Welcome to the intriguing realm of investing, the place alternatives abound for the insightful investor. Two vital funding automobiles usually take heart stage on this panorama: mutual funds and exchange-traded funds (ETFs). These instruments provide the important thing to diversification, enabling traders to entry a broad vary of securities inside a single fund. But, whereas they share frequent benefits, every carries its distinctive attributes, advantages, and potential drawbacks.

On this complete article, we goal to unravel the complexities of those two prevalent funding automobiles. We’ll look at their defining traits, pinpoint their variations and similarities, and examine which could finest swimsuit numerous kinds of traders.

I’m Zifa, your information on this exploration. Collectively, we’ll delve deep into these two pivotal funding instruments, demystifying their intricacies and figuring out how they will finest serve your funding technique. So let’s start this informative journey.

Diversification is a cornerstone of a profitable funding technique. Are you able to increase your portfolio with a promising asset? Contemplate seizing the chance to buy a cryptocurrency. By doing so, you’re entering into the way forward for finance. Changelly affords a simple technique to buy Bitcoin, Ethereum, and over 450 different crypto property. Be a part of the crypto revolution and diversify your portfolio with Changelly as we speak!

What Is a Mutual Fund?

In easy phrases, a mutual fund is a sort of funding car that operates by pooling collectively cash from quite a few traders. This cash is then used to buy all kinds of securities, together with shares, bonds, and different property. Such a mechanism allows particular person traders to take part in diversified investments that they may not have been capable of afford or handle on their very own. Moreover, mutual funds are managed by skilled fund managers whose job is to allocate the fund’s property with an goal to generate earnings or capital positive factors for the fund’s traders. Each share of a mutual fund represents an investor’s a part of the possession there and the earnings it generates.

2 Sorts of Mutual Funds

Diving deeper, we are able to categorize mutual funds into two predominant sorts — specifically, open-ended funds and closed-end funds.

Open-Ended Funds

The open-ended fund is a extra frequent sort of mutual fund. Right here, shares are issued and redeemed primarily based on demand on the web asset worth (NAV) of the fund. To place it merely, as extra traders make investments their cash within the fund, new shares are created. Conversely, as traders redeem, shares are eradicated. The value of an open-ended fund share is set by the fund’s NAV on the finish of the buying and selling day.

Closed-Finish Funds

Conversely, closed-end funds function barely in a different way. These funds challenge a set variety of shares throughout an preliminary public providing (IPO). These shares are then traded on an trade, very similar to particular person shares. The value of those shares is set by market demand, that means it might deviate from the NAV, resulting in shares buying and selling at a premium or a reduction to their precise underlying worth.

What Is an ETF?

