[ad_1]

Present audit practices depart crucial gaps, the place unseen dangers can emerge minutes after audits conclude.

Proof of reserves offers real-time verification of asset backing, whereas proof of composition ensures transparency into what belongings are held and in what proportions—collectively lowering the chance of fraud and insolvency.

If the U.S. needs to guide in onchain finance, it should undertake applied sciences that implement transparency and accountability on a steady foundation.

For the US monetary system to take care of its place because the central hub of worldwide asset creation as finance strikes from on-line to onchain, it should proceed to supply essentially the most trusted and enticing monetary belongings.

The shortage of real-time transparency makes monetary markets weak to failures such because the 2008 world monetary disaster, the place the dangers in opaque mortgage-backed securities had been obscured and monetary contagion unfold throughout world markets. Blockchain know-how can stop systemic vulnerabilities and create a extra steady, dependable monetary system by enabling the creation of belongings which are transparently verifiable by regulators, monetary establishments, and traders.

If the U.S. is seeking to be the worldwide hub of blockchain asset issuance, it must allow belongings which are clear, verifiable, and extremely immune to fraud.

Delayed Reserves Reporting Causes The “Hole” Downside

Monetary audits happen month-to-month or quarterly, creating a spot the place discrepancies or outright fraud can go undetected mere seconds after they’re accomplished. This lack of collateral transparency has resulted in billions of {dollars} of losses.

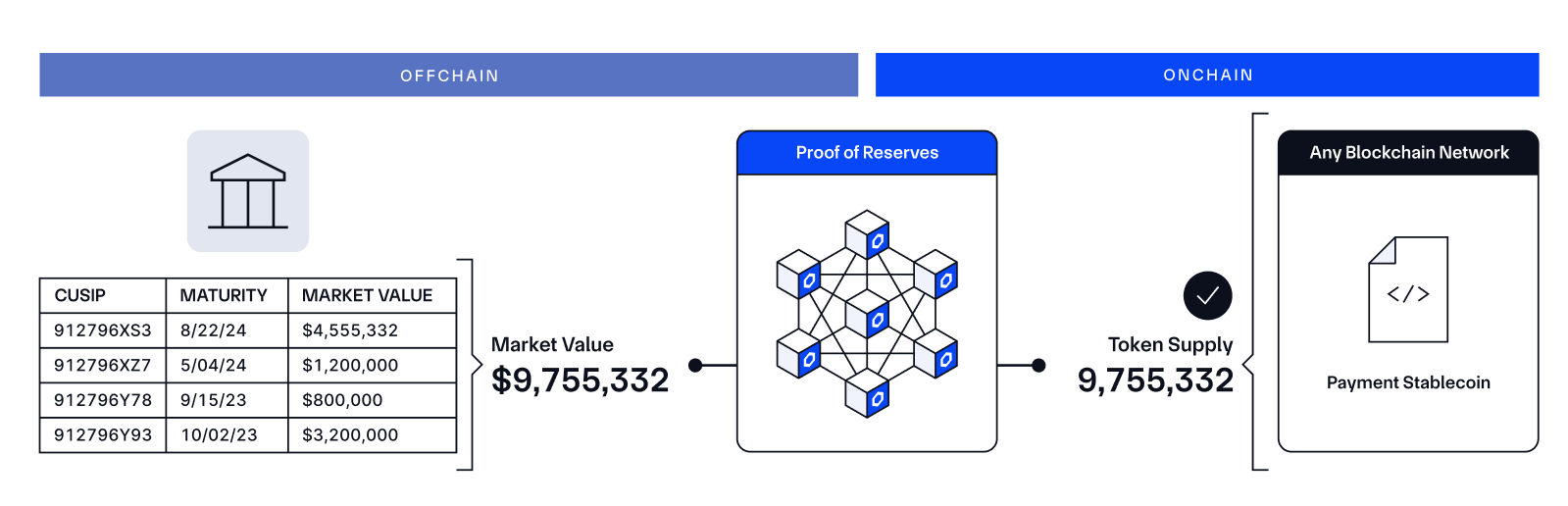

Proof of reserves offers real-time transparency into the worth of the reserves backing any monetary asset, serving to be sure that monetary markets aren’t simply verifiable at single time limits however stay verifiable each second of each day.

Proof of reserves can be used to position technological limitations on tokenized belongings to make sure that extra belongings can’t be created with out adequate collateral—for instance, by together with a line of code stopping extra stablecoins or tokenized belongings from being minted until adequate fiat foreign money or treasury securities are a part of reserves. This permits customers to constantly confirm reserves in actual time and offers regulators with perception into issuers’ compliance with reserve necessities.

