In a latest YouTube video, Michaël van de Poppe, a extremely revered determine within the crypto evaluation sphere, disclosed his high 5 altcoin picks for 2024. Van de Poppe, referred to as founding father of Eight International, emphasised the significance of a balanced strategy over speculative bets on lesser-known altcoins. He said, “I don’t imagine in moving into very small altcoins to maximise the chance. Compounding your returns with a correct technique advantages in the long term.”

Ethereum (ETH) – The Main Crypto Alternative

Van de Poppe’s foremost advice is Ethereum. The crypto analyst rationalizes this alternative by mentioning the crowded area Bitcoin presently occupies, suggesting a shift of focus to altcoins. He articulated, “Bitcoin has been seeing a whole lot of upside already [caused by the spot ETF hype] … it’s getting a bit of bit overcrowded and I feel the upside is comparatively capped.”

He added that Ethereum is presently bottoming out in opposition to Bitcoin. “I feel that Ethereum is undervalued at this level as a result of there’s a deflationary system concerned.” His perception in Ethereum stems from its basic development and the deflationary side of its financial mannequin.

As regards to the 3-day ETH/USDT chart, he commented: “Ethereum holds an important stage at $2,150 and is able to proceed the upwards path. Doubtless, we’ve bottomed on the ETH/BTC pair and have peaked on the Bitcoin dominance.”

Scalability Options – Arbitrum and Optimism

Delving deeper into the Ethereum ecosystem, van de Poppe highlighted the significance of scalability options. He sees Arbitrum as a lovely crypto funding, particularly given its present stage and potential for development.

“Arbitrum has not a lot value motion but, which is difficult, however may give you a really attention-grabbing funding thesis,” he defined, underscoring its upward pattern in opposition to Bitcoin. “Retest at $0.98 did work, continuation in direction of $1.35 as nicely and even additional. Some stunning S/R flips, I feel $1.40-1.45 ought to maintain and we are able to proceed to $2,” he said.

Optimism is his second scalability resolution alternative, albeit with a cautionary word on its latest substantial run. Van de Poppe recommends a dollar-cost averaging technique for Optimism, noting “the hype is already substantial right here… shopping for a portion on each 10 cents that’s dropping to just remember to get a pleasant common entry.”

