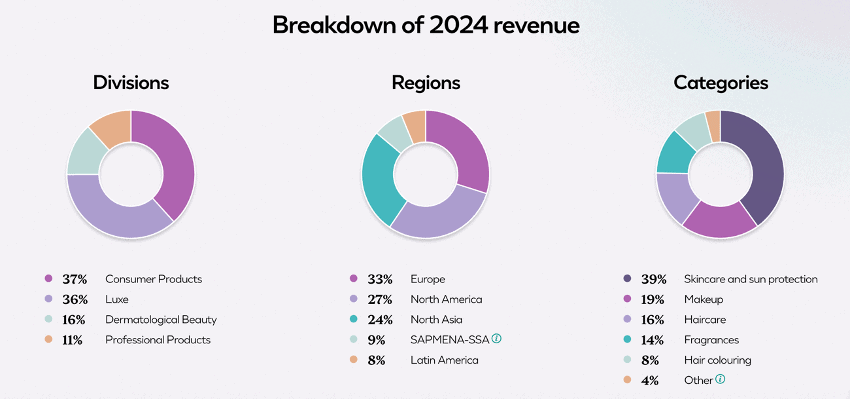

Supply: L’Oréal F2024 Annual Report.

Key Highlights

A Magnificence Large at 30x PE – L’Oréal has dominated for over a century, however is it nonetheless a purchase at this valuation?

AI-Pushed Edge – With 694 patents in 2024, tech innovation fuels progress. Will it maintain premium pricing?

Progress vs. Stagnation – Growth slows, inflation bites. Is L’Oréal nearing its limits?

Enterprise overview

In 1909, a scientist in Paris developed one thing by no means seen earlier than: a safe-to-use hair dye, marking the start of L’oréal with Eugène Schueller. The enduring “As a result of I’m worthy” was the primary commercial of the model in 1970, however it’s nonetheless related as we speak.

The wonder trade has proven resilience even within the worst disaster worldwide, and might discover the explanations behind this by on the lookout for the “lipstick impact,” an actual financial principle explaining why shoppers proceed spending on inexpensive luxuries.

Supply: L’Oréal.com.

Supply: L’Oréal.com.

Magnificence markets are rising in direction of the route of not solely feminine, however a extra inclusive sector, the place males, the aged, and even youngsters are utilizing magnificence merchandise, which will increase the trade’s attain.

L’Oréal has been one of many firms that higher perceive the worth of AI of their processes, as they mentioned:

“We have now optimized the work of our staff, giving them extra time for greater value-added duties, similar to creating methods by means of knowledge evaluation, threat administration, and anticipation.” – L’Oreal investor presentation.

Their CEO, Nicolas Hieronimus, is the instance of management we search for in firm administration, working within the firm since 1987, began as a product supervisor and climbed as much as change into the CEO in 2021. We wish within the administration of our companies dedication, beliefs in the way forward for the corporate, and particularly deep information in how your organization works, processes, and generates revenues.

34.7% of the shares of the corporate are owned by the Betancourt household, and they’re a part of the board of administrators the board, guaranteeing their robust private dedication to the corporate’s long-term imaginative and prescient.

Monetary evaluation

Once we speak about monetary well being, L’Oréal have to be one of many firms with higher historic efficiency I’ve seen. Common income progress of 6,99%, with an impressive historic capital effectivity with a Return on Capital Employed from 17% to 25%.

The worldwide magnificence market worth is about 290$ Bn, rising 4,5% yearly. By 2030, estimations are that 60% of the inhabitants will eat magnificence merchandise, which might imply 750 million extra folks shopping for magnificence merchandise.

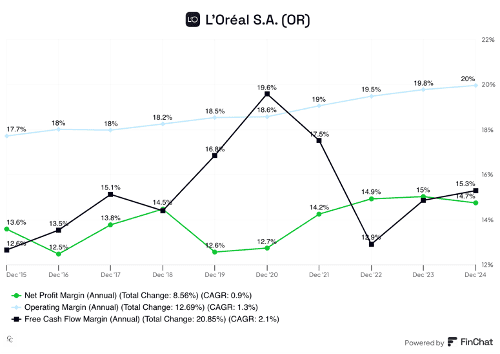

Supply: Finchat.

Nonetheless, as a holding firm with a number of manufacturers underneath its umbrella, L’Oréal’s complexity makes it tough to evaluate the detailed efficiency of every enterprise phase. This construction can typically obscure underlying points, and I stay cautious about assuming steady, uninterrupted progress in income, margins, and internet revenue.

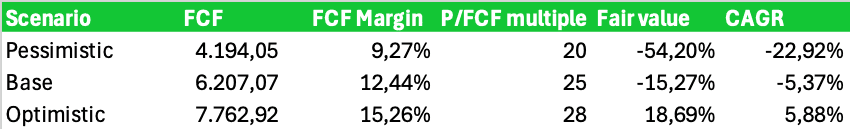

Pessimistic Situation: We thought of a 20x P/FCF a number of with doable stagnation in gross sales, factoring within the dangers of a serious disaster within the coming years that might affect anticipated progress. This leads to a -22.92% lower within the funding worth.