Conventional Funds Are “Black Packing containers” That Carry Hidden Dangers

Present strategies of economic reporting fail to offer correct insights into the belongings that compose a fund, portfolio, or steadiness sheet holdings, resulting in conditions the place reserves could seem to have a low danger profile however truly include high-risk belongings. Actual-time verification can be a problem. Within the U.S., funds are sometimes solely required to report positions quarterly and have as much as 45 days submit quarter-end to file, which means their publicly disclosed holdings could be as much as 135 days previous.

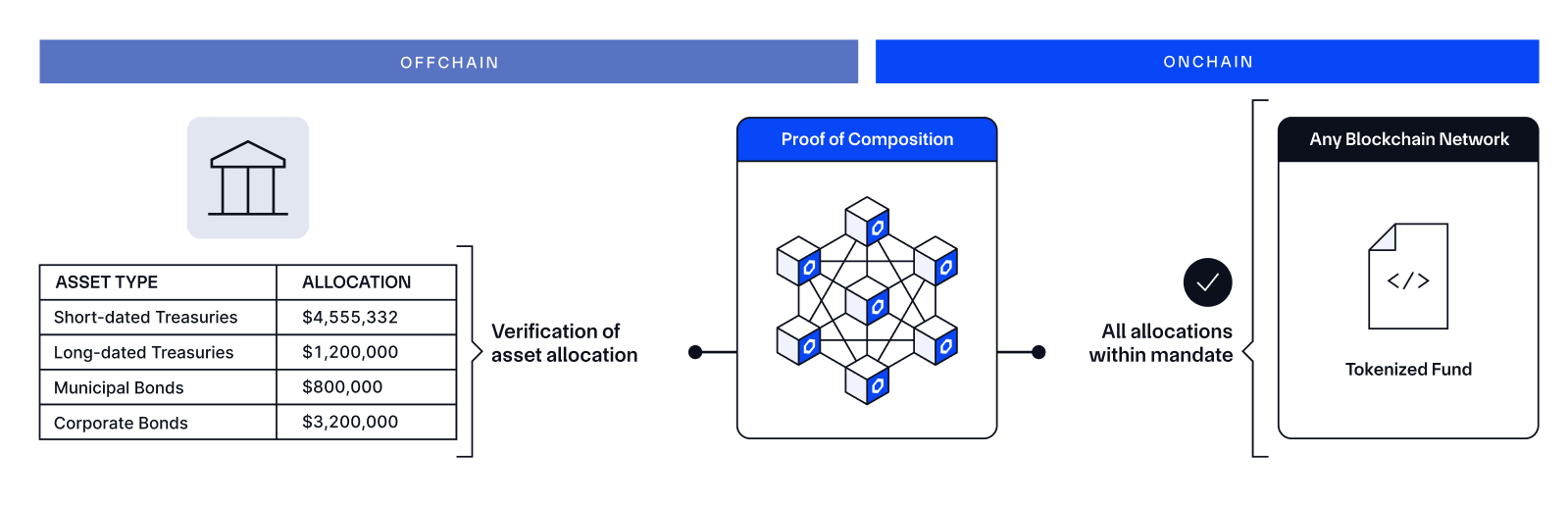

Proof of composition addresses these points by making certain in real-time that monetary asset reserves are composed of the precise belongings within the appropriate proportions, stopping fraudulent or extremely dangerous reserve administration. This permits funds to take care of strategic confidentiality whereas nonetheless offering verifiable assurance that their composition aligns with the fund’s predefined traits.

For instance, proof of composition could be utilized to a tokenized treasury fund to confirm that the yield custodian’s holdings solely embrace on-the-run U.S. authorities bonds versus riskier belongings like company debt devices. This degree of transparency would have been significantly helpful in occasions just like the SVB collapse, the place traders lacked visibility into the composition of long-duration bonds that uncovered the financial institution to extreme rate of interest danger. By analyzing classic information embedded throughout the proof of composition, customers may have recognized the focus of those long-duration bonds and guarded themselves sooner.

Actual-Time Monetary Integrity Powered By Chainlink

Chainlink helps carry enhanced transparency and verifiability to monetary merchandise and strategic digital asset reserves. Because the largest supplier of onchain proof of reserves infrastructure, Chainlink allows real-time monitoring of belongings—serving to to shut visibility gaps that conventional auditing and reporting processes depart open.

By integrating verifiable information immediately into monetary belongings, Chainlink permits for steady assurance that reserves are sufficiently collateralized and composed of the precise devices. This not solely reduces systemic danger but in addition provides regulators and establishments the instruments they should preserve monetary stability.

Whether or not it’s enhancing transparency for stablecoins, tokenized funds, or digital asset reserves, Chainlink offers the infrastructure to assist safe the way forward for world onchain monetary methods. Be part of business leaders who belief Chainlink Proof of Reserve to safe billions in onchain belongings. Attain out immediately.

[ad_2]

Source link