Grand Cayman, Cayman Islands, February fifteenth, 2024, Chainwire

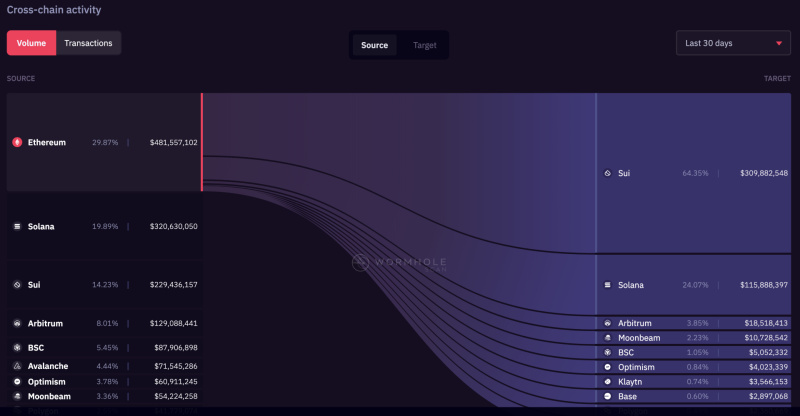

Wormhole information exhibits practically $310 million in property bridged from Ethereum to Sui over the past month — greater than all different blockchains mixed.

Sui, a Layer 1 blockchain that has skilled explosive development since its inception 9 months in the past, is seeing a considerable migration of funds from Ethereum to the Sui ecosystem, with practically $310 million price of property flowing via the Wormhole Portal up to now 30 days. The info is issued by wormholescan.io, which tracks the circulate of funds via Wormhole, some of the vital cross-chain bridges for wrapped tokens and NFTs, and the one most used on the preeminent decentralized trade, Uniswap.

Because the Sui ecosystem has been gaining outstanding traction through the previous month – surpassing $600M in Complete Worth Locked and coming into the highest 10 of DeFi ecosystems – the info from Wormhole exhibits that the origin of plenty of these funds is Ethereum. Of the just about $500M price of funds that had been bridged from Ethereum via Wormhole within the final 30 days, over 64% of it was moved to Sui — greater than the entire funds despatched to Solana, Arbitrum, Polygon, and each different chain mixed.

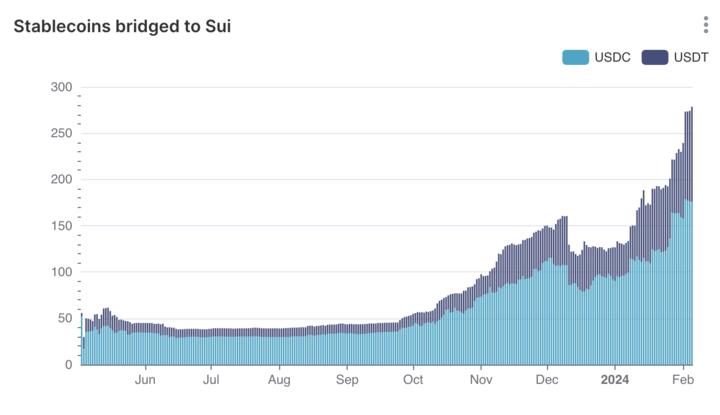

In keeping with the Wormhole information, most of those bridged property are stablecoins, with USDC and USDT bridged to Sui accounting for $134M and $78M of the amount respectively.

supply: wormholescan.io

supply: wormholescan.io

“The prevalence of customers migrating property to Sui demonstrates a rising perception within the energy of Sui’s underpinning expertise and the group of builders, builders, and fans that energy the ecosystem,” mentioned Greg Siourounis, Managing Director on the Sui Basis. “The Sui group seems ahead to persevering with to push the boundaries of DeFi and providing an industry-defining expertise for customers and builders alike.”

supply: Sui Inside Information

Additionally notable within the context of Sui’s emergence in DeFi, Sui’s inner information displays the acceleration of the expansion in bridged stablecoins USDC and USDT to the Sui ecosystem that started in This autumn of 2023. TVL of USDC and USDT went from hovering under $50M to spiking properly past $250M, an increase of over 400% in lower than 5 months.

In current months, along with the empirical information, there may be additionally a qualitative development that factors to Sui changing into a main hub of DeFi’s pleasure and exercise — high initiatives selecting to construct on Sui. In December 2023, two main initiatives that started on different protocols selected Sui for enlargement or full migration.

Solend, which stays the highest lending protocol on Solana at practically $180M in TVL, has devoted a full group to launching a brand new lending protocol on Sui that might be known as Suilend. Likewise, Bluefin, a decentralized derivatives trade that had already achieved over $1B in transaction quantity on its v1 software on Arbitrum, shuttered its preliminary implementation to focus completely on the most recent model constructed on Sui, reaching $2.3B in quantity in its first 4 months on the community. Each initiatives cited the efficiency capabilities of Sui in explaining their strikes.

Extra lately, Sui introduced two extra vital steps in turning Sui into the DeFi platform of selection for builders, builders, and their customers. First, along with Ondo Finance—the third-largest platform bringing tokenized real-world property onto public blockchains, Sui introduced the launch of interest-bearing stablecoin substitutes on Sui. Simply as vital, a brand new partnership with Banxa, a number one funds infrastructure supplier for the crypto-compatible financial system, will allow on and off-ramps through the Banxa platform. Mixed, these steps will broaden the enchantment of the Sui platform to incorporate a far wider viewers.

Contact

Sui Basismedia@sui.io