[ad_1]

Key Takeaways:

Michigan joins 19 different states in proposing laws for a strategic cryptocurrency reserve.

Beneath the proposed invoice, the state treasurer is permitted to commerce and/or mortgage as much as 10% of some state funds for cryptocurrencies.

A Michigan consultant floated the concept of “MichCoin,” a stablecoin backed by Michigan’s gold and silver reserves.

Michigan Eyes a Future in Crypto: A Deep Dive into the Proposed Bitcoin Reserve

The world of cryptocurrencies is altering at an ever-increasing tempo, and it’s no surprise that native governments in the USA are taking part in catch-up. The most recent state lining as much as get in on this phenomenon is Michigan. Michigan’s plan consists of a invoice that will arrange a reserve fund with Bitcoin because the forex. This transfer might sign a rising development of digital currencies as a significant funding avenue and financial development driver, shaping each Michigan’s monetary future and the worldwide crypto market.

HB 4087: The Basis for Michigan’s Crypto Technique

Bryan Posthumus and Ron Robinson are the 2 representatives who launched Home Invoice 4087 (HB 4087) on February thirteenth. Their hope is that the brand new legislation, if enacted, will amend Michigan’s Administration and Funds Act, the aim of which in flip shall outcome within the institution of a strategic Bitcoin reserve for the state. The announcement sparked discussions, with some supporters suggesting that Michigan might achieve a aggressive edge as an early adopter of this funding class.

“Michigan can and will be part of Texas in main on crypto coverage by signing into legislation my invoice creating the Michigan Crypto Strategic Reserve,” Posthumus acknowledged on X. His assertion mirrors the view of many bureaucrats who contemplate the cryptocurrencies as a golden alternative.

Michigan can and will be part of Texas in main on crypto coverage by signing into legislation my invoice creating the Michigan Crypto Strategic Reserve. https://t.co/x2Yke3uWTn

— Rep. Bryan Posthumus (@posthumus_bryan) February 13, 2025

What Does the Invoice Entail?

The proposed laws grants the state treasurer the authority to take a position as much as 10% of the overall fund and the financial stabilization fund in cryptocurrencies. Unsurprisingly, the invoice doesn’t include any particular standards for the sorts of cryptocurrencies that may be purchased. Specifically, the state’s place on Bitcoin is crystal clear because the identify of this digital asset is explicitly talked about within the invoice.

Incomes By way of Lending: A Dangerous Proposition?

The invoice consists of an revolutionary and, maybe, controversial provision that permits the lending of cryptocurrency. One key provision within the invoice states: “If cryptocurrency might be loaned with out rising monetary threat to this state, the state treasurer is permitted to mortgage the cryptocurrency to yield additional return to this state.” Nonetheless, this concept has but to undergo its testing interval and should be confronted with heavy fluctuations and the lacking regulatory framework. Just a few issues linger concerning the precise extent of threat taking throughout these actions.

Custody and Safety: A Precedence

The invoice specifies that the state should retailer its crypto property both by means of safe custody options or exchange-traded merchandise (ETPs) from registered funding firms. This analog even implies some understanding of safety dangers supposed by such property and the necessity to let the dangers by means of established management gates.

The “MichCoin” Idea: A State-Backed Stablecoin?

Following the Bitcoin reserve proposal, Consultant Posthumus launched the concept of “MichCoin.” In his newly composed put up titled x, he proposed the “MichCoin” as “a stablecoin, which I imagine the state of Michigan ought to create” and in addition wrote it could “hyperlink to our gold and silver reserves.” This thought continues to be in its embryonic state; it’s extra just like the case when Michigan is expressing its want to interact in blockchain know-how to make use of it to resolve state-supported digital cash challenges.

The idea of a state-supported stablecoin is fraught with many questions. Will its regulation be just like the regulation of fiat cash? Will a central financial institution assure its stablecoin worth? Will there be a safe and dependable infrastructure to help it? All these are questions that should be resolved earlier than any such scheme can ever grow to be an actual undertaking.

Crypto Adoption in Michigan

It’s price noting that Michigan isn’t a very new participant within the crypto trade. The state’s pension funds have already got sure Bitcoin and Ether exposures made by means of exchange-traded funds (ETFs). Thus, such earlier experiences function a automobile for the long run creation of a broader crypto funding technique in case the invoice turns into legislation.

