[ad_1]

Bitcoin is at the moment holding above the $62,000 mark following a 5% surge from decrease demand up to now few days. Whereas the market grapples with uncertainty, latest knowledge from Coinglass signifies that Bitcoin’s volatility has considerably decreased throughout this era of sideways buying and selling. This discount in volatility usually serves as a precursor to main value actions, main many buyers to take a position {that a} vital shift in market dynamics could possibly be on the horizon.

As merchants analyze market tendencies, the prevailing sentiment is blended, with some expressing optimism a few potential bullish rally, whereas others stay cautious as a result of present volatility panorama.

With many eyes on Bitcoin’s subsequent transfer, the query stays: will it get away to new highs, or will it face additional corrections? Because the cryptocurrency market continues to evolve, Bitcoin’s capacity to keep up its place above $60,000 might set the stage for the following chapter in its value motion.

Bitcoin Analysts Count on A Massive Transfer

Bitcoin is at the moment navigating a panorama crammed with hypothesis following a number of weeks marked by vital value fluctuations. Whereas the latest volatility has made some buyers cautious, the prevailing sentiment amongst many merchants is that BTC and the broader crypto market are on the verge of a bullish rally.

This optimism is bolstered by key knowledge shared by crypto analyst Daan from Coinglass, indicating a notable lower in Bitcoin’s volatility ranges throughout this era of value consolidation.

At the moment, Bitcoin’s volatility is just not but again to the degrees seen in the course of the summer time earlier than the sharp drop in August. Sometimes, when volatility compresses, it creates an setting ripe for a considerable value motion in both path. This attribute of cryptocurrency markets suggests {that a} breakout could possibly be imminent. Ought to BTC handle to carry above the present demand ranges, the potential for a rally to new all-time highs turns into more and more probably.

Merchants are carefully monitoring market tendencies, on the lookout for affirmation alerts that would point out the path of the following main value transfer. If Bitcoin can preserve its place and leverage the lowering volatility, it might set the stage for a major upward shift.

As buyers anticipate this potential rally, the main target stays on Bitcoin’s capacity to maintain its momentum and capitalize on the present market situations, setting a brand new course for the cryptocurrency’s future.

BTC Testing Key Liquidity

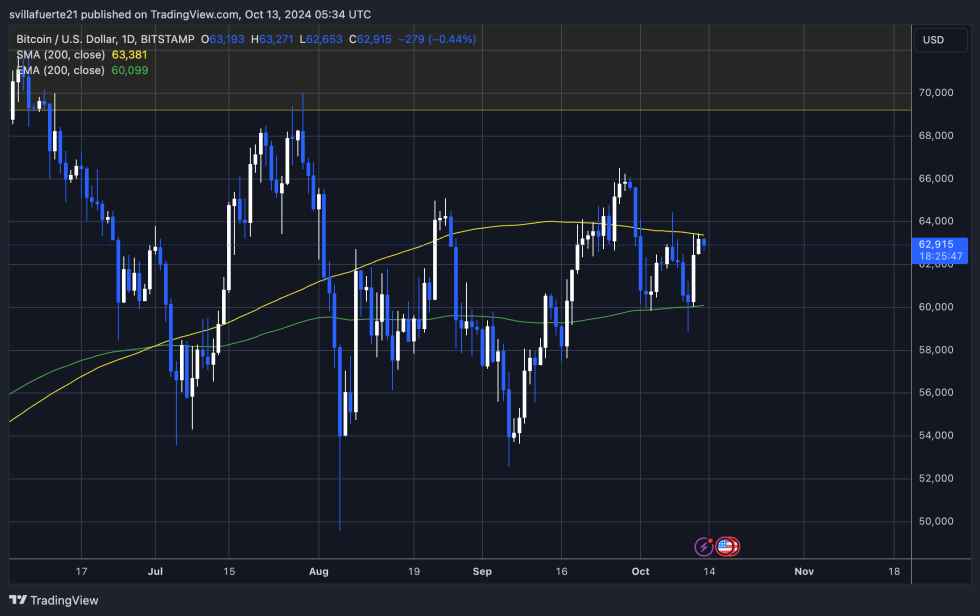

Bitcoin is at the moment buying and selling at $62,900, fluctuating between the 1D 200 exponential transferring common (EMA) at $60,099 and the 200 transferring common (MA) at $63,381. Holding above the essential $60,000 mark, a psychological threshold, units a constructive sentiment available in the market. For bulls to take management and push the worth larger, it’s important to interrupt above the 1D 200 MA at $63,381 and surpass native highs round $66,000.

The present value motion displays a essential second for BTC, as these ranges will decide the path of its subsequent transfer. A profitable rally above the 200 MA might ignite additional shopping for curiosity and doubtlessly result in a surge towards new all-time highs. Nonetheless, if BTC fails to keep up its place above the 1D 200 EMA at $60,000, a deeper correction might happen, with the following assist stage doubtlessly dropping to $57,500.

Merchants and buyers are carefully monitoring these key ranges, as they may play a major position in shaping Bitcoin’s short-term outlook and figuring out the market’s trajectory within the coming days.

Featured picture from Dall-E, chart from TradingView

[ad_2]

Source link