[ad_1]

Q1 earnings are within the books and the S&P 500 did a fairly good job, sporting double-digit progress. What was the tone from the quarter, although?

Earlier than we dive in, let’s be sure to’re set to obtain The Every day Breakdown every morning. To maintain getting our every day insights, all you want to do is log in to your eToro account.

Friday’s TLDR

Q1 earnings had been strong

And the outlook was a aid

However can the patron keep robust?

What’s Occurring?

In April, I went by almost 20 convention calls to provide you an thought of how company America — like banks, bank card firms, and airways — considered the present panorama. General, it was fairly strong. However it hadn’t included retail earnings, as most of them reported within the second half of Could.

With that, right here’s a extra complete takeaway.

First-quarter earnings are (mainly) within the books and traders ought to be exhaling a sigh of aid. The S&P 500 put collectively 1 / 4 of double-digit earnings progress (+13.3%, in keeping with FactSet), however extra importantly, administration spoke in regards to the underlying power and resilience of the patron.

Massive Image Takeaway

Shoppers stay broadly resilient, supported by robust employment, regular incomes, and strong steadiness sheets. Spending is holding up throughout revenue ranges, with specific power amongst prosperous households. That mentioned, lower-income customers are exhibiting indicators of moderation as they proceed to navigate inflationary strain.

Journey and leisure spending has softened — notably in additional price-sensitive classes like economic system airfare — although restaurant and lodging demand stays secure.

Regardless of weaker sentiment, most firms report no main pullback in client conduct. A number of even famous renewed momentum in April, prompting upward steering revisions. Whereas macro uncertainty lingers, enhancing sentiment, wage progress, and inventory market good points supply hope for a extra secure second half.

A Extra Granular View From Retailers

Retailers report combined alerts. Greenback Normal famous pressure amongst its core base, however elevated spending from middle- and higher-income buyers. Walmart sees a continued shift towards requirements, whereas TJX and Costco report broad-based power. Residence Depot describes a wholesome client with robust house fairness, however says excessive rates of interest are limiting massive renovation initiatives.

The Backside Line

Q1 earnings had been strong, however with commerce tensions nonetheless current — albeit to a lesser diploma — Q2 and Q3 could possibly be a tougher hurdle. Nonetheless, traders could overlook the tariff influence to earnings if they continue to be assured within the client and in the event that they consider that earnings progress will re-accelerate in This fall and into 2026.

Given how vital the patron is to company earnings and the US economic system — with client spending accounting for roughly two-thirds of GDP — it’s reassuring to listen to a cautious-but-optimistic takeaway from Q1. If that development persists all through Q2, the US economic system may stay resilient within the face of ongoing macro uncertainty.

Wish to obtain these insights straight to your inbox?

Join right here

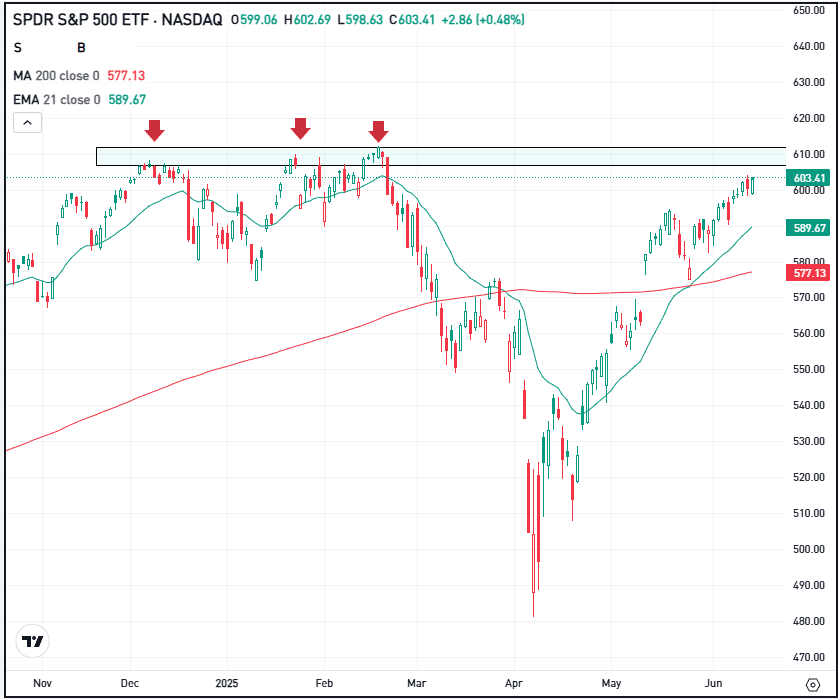

The Setup — S&P 500

The SPY ETF has been on fireplace, up about 25% from its April low and now inside 2% of its document excessive from February. Now, SPY is coming right into a key resistance space within the $607 to $612 vary, which held agency in December, January, and February.

Lively traders may even see this space and choose to trim a few of their lengthy positions or contemplate hedging within the occasion of a decline, whereas much less optimistic traders could contemplate this to be a bearish setup. Others could merely observe the S&P 500 to see the way it handles this zone.

A pullback from this space may arrange a possible “purchase the dip” state of affairs, whereas a breakout may assist set off the subsequent leg of the rally. Or, if markets actually lose momentum, this resistance zone may maintain agency and set off a bigger selloff.

No matter how the charts resolve within the brief time period, figuring out this potential resistance space could possibly be useful for energetic traders.

Choices

For choices merchants, places or bear put spreads could possibly be one option to speculate on resistance holding if SPY will get there. It may be a approach for traders to hedge their lengthy positions within the occasion of a pullback. On the flip aspect, bulls may make the most of calls to invest on a breakout.

Discover out extra about choices buying and selling with our free Academy programs.

Disclaimer:

Please word that on account of market volatility, a few of the costs could have already been reached and situations performed out.

[ad_2]

Source link