Key Takeaways:

THORChain swap quantity surged previous $1 billion post-Bybit hack.Considerations rise over its potential misuse for laundering stolen funds.RUNE worth jumps amid elevated platform exercise.

THORChain, a decentralized cross-chain swap protocol, is dealing with heightened scrutiny after its swap volumes surged following the $1.4 billion exploit of cryptocurrency trade Bybit. Though this current inflow of exercise highlights the growing want for THORChain’s choices, it has additionally fueled fears across the misappropriation of stolen cash on the platform — particularly contemplating the usage of teams like Lazarus.

📢 #RUNE Jumps 33%

The RUNE worth surge follows a 300% surge within the DEX buying and selling quantity on THORChain (@THORChain) previously week.

📌 Study Extra: https://t.co/zCCbDYQmaY pic.twitter.com/sUvKklyHeJ

— Coinspeaker (@coinspeaker) February 27, 2025

Cross-Chain Swaps Gas File-Breaking Buying and selling Volumes

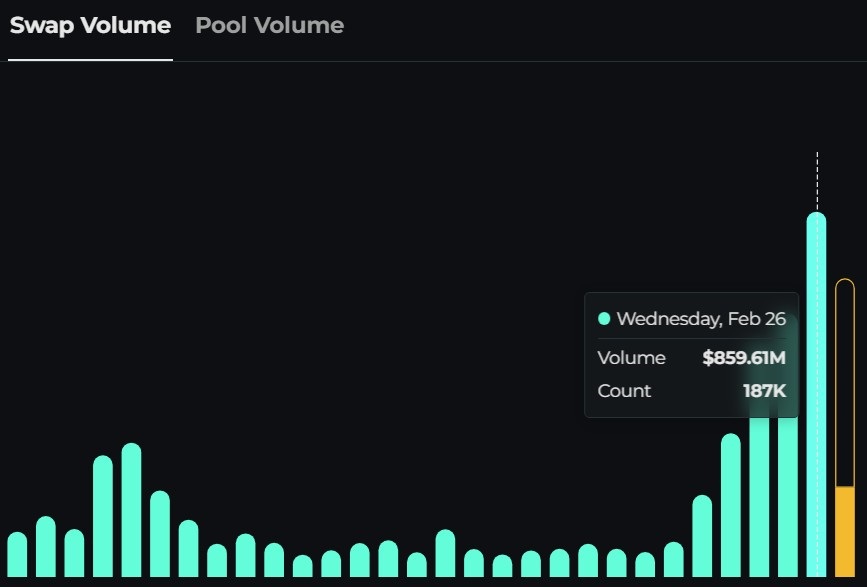

The info tells a strong story in current spikes. On Feb twenty sixth, THORChain recorded $859.61 million in swaps. This marked the very best single-day quantity ever recorded by the protocol, in accordance with meticulously compiled information from THORChain Explorer. The surge continued uninterrupted into February twenty seventh, with one other $210 million shifting by the platform. Because of this, complete swap quantity surpassed the $1 billion mark in beneath 48 hours.

For the reason that Bybit hack, THORChain swap quantity has spiked dramatically. Supply: THORChain Explorer

THORChain performance is bottom-up, which means that it allows a direct swap between two totally different blockchains with none centralized intermediaries. That’s, customers might simply swap Ether (ETH) for Bitcoin (BTC) or vice versa in a decentralized context. These swaps are executed utilizing RUNE, the native token of THORChain, which additionally helps preserve liquidity inside its swimming pools.

This has raised considerations that people might exploit it to obscure the origins of illicit funds. Decentralized cross-chain asset actions can complicate transaction tracing efforts and have been cited by legislation enforcement as a possible methodology for laundering stolen cryptocurrency.

Worry of Lazarus Group and the Circulation of Soiled Cash

A key issue behind the heightened scrutiny on THORChain is Lazarus’ previous involvement in cryptocurrency laundering. Utilizing Bitcoin (BTC) as a conversion device for its stolen digital belongings stays the first methodology of obfuscation, in accordance with blockchain analysts who’ve persistently tracked Lazarus’ actions. The group additionally makes use of decentralized platforms as an alternative of centralized ones, making it harder to hint these funds.

