[ad_1]

The market efficiency of the spot Bitcoin ETFs (exchange-traded funds) in america has been spectacular over the previous couple of weeks. Persevering with their wonderful streak, the crypto funding merchandise closed the earlier buying and selling week with their greatest single-day efficiency in nearly 4 months.

The optimistic investor sentiment surrounding the spot ETFs appears to have additionally bubbled into the Bitcoin and the overall crypto market, which has recovered properly from an early value droop in September.

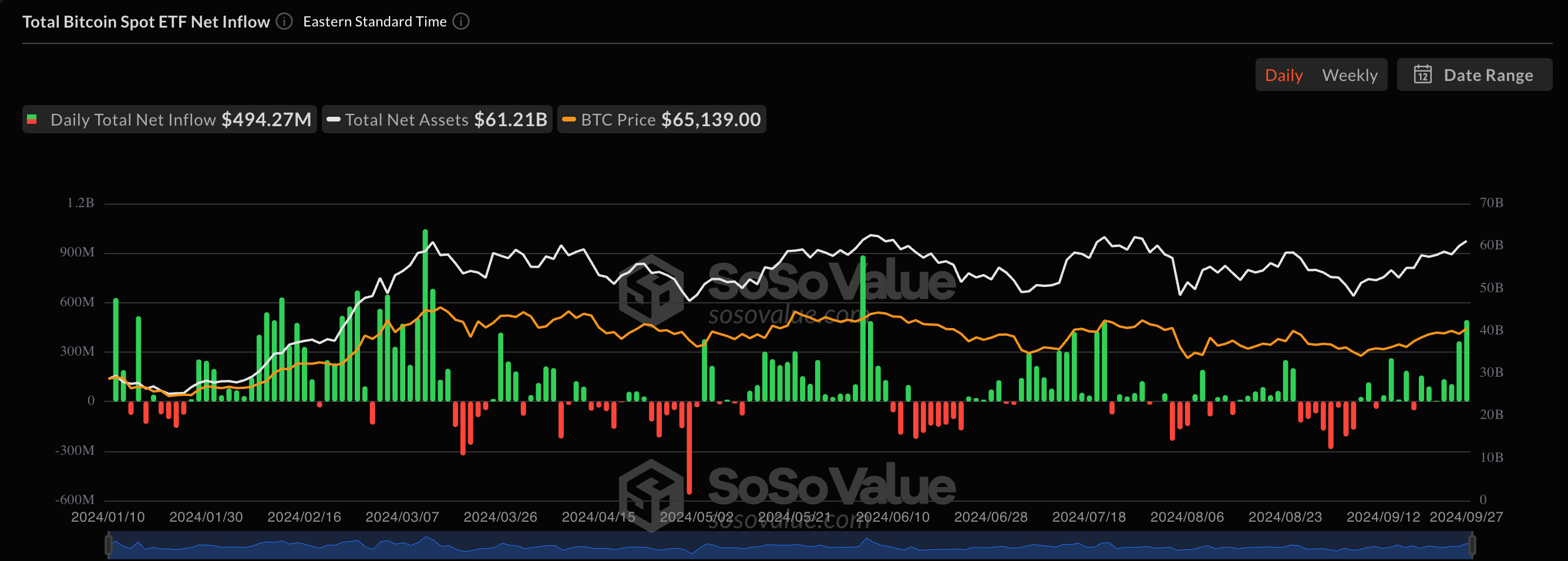

US Bitcoin ETFs Publish Practically $500 Million In A Single Day

On Friday, September 27, the US spot Bitcoin ETF market registered a complete web influx of $494.27 million, the very best worth for the reason that $886 million capital inflow on June 4. This was one other robust day by day efficiency by the crypto-based merchandise, which posted over $365 million in web inflows barely 24 hours earlier than.

In line with information from SoSoValue, Ark Make investments and 21Shares’ ARKB led the day with an influx of $203 million, whereas Constancy’s FBTC adopted in second place with a $124 million inflow. In a seeming resurgence, BlackRock’s IBIT got here in third with a web influx of over $110 million.

Supply: SoSoValue

In the meantime, Grayscale Bitcoin Belief (GBTC) recorded a uncommon optimistic day, with $26.15 million flowing into the product. Unsurprisingly, this worth represents the fund’s highest capital inflow since mid-Could, reflecting the extent of redemption it has skilled for the reason that spot Bitcoin ETFs launched.

On account of Friday’s efficiency, the entire weekly web inflows for the BTC exchange-traded funds rose to a exceptional $1.11 billion. This billion-dollar displaying makes it the third consecutive week by which the US-based spot Bitcoin ETFs has recorded a cumulative weekly web influx.

Spot Ethereum ETFs Document Second Optimistic Week Ever

The excellent efficiency of the Spot Bitcoin ETFs appears to have impressed its Ethereum counterpart, because the ETH funds posted their second optimistic buying and selling week since launch. The Ethereum ETFs registered a cumulative web influx of greater than $84.51 million previously week.

On Friday, the entire web influx of spot Ethereum ETFs stood round $58.6 million. Knowledge from SoSoValue reveals that Constancy’s FETH led with a capital inflow of $42.5 million, with BlackRock’s ETHA in second with $11.46 million.

iShares Ethereum ETF eclipses $1bil in belongings…

Now in prime 20% of all 3,700+ ETFs.

Did that is 2 months. pic.twitter.com/iRWaxkjZxl

— Nate Geraci (@NateGeraci) September 28, 2024

In a submit on X, ETF knowledgeable Nate Geraci talked about that the BlackRock Ethereum ETF has surpassed the $1 billion mark when it comes to belongings. Whereas acknowledging that this feat was achieved in two months, Geraci revealed that ETHA is now within the prime 20% of over 3,700 ETFs in america.

The value of Bitcoin fails to carry above the $66,000 mark on the day by day timeframe | Supply: BTCUSDT chart on TradingView

Featured picture created by Dall.E, chart from TradingView

[ad_2]

Source link