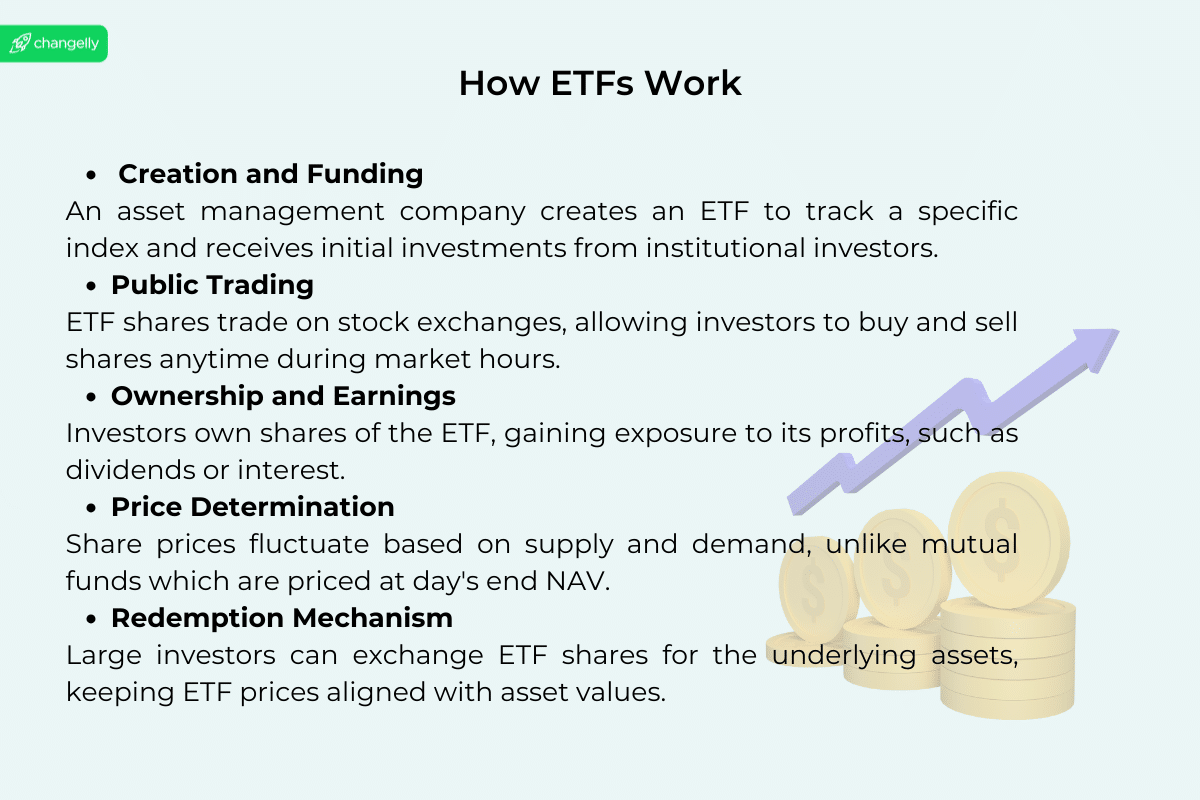

Identical to mutual funds, an exchange-traded fund (ETF) is a sort of funding fund that owns property comparable to shares, bonds, commodities, and extra. ETFs additionally enable traders to pool their cash right into a fund that makes investments in a specific class of property and get an curiosity in that funding pool. Nonetheless — and right here, the distinction comes into play — ETFs are traded on inventory exchanges, very similar to particular person shares.

ETF Creation and Redemption

ETFs have a novel creation and redemption course of that entails massive institutional traders referred to as approved contributors (APs). These APs can create new ETF shares by offering the ETF with the suitable basket of underlying property, or they will redeem ETF shares for the underlying property. This distinctive mechanism helps to make sure that the ETF value stays near its NAV.

ETF Advantages

ETFs provide a number of advantages, together with the power to commerce shares all through the day, just like shares, which contrasts with mutual funds that may solely be purchased and offered on the finish of the buying and selling day. Additionally they sometimes have decrease expense ratios in comparison with mutual funds and are extra tax-efficient due to how shares are created and redeemed. Moreover, ETFs are usually extra clear than mutual funds as a result of they disclose their holdings every day.

Bitcoin ETFs have actually been making a buzz within the funding world. Keep forward of the curve and discover our curated checklist of the highest 5 Bitcoin ETFs.

3 Buildings of ETFs

Broadly talking, there are three predominant kinds of ETFs: open-end index ETFs, unit funding belief (UIT) ETFs, and grantor belief ETFs. Open-end index ETFs, that are the commonest sort, function equally to open-ended mutual funds. They’ll challenge and redeem shares on an ongoing foundation. UIT ETFs, however, are required to duplicate the efficiency of particular indexes, which limits their funding choices. Lastly, grantor belief ETFs enable traders to personal the underlying shares of the businesses by which the ETF is invested, thereby providing traders extra direct possession.

Variations between Mutual Funds and ETFs

Right here’s an in depth checklist of their variations in a pleasant {and professional} tone:

1. Buying and selling and Pricing

Mutual Funds are purchased and offered on the finish of the buying and selling day at a value referred to as the NAV (Internet Asset Worth), which is set after the market closes. This implies you gained’t know the precise buy or sale value on the time of your order.

ETFs are traded on inventory exchanges all through the day at fluctuating market costs, just like particular person shares. This enables for extra flexibility and the power to execute trades at identified costs throughout market hours.

2. Funding Minimums

Mutual Funds usually have minimal funding necessities that may vary from just a few hundred to a number of thousand {dollars}, making it probably tougher for small traders to enter.

Since ETFs are traded like shares, you should purchase only one share, with the minimal funding being the value of 1 share plus any fee charges (although many platforms now provide commission-free buying and selling). So, traders with restricted capital might discover this feature extra accessible.

3. Administration Type

Mutual Funds might be actively or passively managed. Actively managed mutual funds have managers making choices about learn how to allocate property in an try and outperform the market, which might result in larger charges. Passively managed mutual funds, like index funds, goal to duplicate the efficiency of a selected index.

ETFs are sometimes passively managed, specializing in monitoring the efficiency of an index, which typically results in decrease expense ratios. Nonetheless, there are actively managed ETFs as properly, although they’re much less frequent.

4. Charges and Bills

Mutual Funds are likely to have larger expense ratios as a result of the price of energetic administration in lots of instances. They could additionally cost gross sales masses (fee) and different charges.