Though there isn’t a direct proof linking this quantity to the stolen Bybit funds, the sudden surge in THORChain’s swap quantity across the similar interval has raised considerations that the protocol might be used to launder illicit belongings.

For instance, following previous crypto trade hacks related to Lazarus, analysts have noticed a recurring sample within the motion of stolen funds on decentralized platforms, together with cross-chain swap protocols. These actions are generally made by a sequence of fast transactions and conversions amongst varied cryptocurrencies, aimed at severing the chain of custody and obfuscating the cash’ supply.

It is very important notice that this doesn’t recommend THORChain’s direct involvement. However with its decentralized character, in addition to its capability to permit for cross-chain swaps, the platform might be an enticing instrument for the cash laundering of stolen cryptocurrency.

THORChain’s Response and Group Dialogue

The potential for abuse has led to an advanced dialogue on THORChain’s discord and amongst its core devs. “Pluto”, a 9 Realms engineer who has considerably contributed to the event of the protocol, has acknowledged these considerations and acknowledged that illicit funds may need been laundered by the platform.

Pluto emphasised that the THORChain staff is dedicated to implementing measures to mitigate illicit actions. They include serving to with implementations of screening options for pockets and integration companions in order that they’ll establish and block doubtlessly suspicious transfers. They’ve additionally harassed that the set up of companies isn’t the issue and that the decentralized nature of THORChain shouldn’t be demonized for the way its customers entry its choices.

After we first began seeing illicit flows on THORChain, our staff bridged the hole for wallets and integration companions, serving to them combine screening companies like @elliptic. I’m happy to that @SwapKitPowered and @RangoExchange provide this resolution to their companions. Any… https://t.co/3yHifg925m

— Pluto (9R) (@Pluto9r) February 22, 2025

However that has not alleviated all considerations. Decentralization advocates within the cryptocurrency neighborhood have mentioned THORChain should do extra to forestall its use for illicit actions, even when that compromises THORChain’s decentralized properties. Others argue that it’s as much as legislation enforcement and regulatory companies to trace down and convey to justice these utilizing decentralized platforms to launder stolen crypto.

this horrific cult really must be completely exiled from this trade.

this is identical “decentralized” protocol that rugged professional customers and nonetheless—to today—has their funds frozen af.

that is extra disgusting than even the memecoins. 🤮https://t.co/f6kZoNPURj

— Tay 💖 (@tayvano_) February 27, 2025

Impact on RUNE Token and THORChain Atmosphere

Regardless of the controversy, THORChain’s RUNE token has seen giant worth will increase over the previous couple of days. The info from CoinGecko reveals RUNE up 36.6% within the final seven days. This surge doubtless displays the rising demand for THORChain’s companies and the rising liquidity inside its swimming pools.

The value surge highlights the steadiness between a decentralized platform’s perceived utility and the dangers of potential misuse. Some may balk at placing cash right into a platform that’s within the highlight for having acted as a facilitator for unlawful conduct, however others might be attracted by the elevated liquidity and doable yields that accompany larger transaction volumes.

The long-term affect of the Bybit hack and the ensuing scrutiny on the THORChain ecosystem stays unsure. The protocol is anticipated to evolve additional because it grows past this stage.