Chainlink (LINK) – The Darkish Horse

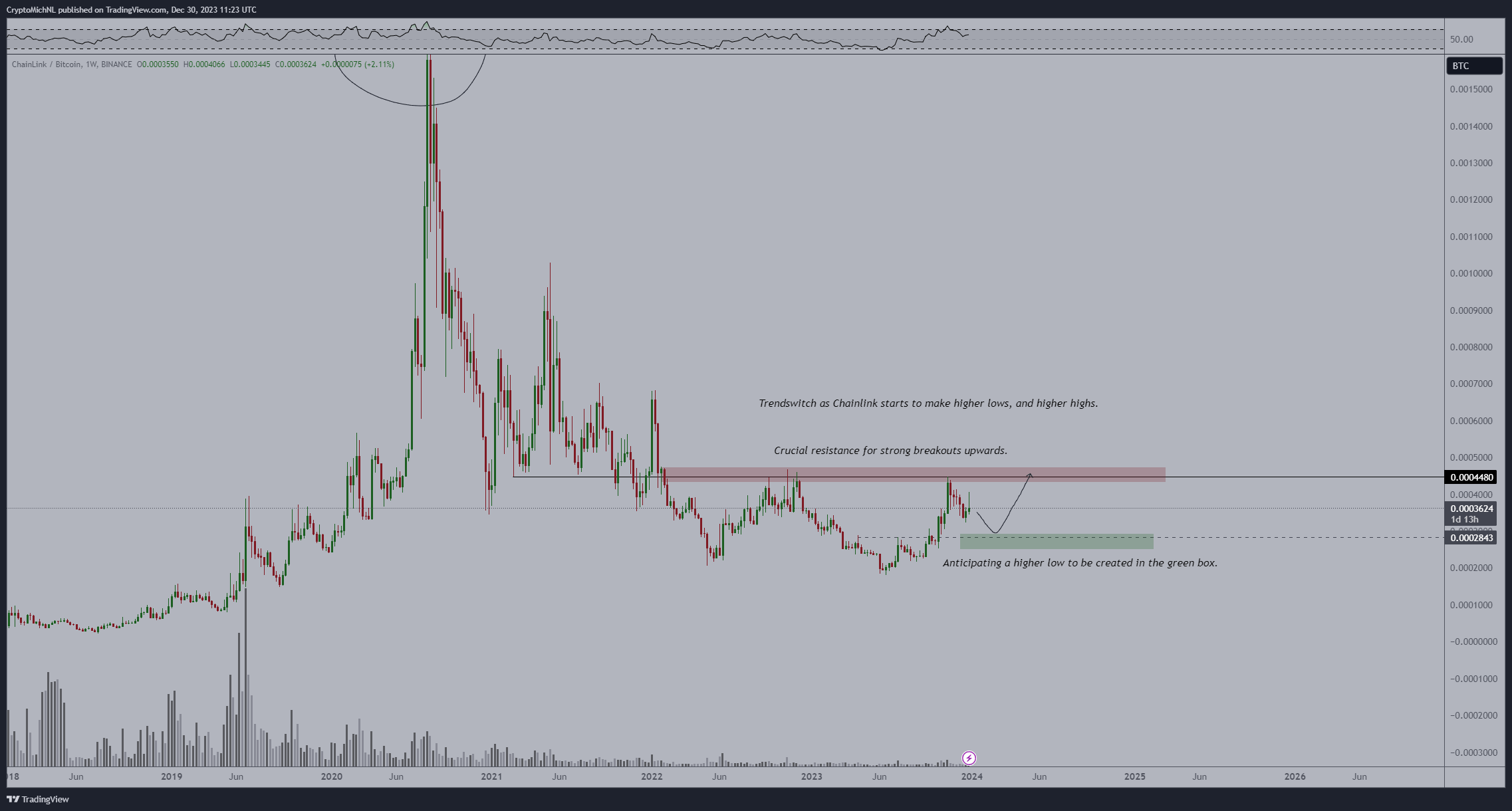

Chainlink (LINK) emerged as his fourth choose. Van de Poppe sees its extended bear market and early peak in opposition to Bitcoin in 2020 as indicators of great potential, particularly at the side of DeFi, RWA, and NFTs. “Chainlink… has been going into the longest bear market that it existed… cycles will occur, and that’s why the chance prices are large,” the crypto analyst remarked.

“Chainlink reveals that the markets are in search of the next low on the BTC pairs. Bitcoin pairs present power in altcoins and are a key indicator in bull markets. So long as LINK stays above 0.000253 BTC, it’s advantageous and we are able to begin focusing on 0.006 BTC,” van de Poppe famous.

SUI – The New Competitor

The ultimate altcoin in van de Poppe’s choice is SUI, a more moderen venture he compares to profitable platforms like Phantom, Avalanche, and Matic. He advises on investing in Ethereum opponents, asserting, “The ultimate one which I’m going to clarify right here is SUI, which is presently additionally beginning to pattern upwards. I’m undecided what it will maintain although, however exterior of the Ethereum ecosystem and DeFi nook.”

He added, “I need to be investing into opponents of Ethereum and you’ll select SUI, DOT, ATOM, all these tasks. I want to select one thing that’s comparatively new, SUI.”

Trying on the 1-day chart of SUI/BTC, the crypto analyst said: “The ecosystems are heating up, and SUI is waking up alongside ARB and OP. Searching for the BTC pair right here, which is able to do a lovely retest on the 0.00001710 space. If that holds, an uptrend probably begins to 0.00003000 BTC.”

Crypto Portfolio Distribution And Technique

Van de Poppe suggests a balanced portfolio distribution, advocating for a bigger allocation to extra established cash: 40% in Ethereum, 20% in Chainlink, and smaller parts in Arbitrum and Optimism (every 15%) in addition to SUI (10%). He additionally emphasised the necessity for a dynamic strategy to buying and selling and profit-taking, saying, “Buying and selling is lots about being versatile and having a versatile mindset.”

Featured picture from BoliviaInteligente / Unsplash, chart from TradingView.com

Disclaimer: The article is supplied for academic functions solely. It doesn’t symbolize the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You’re suggested to conduct your personal analysis earlier than making any funding choices. Use info supplied on this web site completely at your personal threat.