Base Situation: We raised the a number of to 25x, accounting for some progress. Nonetheless, at present costs, we might nonetheless see a -5.37% lower in funding worth.

Optimistic Situation: Solely on this case would we notice beneficial properties, assuming a 28x a number of and the expansion L’Oréal expects over the subsequent three years. 28x is the a number of I assign to high-gain companies with aggressive benefits and robust progress expectations.

As a result of we solely make investments if we gained’t lose cash underneath any situation, L’Oréal doesn’t appear to be a pretty funding at these costs. Our objective retains being the identical: “Don’t lose cash.”

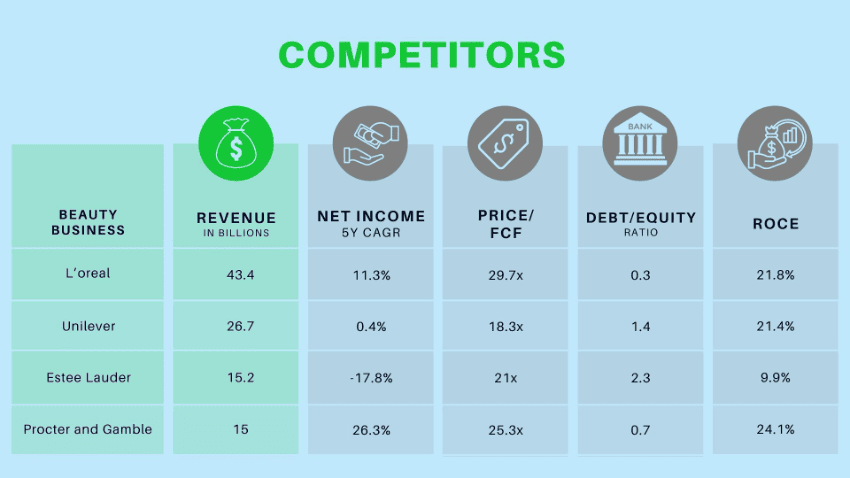

Comparative

Supply: Finchat.

Amongst all magnificence firms, L’Oréal is the most important when it comes to market share. In comparison with Unilever and P&G, its income is solely derived from the sweetness phase.

One key aggressive benefit is L’Oréal’s resilience in Asia. Whereas the corporate reported a 3.2% decline in This autumn gross sales, Estée Lauder skilled a a lot sharper 11% decline in the identical interval.

L’Oréal continues to steer in innovation, submitting 694 patents in 2024 and investing €1.3 billion (3% of gross sales) in analysis and innovation.

Their AI-powered digital magnificence assistant, Magnificence Genius, has supplied personalised diagnostics and proposals to over 100,000 customers in 2024.

BETiq improves advertising and marketing effectivity and return on funding. At present carried out in 6 international locations, it’s anticipated to broaden to eight by 2025.

CreAItech makes use of AI-powered creativity to reinforce content material creation.

L’Oréal pays a 2.05% dividend, with a 6% enhance in 2024, marking the very best dividend progress in 10 years. The corporate additionally accomplished €0.5 billion in share buybacks.

Dangers

Stagnation Danger – As L’Oréal reaches world saturation, future progress could change into more difficult. Growth into Africa and Asia would require greater investments and elevated operational prices.

Asian Competitors – The wonder market in Asia is very aggressive, making it tough for L’Oréal to seize extra market share.

Inflation & Forex Dangers – Presence in high-inflation international locations like Argentina and Turkey poses dangers, although some prices are offset by the latest energy of the Euro.

Political Dangers – Trump’s potential tariffs on imports might cut back L’Oréal’s margins within the essential U.S. market.

Retailer Dangers – Gross sales in pharmacies and drugstores have slowed attributable to declining foot visitors, affecting total efficiency.

Growth Dangers – Shifting into dietary supplements requires important CAPEX funding, and a scarcity of expertise on this phase poses execution dangers

Conclusion

I don’t suppose we are going to ever see L’Oréal at considerably decrease valuations. Nonetheless, attributable to its measurement, it should ultimately attain some extent the place its unbelievable sustainable progress will decelerate. We will justify paying a premium for high-quality companies, however a valuation of 25-28x PE appears applicable.

Progress expectations for 2025 are 4-4.5%, indicating stabilization moderately than overperformance. At present valuations, I’m not shopping for, however I’ll monitor for a worth drop. Nonetheless, for dividend-focused buyers looking for a dependable blue-chip inventory, L’Oréal stays a pretty selection.

This communication is for info and schooling functions solely and shouldn’t be taken as funding recommendation, a private suggestion, or a proposal of, or solicitation to purchase or promote, any monetary devices. This materials has been ready with out taking into consideration any specific recipient’s funding goals or monetary scenario and has not been ready in accordance with the authorized and regulatory necessities to advertise unbiased analysis. Any references to previous or future efficiency of a monetary instrument, index or a packaged funding product are usually not, and shouldn’t be taken as, a dependable indicator of future outcomes. eToro makes no illustration and assumes no legal responsibility as to the accuracy or completeness of the content material of this publication.

[ad_2]

Source link