The Pursuit of Stolen Funds by Bybit

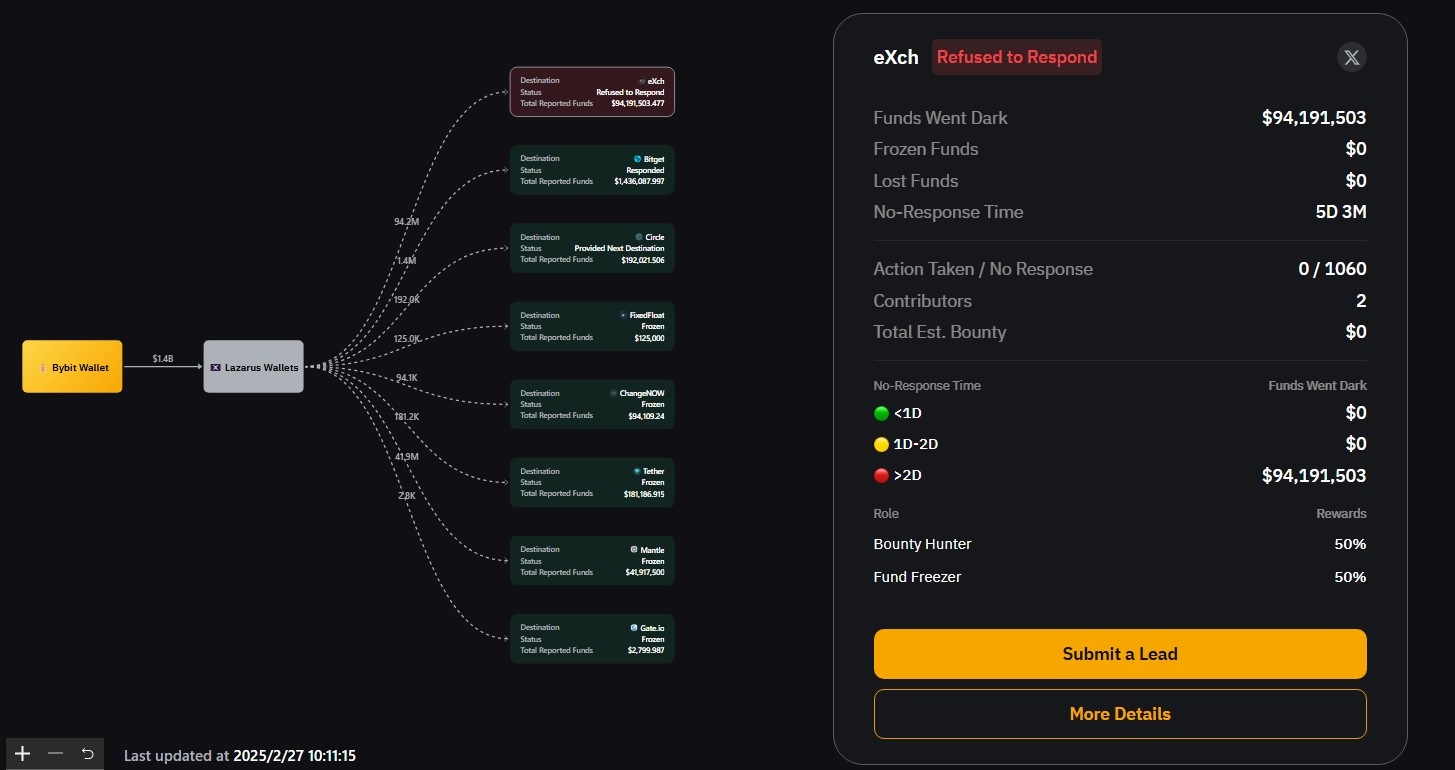

Bybit, the trade focused within the staggering $1.4 billion exploit, has mounted an exhaustive effort to hint the stolen funds and convey the attackers to justice. The trade has launched a devoted web site to trace the motion of stolen funds in real-time and is promising a bounty to any entity that helps freeze the belongings.

Extra Information: Bybit Suffers Huge $1.4 Billion Hack: What You Must Know

As of February twenty seventh, the Bybit web site had named seven cryptocurrency exchanges which can be cooperating with the investigation and one of many platforms, eXch, which it mentioned was a “dangerous actor” that has reportedly declined to freeze funds associated to the hack.

Bybit recognized eXch as the one “dangerous actor”. Supply: Lazarusbounty/Bybit

This highlights the necessity for better cooperation between cryptocurrency exchanges, legislation enforcement companies and regulators to deal with illicit exercise within the digital asset trade.