ETFs typically have decrease expense ratios, particularly for passively managed ETFs. They could incur brokerage commissions when purchased and offered, however many brokers provide a spread of ETFs that may be traded with out commissions.

5. Tax Effectivity

Mutual Funds might be much less tax-efficient as a result of the shopping for and promoting of securities to satisfy redemption requests by shareholders can set off capital positive factors distributions which can be taxable to all shareholders.

ETFs are typically extra tax-efficient as a result of their distinctive creation and redemption course of involving in-kind transfers, which usually don’t set off a taxable occasion. This makes ETFs significantly engaging for taxable funding accounts.

6. Dividends

In mutual funds, dividends might be routinely reinvested, which permits traders to compound their returns with none transaction charges.

ETFs additionally provide dividend reinvestment, however the course of may be barely totally different relying on the dealer, and generally it may be much less simple than with mutual funds.

7. Transparency

Mutual Funds disclose their holdings quarterly or semi-annually with a lag.

ETFs typically provide higher transparency, disclosing their holdings day by day, which might be advantageous for traders who want to know precisely what they personal at any given time.

What Do ETFs & Mutual Funds Have in Widespread?

Regardless of these variations, ETFs and mutual funds do share a standard floor. Each are kinds of funding funds, and as such, they supply a manner for traders to carry a diversified portfolio of property. This enables traders to unfold their threat throughout many alternative securities. Each kinds of funds are managed by skilled cash managers, and so they each goal to generate returns for his or her traders, both by means of earnings (like dividends or curiosity funds), capital positive factors, or a mix of each.

ETFs vs. Mutual Funds: Which Is Greatest for You?

The choice to put money into ETFs or mutual funds usually comes all the way down to the person investor’s wants, targets, and funding technique. In the event you worth the power to commerce all through the day, want decrease prices, and prioritize tax effectivity, ETFs could also be a better option. Nonetheless, when you want a extra hands-off strategy, recognize systematic funding choices, and lean in direction of energetic administration, then mutual funds may be extra becoming.

Is It Higher to Put money into the Market By means of a Mutual Fund or ETF?

The reply to this advanced query relies upon closely on particular person circumstances and funding targets. ETFs and mutual funds might be wonderful automobiles for investing out there. For passive traders with a long-term funding horizon, each of those can function strong instruments to attain diversification. ETFs may need an edge as a result of their typically decrease expense ratios and higher tax effectivity, making them probably less expensive over the long term. However, mutual funds might be extra handy for normal, automated investments as a result of options like dollar-cost averaging and the power to buy fractional shares.

What Are Actively Managed Funds?

Actively managed funds are portfolios overseen by a supervisor or a staff of execs who make ongoing, particular funding choices primarily based on analysis, forecasts, and their judgment. The target of those funds, which could possibly be both mutual funds or ETFs, is to outperform a selected benchmark index. Their administration type tends to contain extra frequent buying and selling, resulting in larger prices and probably extra vital tax implications for the traders.

What Are Passively Managed Funds?

Passively managed funds, conversely, search to duplicate the efficiency of a selected index. By investing in the identical property in the identical proportions because the index, these funds goal to reflect the market’s efficiency slightly than making an attempt to beat it. This passive strategy is less expensive because of the decrease turnover and less complicated administration course of, making such funds extra tax-efficient.

How do They Relate to ETFs and Mutual Funds?

Each energetic and passive administration kinds might be utilized to mutual funds and ETFs. The distinction lies of their construction and buying and selling mechanisms, not their administration type. ETFs are traded on an trade like shares, permitting shopping for and promoting all through the day. In distinction, mutual funds are transacted instantly with the fund firm on the day by day web asset worth (NAV).

What to Select?

Selecting between energetic and passive funds — and ETFs or mutual funds per se — relies on particular person funding targets, threat tolerance, time horizon, and private preferences.

ETFs provide benefits when it comes to decrease charges, tax effectivity, and buying and selling flexibility. That’s why cost-conscious traders and people in search of to use market timing might discover them engaging.

Mutual funds, however, present advantages for these in search of energetic administration potential and ease of systematic investing. They attraction to traders who’re much less involved with speedy liquidity or buying and selling prices. By rigorously contemplating these components, traders could make a extra knowledgeable selection that most accurately fits their long-term funding targets and techniques.

Tax Issues

ETFs are identified for his or her tax effectivity, largely because of the in-kind creation and redemption mechanism, which often doesn’t set off capital positive factors taxes. This characteristic is especially advantageous to traders in taxable accounts.