The Greater Image: A Development of States Embracing Crypto

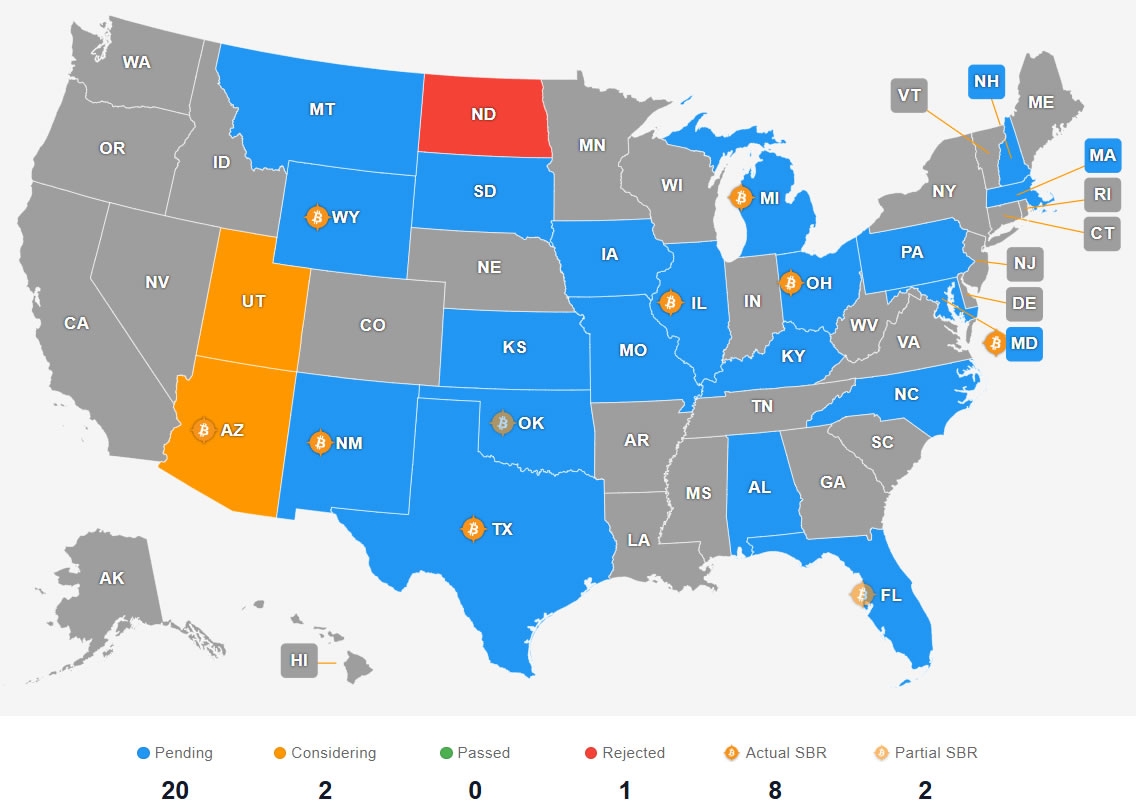

Michigan’s proposal constitutes part of a bigger sample throughout the USA. As many as 20 states have launched laws concerning state funding in crypto. For instance, Texas is the newest state to introduce related laws. However North Dakota is the one state to this point to have voted down the invoice.

Extra Information: Texas Considers Establishing a Bitcoin Reserve in 2025 Beneath Lt. Governor Dan Patrick

The payments’ standing. Supply: Bitcoin Reserve Monitor

Matthew Sigel, head of digital property at VanEck, estimated that as much as $23 billion in state funds might probably enter the crypto market, driving important upward strain on Bitcoin and different digital property.

The development isn’t restricted to states; companies are additionally leaping on the crypto bandwagon. Metaplanet, for instance, has just lately declared that it has raised about $26.1 million to purchase extra Bitcoins utilizing zero-interest, unsecured bonds. This motion is a direct consequence of institutional capital flows as a cryptocurrency that’s changing into an asset.

Components Behind the Push for Crypto Reserves

One key issue is the rising acceptance of crypto reserves by numerous establishments. Just a few contributing components are issues like a spike in the usage of digital currencies, diversification incentives, and aggressive strain in a quickly evolving monetary scene.

Diversification: The crypto property market, with Bitcoin being essentially the most distinguished one, is perceived by some as a definite unalloyed asset class, so their costs transfer in a fashion that isn’t immediately related to the normal markets. Allocating a portion of state funds to crypto could cut back total portfolio threat by offering diversification advantages.

Innovation: States may very well be compelled to exhibit that they’re aggressive to their friends and in a position to entice tech-savvy companies and residents by integrating new applied sciences, reminiscent of blockchain and digital currencies, into their organizational buildings.

Yield Technology: Lending acquired crypto to generate further earnings presents a lovely alternative for states to enhance their monetary efficiency.

Challenges and Issues

The potential of issues and opposing components need to be very a lot within the forefront after we wish to discuss potential advantages.

Volatility: The cryptocurrency market is normally characterised by its excessive volatility. States have to have resilience in case of considerable market fluctuations.

Safety: Crypto property are liable to theft, be it bodily or digital, as a consequence of poor safety and hacking. The answer is powerful safety methods and safe custody options that need to be applied.

Regulation: The world of cryptocurrencies continues to be underregulated and it’ll take time for the event of correct authorized frameworks. States ought to be environment friendly in using good authorized methods in a difficult and ambiguous world.

Integrating cryptocurrency into state monetary methods, as Michigan proposes, requires cautious and knowledgeable decision-making. The anticipated return on funding is excellent, however the thorough understanding of the dangers is the important thing for the safety of the taxpayer’s cash.

[ad_2]

Source link