[ad_1]

Key Takeaways:

On April 26, 2025, Loopscale paused its lending markets after attackers drained roughly $5.8 million, representing about 12% of its complete worth locked.The exploit leveraged an beneath collateralization vulnerability by manipulating the on-chain worth feed for the RateX PT token.Repayments, collateral top-ups, and place closures at the moment are permitted, however withdrawals stay disabled whereas investigations proceed.This incident highlights the significance of strong oracle architectures, multi-layer audits, and on-chain insurance coverage mechanisms in DeFi.

Background of Loopscale’s Lending Mannequin

Loopscale launched in early April 2025 as a novel Solana-based DeFi protocol, providing order-book matching for lenders and debtors as an alternative of standard liquidity swimming pools. By mid-April, the platform had attracted over 7,000 customers and amassed practically $40 million in deposits throughout USDC and SOL vaults. Its modern design aimed to ship tighter spreads and extra clear mortgage phrases, together with choices for undercollateralized borrowing—an unusual characteristic in DeFi on the time. Regardless of present process safety critiques, Loopscale’s speedy rollout left little room for intensive stress testing beneath adversarial situations.

Attacker deployed a bug through Loopscale

Sequence of the Undercollateralized Exploit

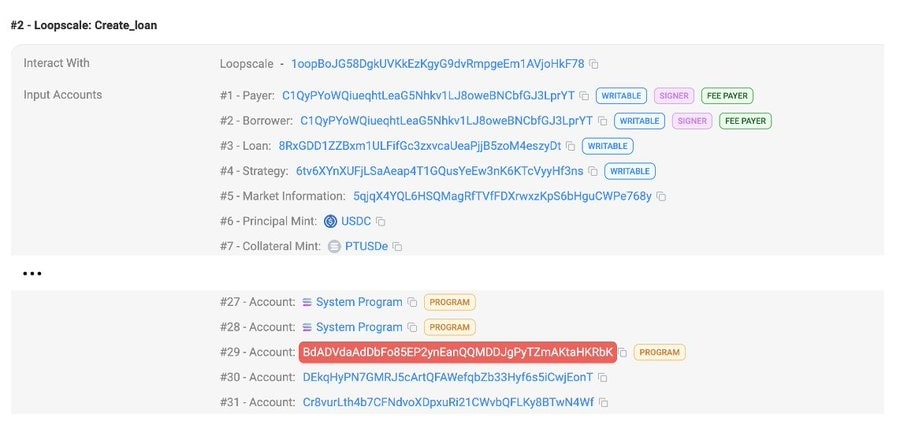

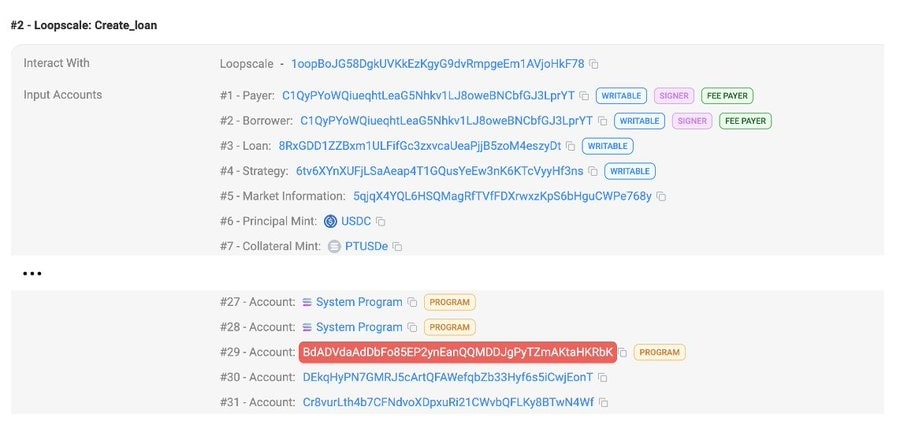

On the afternoon of April 26, a coordinated attacker executed a collection of transactions that exploited a flaw within the collateral valuation mechanism:

Oracle Manipulation: The attacker depressed the reported worth of the RateX PT token by injecting skewed pricing knowledge.Debt Creation: With the token undervalued, the protocol permitted loans with inadequate collateral backing.Asset Drain: The attacker drained each USDC and SOL vaults in speedy succession, withdrawing property far past secure collateral thresholds.

This multi-step strategy allowed the hacker to borrow and withdraw roughly 5.7 million USDC and 1,200 SOL (totaling $5.8 million) earlier than the system directors may intervene.

Fast Remediation Measures

Following detection of irregular worth swings and unusually massive withdrawal requests, the Loopscale staff enacted emergency protocols:

Market Suspension: All new lending and vault withdrawal capabilities had been instantly frozen.Selective Reinstatement: Customers have been allowed to repay excellent loans, add collateral, and shut positions (“loop closing”), serving to forestall additional debt accumulation.Audit and Forensics: Sensible contract logs and transaction histories are beneath intensive assessment by each in-house engineers and exterior safety specialists.

Whereas these steps have curtailed extra losses, full withdrawal performance stays offline pending an intensive vulnerability evaluation and patch deployment.

Technical Evaluation of the Vulnerability

On the exploit’s core lay a basic oracle assault mixed with an beneath collateralization bug:

Worth Feed Reliance: The protocol calculated collateral necessities utilizing a single, time-point worth feed sourced from a liquidity pool.Manipulation Window: By deploying a flash mortgage technique to purchase or promote massive quantities of RateX PT simply earlier than mortgage initiation, the attacker created a short lived worth discrepancy.Unchecked Collateral Logic: The sensible contract didn’t incorporate time-weighted common pricing or multi-source aggregation, permitting it to just accept manipulated values immediately.

Absent safeguards similar to TWAP or multi-oracle checks, the pricing module misjudged collateral worth and inadvertently licensed unsecured debt issuances.

Market and Ecosystem Penalties

The exploit triggered margin calls throughout interconnected Solana lending platforms as cascading liquidations drove SOL and USDC costs down on decentralized exchanges. Investor confidence in emergent DeFi initiatives eroded, resulting in extra restrictive capital flows, heightened regulatory scrutiny, and intensified examination of safety audits. These developments underscored that modern protocol design, regardless of how compelling, can not change complete safety measures when managing substantial property, reinforcing the crucial for rigorous threat controls in decentralized finance.

Extra Information: Solana Celebrates 5 Years with 400 Billion Transactions and $1 Trillion in Quantity

[ad_2]

Source link