Mutual funds might incur taxable occasions when securities inside the fund are offered by the supervisor, probably resulting in capital positive factors distributions to all shareholders, no matter particular person purchase or promote actions.

Believers within the capability of execs to outperform the market, who’re keen to pay larger charges for his or her experience, might want actively managed funds. The selection between mutual funds and ETFs then comes down as to whether you worth the power to take a position repeatedly (as is simpler with mutual funds) or the pliability of intraday buying and selling (supplied by ETFs).

Alternatively, when you adhere to the environment friendly market speculation — the idea suggesting it’s practically unimaginable to constantly outperform the market — you would possibly lean in direction of passively managed funds. These sometimes lower-cost funds can give you market-matching returns with higher tax effectivity, particularly within the case of ETFs.

Nonetheless, there’s no universally proper selection. What’s finest for one investor won’t be appropriate for an additional. Thorough analysis or session with a monetary advisor is all the time advisable earlier than making funding choices.

FAQ

Is S&P 500 a mutual fund or an ETF?

The S&P 500 is neither a mutual fund nor an ETF. It’s an index that tracks the efficiency of 500 massive firms listed on U.S. inventory exchanges. Nonetheless, quite a few mutual funds and ETFs are designed to duplicate the efficiency of the S&P 500. These funds maintain the identical securities in the identical proportions because the S&P 500, permitting traders to broadly mimic the efficiency of the biggest section of the U.S. equities market.

Are ETFs riskier than mutual funds?

The chance of ETFs and mutual funds is basically decided by their underlying property — that’s, what the ETF or mutual fund invests in. ETFs, as a result of their construction and skill to be traded like shares, may result in extra frequent buying and selling and probably elevated prices, significantly if traders attempt to time the market or commerce steadily. Nonetheless, normally, an ETF that invests in a broad, diversified group of shares just isn’t inherently riskier than a mutual fund with comparable investments.

Do ETFs pay dividends?

Sure, many ETFs do pay dividends to their traders. If an ETF consists of dividend-paying shares amongst its holdings, the dividends are collected and sometimes distributed to ETF shareholders. The frequency of those dividend funds can fluctuate, however they usually happen on a quarterly foundation.

Which is safer: an ETF or a mutual fund?

The protection of an funding isn’t decided solely by whether or not it’s an ETF or a mutual fund. Reasonably, it relies on what the fund invests in, how well-diversified it’s, the abilities of the fund supervisor, and the general market circumstances. On the whole, funds (ETFs or mutual funds) that put money into riskier securities, comparable to small-cap shares or junk bonds, shall be riskier than funds that put money into safer securities, comparable to large-cap shares or authorities bonds.

Ought to I put money into each an ETF and a mutual fund?

Investing in each ETFs and mutual funds can provide diversification advantages and steadiness your portfolio out. This strategy permits traders to make the most of the distinctive options of each kinds of funds. Nonetheless, it must be primarily based on particular person monetary targets, threat tolerance, funding technique, and preferences.

Have index funds turn into extra well-liked lately?

Sure, index funds, which embody each index mutual funds and ETFs, have been rising in recognition as a result of their low prices and ease. They goal to imitate the efficiency of a selected index slightly than outperform it. As many energetic fund managers have struggled to constantly outperform the market, an growing variety of traders have turned to index funds. This pattern has been additional bolstered by the rise of robo-advisors and the growing consciousness in regards to the affect of excessive charges on long-term funding returns.

Mutual Fund vs ETF: Last Ideas

In conclusion, whereas each mutual funds and ETFs can function efficient funding automobiles, the choice between the 2 must be primarily based on particular person funding targets, threat tolerance, and private preferences. By understanding the distinctive traits and advantages of every, traders could make knowledgeable choices and select the trail that finest aligns with their monetary targets.

References

https://www.bitpanda.com/academy/en/classes/what-is-an-exchange-traded-fund-etf/

https://www.nerdwallet.com/article/investing/how-to-invest-in-mutual-funds

https://www.cnbc.com/choose/what-are-mutual-funds/

https://www.constancy.com/learning-center/investment-products/etf/what-are-etfs

Disclaimer: Please notice that the contents of this text aren’t monetary or investing recommendation. The knowledge supplied on this article is the creator’s opinion solely and shouldn’t be thought of as providing buying and selling or investing suggestions. We don’t make any warranties in regards to the completeness, reliability and accuracy of this info. The cryptocurrency market suffers from excessive volatility and occasional arbitrary actions. Any investor, dealer, or common crypto customers ought to analysis a number of viewpoints and be conversant in all native rules earlier than committing to an funding.